What’s Worse In Retirement? An Investment Decrease Or A Spending Increase?

A large decrease in portfolio value is a common concern when entering retirement. After all, seeing a large chunk of your retirement portfolio evaporate over just a few months can be quite disconcerting.

But… a large spending increase should be much more concerning in retirement.

If you had to guess, between a 20% drop in portfolio value and a 20% increase in spending, what is worse for a retirement plan?

It feels like a large stock market correction of 20%+ is the worst thing that can happen in retirement. After all, for an average retirement portfolio, a 10-20% drop could equate to a portfolio decline of $50,000 to $200,000+. That’s a large amount of money!

But a permanent increase in retirement spending should be much, much more concerning.

An increase in retirement spending of 10-20% is significantly worse than a 10-20% portfolio decline. Let’s see why…

What Causes A Large Increase In Retirement Spending?

First, it’s important to highlight that there are many reasons why retirement spending could increase more than expected.

One reason could be that there simply wasn’t a retirement budget in the first place. Or it could be that the initial retirement budget was unrealistically low. Or it could be that the retirement budget was missing certain expenses like vehicle repairs, vehicle upgrades, and home repairs, these infrequent expenses can easily add up to $1,000+ per month.

Another important reason retirement spending could increase is when there is a unique external factor. For example, a large increase in monthly condo fees could cause a permanent increase in retirement spending of hundreds per month. Or perhaps a vehicle accident could increase insurance rates going forward.

The other common reason spending can permanently increase in retirement is when there is a new health issue or a disability that requires extra care. The cost of new prescriptions, additional care, specialist visits, or medical equipment, can permanently increase spending in retirement.

The last and final reason retirement spending can increase is during a period of high inflation. Inflation impacts everyone differently, so even when inflation is at a reasonable level, it can still cause a large increase in personal spending depending on your particular budget.

The Impact Of Higher Retirement Spending

We’ll look at a more detailed example below but to get a sense of why retirement spending is so important let’s look at a simple example. Imagine a couple spending $75,000 per year in retirement. This is a fairly reasonable retirement budget.

For this couple an increase in retirement spending of 10-20% is equal to $7,500 to $15,000 per year in extra spending. Instead of spending $75,000 per year they are now spending $82,500 or $90,000 per year.

Watch The Video!

Just consider the amount of financial assets required to support an extra $7,500 to $15,000 per year in spending. Even if there was no tax, this extra spending would require an additional portfolio value of $187,500 to $375,000+ inside a TFSA if we use the 4% rule ($7,500 / 4% = $187,500).

With a 30% marginal tax rate this level of spending requires an additional portfolio value of $267,857 to $535,714+ inside an RRSP ($7,500 / (1 – 30%) / 4% = $267,857).

So even if spending goes up by just $7,500 per year ($625 per month), this would require an extra quarter million in financial assets inside an RRSP to be sustainable.

This is why spending is one of the most important levers within a retirement plan. A portfolio decline of $100,000 to $200,000 during a recession is nothing compared to a spending increase of 10-20% because a spending increase requires significantly more financial assets to support the extra spending.

Portfolio Declines Are Temporary While A Spending Increase Is Permanent

While a large portfolio decline can feel daunting it is a rather common occurrence in retirement. Seeing the portfolio decline by 20%+ will likely happen at least 5-10 times over a 30-40 year retirement period.

But one important thing to remember is that the stock market will eventually continue its relentless march upward. It may take months or even years, but eventually portfolio values will recover.

On the other hand, a large increase in retirement spending is worse for a retirement plan because quite often it’s permanent. It’s very hard to recover from a large increase in retirement spending without severely scaling back on other spending to compensate.

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

Example: Average Retirement Couple

To help illustrate how sensitive a retirement plan can be to spending let’s look at an “average retirement couple” Marlene and Bert.

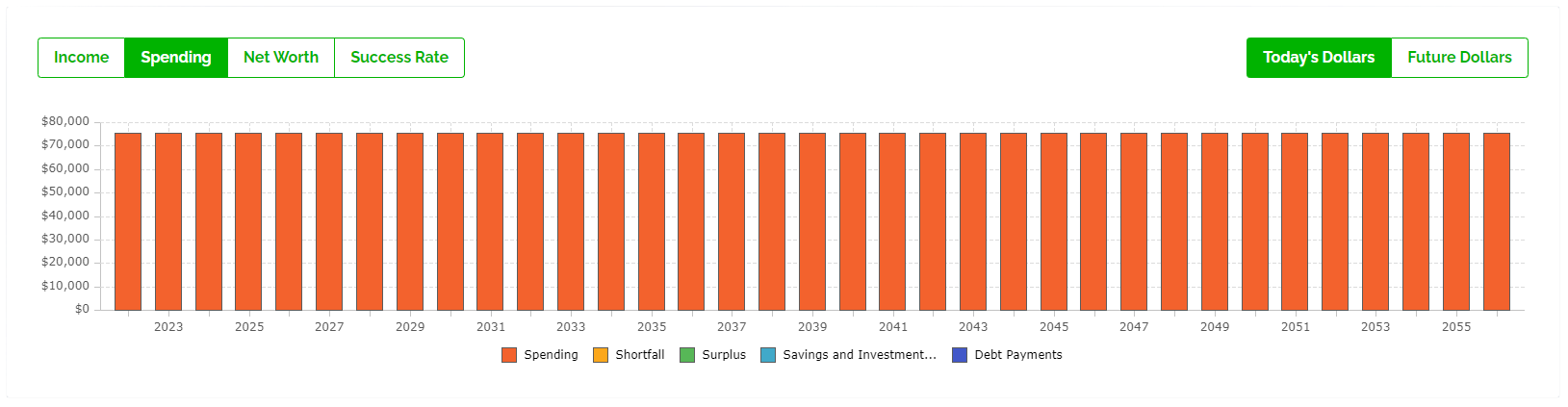

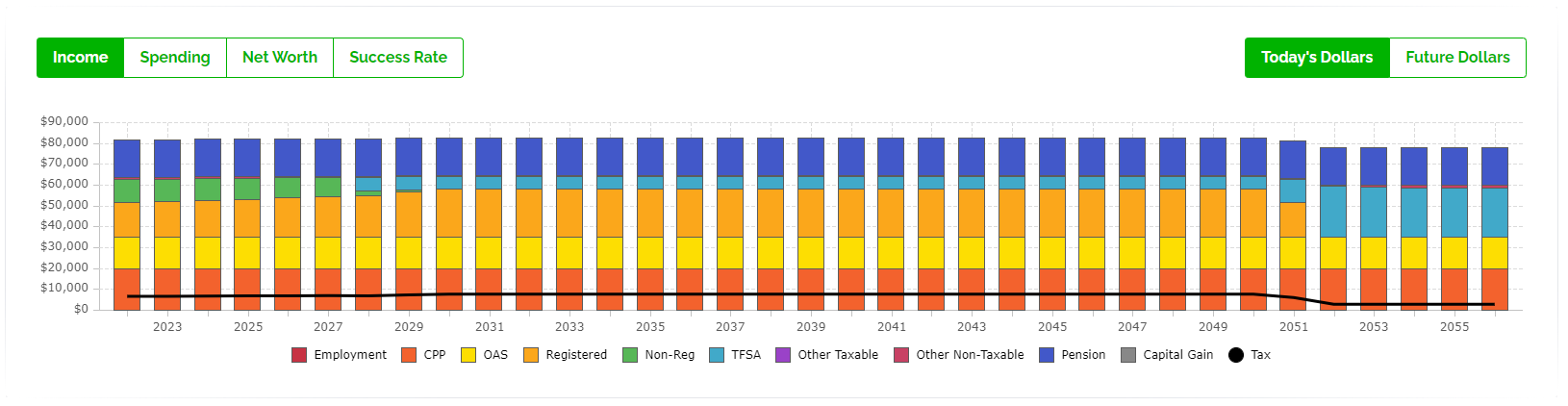

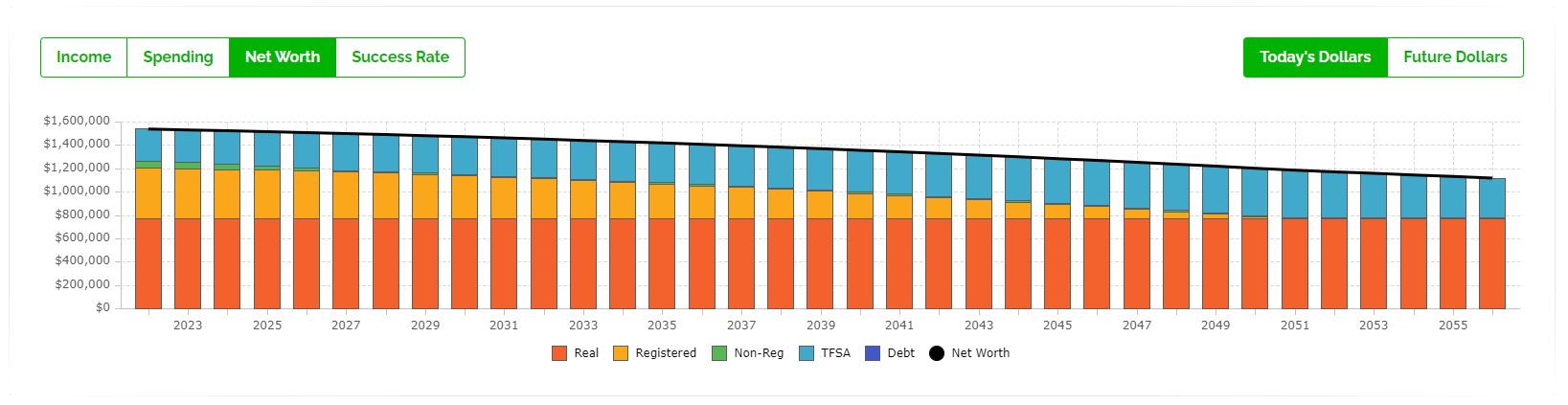

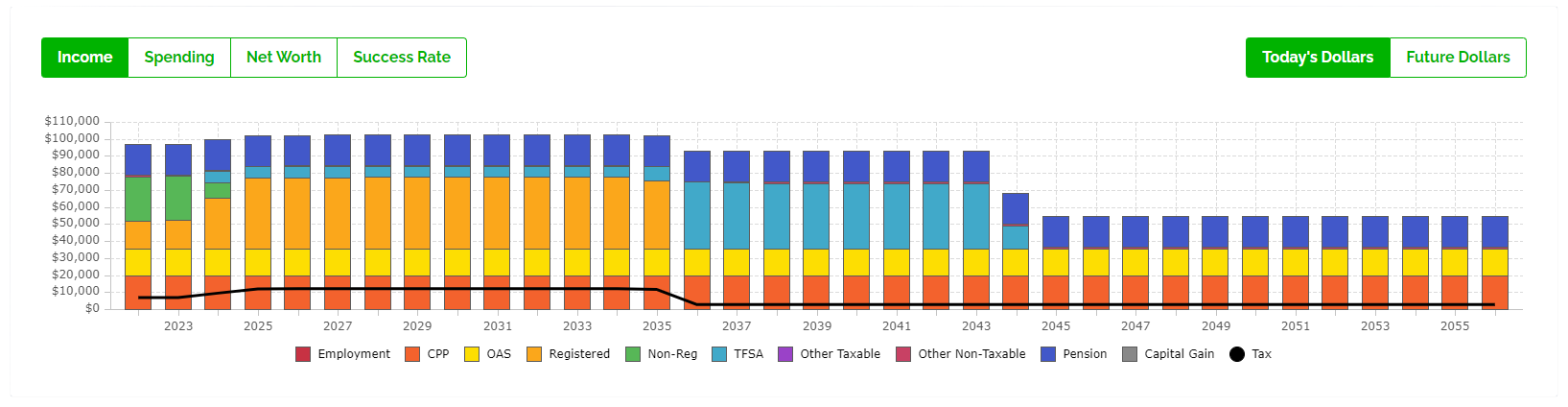

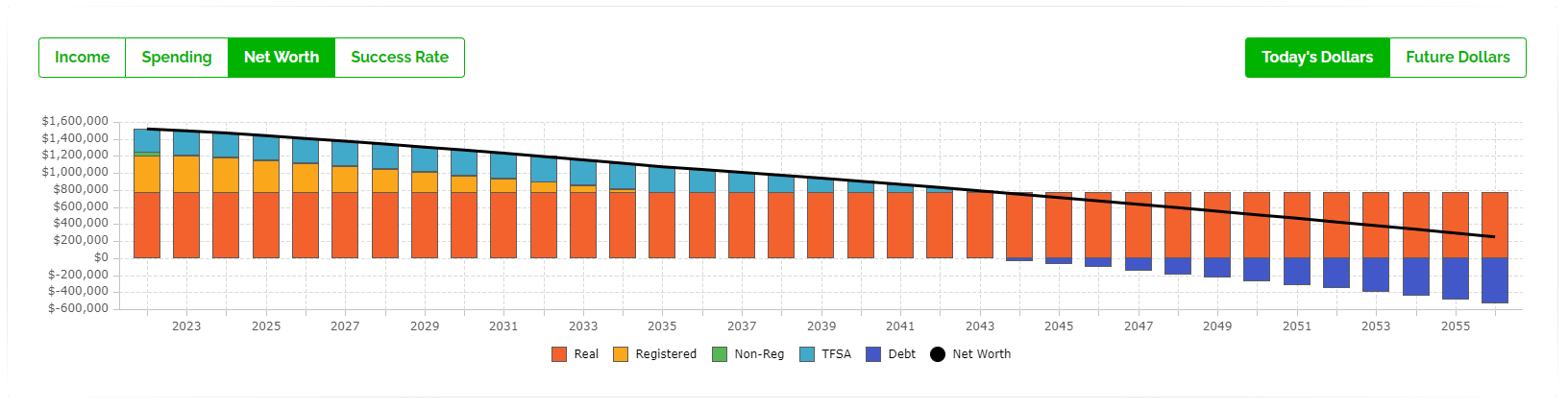

Marlene and Bert have around $750,000 in financial assets between RRSPs, TFSAs, and non-registered accounts. They also have approximately $35,000 from CPP and OAS. Plus Bert has about $18,000 per year from a small defined benefit pension. They want to spend $75,000 per year in retirement.

One important thing to appreciate right off the bat is that Marlene and Bert’s portfolio only needs to support a portion of their retirement spending. But this also means that even a small increase in spending will cause a big increase in investment withdrawals.

Just for a second, imagine there was no tax. Their CPP, OAS, and pension income would cover $53,000 per year in retirement spending and the portfolio would need to cover $22,000 per year. A pretty reasonable amount with a $750,000 investment portfolio.

But if spending increases by 20% to $90,000 per year now the portfolio needs to cover $37,000 per year. A much more challenging amount with $750,000 in financial assets.

So already we can anticipate that Marlene and Bert’s retirement plan will likely be very sensitive to retirement spending assumptions.

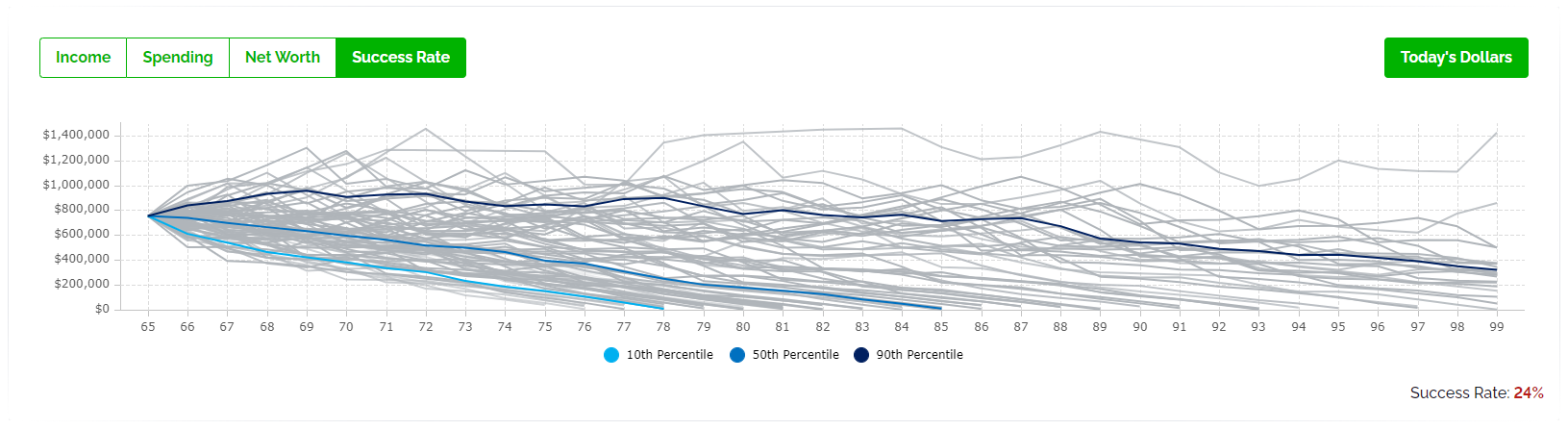

Let’s look at three scenarios, one with their target retirement spending. A second with a 10% increase in retirement spending. And a third with a 20% increase in retirement spending.

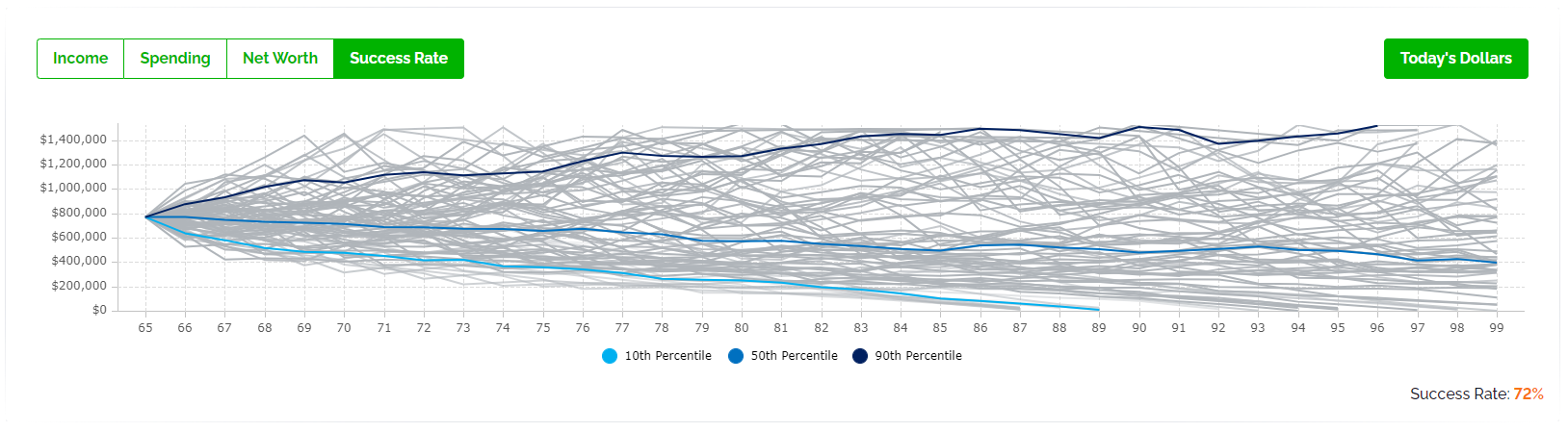

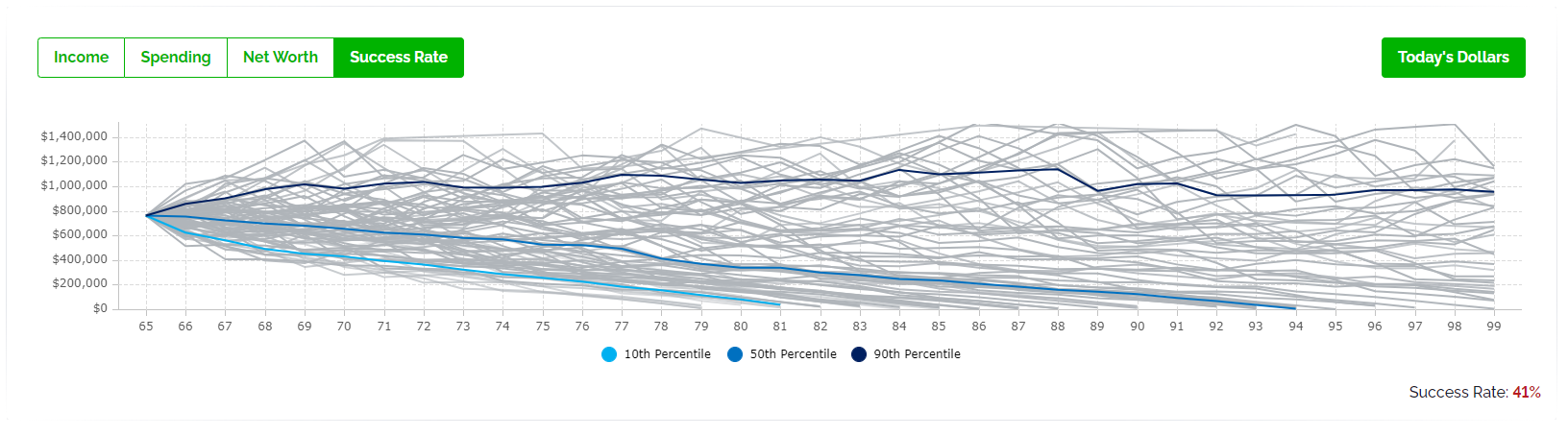

Their base retirement plan is already somewhat risky with a 28% chance of running out of money in the future (72% success rate) and this risk only increases when spending goes up. This really highlights how sensitive a retirement plan is to changes in spending.

Marlene and Bert’s Retirement Plan

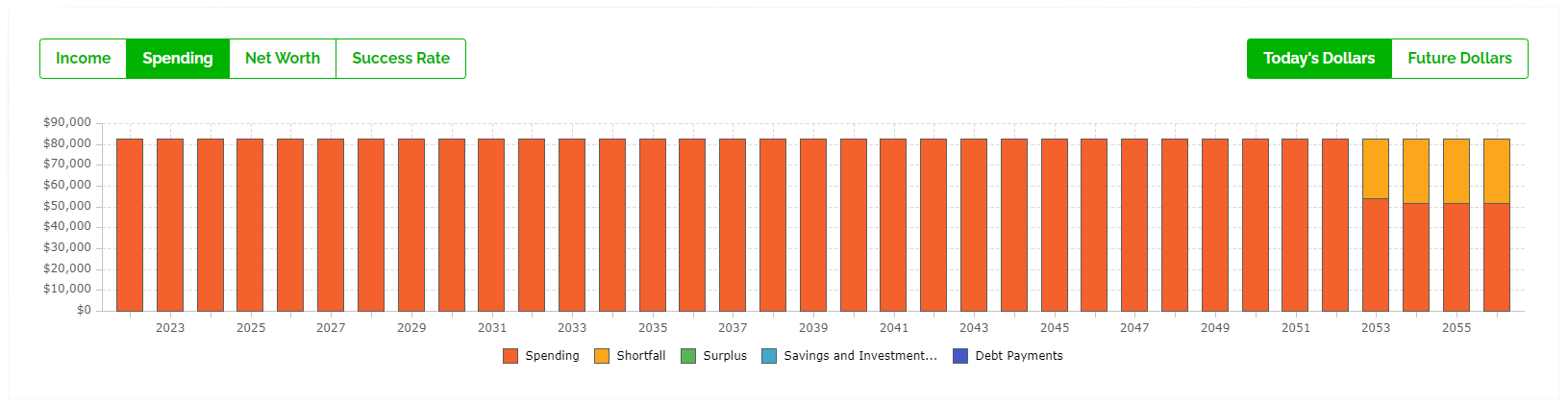

Spending $75,000 per Year

Marlene and Bert’s Retirement Plan

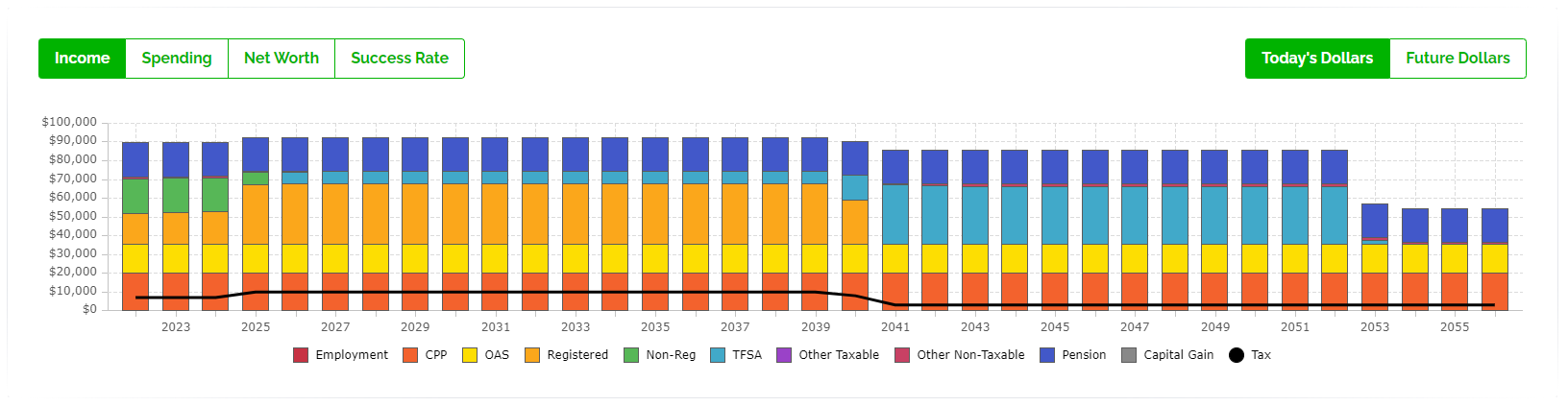

Spending $82,500 per Year (+10% Spending)

Marlene and Bert’s Retirement Plan

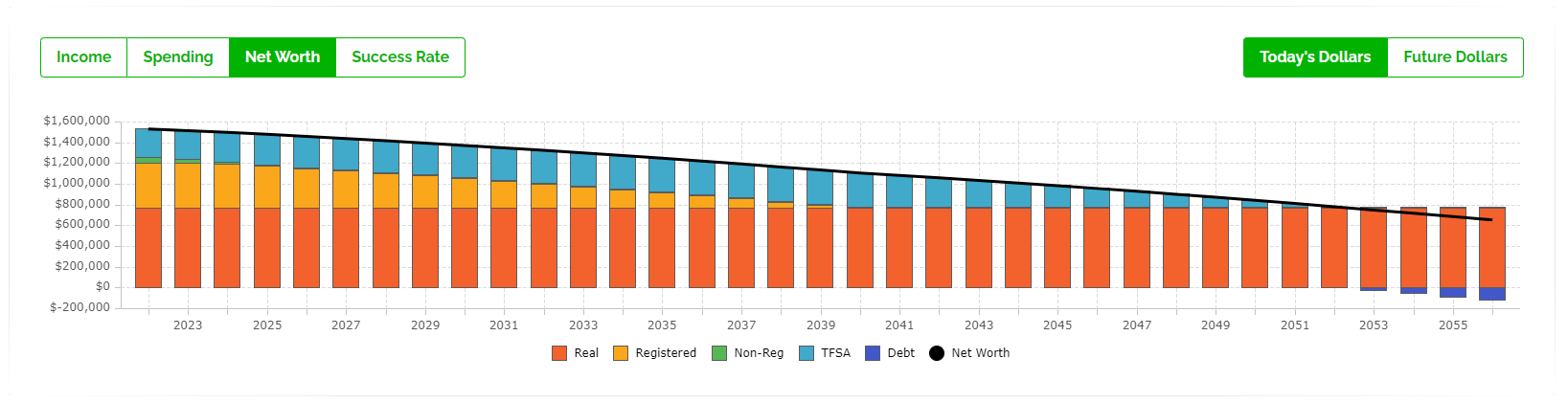

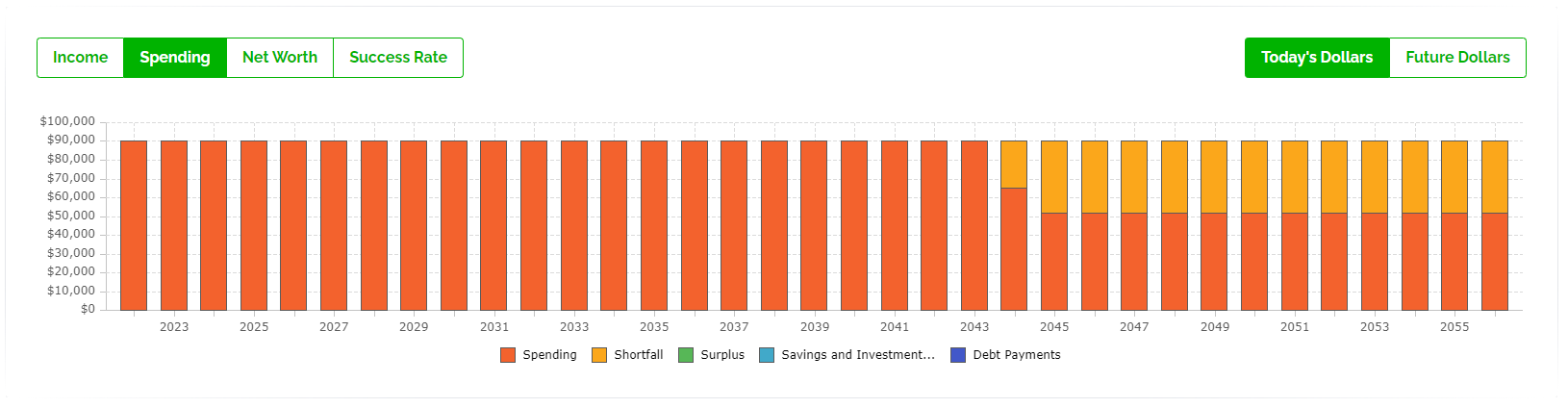

Spending $90,000 per Year (+20% Spending)

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments