Reaching Financial Independence Tax Free

Financial independence is a goal for many people. Financial independence is when work becomes optional. It’s when your investments are large enough to support your annual spending indefinitely, without the need for employment income. Reaching financial independence frees you from the typical work/money/time equation. When you reach financial independence you no longer have to trade your time for money.

How much you need to reach financial independence is different for everyone, but the quick and most common metric is 25 times your annual spending. Once you reach this level of savings and investments (not including your home) you can withdraw 4% of your portfolio indefinitely. With the right portfolio your investments will grow enough each year to pay you 4% of the original principal and still keep up with inflation.

Taxes are obviously a big consideration when growing your investments. Tax free growth allows your investments to grow faster and lets you hit your goals earlier.

In Canada we have two main accounts that provide tax free growth, the TFSA and RRSP. With the TFSA you pay tax now but don’t pay tax later. With the RRSP you don’t pay tax now, but you do pay tax later. Regardless of when you pay the tax, the investment growth within an RRSP or a TFSA is tax free. Using your TFSA and your RRSP to its full potential means you can hit financial independence much faster.

As Canadians we can put a lot of money in these tax advantaged accounts. A couple earning $50,000 each will be able to put $18,000 per year in their RRSPs and $11,000 per year in their TFSAs. To max out their tax advantaged space that’s $29,000 per year in savings or a 29% savings rate on pre-tax income.

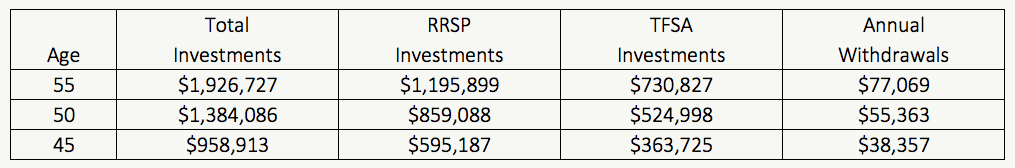

So how early can someone reach financial independence if they’re using only their RRSP and TFSA? It depends on how much you want to spend. Starting at age 25, this couple could reach financial independence as early as 45 using TFSA and RRSP alone. After reaching financial independence they would have an annual spending of $38,000 per year which is 4% of their $960k nest egg (spending in this case includes the taxes they would need to pay on RRSP withdrawals).

If their spending target is a bit higher they might need to wait until age 50 or 55. Reaching financial independence using tax free accounts alone is definitely possible with a pre-tax savings rate in the 30% range.

If you’re savings rate is higher than 30% then you may be able to take advantage of extra tax advantaged room you accumulated before starting full time employment. TFSA room starts to accumulate at the age of 18. RRSP room starts to accumulate at the age of 18 when you earn employment income.

If all your tax advantaged room has been used up, additional savings can be used to pay down the mortgage or invested in a non-registered investment account. Which one you choose will depend on your personal goals, circumstances, and risk tolerance. Paying down the mortgage offers a risk free return on your savings whereas investing in a non-registered account can provide higher returns but comes with complications like annual tax filing and dividend gross ups that could impact your benefits.

At PlanEasy we love it when individuals, couples, and families have financial independence as one of their financial goals. If you’d like some help figuring out how to reach financial independence, please take the discovery survey to see if we’re a good fit. After the survey you’ll have the chance to book a free discovery session with us to talk more about your goals. We’d love to help you reach financial independence!

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

I just want to say I love the TFSA and the RRSP!

ME TOO! We’ve got some great tax-advantaged accounts in Canada : )