Bonds Aren’t Boring:

The Psychological Benefit Of Holding Bonds

Bonds seem like a really boring investment. They’re low growth. They won’t make you rich. Plus, bond prices fall when interest rates increase. And if you use a bond ETF they usually pay a tiny monthly dividend, typically not even enough to buy another share via DRIP unless you have a lot invested.

So, why would anyone invest in bonds?!?

There are a few good reasons to invest in bonds but there is ONE reason in particular that I think is very important. It’s not a typical reason you see mentioned when people talk about investing in bonds, but I think it’s one of the best reasons. It’s based on investor psychology and behaviour and it can make a big difference during a stock market dip or a full blown downturn.

Many DIY investors may not realize it, but they are their own worst enemy. There is plenty of research around investor behavior, in particular how investors like to time the market. Timing the market means investors try to buy low and sell high, but this rarely happens, if anything they do the opposite, buy high and sell low. For most DIY investors time in the market is more important than timing the market.

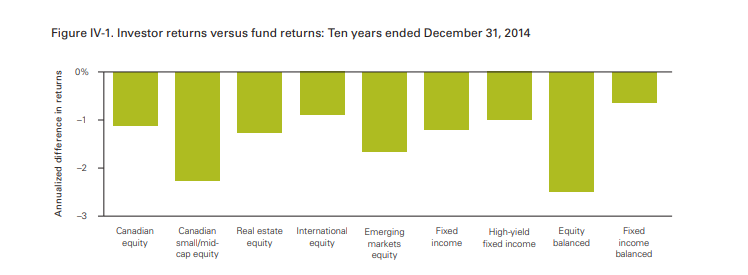

Morningstar does an analysis that measures fund inflows and outflows. They use this to approximate when people are trying to time the market. Vanguard did a great summary of this analysis and they found investor returns lagged the market by 1 to 2%. They estimated that behavioral coaching can be worth up to +1.5% per year for the average investor.

So as a DIY investor how do bonds help you avoid timing the market? Let me explain…

The Psychological Benefit of Bonds:

Any good investment plan should have at least four components and one of those should be your asset allocation. For many people their asset allocation will include some sort of fixed income, usually bonds.

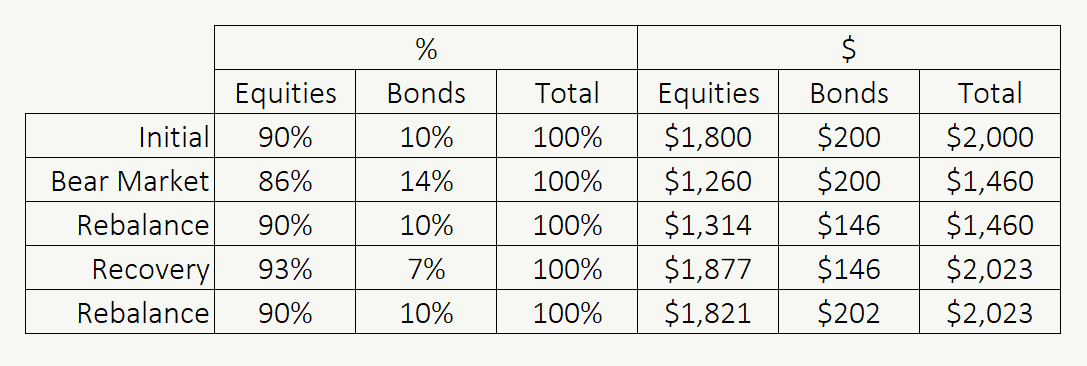

Let’s say that I’m a young investor with a high-risk tolerance and long investment horizon. I’ve invested $2,000 and I might have 90% of my portfolio in equities and 10% of my portfolio in bonds.

If we were to enter a bear market equities might lose -30% and bonds might remain relatively flat. If that was the case then my portfolio allocation shifts from 90/10 to 86/14 because my equities have gone from being worth $1,800 to just $1,260.

To get back to the asset allocation in my investment plan I need to re-balance my portfolio. I need to sell $54 of bonds and buy $54 of equities to get back to 90/10.

Having bonds in my portfolio along with a good investment plan has FORCED me to buy equities during the correction. While everyone else is freaking, out my investment plan has me buying more! I’m buying low and hopefully in the future I’ll be selling high. This feels great! It feels smart. I’m not worried about all the other people telling me to “sell everything!”. I planned for this. I’m going to follow my plan.

Owning bonds plus having a clear investment plan that forces you to re-balance your portfolio 1-2 times per year is a great way to avoid harmful investor behavior.

You could get a similar result buy just having a clear investment plan and owning 100% equities, but the benefit of owning some bonds is that you have to buy into the dip. You’re forced to buy equities, and this helps avoid the temptation to sell. If you own 100% equities you don’t get that benefit and you’re constantly fighting the urge to sell during a bear market. By re-balancing your portfolio you don’t have to fight the urge to sell because you’re buying instead, and why would you sell equities after just buying them?!?

New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

The Benefit Of Owning Bonds:

Owning bonds (in conjunction with a good investment plan) provides a HUGE psychological advantage during a downturn. Sure, bonds aren’t as sexy as equities, and they don’t provide as much return, but there is a big benefit to holding at least some bonds in your portfolio.

There are actually many more benefits to owning bonds… but that’s a topic for another post.

Subscribe to our mailing list to get notified of new posts in your email.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments