Should You Make A Large RRSP Withdrawal Before The End Of The Year?

As we approach the end of the year, one strategic tax and gov. benefit opportunity to take advantage of is making a large RRSP withdrawal.

Making a large RRSP withdrawal before the end of the year can make sense in a few situations. If you find yourself in one of these situations, a strategic RRSP withdrawal can help reduce income tax and increase government benefits over the course of your plan.

Out of these three situations we’ll explore in this blog post, one situation happens before retirement and about 1 in 3 people will find themselves in this situation. The other two situations happen after retirement and can help avoid higher income tax rates later in retirement.

Future Income Tax And Benefit Clawback Rates

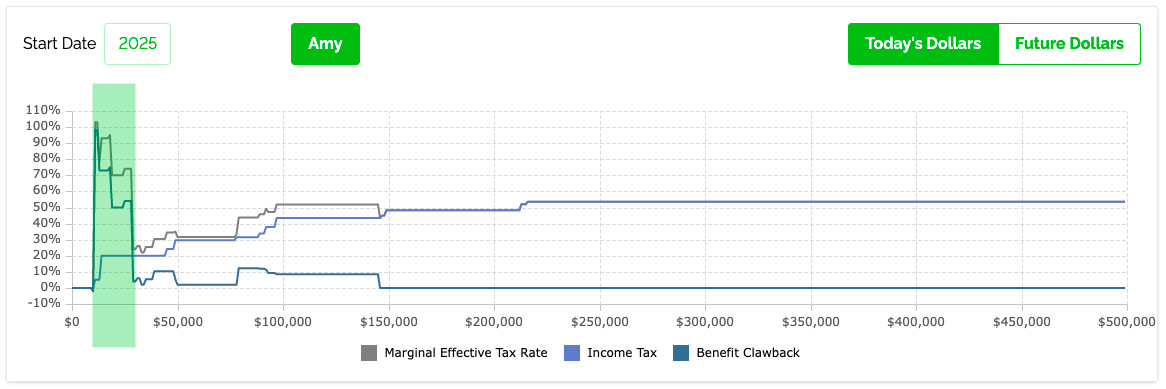

To do this type of planning we need to understand what income tax and benefit clawback rates will be both now and in the future. We want to anticipate how these rates will change over different periods of a financial plan.

For each year within a financial plan we can map out both income tax rates (easier to do) and government benefit clawback rates (much harder to do).

Thankfully the PlanEasy platform does this work for us so we can easily see how tax and benefit rates change over time. In particular we’re interested in the tax rate now versus retirement.

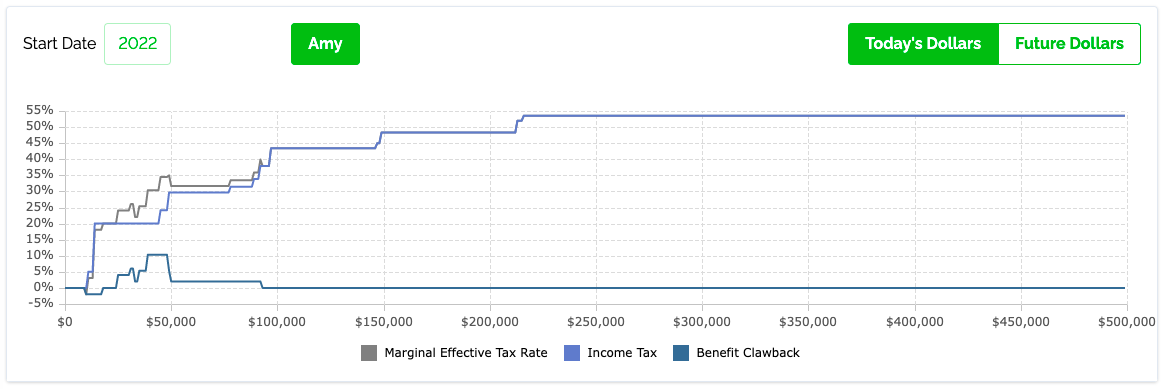

Example of Tax and Benefit Clawback Rates Before Retirement…

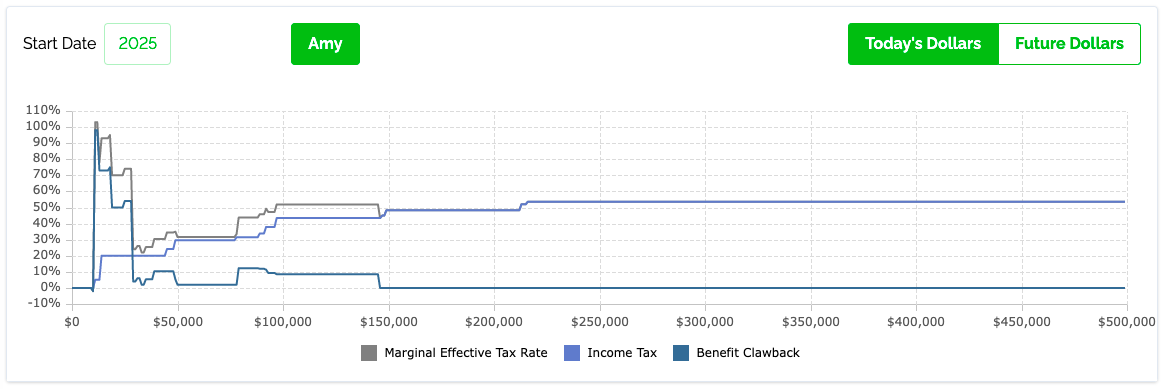

Example of Tax and Benefit Clawback Rates After Retirement…

The light blue line represents the marginal income tax rate. As income increases the marginal tax rate becomes higher and higher.

The dark blue line represents the government benefit clawback rate at different income levels. This can vary greatly from year to year depending on your age, partners age, age of children, being a homeowner vs a renter etc. etc. This clawback rate can be quite high in retirement with clawbacks on GIS benefits or OAS benefits.

The grey line represents the combination of the income tax line and the gov. benefit clawback line. The grey line is the marginal effective tax rate or METR.

If you find yourself in three particular areas of the tax and benefits chart, then making a large RRSP withdrawal at the end of the year could be a very smart tax and gov. benefit planning strategy.

Important! These charts are examples only and everyone’s tax and benefit clawback situation will be slightly different depending on their unique circumstances. To do this type of planning for your financial plan you’ll need to calculate your own tax and benefits curve.

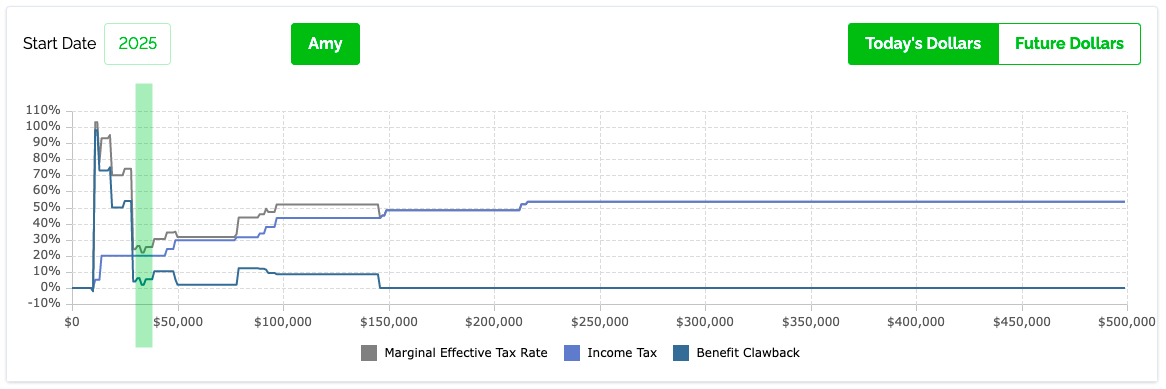

Large RRSP Withdrawal To Maximize Lower Tax Bracket

One opportunity is to make a large RRSP withdrawal to help maximize a lower tax bracket. This strategy can make sense before mandatory RRIF withdrawals begin which could push you into higher tax brackets in the future.

This strategy will allow a person to draw down some of their RRSP at a lower tax rate. By maximizing a lower tax bracket these withdrawals will be taxed at a lower rate now than in the future.

This is also a great strategy to help create additional income that can be used to maximize new TFSA contribution room in early January.

If you find yourself in a lower tax bracket in early retirement then this could be a good strategy to consider.

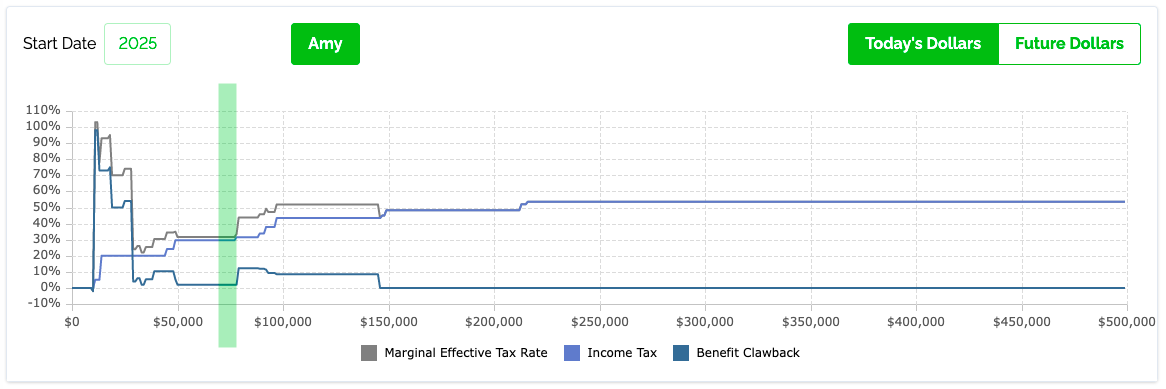

Large RRSP Withdrawal To Maximize Income Just Below OAS Clawback Threshold

For higher income retirees it can make sense to make a large RRSP withdrawal to maximize the income just below the OAS clawback threshold.

This is especially important to consider before mandatory minimum RRIF withdrawals begin. These mandatory minimum RRIF withdrawals could push someone into the OAS clawback territory in the future. Drawing more from the RRSP now can help avoid this issue in the future.

Also, because mandatory minimum RRIF withdrawals get larger and larger throughout retirement, it can be possible to be under the OAS clawback threshold now but then over the OAS clawback threshold in the future. Drawing more from the RRSP can help avoid this issue as well.

If you find yourself just under the OAS clawback threshold in retirement, and you expect to be over the threshold in the future, then this could be a good strategy to consider.

Large RRSP Withdrawals While Still Employed To Avoid GIS Clawbacks In The Future

Lastly, one strategic opportunity to withdraw from an RRSP before retirement is when a person will be eligible for Guaranteed Income Supplement (GIS) benefits in the future.

About 1 in 3 people will receive GIS benefits in the future so a lot of people will find themselves in this situation either now or in the future.

These government benefits can begin as early as age 65 and are based on taxable income the year prior at age 64. GIS benefits are reduced by 50% to 75% of any RRSP or RRIF withdrawal. A $1,000 RRSP or RRIF withdrawal will reduce GIS by $500 to $750.

Drawing down RRSPs before age 64 can help avoid hefty GIS clawbacks of 50% to 75%. This might mean paying income tax of 20% to 30% when withdrawing at lower income levels, but that’s much better than a 50% to 75% “tax” on GIS benefits in retirement.

In these situations, when you expect to face GIS clawbacks in the future, making a large RRSP withdrawal at the end of the year and transitioning assets from RRSP to TFSA can make a lot of sense.

Should You Make A Large RRSP Withdrawal Before The End Of The Year?

Should you make a large RRSP withdrawal before the end of the year? In some situations the answer is “YES!”.

Making a large RRSP withdrawal can be a great strategy when you expect your marginal effective tax rate (METR) to be higher in the future. This is the combination of income tax rates and government benefit clawback rates.

This type of planning can become complex, so a financial planning platform like PlanEasy can help make these decisions easier. If you need help deciding if a large RRSP withdrawal is right for you then consider setting up a call with one of our advice-only financial planners.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Owen, you covered withdrawing from an RRSP to fund a TFSA, what are your thoughts on withdrawing from an RRSP to fund a TFSA + an all Canadian stock non-registered account? One caveat to this option is that the RRSP withdrawal itself does not result in the person moving into a higher tax band or a reduction in OAS. Thanks

Ah, that is a very interesting question Bob!

Shifting money from an RRSP to a TFSA is an easier decision because they both provide the same tax free growth. So when we expect marginal effective tax rates to be higher in the future then a shift from RRSP to TFSA is an easy/great decision.

Shifting money from an RRSP to a non-reg account can also be a great decision, but only in more specific circumstances. As you probably know, in certain provinces, and a certain income levels, the tax rate on eligible Canadian dividends is negative. This can essentially allow for tax free or at least very low tax growth in a non-reg account. So in these situations, when we still expect marginal effective tax rates to be higher in the future, shifting from RRSP to non-reg can also be a great decision too.

What were your thoughts Bob? Would you draw from your RRSP to increase a portfolio of non-registered Canadian stocks?

PS. I’ve explored this idea a bit in previous blog posts for anyone interested in further reading…

https://www.planeasy.ca/retirement-income-start-drawdown-with-rrsp-non-registered-or-tfsa/

https://www.planeasy.ca/how-are-dividends-taxed-help-lower-taxes-in-retirement/

Thanks for the links to the other blog posts. I’ve read every post of yours, but it was a good refresher to read them again.

In November I made RRSP withdrawals to cover our 2022 expenses, plus enough to fund our TFSAs, and a small amount to buy Canadian stocks ($4K of VCN) in a non-registered account.

We live in Manitoba, so we don’t see a negative tax rate on dividends at any level of income. At our target income level of $50K each, according to the TaxTips.ca website, we’ll be taxed at 6.53% on eligible Canadian dividends.

My thoughts are about having more control over our money, and to be able to turn the “tap” on and off as needed. Once all our pension income sources are running (i.e. a work pension, a LIF, 2 x CPP, 2 x OAS, 2 x foreign pensions, and some interest and dividends), forced RRIF withdrawals at 71+, could push us into a higher tax band, and OAS clawbacks in the event one of us dies.

Two very good points. Having more control is a very good consideration, funds are much more accessible in the non-reg account. And for couples the risk of having a “monster” RRSP/RRIF in a survivor scenario is a very important risk to consider as well.

If its between a slow draw down and a slightly faster drawdown my preference is to see an RRSP/RRIF wound down a bit faster.

That’s reassuring to know. Thanks