The Tale Of Two Pandemics

The global pandemic has impacted all of us differently, our personal finances have gone through many changes and some have “weathered the storm” better than others.

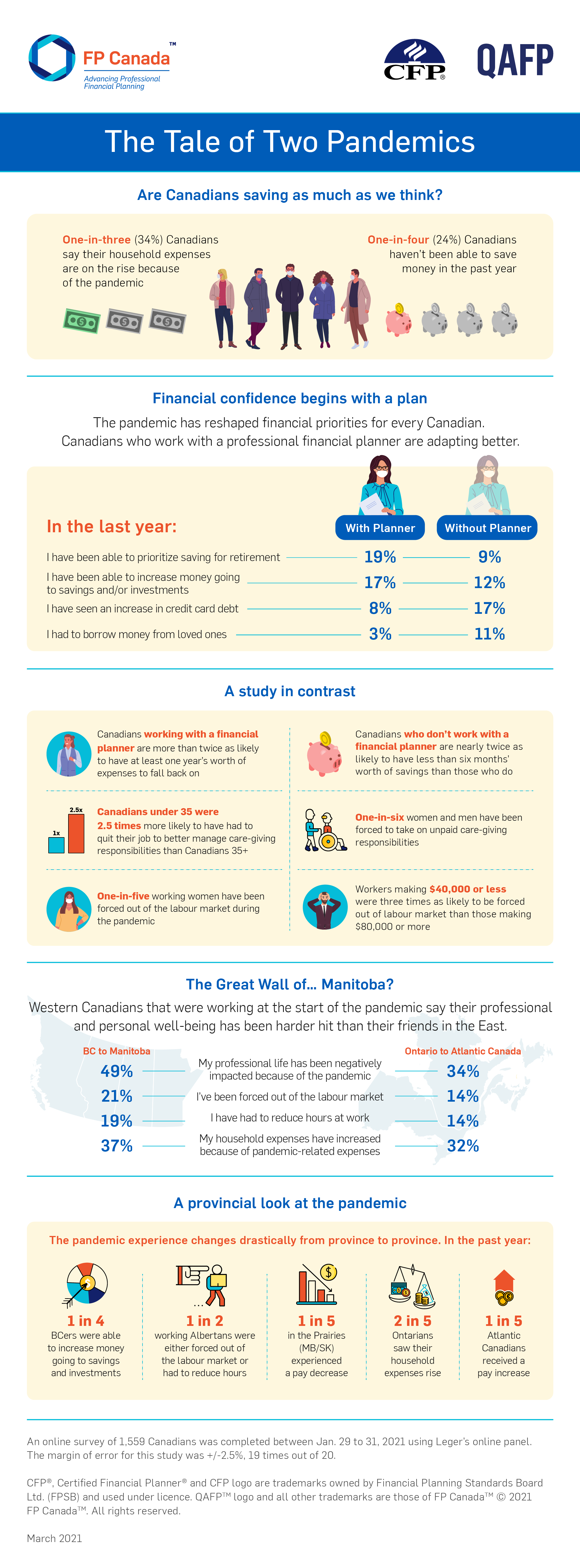

FP Canada, the board that governs the Certified Financial Planner (CFP) designation in Canada, recently came out with a survey called “The Tale Of Two Pandemics” and it highlights both the positive and the negative impact that the pandemic has had on our personal finances (more details on the survey results at the end of this post).

There are some troubling stats within the survey, for example 14% of those in Ontario have been forced out of the labor market, 21% have seen an increase in expenses, and 14% have seen a reduction in work hours/income.

But the survey also highlights the opposite side of the pandemic, many people have not experienced a job loss, or a reduction in income, or an increase in expenses over the course of the pandemic.

In fact, looking at the statistics, it looks like there is a large group of people that have not been affected by the pandemic at all, and another group of people who have actually benefited financially from the pandemic.

This is consistent with the conversations we’re having with clients.

For those who have been fortunate enough to remain gainfully employed, for those who own a home or recently purchased a home, for those with a mortgage or other debt like student loans or HELOCs, and for those who are investing on a regular basis, the pandemic has actually improved their personal finances in a number of ways.

The pandemic has impacted us all differently, but for many people there have been one, two, three or more positive changes that may have actually improved their personal finances. As it turns out, this is especially true for those who had a financial plan already in place.

Here are some ways that a person’s personal finances may have improved during the pandemic…

Number One: Lower Interest Rates

As the pandemic took hold the Bank of Canada quickly lowered their benchmark rate to a record low of 0.25%. This had an immediate effect on any debt that was tied to the prime rate. It immediately lowered interest costs for many individuals.

Similarly, the interest rate on fixed mortgages quickly dropped to record lows. Five-year fixed rate mortgages were being secured at interest rates as low as 1.49%.

This decrease in interest rates had a large positive effect for homeowners and those with debt tied to prime (HELOCs, government student loans etc). It also created a large opportunity to revisit debt payoff plans. With interest rates at record lows, paying off debt may become less of a priority. It also created an opportunity to refinance existing debt and lock in at record low rates, this improved cash flow and will help achieve other financial goals.

If you have debt, you may have already benefited from the lower interest rates. And if you haven’t revisited your debt payoff plan, now might be the right time to do so.

(Oh… and one other benefit… for those with a spousal loan set up, the drop in prime also mean a drop in the prescribed rate from 2% back to 1%, decreasing the income being taxed in the hands of the higher income earner)

Number Two: Rising Home Prices

With record low interest rates, and a desire for space, the housing market in some areas has been on fire. The result has been a rapid increase in home prices.

For homeowners and new homeowners, this has resulted in a large increase in home equity over the last 12-months. In some areas, the increase in average home prices has been more than average annual employment income!

Rising home equity, especially when it causes the debt-to-equity ratio to drop below 80%, can create an opportunity to refinance debt and/or secure an investment loan.

An increase in home prices could create an opportunity to roll higher interest debts like vehicle loans, HELOCs, lines of credit, or credit card debt, into the mortgage and significantly decrease interest costs and increase cash flow (especially considering the ultra-low interest rates mentioned above).

The increase in home prices, coupled with record low interest rates, also creates an opportunity to use that increased home equity for investment purposes. Investment loans for non-registered investments and/or rental properties are tax deductible. This tax deduction lowers the cost of borrowing even further (although this increased leverage does also increase investment risk, so be careful!)

Strategies like the Smith Maneuver, which helps convert interest on mortgages or HELOCs into a tax-deductible expense, have become more popular with ultra-low interest rates and rising home equity. For someone in the highest tax bracket, the net interest cost after tax deduction can be lower than 1%! This makes this type of investing and tax strategy very attractive in some financial plans.

Number Three: Deferrals On Student Loan Payments And Mortgages

During the pandemic, certain debts had either automatic deferrals or deferrals upon request. These deferral opportunities allowed many people to increase their savings, build an emergency fund, and in some cases even invest that extra cash flow.

This increased cash flow, especially when still fully employed, allowed many to kick start their savings accounts and/or investment accounts.

Number Four: Lower Expenses And More Savings

Although a large group has seen an increase in expenses during the pandemic, an even larger group has either seen their expenses remain flat or decrease.

As spending on entertainment, travel, and discretionary purchases decreased, piles of cash began to accumulate. For families with young children in daycare, those costs were reduced even further by stay-at-home orders, this significantly reduced spending for young families (although it significantly increased stress too!)

With lower monthly spending many people have accumulated a sizable pile of cash over the course of the pandemic. This could be a few $1,000 or $10,000+. In some cases, the cash pile has grown to $50,000+ over the last 12-months.

This creates an opportunity to revisit investment plans and put that cash to work. Investing a large pile of cash is a daunting experience but it’s important to maintain “the right” amount of cash and allow the rest to grow for the future. What “the right” amount of cash is will vary from household to household.

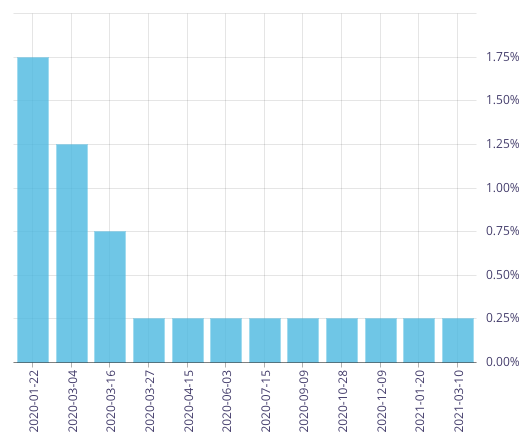

Number Five: An Increase In Investment Values

Lastly, for those who had a strong investment plan and were investing on a regular basis during the course of the pandemic, the drop in investment values in early 2020 ended up having a positive effect on their portfolio value.

Regular dollar cost averaging and regular rebalancing would have helped the average investor “buy low” during the drop and subsequent recovery in investment values. Having a good investment plan would have helped investors “stay the course” during those large drops in March and April 2020.

It’s Time To Revisit Your Financial Plan

Whether it’s fair or not, the pandemic has affected us all differently. For many people, the pandemic has had a positive effect on their personal finances.

Regardless of which group you’re in, it’s probably time to revisit your financial plan (or create a new plan if you’ve never done so).

A financial plan will help you chart a course for your personal finances over the next 5, 10, 25+ years. A financial plan will help you take advantage of any opportunities that currently exist (like some of the ones mentioned above). A financial plan will help you create the right routines and the right systems to feel confident about your finances in the future.

We don’t know what will happen over the next 3, 5, 10+ years, but there are certain things that we can do now to put us in the best position to “weather the storm” in the future.

If you’ve never created a financial plan, then this is the perfect time to start. If you’ve created a financial plan before, now is a good time to revisit that plan and make adjustments. Let’s start planning! Check out our planning packages now!

Survey Highlights…

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments