Thank you for subscribing!

We can’t wait to send you our next post, you’re going to love it! In the mean time, check out our free resources.

Check out our latest blog posts…

4 Investment Planning ‘Must Haves’ For Every Investor

Do you have an investment plan? Do you know what an investment plan is? Did you know that an investment plan can save you $1,000’s and keep you sane during a downturn?

Why do you need an investment plan?

Having an investment plan is critical for every investor because we’re not always the rational, logical, disciplined investors we’d like to be. We’re emotional. We fear loss. We suffer from behavioural traps.

The performance of individual investors has been repeatedly shown to lag the index they invest in.

Living Small and Saving Big

Living small is a great way to save money. Today we’ve got a guest post on 1500 Days To Freedom about how our family of four lives in just 1,000 square feet.

1500 Days To Freedom is a blog written by Mr.1500 (he blogs anonymously). The blog is about his family’s goal to achieve financial independence by amassing $1,000,000 of investments in just 1500 days. Check out our guest post about living small and please make sure to check out the rest of the site too!

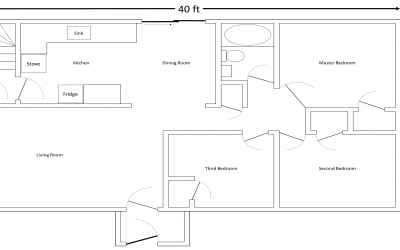

In the guest post you’ll find a detailed layout of our house. We live in a three bedroom bungalow that measures just 40ft by 25ft. We have a full size kitchen, living room and dining room but our bedrooms range from just ~80 square feet to ~120 square feet.

We chose to live small for many reasons, all of which are covered in the post, but one important reason was that it lets us save big. Our annual housing costs are approximately $15,000 lower than other family homes in our area.

Living small also allowed us to buy a house in a great location. This helps us save big on transportation every year.

In total, for both housing and transportation, our annual budget is only $13,220 per year.

Where Are You In The Financial Planning Life Cycle?

Where are you in the financial planning life cycle? Are you a student? Single? In a relationship? Do you have a young family? Maybe a growing family? Perhaps you’re entering retirement or maybe you’re starting to consider your legacy for the next generation.

The financial planning life cycle is a quick way to visualize the different financial needs a person will experience throughout their life.

Depending on where you are in the financial planning life cycle your financial needs will change. The financial needs of a university student are vastly different from a new retiree.

Knowing where are you are in the financial planning life cycle will help you anticipate your future financial needs and ensure you’re setting yourself up well for the future.

Knowing where you are in the financial planning life cycle will also help you ensure you’re not skipping anything today.