Setting Financial Goals

A List of 16 Short- and Long-Term Money Goals

Setting a goal can have amazing results.

Even just thinking about your goals will give you a higher chance of achieving them. Writing down your goals will improve your chances again. Revisit your goals regularly and your chances get even better!

The chance of hitting your goals will improve by 80% when you write them down and create a plan.

I love goals, especially financial goals.

One of our previous financial goals was to pay off our mortgage early. We did this in exactly five years! At the end of the post I’ll share with you our original plan and how it actually went down (because things never go according to plan).

Plus! Join our community below and download our monster list of financial goals (our always growing list of short and long term financial goals).

The Power of Setting Goals:

So why is setting a goal so powerful?

Goals give you something to focus on. It gives you something to weigh decisions against (should I make that impulse purchase or not?!?!?).

Goals get you moving. They help fight procrastination.

A good goal gives you something to measure against (and what gets measured gets done). Goals help you understand if you’re on track or not.

Goals give you motivation.

Setting A Goal:

Setting a goal can be easy. Just follow these 4 steps. Don’t spend a lot of time on this. Goals can be revised and changed. The important thing is to start.

Step 1: What is your goal?

(If you’re having trouble thinking of a good financial goal we’ve listed a few examples of short- and long-term financial goals below)

Step 2: Write it down.

Step 3: Make it specific. How much? When?

Step 4: Make a plan. Break down your big goal into smaller goals.

Don’t spend too much time setting your goals the first time. Plans will change, and you can always update your goals accordingly. The important thing is to get them written down.

“Setting a goal can have amazing results. I love goals, especially financial goals.”

Examples of Short-Term Money Goals:

Examples of Long-Term Money Goals:

- Become Mortgage-Free

- Save For Kids’ Education

- Create Multiple Income Streams

- Financial Independence

- Early Retirement

- Retirement

Our ‘Mortgage Payoff’ Goal:

We came up with our mortgage payoff goal shortly after buying our first home in 2009. We joked about it at first, but we really liked the idea of being completely debt-free, so quickly we put a plan in place.

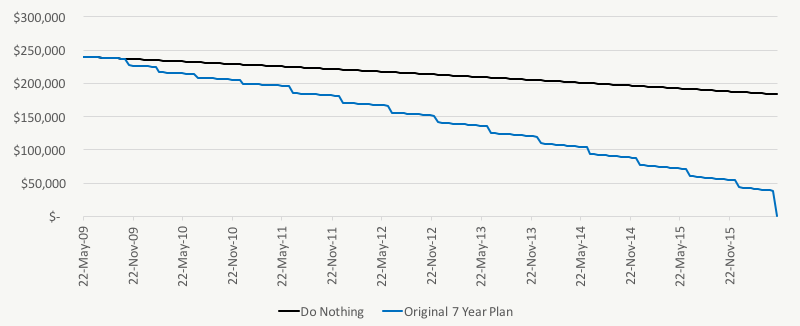

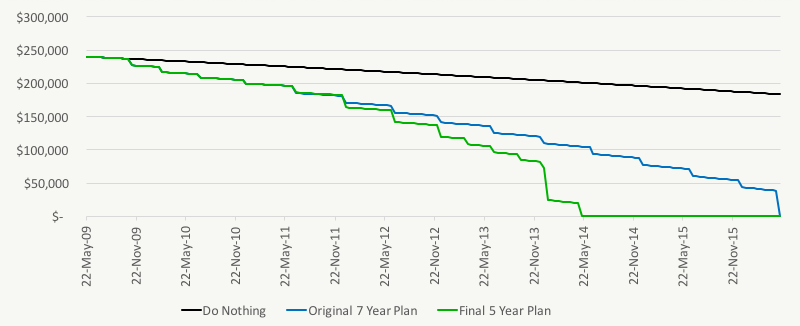

Our original goal was 7+ years to pay off our mortgage. We broke down our goal into six-month “chunks.” Here is our original mortgage payoff plan…

We reviewed our progress every four months. Not surprisingly this provided a lot of motivation. We ended up making bigger and bigger changes. The end result is that we beat our original goal by two whole years!

We paid off our mortgage exactly 5 years from the day we purchased the house. By coincidence, the final payment went out two days before our first daughter was born.

This was a big goal for us. It drove us to make many financial and lifestyle changes. These changes have both improved our finances and our life in general.

This only happened because we set a goal.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

I 100% agree with you that setting specific, concrete goals are essential in order to be successful. I also recently discovered my love for finance goals. My wife and I will be debt next month! Next goal, save up for a house, then save up for a 6 month vacation, all while saving up for early retirement.

Are you still living in your 1000 square feet home? I read your guest post on 1500days, and love your house. The idea of minimalistic living sounds awesome.

Congratulations on becoming debt free! Thats a huge milestone.

Yes, we still live in our 1,000 sqft bungalow. We love it. It’s small, but a very efficient use of space. It also saves us a lot of money each year which we prefer to use for other things.