The Psychological Risk Of Taking A Commuted Value

When leaving an employer, or when transitioning into retirement, those with a defined benefit pension will have a difficult decision to make… take a lifetime pension? Or take a commuted value?

A commuted value is essentially the current value of those lifetime pension payments in one large lump sum. The commuted value is an amount that is determined to be equal to the lifetime of payments that a pension would provide. It’s calculated by the pension actuaries and can easily be several $100,000 or even $1,000,000+

With interest rates at historical lows, the commuted value of a pension can easily be $1,000,000+ for those at retirement age. Low interest rates will push up the size of a commuted value, which is partially driven by an assumed rate of return, and right now interest rates are at historical lows.

This creates a very large psychological problem; how do you invest all that cash?

In particular, when do you invest it? Do you invest it all at once as a large lump sum? Or do you invest it in smaller increments over a period of time?

If invested all at once, that commuted value could drop dramatically if markets experience a correction in the near future.

If invested later, that commuted value could miss out on a large increase in value during a period of growth.

The indecision around how to invest a large amount of cash can cost tens of thousands of missed investment gains, or it can cost hours of lost sleep and feelings of stress. It’s not something to be taken lightly.

Investing a large lump sum is a daunting experience even for the most seasoned investor.

Investment Experience Is One Consideration

One of the most challenging aspects of taking a commuted value is that it can often double, triple, or quadruple the size of an investor’s portfolio.

For those with a good pension, there likely hasn’t been a lot of capacity to save and invest (or need for that matter). There may not be a lot of RRSP contribution room available and there may be modest TFSA or non-registered investments.

As a result, investors with a good pension may have a relatively small investment portfolio. They may not have much investment experience. They may not have experienced many large increases/decreases in portfolio value in the past. They may not have a good routine for managing their investment portfolio. Their investment portfolio might have high investment fees, an asset allocation that is not in line with their risk profile, a lack of diversification, or no clear rebalancing guidelines etc. etc.

Add on $1,000,000 in cash to invest and things can get very overwhelming very quickly. This can lead to indecision about how to invest this large pile of cash. One common mistake is that an investor sits on this large pile of cash for months (or even years) waiting for a “good time to invest”.

Without a good plan in place, without considering the psychology behind investing a large lump sum, it can be easy to just put off making an investment decision for a while.

Considering both the psychology and the math behind investing a large lump sum there are often two options to choose from. One is to invest everything in one large lump sum, the second is to dollar cost average over a period of time.

Both options have pros and cons, and the correct option will depend on your personal circumstances, investment experience, current portfolio etc. etc.

(Read about some other considerations when taking a commuted value)

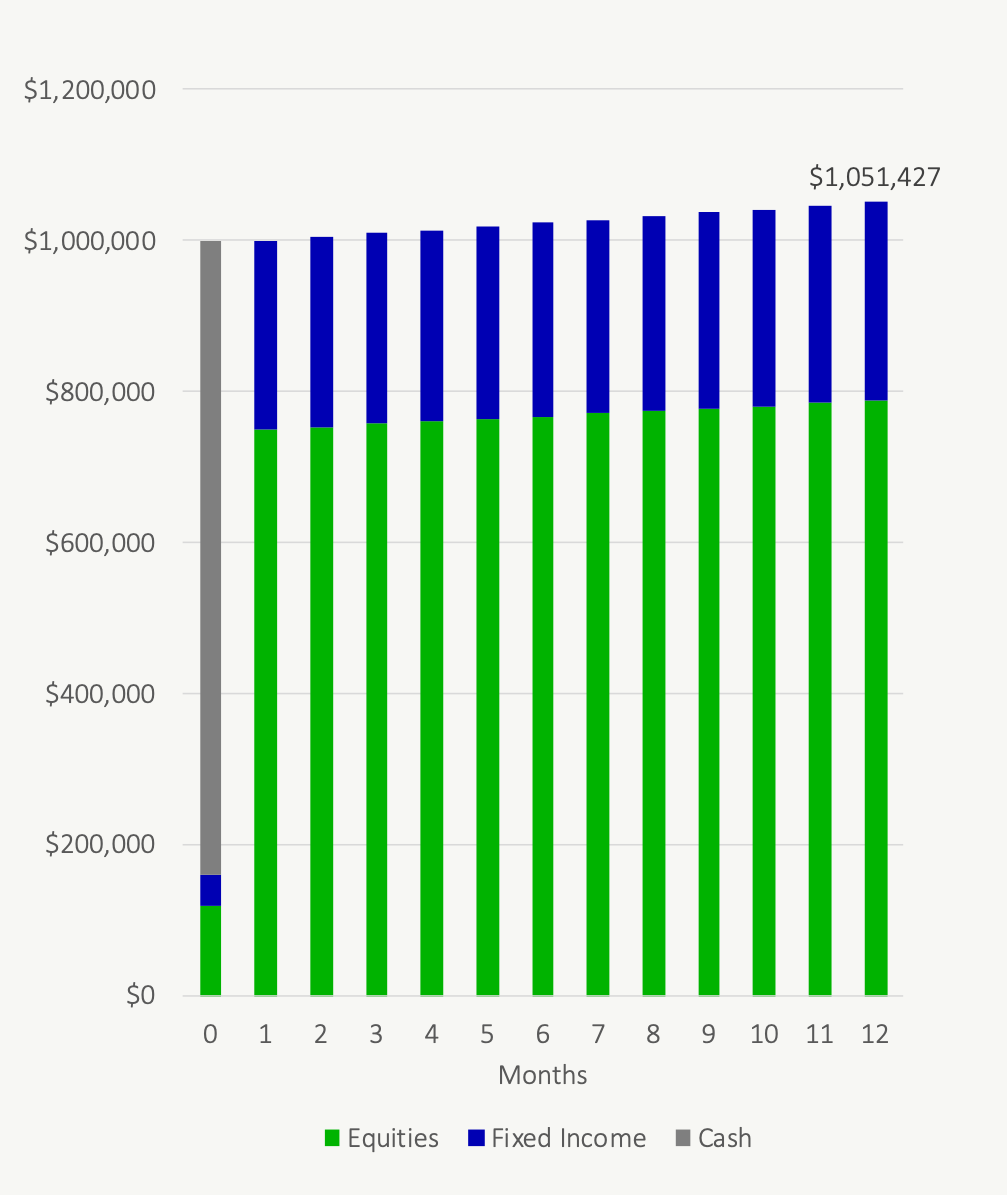

Option 1: Investing A Large Lump Sum All At Once

Investing a large lump sum is mathematically the best option about 2/3rds of the time. On average, investing a large lump sum, rather than smaller amounts over time, will lead to a higher portfolio value in the future.

When investing a large lump sum the entire amount is invested all at once. This method benefits from having the most “time in the market”. This option also benefits from the fact that, on average, a portfolio will grow year over year. Investing everything all at once will maximize this growth.

On average we know this is a good decision based on past historical results. Investing all $840,000 at once would, on average, lead to a higher value after 12 months. If we could make this decision 100 times, then on average we’d come out ahead.

The challenge, of course, is that we only make this decision once and we have no idea what side of the average we’re on. Are we in the 2/3rd that benefit from a large lump sum, or are we in the 1/3rd that could see a large drop in the near future? Will the portfolio soon decline by 10%, 20%, 30%+? And more importantly, how would that feel?

Making a large lump sum investment is a daunting experience, even for the most seasoned investor, but it’s especially challenging if past investment experience has been minimal.

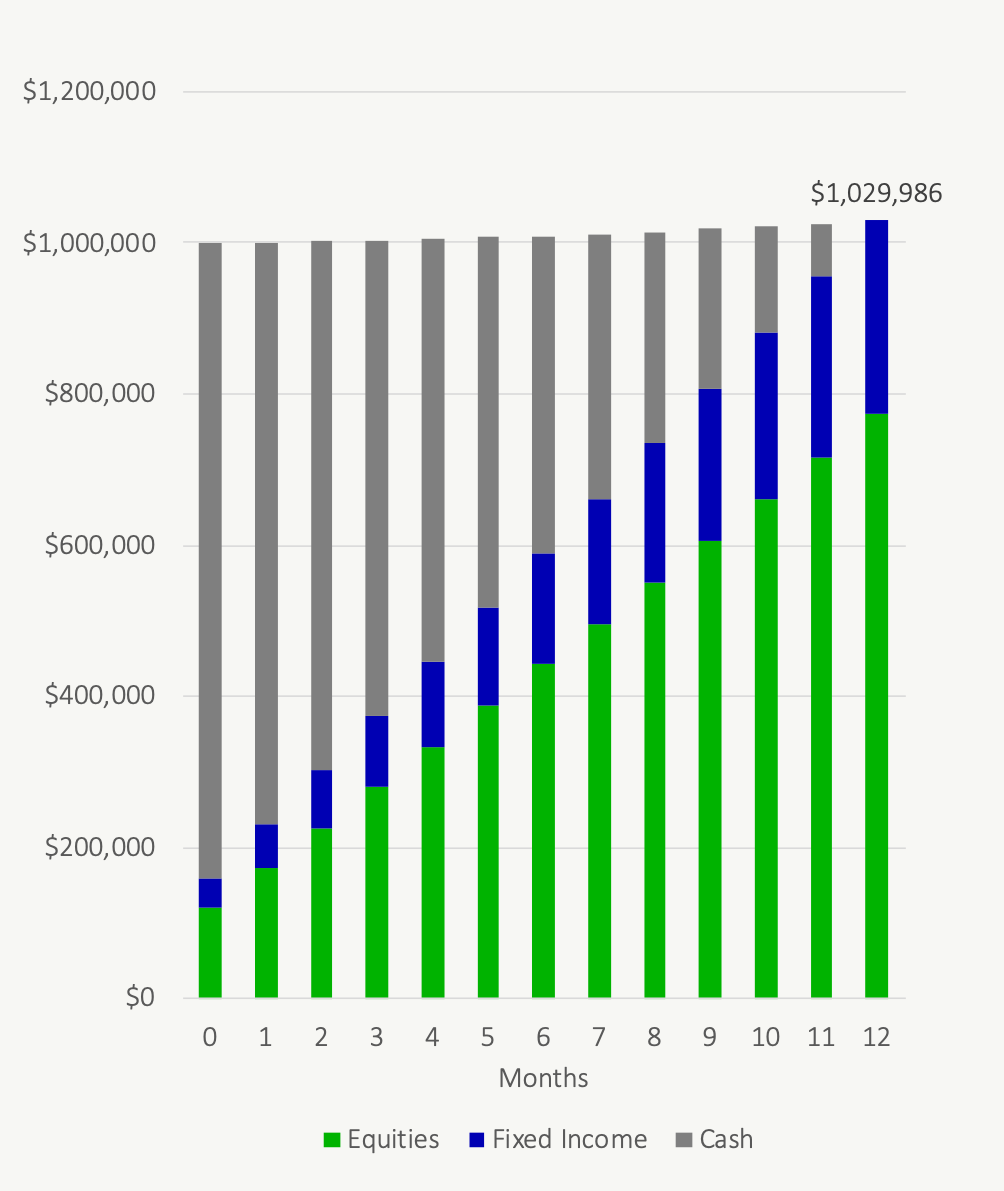

Option 2: Dollar Cost Averaging Over A Short Period Of Time

Investing over a short period of time may not be the mathematically best option, but psychologically it might be a better choice for many.

“Dollar cost averaging” is the term used to describe a series of smaller investments made on a regular basis.

Dollar cost averaging a commuted value might involve splitting a commuted value into 12 equal chunks and investing those chunks each month for 12 months.

The benefit of this approach is that it provides a psychological advantage. If investment values decline in the near future the investor feels good because they can buy more at a reduced cost. If investment values rise in the near future the investor feels good because they already have part of their cash invested and have benefited from the increase. Dollar cost averaging helps manage the psychological risk.

This may not be the best option mathematically, but psychologically it can be much easier to stomach investing $70,000 per month for 12 months rather than $840,000 all at once.

Common Mistake: Sitting On A Large Amount Of Cash-On-Hand

The indecision that is caused by a large commuted value isn’t something that should be taken lightly. One of the largest risks, and one of the most common mistakes when receiving a commuted value, is leaving that money in cash for a few months (or even years).

Sitting on a large amount of cash-on-hand, whether that be from a large bonus, an inheritance, a commuted value etc. is a common problem. Without a plan it can be daunting to invest a large amount of cash. It can cause a lot of indecision and second guessing. Often that indecision can last for years. This can impact an investors long-term portfolio value.

It’s an understandable issue, no one wants to invest at a market peak only to see their investments drop in the near future (although over the long-term we know investing at an all-time-high doesn’t really matter that much).

This feeling is multiplied by 10x or 100x when a large commuted value is involved. This feeling becomes even worse when those investments are necessary to support retirement spending. And it’s especially challenging when a commuted value increases the size of an investment portfolio by 2x to 4x.

But sitting on cash creates a large opportunity cost. At an average return of 5.55% for a portfolio of stocks and bonds that indecision could cost tens of thousands per year.

If you expect to receive a large commuted value in the future, then it’s important to plan how that large amount of cash will be invested. It may seem easy in theory but it’s difficult in practice. Without a clear plan in place there is a risk that cash sits around for months or even years.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Very important and thought provoking ideas.

Something to consider and how your actions help / hurt you.

Great post Owen, I have read that it closer to 90% better to lump-sum…we get this question all the time from clients. I invariably recommend a hybrid – 25% upfront and the balance over a year with the plan to accelerate the DCA when the markets correct down. We did a white paper related to this last summer.

https://www.steadyhand.com/personal_investing/2020/07/28/the-hardest-decision-in-investing/index.php

The hybrid approach is a great idea David! Investing earlier is always better and the hybrid approach gets more invested earlier but still addresses the psychological risks, great suggestion!

In terms of lump-sum vs dollar cost average, Ben Felix at PWL did a detailed analysis and found on average 65% of the time lump-sum investing did better than dollar cost averaging, however there are a few gaps in the analysis, one is that the comparison was cash versus a 100% equity portfolio, which isn’t typically the case, the second is that investment fees were not taken into account, which would reduce the gap between cash returns and net equity returns and decrease the advantage of lump-sum investing slightly. Still, its a very thorough analysis… https://www.pwlcapital.com/wp-content/uploads/2020/07/Dollar-Cost-Averaging-vs-Lump-Sum-Investing.pdf