The Effect Investment Fees Have On Retirement Planning

Everyone is talking about investment fees these days. There are ads on the radio, television, and online… there are podcasts, websites, blogs dedicated to low-fee investing… there are also books, magazines and research studies… all focused on one thing… how much the average investor pays in fees while saving for retirement.

But very few people are talking about the effect investment fees have on retirement itself. Mostly they talk about how fees impact you as you save for retirement, but very few mentions what happens if you continue to pay high fees as you enter retirement.

Fees definitely have an enormous impact on how much you can save for retirement. The average mutual fund fee is 2.35% in Canada, and that’s the average, there are lots of situations where the fee is even higher. The effect of this fee on a lifetime of savings and investments is enormous!

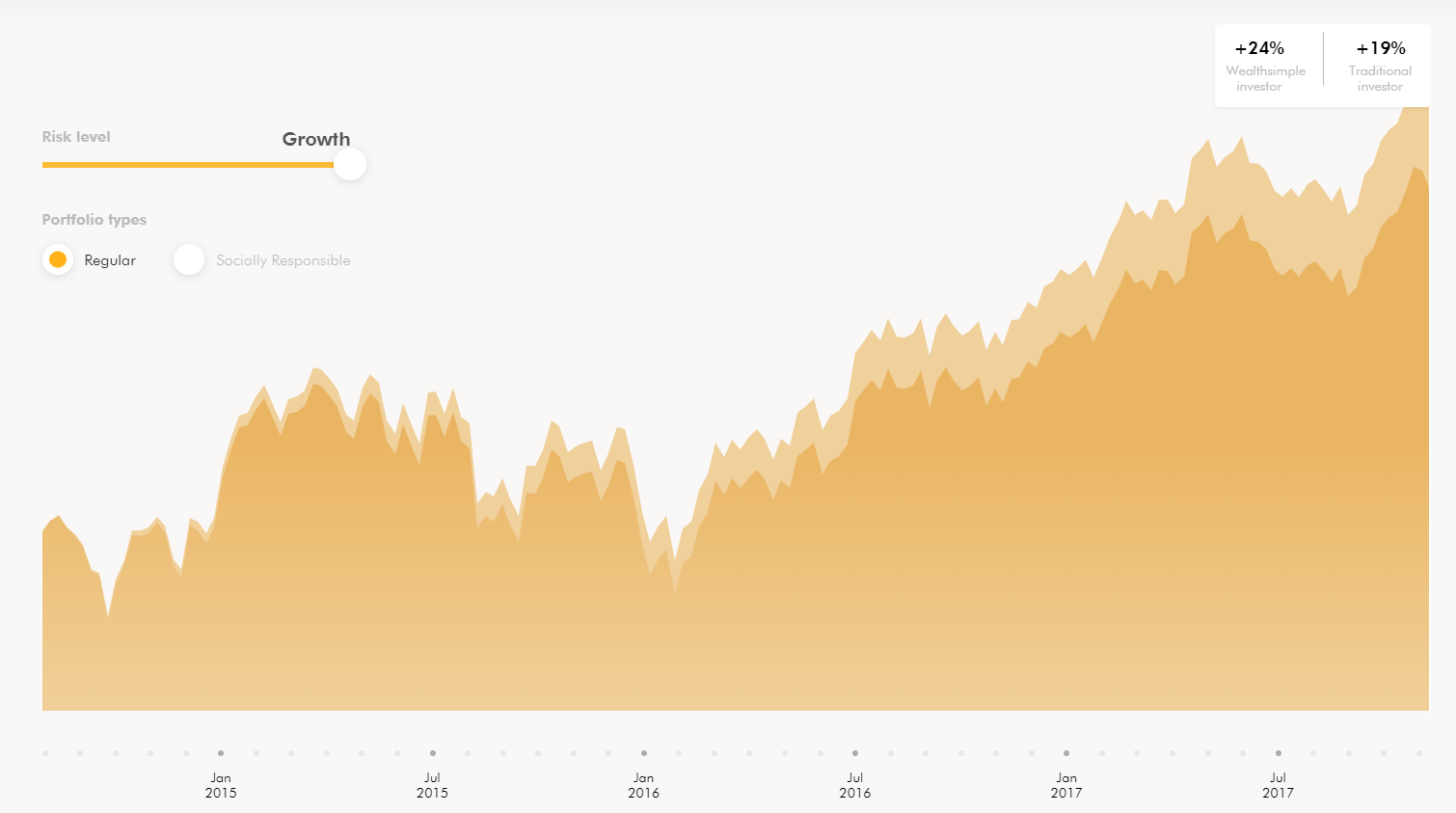

Here’s an example taken straight from WealthSimple’s website…

But what if you’re close to retirement? What is the impact then? Arguably the effect of investment fees on retirement planning is even greater than any other period.

Why?

Fees have an enormous effect on retirement planning because by the time we’ve reached retirement we’ve already saved up a huge nest egg. Unlike the accumulation phase, where you have limited assets in the beginning, when it comes to retirement, you’re starting with a huge amount of investment assets. This makes the impact of fees enormous, especially in early retirement.

The problem for retirees is that investment fees are hard to spot, hard to find, they’re almost hidden by investment providers, whether that is intentional or not. I’ve seen this on countless investment statements I receive from clients. Based on the statement alone you would NEVER know how much they’re paying in investment fees each year.

This isn’t an isolated issue, it’s a problem that many, many retirees face. Low-fee investing is a relatively new option in Canada. If you were investing 10-20+ years ago there just weren’t as many options to reduce your investment fees.

Many retirees who have high-priced investments are shocked (and somewhat saddened) to learn exactly how much they’re paying each year. It’s not their fault, this information is hard to find and not readily available to investors.

To figure out how much an investor is paying each year usually requires some digging. Mutual fund codes vary by fund and fund class. Sometimes fees can vary by 1% or more for the same mutual fund depending on the class.

But once you know how much you’re truly paying you can start to see the impact it will have on your retirement plans. There are two main effects that high fees can have on retirement, and the impact can be substantial.

Effect #1: Reduced Spending

Plain and simple, high investment fees mean you need to decrease your retirement spending to offset. Paying $10,000 per year in fees? That means you need to reduce your retirement spending by about $10,000 to offset. How many vacations could you get for $10,000 per year?!?

Let’s look at a quick example.

Mark and Sandra have saved $800,000 for retirement and they pay 2.56% average Management Expenses Ratio (MER) on their investments. This is slightly above the average in Canada but still pretty common.

By comparison a low-cost portfolio of mutual fund or ETFs could be anywhere from 0.5% to 0.2% MER. That means they’re paying their investment advisor an additional 2.06% to 2.36% per year.

Although the 2.56% is deducted right from their investments each year and they never pay this amount out of pocket, this is still an expense, pure and simple.

The cost for Mark and Sandra is $20,480 per year. A low-cost alternative could be as little as $4,000 to $1,600 per year.

By sticking with their high-priced mutual funds Mark and Sandra are paying an extra $16,480 to $18,880 in investment expenses each year (whether they see it or not).

We all value spending differently. For Mark and Sandra, they may really benefit from their investment advice and may not mind paying $18,000+ per year. But they may also feel like this $18,000+ could be better spent in other areas like travel, entertainment, gifts for loved ones, or donations.

When it comes to retirement spending, we have to evaluate how much value each expense actually provides, and that includes investment fees.

Even with fancy tax planning and drawdown strategies there are usually limited dollars to go around (unless you’re super wealthy). When it comes to retirement spending, investment fees are an expense just like any other, and for some people the value they receive may not be equal the actual expense.

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

Effect #2: Reduced Success Rate

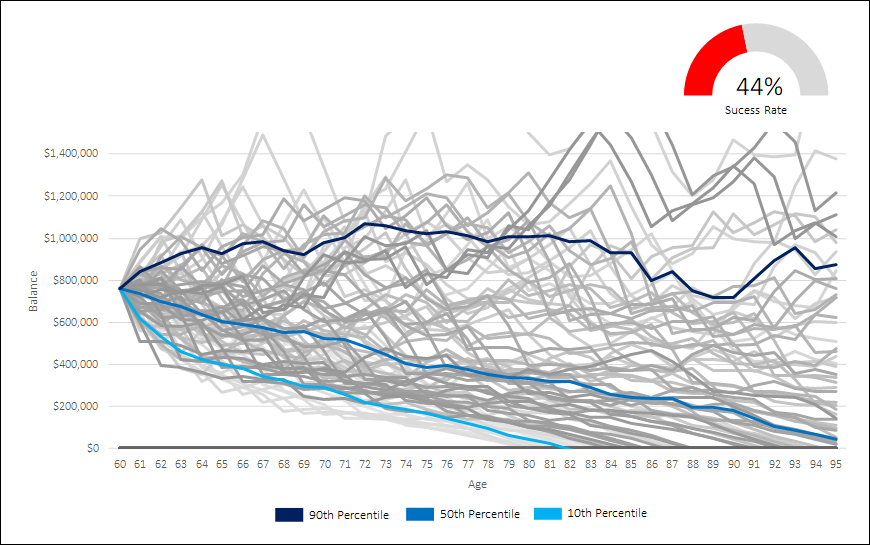

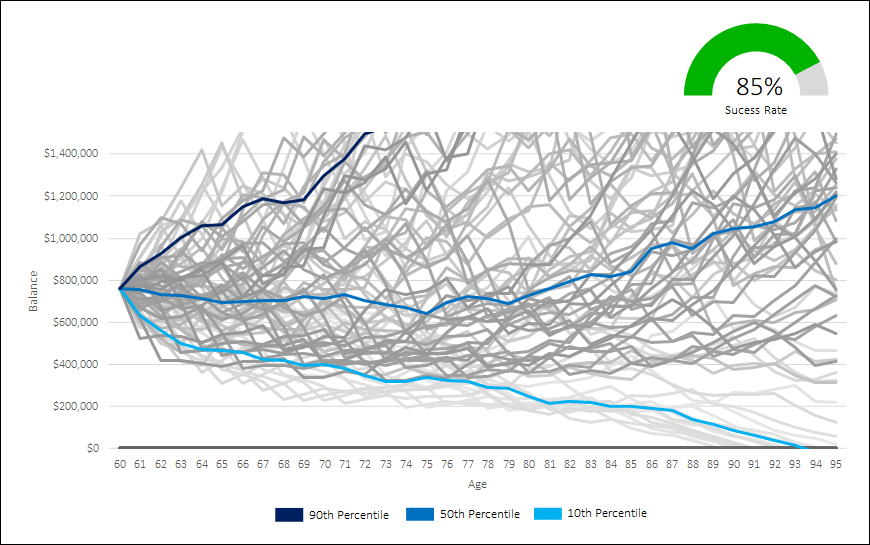

The other effect that investment fees can have on a retirement plan is a decrease in the overall success rate. Success rate is the likelihood that your retirement plan won’t run out of money over the course of your lifetime. It looks at your investment assets and withdrawal plan over historical periods of stock, bond, and inflation rates.

Higher annual fees will eat into the portfolio returns and cause the portfolio to decline faster than it otherwise would. The result of this faster decline is that the retirement plan runs out of money more often.

With lower annual fees, the portfolio doesn’t decline as quickly, and there is a higher chance that your portfolio can weather future recessions.

The effect that investment fees can have on the success rate of a retirement plan is significant. For Mark and Sandra their plan goes from having a high success rate of 85 times out of 100 when there are low-fees, to a much lower success rate of 44 times out of 100 when there are high-fees. With high-fees their retirement plan is likely to fail over half the time!

Higher investment fees mean that Mark and Sandra have to be very careful during retirement. If investment returns are negative, or even just flat for a period of time, this could put their plan at risk. This will require big reductions in spending to stay on track.

The Effect of High-Fees on Success Rate

The Effect of Low-Fees on Success Rate

Avoid The Drag Of Fees

One of the best things a person can do for their financial future is to reduce and/or avoid the drag of fees on their investment portfolio.

Saving more money is good, being tax efficient by using TFSA and RRSP is good too, but reducing the drag of investment fees on your portfolio is great. Once you reduce your investment fees there is very little ongoing effort required. Once you make the switch, you’ll reap the benefits for years or decades to come.

It can be scary to make change. There is always the fear of the unknown. This is where a little bit of help can go a long way. Once you’ve made the change, you’ll find that it’s actually much easier than you thought, and your future self will thank you.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Wow crazy graph!

It’s unfortunate how high the MER fees are in Canada. Thank goodness I got out of that black hole years ago and picked the DIY low cost low fee approach!

It is really unfortunate, it has a big impact on people’s financial plans, especially in retirement. That’s great you go out GYM, low-cost investing is the best way to go, and there are so many options available now!