What Is GIS Allowance?

GIS Allowance is one of those unique government benefits. It applies only in very specific situations, but when it does apply, it can be very large.

GIS stands for the Guaranteed Income Supplement and it’s a government benefit for low- and moderate-income retirees. It is available after the age of 65 if OAS benefits have begun and if taxable income (line 23600 on your tax return) is below a certain threshold.

Allowance is another government benefit tied to GIS. Allowance is only available in very specific situations but it’s worth over $1,200 per month or $14,000 per year!

Given the size of GIS Allowance it can be very beneficial to understand how it works and when it applies. But, because it’s so rare, its often not considered when creating a retirement drawdown strategy. Unfortunately, not adjusting a financial plan for GIS Allowance will make retirement unnecessarily difficult for lower-income couples.

GIS Allowance is a government benefit that applies in only a few situations, but it is a benefit that is extremely large, and therefore it’s important to understand if and when you may qualify.

Who Is Eligible For GIS Allowance?

GIS Allowance only applies in very specific circumstances. The criteria to receive GIS Allowance include…

- Married or common-law couple

- Must have an age gap between partners

- The older partner must be eligible for GIS (over the age of 65, has started OAS, and has household income below the cutoff threshold)

- The younger partner must be age 60 to 64

- The younger partner has lived in Canada for at least 10+ years (or come from a country with a social security agreement with Canada)

These eligibility criteria are very specific, aren’t they? The GIS Allowance applies only in very specific situations but the benefit, if you can qualify, is very large.

How Many People Receive GIS Allowance Each Year?

Given the very specific criteria required for GIS Allowance, it’s understandable why it doesn’t make it into most retirement plans and may not even be on the radar for most financial planners.

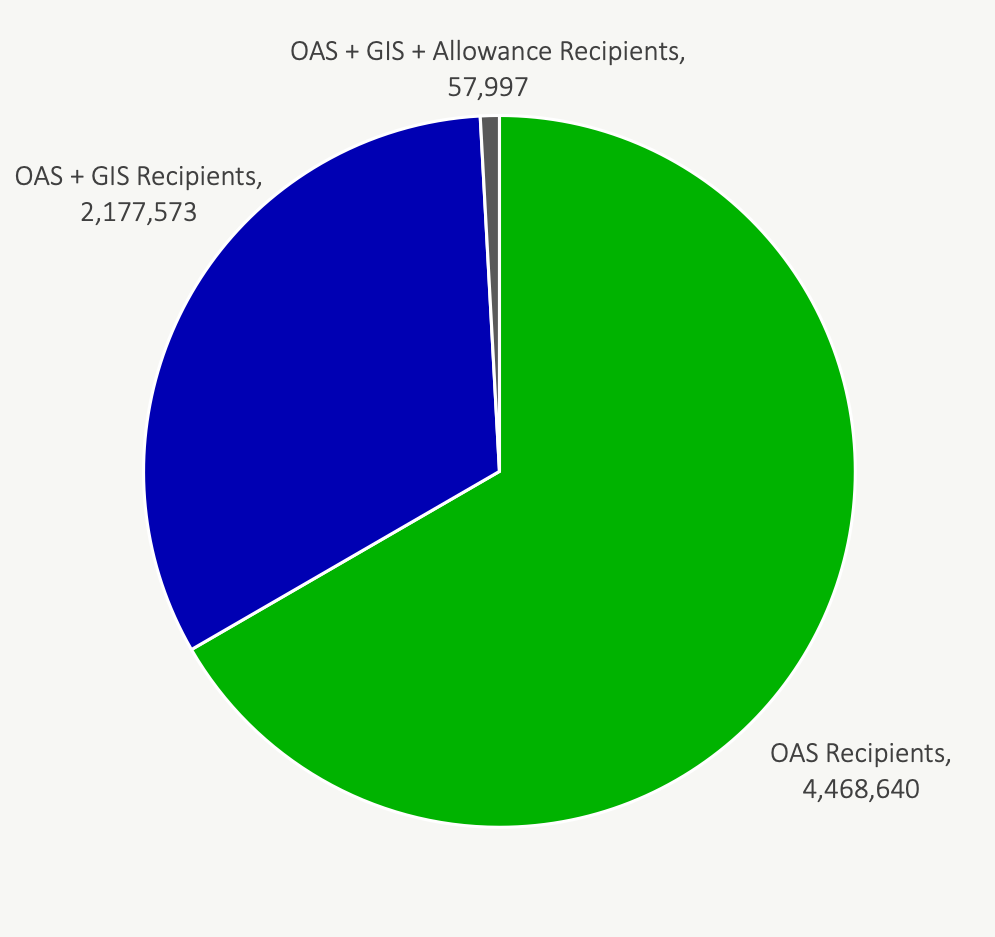

The statistics on OAS, GIS, and GIS Allowance show that less than 1% of OAS recipients qualify for GIS Allowance.

Given that GIS Allowance only applies for 5-years of retirement at most (when the younger partner is age 60 to 64), only to couples with an age gap (because the older partner must be over age 65 and the younger partner must be age 60 to 64), and only to couples who have lower-income, it’s understandable that planning for GIS Allowance isn’t more common as a retirement income strategy.

But I personally believe GIS Allowance would be more commonly used if the criteria and benefit were better known. I believe there are many circumstances where a lower-income couple could have been eligible for GIS Allowance if their retirement drawdown decisions were made differently.

OAS, GIS, and GIS Allowance Statistics…

- # of OAS Recipients: 6,762,207

- # of GIS Recipients: 2,235,570 (33% of OAS recipients)

- # of GIS Allowance Recipients: 57,997 (0.9% of OAS recipients)

As you can see, approximately 33% of retirees who receive OAS also receive GIS benefits, that’s just about 1 in 3 retirees who receive GIS, but only 0.9% of retirees who receive OAS also receive GIS and have a partner receiving GIS Allowance. At any given time, only 1 in 100 retirees are receiving GIS Allowance, so it’s quite rare.

How Much Is GIS Allowance?

Despite GIS Allowance being less common, the reason GIS Allowance is so important is because it’s a very generous government benefit. The maximum GIS Allowance is currently $1,206.41 per month or $14,476.92 per year! (As of September 2021, this amount will increase with inflation each year).

At a maximum, GIS Allowance is available for 5-years while the younger partner is age 60 to 64, so at the max, GIS Allowance can be worth $72,385 for a couple over 5-years. Not a small amount for any couple but especially when retiring on a lower income.

The maximum GIS Allowance benefit of $14,476.92 per year will be reduced by the GIS “clawback”. This clawback reduces GIS and GIS Allowance for any taxable household income (line 23600 on your tax return). This includes CPP payments, defined benefit pension payments, and importantly, RRSP/RRIF/LIF withdrawals. Learn more about GIS clawbacks.

Making the wrong decision about retirement income could result in a couple being ineligible for GIS and GIS Allowance (for example if large RRSP/RRIF/LIF withdrawals are made). It can also be possible to qualify for MORE GIS and GIS Allowance when strategic RRSP contributions are made. Learn more about how strategic RRSP contributions can increase GIS.

The maximum GIS Allowance is $1,206.41 per month because it is essentially paying the equivalent of both OAS benefits ($635.26 per month) and GIS benefits ($571.15 per month) to the younger partner even though they are not yet eligible for OAS.

At a maximum, the older partner will receive $635.26 per month from OAS and $571.15 per month from GIS, and the younger partner will receive $1,206.41 per month from GIS Allowance. In total, at a maximum, and before clawbacks, these benefits are worth $28,953.84 per year for a couple!

When Should You Care About GIS Allowance?

So when should you care about GIS Allowance? As you can see, for any couple with an age gap this type of retirement drawdown planning is extremely important.

When a couple are similar age, they’ll both be eligible for OAS and GIS around the same time. In these situations, GIS Allowance isn’t as important because the number of months they’ll qualify will be small.

But when a couple has an age gap of a 1-2 years or more, it becomes extremely important to consider the impact of GIS benefits and specifically GIS Allowance.

With a little bit of retirement income planning, it can be possible to qualify for GIS and GIS Allowance. These generous government benefits can make retirement significantly easier, especially for lower-income households.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

I’m very surprised that only .9% receive the allowance. I suspect it is because most seniors are unaware that it exists. The other ‘big secret’ is the ISP3041 form that allows seniors to receive GIS based on the current year rather than last year’s income when retiring.

You’re right Mark, the Statement of Estimated Income form is a great opportunity for many new retirees which probably doesn’t get used as much as it should.

For those reading this comment and want to find the form it is ISP3026 and not ISP3041.

Hi Owen,

Do the same income clawback rules apply to the allowance as for GIS proper with regard to employment? So $5000 employment income not triggering a clawback and the next $5000 only triggering a $1250 clawback?

Thank you for your feedback!

That is a good question Will, I’m not 100% certain if a spouse, who qualifies for GIS Allowance, also gets the $5,000 exemption on employment income. That is something that would require a call to Service Canada.