What Is The Cost Of Mortgage Deferral?

Having the option to defer mortgage payments has been a great source of relief for many Canadians. The large banks introduced options to defer up to 6-months of mortgage payments. But what is the cost of mortgage deferral and how does your mortgage change in the future?

The option to defer mortgage payments has been incredibly helpful for those with reduced income or cash flow. It’s provided an enormous amount of relief. It’s even allowed some people to build up a small amount of emergency savings (a personal finance best practice).

But what is the cost of these reduced payments? How will interest be accrued? What options do you have to reduce this accrued interest in the future?

In this post we’re going to use our free debt calculator to estimate the cost of mortgage deferral. We’re going to explore how the deferral impacts both short-term and long-term finances. Plus we’ll look at how different repayment options may impact the total amount of interest paid and the length of time to mortgage freedom.

How Mortgage Deferral Works

Mortgage deferral works by pausing payments on the mortgage for a period of time. This period depends on personal circumstances and the financial institution your mortgage is with. Currently the maximum deferral is 6 months.

During this 6-month period the payments against the mortgage are paused but the interest continues to grow.

Normally the monthly mortgage payments would go towards interest and principal. This means that every month the mortgage principal gets smaller. With payment deferral the mortgage balance actually grows and the principal gets larger each month.

To see the difference let’s look at a 5-year term on a $425,000 Mortgage at 2.34%.

Using the free debt payoff calculator here is what the mortgage would normally look like with payments of $1,980 per month.

Normal Mortgage With No Deferral

And here is what the mortgage would look like with 6 months of deferred payments. To do this we added a negative amount equal to the normal payment to the debt payoff calculator. This decreases the payment down to zero for 6-months.

Because of the mortgage deferral the balance grows during the 6-month deferral period. This is the interest being added to the mortgage principal each month. Normally the mortgage balance would decline to $415,727 but because of the deferral the mortgage balance actually increases to $427,665. The interest portion is $4,970.

It’s hard to see with the scale but notice how the mortgage principal doesn’t decline during the 6-months deferral period?

Mortgage With 6 Months Deferral

What Is The Cost Of Mortgage Deferral?

The cost of a mortgage deferral is the interest that will continue to accrue during the deferral period. This extra interest gets added to the mortgage principal as we saw above. Plus there is an additional cost as this extra interest compounds over the rest of the amortization period.

The extra interest being accrued will be the last thing to be paid off at end end of the mortgage. The extra cost therefore isn’t just the extra interest over the 6 month deferral but also the extra interest that compounds over the remaining mortgage.

This compounding increases the “cost” of the mortgage deferral. The exact cost will depend on the remaining amortization but we can use our example from above to get an idea of what that total cost might be.

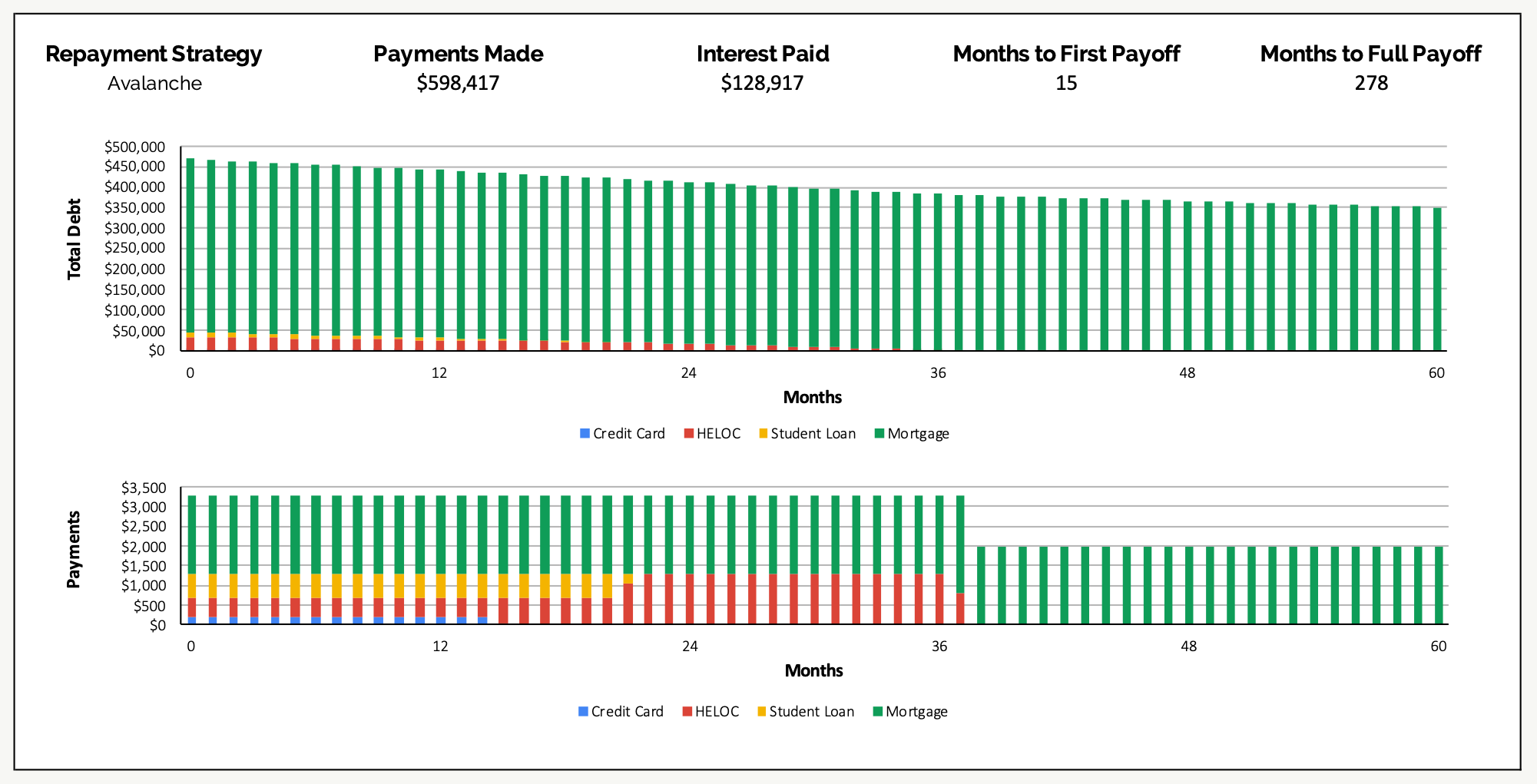

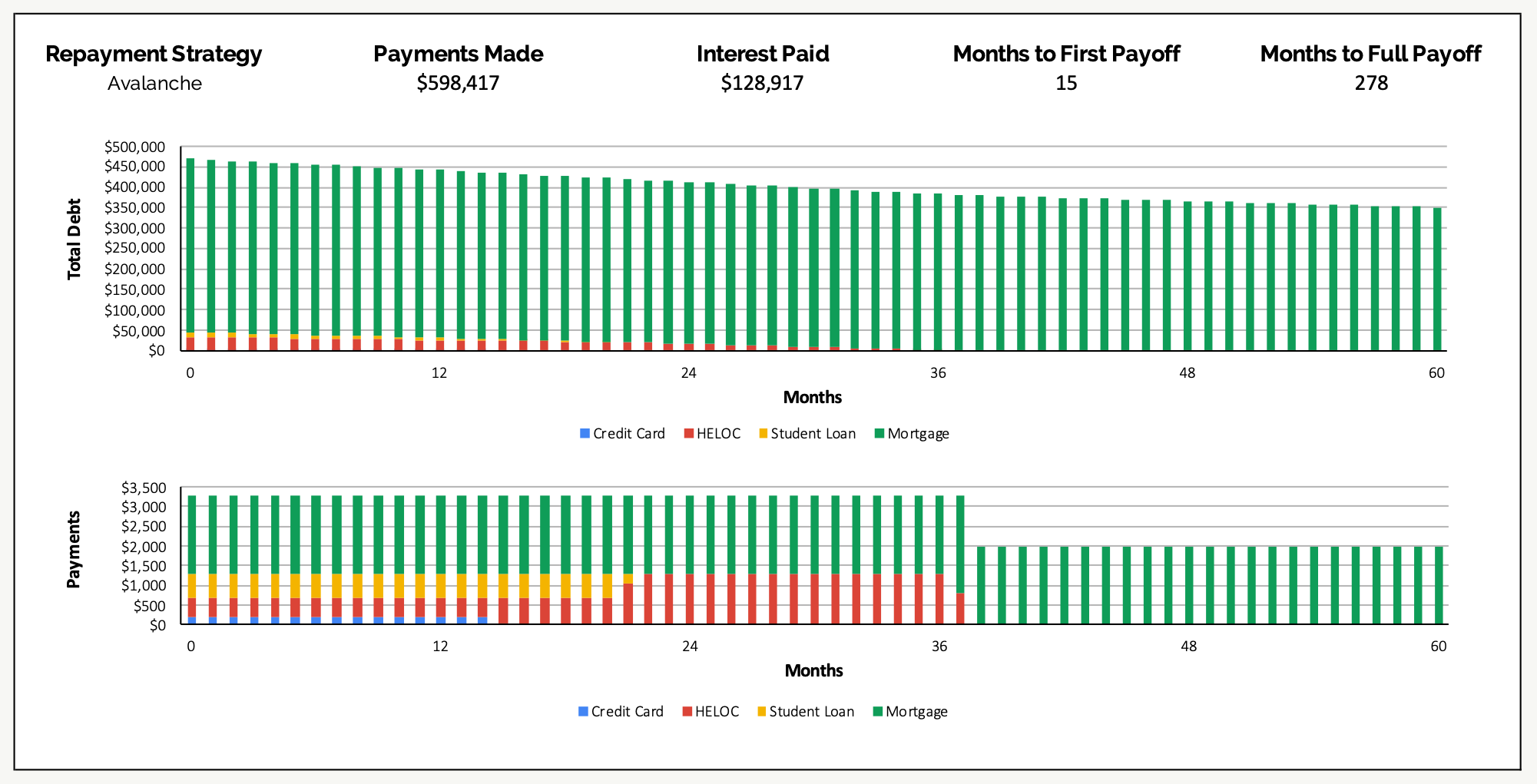

Normal Mortgage With No Deferral

Total interest of $128,917.

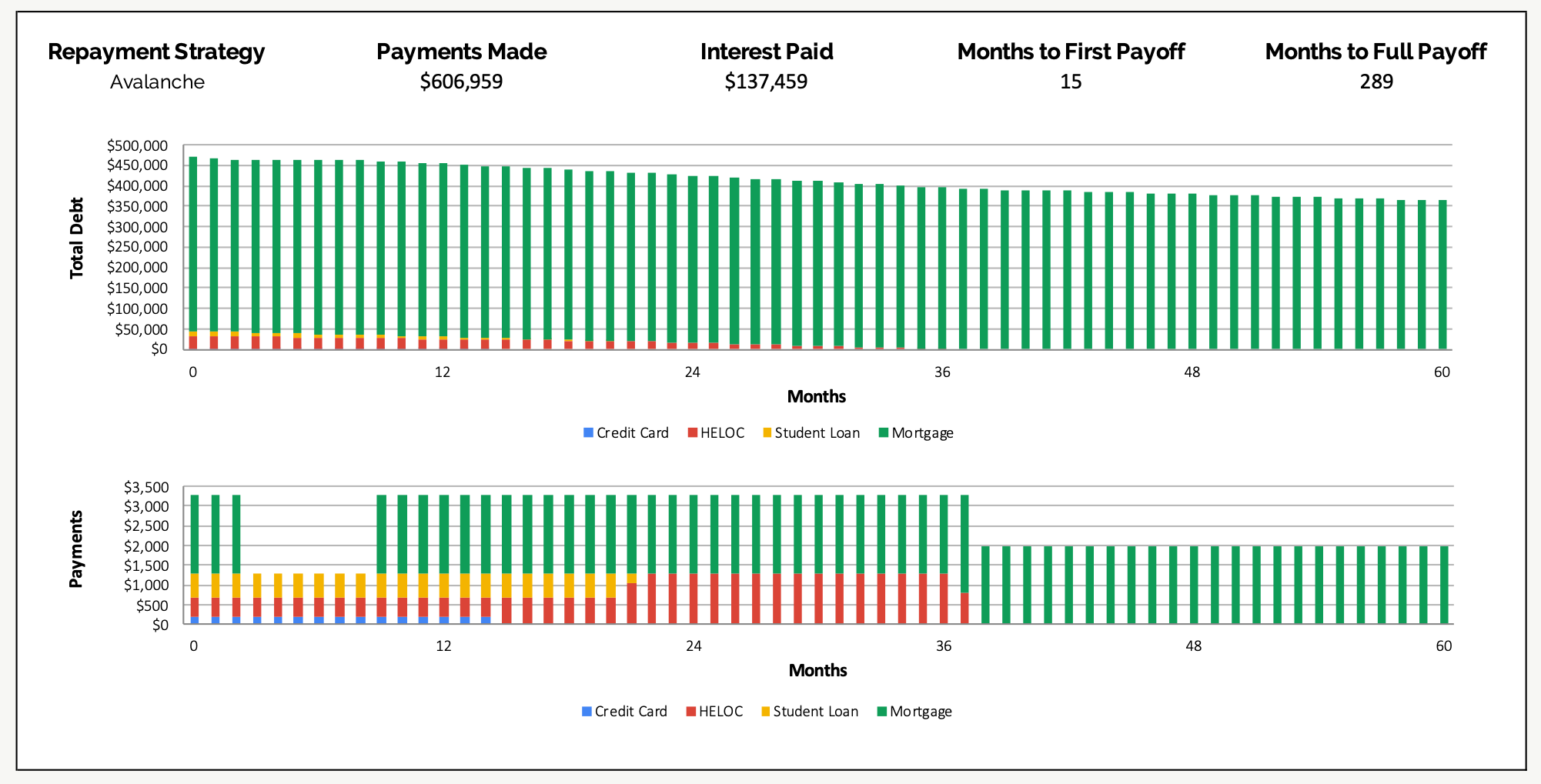

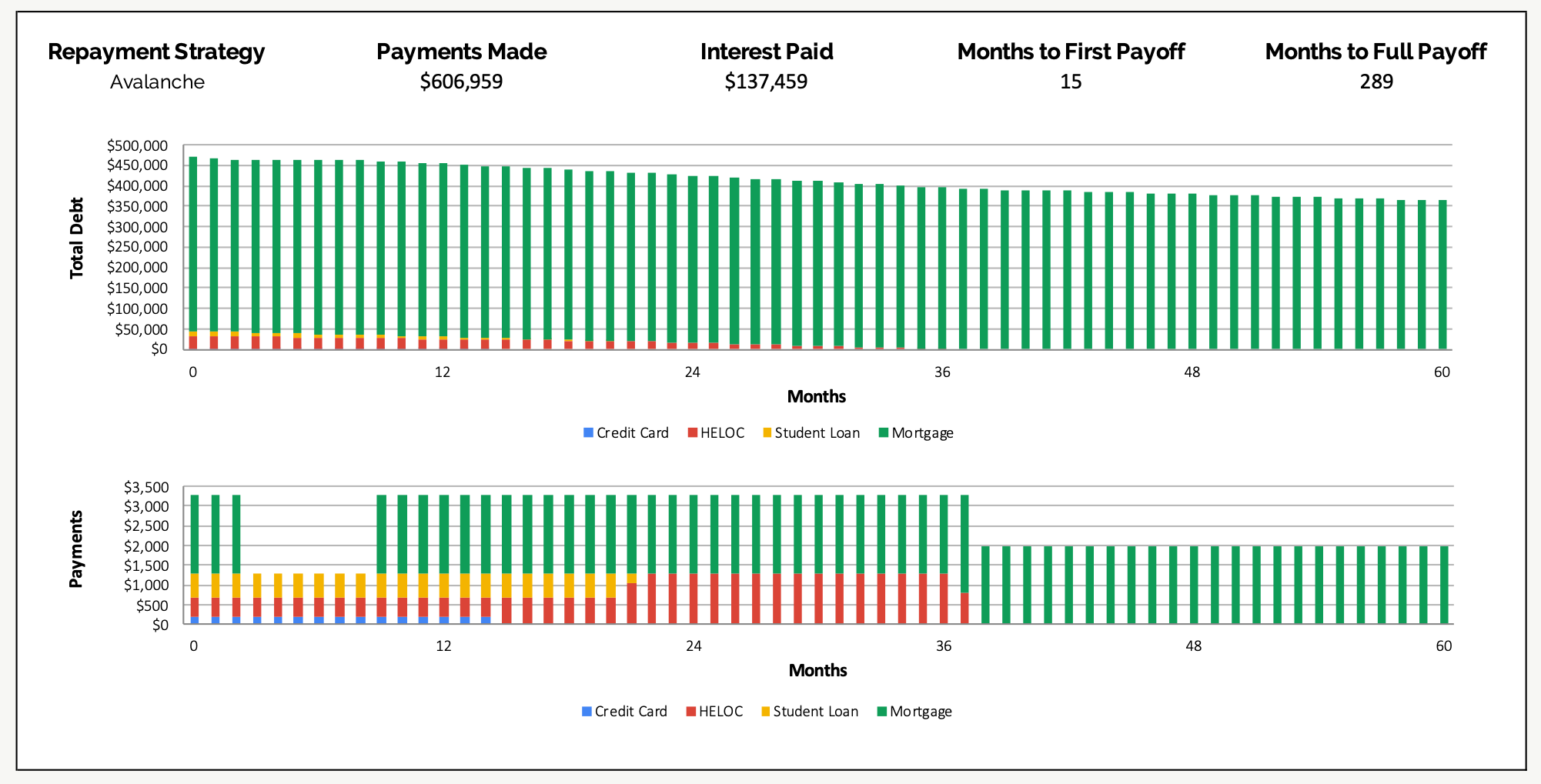

Mortgage With 6 Months Deferral And Extra Interest Added At End

(Same payments, extended amortization)

Total interest of $137,459. An increase of $8,542.

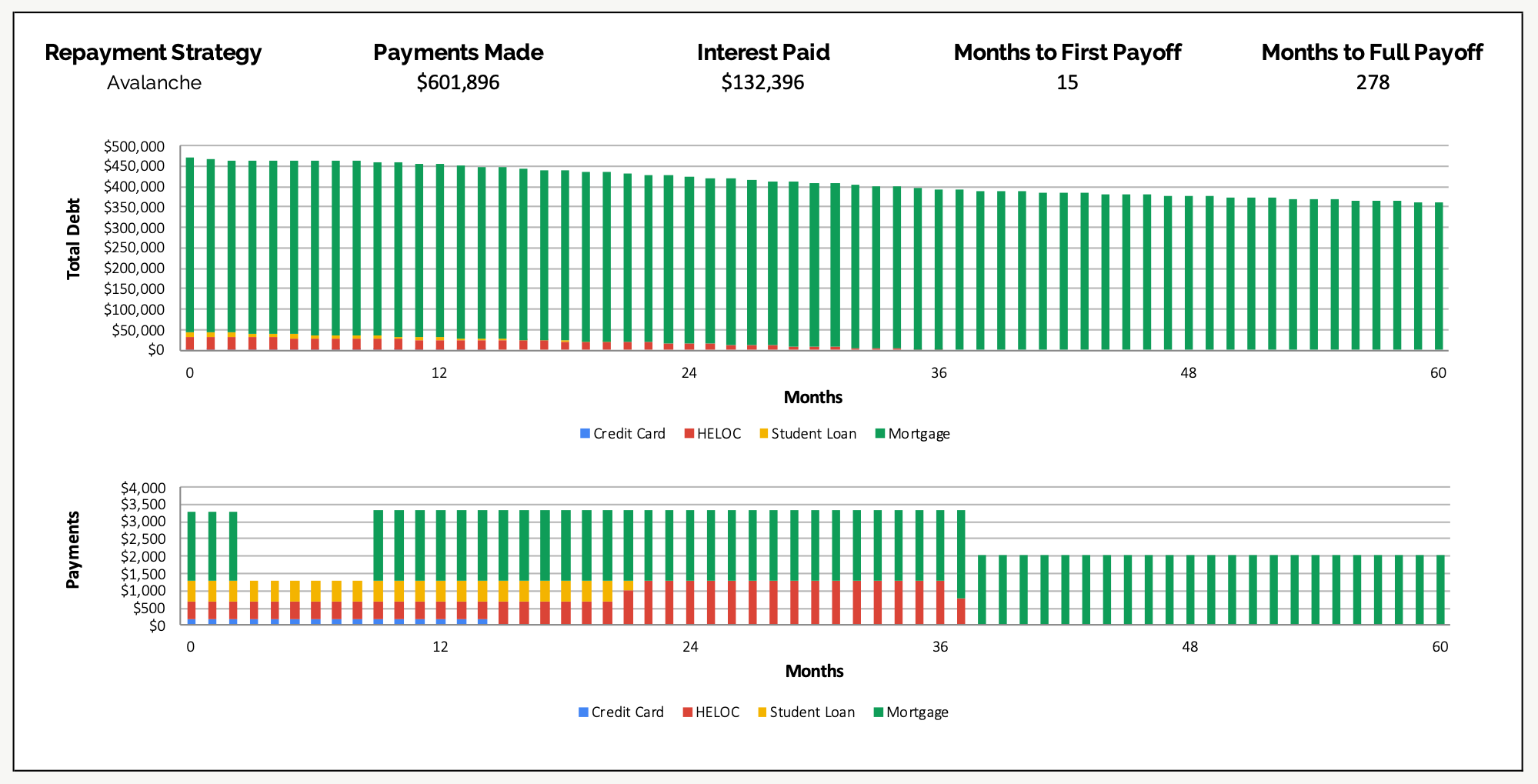

Mortgage With 6 Months Deferral And Increased Payments

(Higher payments of +$57/month, same amortization)

Total interest of $132,396. An increase of $3,479.

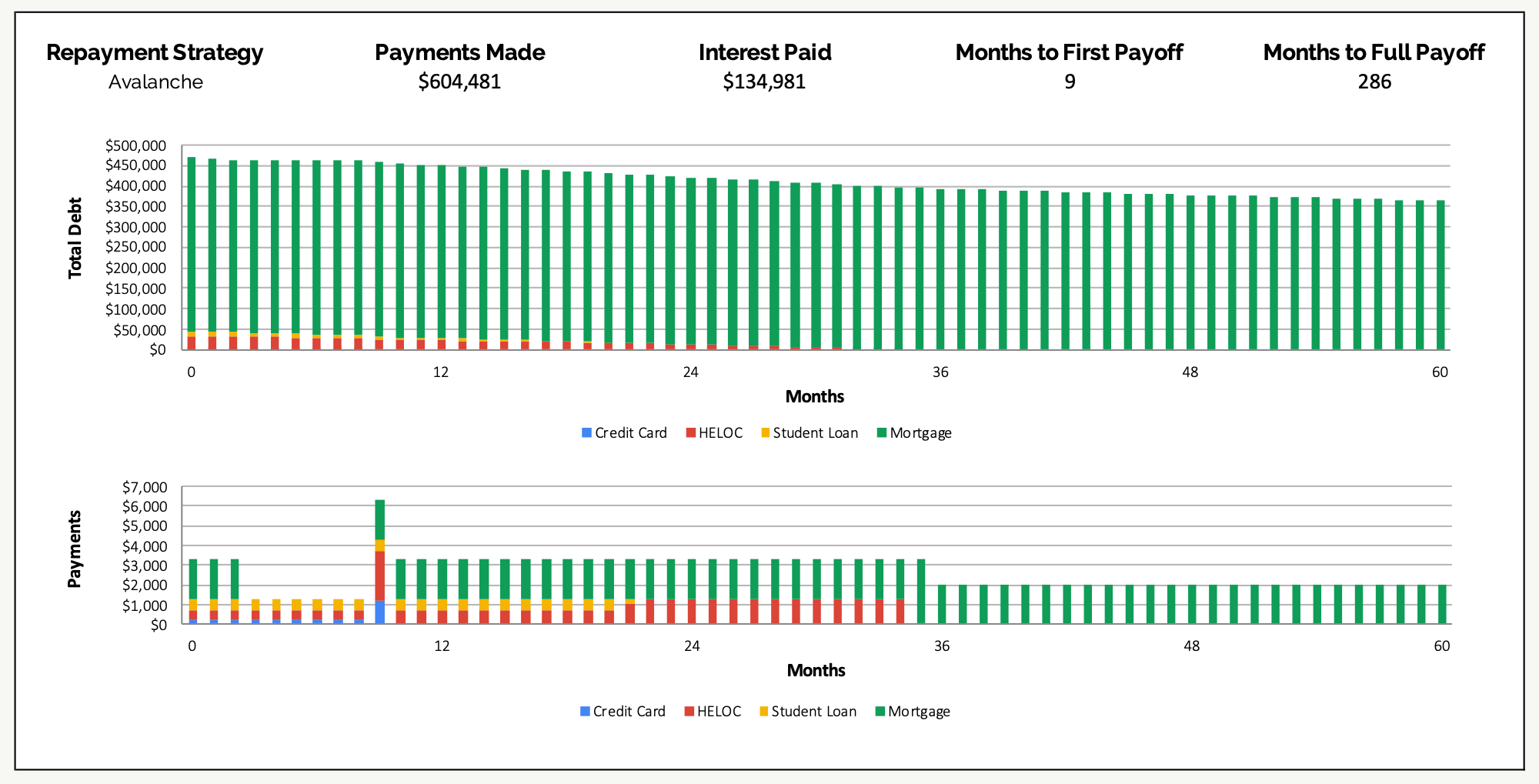

An Opportunity To Pay Off Other Debt

The mortgage deferral may actually create an opportunity to pay off other debt rather than the mortgage. This could be a great opportunity for individuals and families who have debt with interest rates higher than the mortgage. This could be credit card debt, a line of credit, a HELOC etc.

If the mortgage deferral has allowed for a small amount of cash savings to be built up then this could be used to pay down higher interest debt.

Imagine that the family in our example above was able to save $3,000 cash by the end of the mortgage deferral. This might be a result of deferred mortgage payments plus decreased expenses for childcare, restaurants, entertainment etc. If their cash flow has improved then one option would be to put this extra $3,000 back on the mortgage, but a better option would be to use it against higher interest debt.

If there was a HELOC and a credit card balance, then overall interest would be minimized by putting the extra $3,000 against the credit card debt.

Putting Extra $3,000 Against Credit Card Balance

The Cost Of Deferring A Mortgage

It’s a great source of relief to defer mortgage payments when income and/or cash flow are tight, but unfortunately the bank isn’t doing this for free and there is a cost to this deferral. The exact cost will depend on your mortgage payments, interest rate and remaining amortization. But regardless of the details, the effect will be the same, the interest will continue to accrue during the deferral period.

To determine the cost of mortgage deferral you can use our debt payoff calculator to help estimate interest cost over the remaining mortgage. By comparing a mortgage deferral versus making regular payments you can get a sense of how your future finances may change as a result of the deferral.

A small increase in payments may be all it takes to get back on track after the deferral is over. Or a lump sum payment down the road could work just as well. Leaving the payments the same however will mean the deferred payments are added to the end of the mortgage and the extra interest will compound over that period of time.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments