The Benefit Of Financial Planning When You’re Young

There’s a common misconception that financial planning isn’t necessary when you’re young. Young people are often told to go “read some books” about personal finance. Financial planning is traditionally thought of as something reserved for those with higher income, higher net worth, transitioning into retirement etc.

The fact is… this couldn’t be further from the truth.

One of the BEST times to build a financial plan is when you’re young, when you have lots of options, when you’re designing your life (both personally and financially), and when you’re making some BIG financial decisions that will impact you well into the future.

Some of the financial decisions you make while you’re young can haunt you for years or decades. Making the right decisions now can mean less stress and greater peace of mind in the future.

So why is there this misconception that financial planning isn’t for young people?

Most likely because financial planning in the past was focused on products, it was all about investments, insurance, new debt etc. Products that could be sold. Young people were often left out of the conversation because in general, young people don’t need products, they need advice.

Getting the right advice is so important when you’re young.

Even small decisions can have an enormous impact over time. It’s important to get the right advice early on, avoid common mistakes, and create the right systems and habits that will pay dividends for decades to come.

This advice should cover a few key areas that “traditional” financial advisors rarely cover.

#1 Advice Around Income And Spending

One of the most important areas in any financial plan is income and spending. But this is arguably even more important when you’re young. Spending habits, specifically bad spending habits, will follow you for the rest of your life. The difference between financial success and financial failure is as little as $10 per day.

Setting up (and perfecting) a system to manage income and spending is one of the most important things you can do while you’re in your 20’s and 30’s.

There are best practices around budgeting, emergency funds, planning for infrequent expenses etc.

Getting a strong system in place is easiest when these are things are small. And there is less impact when making mistakes. A good financial plan should highlight these best practices and ensure you have a strong system in place to help manage income and spending in the future.

#2 Advice Around Buying A House

The biggest purchase most of us will ever make is buying a house. Buying that first home is an important decision. It can influence years and decades of expenses in the future.

Understanding the impact of a home buying decisions is an important part of a financial plan and for someone who is buying their first home this is even more important.

Leading up to the home purchase there are decisions around down payment, mortgage insurance, fixed or variable mortgage rates. There are important considerations like mortgage qualification as well, how much home can you actually purchase given your income level and savings?

Along with how much you can buy, there is a question of how much home you SHOULD buy.

A home is a significant driver of ongoing monthly expenses. There are mortgage payments, property tax, utilities, maintenance, insurance etc. etc. Making the right home purchase can mean more manageable monthly housing costs. Making the wrong home purchase can mean a prolonged feeling of being “house poor”.

The easiest way to save money is by spending less on housing and transportation. Living small is possibly the best way to save money (even if it’s just 10% smaller!). Making the right home purchase decision in your 20’s or 30’s will make saving money so much easier in the future.

Related: See how and why we live in a 1,000 sq ft home

#3 Advice Around Starting A Family

Another extremely important period is when starting a family. There are large changes to both income and spending that can catch families off guard.

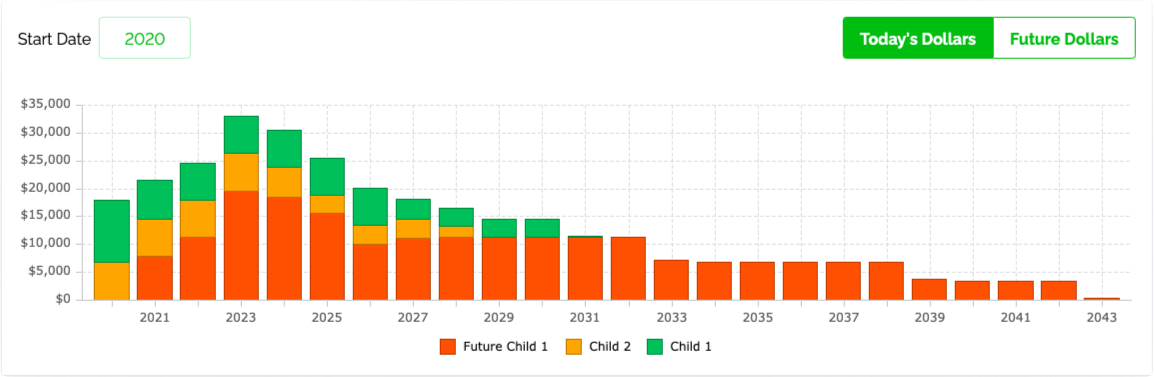

The average cost of raising a child in Canada is $203,550! That includes childcare, food, clothing, activities etc for up to 22 years. That’s a significant impact on a family’s financial plan! It’s important to understand how these expenses will be “phased” over the financial plan because unfortunately a lot of child expenses are right at the beginning.

Not only is there a large impact due to the sheer volume of expenses but there is also an impact due to the number of changes happening at the same time (Read more about the changes to expect when starting a family here)

There are…

- New one-time expenses

- New on-going expenses

- Income reductions and time off work

- New income from government benefits

- Pension contributions/catch up

- RESP contributions

- And more!

Managing all these changes can be overwhelming, especially when in a sleep deprived state! That’s why creating a financial plan in advance can be so advantageous for new families. After all, if a child will cost an average of $203,550 then that seems like an important thing to plan for.

#4 Advice Around Debt Payoff

Creating a debt payoff plan is rarely a focus for “traditional” advisors. For many “traditional” financial advisors, the focus is on helping you secure new debt, not pay off old debt. Most financial advisors aren’t interested in helping you pay off existing debt or make debt payoff plan.

But, creating a debt payoff plan is an important part of any financial plan, and it’s especially important when you’re young. Becoming debt free is a major financial accomplishment and is a key milestone to strive for (even with historically low interest rates).

Compound interest can either work for you or against you. And with debt, compound interest works against you.

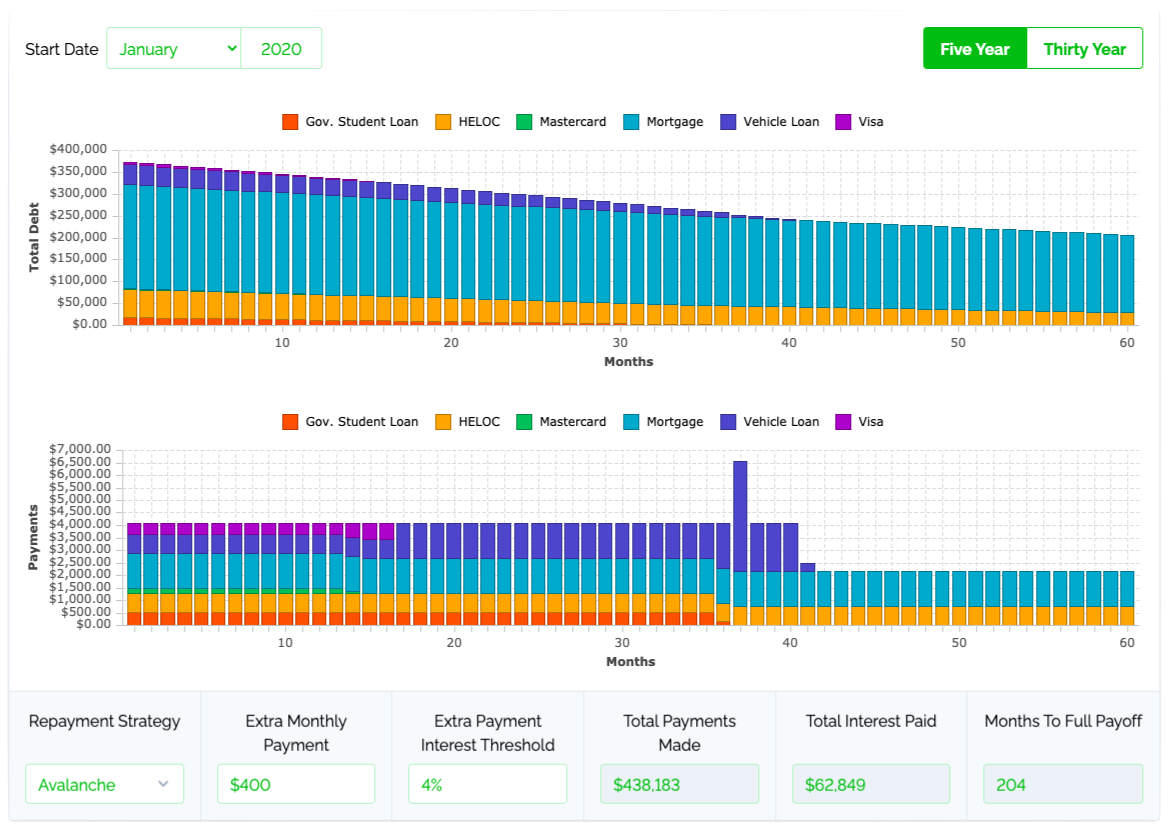

Getting out of debt is so important that it’s a key focus in our advice-only financial plans. As part of our innovative financial planning platform we help clients create a debt payoff plan that automatically plans extra debt payments. It helps prioritize extra payments against higher interest debt like credit cards and unsecured lines of credit, planning extra payments to help pay off these debts faster. But it automatically avoids extra payments on “good debt” like mortgages.

This helps create a highly custom, tailored and motivating debt payoff plan that can be tracked against on a monthly basis.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments