With Low Investment Returns, Fees Are Even More Insidious

Bonds and other fixed income are an important part of everyone’s plan. Bonds are great but with low interest rates and low investment returns the fees on bond funds become even more insidious.

Investment fees are always important. They’re a hidden investment expense and can easily take a large chunk of investment returns. But with low interest rates and low returns on bond funds, these fees can easily eat up 30%, 40% or over 50% of yield!

What’s worse is that there are many lower cost options out there. A lower cost bond fund could provide a similar return but at a much lower cost.

Yet despite the high fees there are still BILLIONS being held in bond funds that are now eating up 50%+ of the bond yield.

Are you invested in bonds? Are you losing 50%+ of your annual yield to fees?

Below we explore one large bond fund that holds over $20 billion in assets and eats up 56% of yield through fees! But first, let’s understand what a bond fund is and why they might form part of our investment plan.

Why Bonds?

Bonds seem boring but they’re absolutely great. They feel like a low return investment, but they play an important role within an investment plan. There are lots of great reasons to hold bonds, but one somewhat overlooked reason is the pure psychological benefit.

Bonds help reduce the volatility of an investment portfolio. They also give us something to do during a drop in equity values. Having a target bond allocation usually means rebalancing from bonds into equities during a recession. Equity prices have dropped and that may require a rebalance from bonds into equities. It’s forcing us to “buy low” and hopefully “sell high“ in the future.

This “forced rebalancing” during a recession is one of the largest and most understated benefits of a bond allocation.

Read more about the psychological benefit of holding bonds.

But how do you buy bonds as an individual investor? This is where a bond fund can be very helpful.

Using Bond Funds To Increase Diversification

Buying individual bonds is out of reach for most individual investors. It’s possible to buy bonds, but it would be too difficult to achieve a high level of diversification. A bond fund on the other hand holds many, many different bonds. It provides a high level of diversification in one neat little package.

Bond funds are great. There are many different types of bond funds. A bond fund could have a specific focus like government bonds, corporate bonds, international bonds etc. It could hold different length bonds, short, medium, long-term. It could also hold a specific bond rating, “investment grade” all the way down to “junk” bonds. Or a bond fund could hold a mix of bonds with the goal of tracking a particular bond index.

Bond funds do what the individual investor cannot, they purchase thousands of bonds to reduce the risk of default. The added benefit is that by holding many bonds they also provide a steady monthly or quarterly yield.

Bond funds provide the benefit of diversification for a small fee.

But… fees impact returns and when returns are low those fees become even more important.

Bond Fund Returns: Yield To Maturity

When it comes to bond funds there are a few different metrics to understand. Not all bond funds are created equal. They hold different types of bonds (government, corporate, junk etc), these bonds have different lengths (the longer the bond the more sensitive to interest rate changes), and they have different returns (average coupon, yield to maturity)

The anticipated return for a bond fund is usually shown two ways, the average coupon and the yield to maturity.

The average coupon is the income being paid by the various bonds on average. Easy enough to understand.

The yield to maturity is a bit more complex. It considers this average coupon income BUT also includes when a bond is above or below its maturity value.

For example, when interest rates go down a bond’s price could be above its maturity value. If a bond is purchased “above par” and then later matures this creates a loss. Because a lot of bonds were issued when interest rates were higher, this means a lot of bonds are above par right now. It also means that holding a bond fund right now will lead to a capital loss that offsets some of the coupon. This combination of coupon plus gain/loss gives us the yield to maturity. The YTM is a better gauge of the return for a bond fund because it includes how the bond is currently valued as well as the regular coupons.

(By the way, the fact that many bonds are above par right now will create a capital loss in the future, this is why they’re not very tax efficient in non-reg accounts. Interest income from the coupon is taxed at your full marginal tax rate but the capital loss offsets at just half your marginal tax rate. This leads to more tax in a non-registered account versus a registered account)

Are Fees Eating Up 50%+ Of Your Bond Returns?

If interest rates remain steady, the yield to maturity is the best gauge of bond returns.

With low investment returns on bond funds, investment fees are even more insidious, they can eat up a very large portion of the bond yield.

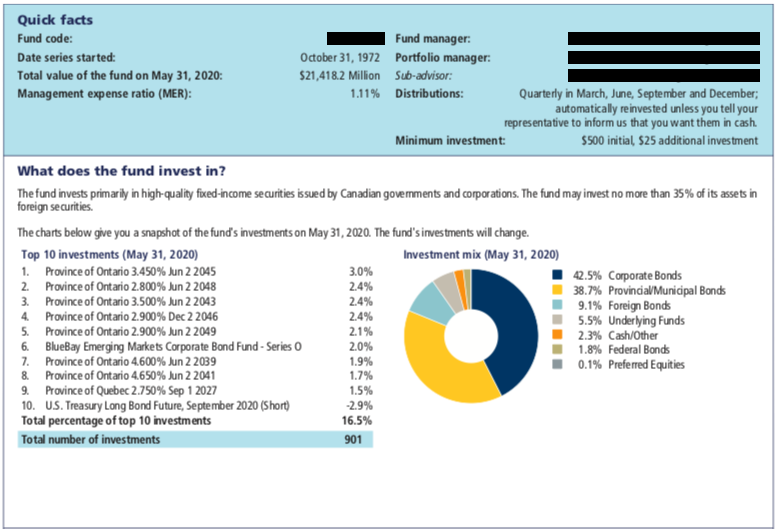

Let’s use an example. A bond fund like this financial institution’s bond fund (not naming names) has been around forever, since 1972 actually. The fees are typical of a mutual fund bond fund at 1.11% total MER.

When interest rates and bond returns were higher, this fee didn’t look as bad. If interest rates/bonds were yielding 6% or 8%, that 1.11% MER would only eat up 18.5% or 13.9% of the YTM, not great, but not crazy.

But with low interest rates and low investment growth the YTM for this bond fund is only 2.0%. The investment fees on this bond fund are eating up a whopping 56% of the YTM! Yikes! After subtracting investment fees, the yield is less than a high interest savings account.

Investment fees are always important, but with low interest rates and low investment returns, fees become even more important.

A bond ETF might be able to produce the exact same returns but with fees of 0.11% (or even lower). Instead of losing 56% of the YTM to fees, a lower cost investment like a bond ETF would only lose 5.6%, a much more reasonable cost for access to this highly diversified fixed income.

Regardless of how you view bonds as an investment. If bonds are in your portfolio, make sure they’re at least low fee. Otherwise, like these bond mutual fund investors above, you could be taking 100% of the investment risk but only receiving 44% of the reward.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments