New Parents Guide To Setting Up An RESP

Congratulations! You’re starting a family or have already started a family and through all the craziness of raising children you’re also thinking about setting up an RESP. That’s fantastic!

As a new parent you now get access to a special tax advantaged account called the RESP and it comes with some special features that all parents should take advantage of.

As the name implies, the Registered Education Savings Plan (RESP) is meant to help parents (or relatives) save for a child’s post-secondary education.

There are a few benefits to the RESP that make it attractive to parents. One is that investments inside the RESP are able to grow tax free. The second is that contributions receive a matching grant of up to 20% or $500 per year, whichever is lower. Plus there are even extra grants and learning bonds available for lower income families.

But with all the attractive features of an RESP there are also some restrictions. These restrictions can sometimes be worrisome for parents and cause them to avoid setting up an RESP for their children. In this post we’ll explain what an RESP is, what you’ll need to set one up, some of the terminology you’ll encounter, and finally how to withdraw from your RESP in the future.

What Is An RESP?

An RESP is a tax advantaged account that is specifically meant to help parents (or relatives) save for a child’s education.

Contributions to the RESP grow tax free inside the account. In the future this growth is taxed in the hands of the child who is likely in a much lower tax rate. This provides a great income splitting opportunity.

To provide an incentive to use an RESP the government provides grants to families called the Canada Education Savings Grant (CESG). The grant is 20% of your contribution up to a maximum of $500 for the year per child. This means a contribution of $2,500 per year per child will maximize the grant.

The lifetime maximum CESG is $7,200 per child. This means that after 14 years of making maximum contributions of $2,500 per year your last contribution will only need to be $1,000 to maximize the grant. In total, to maximize the grant, you need to make $36,000 in contributions per child.

Even though you need to make $36,000 in contributions to maximize the RESP grant, the lifetime maximum amount of contributions per child is $50,000, so after maximizing the grant with $36,000 in contributions you can still add an extra $14,000 to the RESP (but you probably don’t want to unless you’ve already maximized your TFSA and RRSP).

Catch-Up Contributions

There’s a lot going on when you first have children so it’s understandable if setting up an RESP is not the first priority on your list. Not to worry, you have the ability to make “catch-up” contributions to your RESP to take advantage of grants from previous years.

If you’re setting up an RESP a few years after your children were born you have the ability to make catch up contributions to maximize the current year’s grant PLUS one catch-up year. This means a $5,000 RESP contribution per child would maximize this year’s grant of $500 AND also maximize one previous year’s grant of $500 for a total of $1,000 in grants.

Because it’s only possible to “catch-up” one previous year at a time this means that catch-up contributions must start by the time the child is 10-years old to ensure that the maximum grant is received by the time they are 17.

The only restriction on catch-up contributions is once a child reaches age 15. To receive the Canada Education Savings Grant (including catch up grants) at age 16 and age 17 the child has to meet one of two thresholds.

One: By age 15 a child must have at least $2,000 in contributions by the end of the of the calendar year they turn 15. So as long as you make a $2,000 contribution the year they turn 15 then you can still receive the grant the following 2-years at age 16 and age 17.

Two: A minimum of $100 annual contributions must have been made to the RESP in the 4-years by the end of the of the calendar year they turn 15. So as long as you make at least a $100 contribution at age 15, 14, 13, and 12 then you can still receive the grant at age 16 and age 17.

So, if you’re setting up an RESP for a teenage child it’s very important to make sure at least one of these two thresholds have been met otherwise you will not be able to receive grants when they’re 16 and 17.

Learn more about RESP catch-up contributions.

Reasons To Set Up An RESP

There are lots of reasons to set up an RESP. Here are a few of the important considerations…

- Contribution grows tax-free

- The government will provide grants and match 20% of your contributions

- Up to $500/year per child

- Up to a lifetime maximum of $7,200 per child

- Withdrawals of growth and grants are taxed in hands of the child at a much lower tax rate (a nice “income splitting” opportunity)

- After a child starts post-secondary education the original contributions can be taken back by the parent with no penalty

- Lots of different types of post-secondary education qualify for withdrawals, university, college, trade-programs etc.

- You can contribute whenever you want, with a lifetime cap of $50,000/child

- An RESP can stay open for 36 years, so taking a gap year or two is not a concern

- Wide range of investment options are available within the RESP (such as stocks, bonds, mutual funds, ETFs, GICs etc)

Type of RESPs: Individual, Family, or Group

There are three main types of RESPs that you may encounter. Which once you choose to use will depend on your goals and your situation.

Individual RESP:

Individual RESPs are great when you only have one child and/or if you’re not related to the beneficiary. If you have more than one child it’s possible to set up an individual RESP for each of them, but this can be more onerous for tracking and making contributions.

Family RESP:

A family RESP is great when you have more than one child because contributions, grants and growth are pooled together. This can make it easier to manage the RESP while making contributions and pay out distributions in the future (Warning: Unless you specify when making a contribution most financial institutions will spread a contribution across children. If you’re trying to perfectly maximize the grant for each child this may not be what you want).

With a Family RESP the children need to be related to you, either by blood or by adoption. This could include grandparents but does not include aunts and uncles. A grandparent could open a family RESP for their grandchildren but if they have multiple children who each have children of their own then they would need to open a separate Family RESP for each family.

Group RESP:

A group RESP is like a family RESP in that contributions are pooled but with a group RESP the children do not need to be related. The provider of the group RESP will invest funds on behalf of all the beneficiaries. The downside with a group RESP is that they can be very restrictive and come with high fees. Make sure to read the fine print if you’re considering a group RESP.

Opening An RESP

The terminology in the RESP application can be a bit confusing so here is a quick primer on the terminology you may encounter and the steps you’ll need to go through.

- The “subscriber” is the person that opens an RESP

- Anyone can open an RESP and become a subscriber… this could be a parent, a grandparent, an uncle or aunt etc

- The “beneficiary” is the person that benefits from an RESP

- The “successor subscriber” is the person who will manage the RESP if you pass away (if you don’t name a successor subscriber the RESP will become part of your estate and will be closed, probably not what you want)

- You’ll need a SIN for the child to add them as a beneficiary (There is no charge to get a SIN for a child but you will need documents such as birth certificate to get a SIN)

- Choose between an individual or a family RESP

- Review RESP providers for set-up fees, annual fees, penalties, restrictions…

- A financial institution like a bank, credit unions, or discount broker

- A group RESP plan (Warning! Do your research on group RESPs! They can be very restrictive and have high fees!)

- Choose your investments for inside the RESP

- The RESP is just an account and you can purchase different investments inside the RESP

- Typical investments include stocks, bonds, mutual funds, ETFs, GICs etc

- Choose the right allocation between stocks and bonds based on the child’s age

Learn more about low-cost investment options that you can set up inside your RESP.

Setting The Right Asset Allocation For An RESP

After you’ve set up your RESP and have made your first contribution you now need to decide how you’re going to invest the contributions and grants.

We would highly recommend considering a low-cost investment option. Many banks and investment advisors will push for investments with fees of 2.0%+ per year but this will eat into the growth of your RESP and limit the amount available for your children in the future.

A low-cost ETF portfolio or a robo-advisor are two good options that will help limit the impact that fees have on your newly set up RESP.

If you choose the low-cost ETF option we highly recommend setting up an investment plan for your RESP (see below for an example). One of the major challenges when investing inside an RESP is that you quickly go through three different investment horizons. You start with a long-term investment horizon but quickly shift to medium-term and then to short-term.

You want to make sure that you decrease the risk within the RESP as your children get older. This can be done by adjusting the asset allocation over time.

Check out this post for more information on how to set the right asset allocation for your RESP (especially for family RESPs where there may be a large age gap between beneficiaries)

Withdrawing From An RESP

One of the reasons parents avoid setting up an RESP is because they’re unsure about how to withdraw from the RESP in the future. There are a few rules when withdrawing from an RESP and it’s good to be aware of how withdrawals will eventually be treated.

Withdrawals are always in the control of the subscriber (usually the parent) and the subscriber decides where the withdrawals go and in whose hands they get taxed. When making withdrawals there are two terms you’ll encounter, Educational Assistance Payments (EAPs) and Post-Secondary Education Payments (PSEs).

EAPs represent the grants and growth received inside the RESP. These withdrawals are fully taxed in the hands of the beneficiary. Because the beneficiary has personal tax credits these withdrawals will likely be taxed at a very low rate (even zero).

PSEs represent the original contributions. These are not taxed. The original contributions can be withdrawn in the hands of either the subscriber or the beneficiary, but in either case there is no tax on PSEs.

Withdrawals from the RESP can only start once a child is enrolled in postsecondary education otherwise grants have to be paid back. Post-secondary education could be university, college, a trade-program etc. The only restriction on withdrawals is that there is a maximum of $5,000 in EAP withdrawals in the first 13-weeks. After 13 weeks there is essentially no restriction on withdrawals.

When withdrawing from the RESP you need to specify whether or not you’re withdrawing EAPs or PSEs. It’s highly recommended that you plan your RESP withdrawals to ensure that all EAPs are withdrawn by the time the child ends their education (or even earlier if there is a chance they may not complete their education). Any left over EAPs will be subject to restrictions and penalties when withdrawn after the child has left post-secondary education.

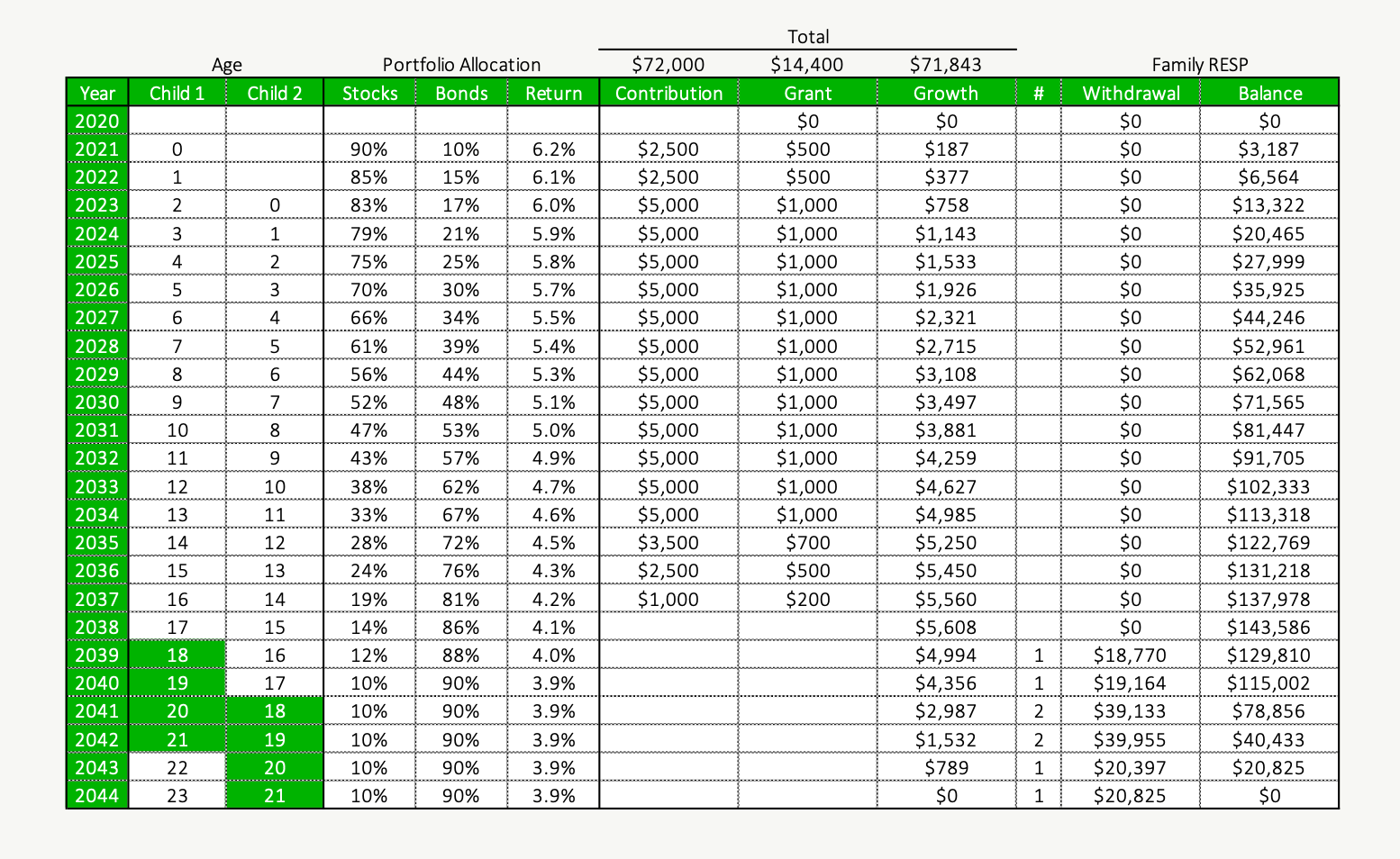

Here is an example of how contributions and grants could grow over time and eventually be withdrawn. This plan would provide each child with annual withdrawals of $12,600 per year for 4-years (in today’s dollars). This assumes a low-cost investment option with annual fees of 0.25% or lower.

Winding Down An RESP

Let’s say your child isn’t going to attend post-secondary education, what do you do with an RESP? This is a valid concern and one of the main reasons parents avoid setting up an RESP. There are a few rules to be aware of when winding down an RESP and some nuances to these rules but we’ll cover the basics below.

The one thing to keep in mind is that an RESP can stay open for 36-years, so even if your child isn’t planning on attending post-secondary right away, there is no need to wind down the RESP immediately, especially if there is a possibility they’ll attend post-secondary later. There is also the option of naming another beneficiary on the RESP.

When winding down an RESP the contributions can be taken back without any tax or penalties. So no concern there.

When winding down an RESP the grants and bonds will need to be given back to the government. No avoiding that, so don’t even worry about it.

When winding down an RESP the investment growth inside the RESP can be dealt with in a few different ways…

Investment growth can be withdrawn and taxed in the hands of the subscriber with an extra 20% penalty (so on top of your marginal tax rate there is also an extra 20% penalty tax)

Investment growth of up to $50,000 can be transferred to an RRSP (if the subscriber has contribution room)

Investment growth can be transfered to an RDSP for the beneficiary (if the beneficiary is eligible for an RDSP and if there is contribution room)

Setting Up An RESP

Setting up an RESP may seem daunting, especially with everything else going on, but once you get past some of the terminology it’s not too difficult.

It’s also not extremely urgent, catch-up contributions can be made which allow for previous years grants to be received. So, if you take a year or two to open an RESP you can always make a catch-up contribution to still take advantage of those grants you missed.

RESPs are a great tool for helping children fund post-secondary education in the future. There are great incentives in the form of grants and bonds and investments grow tax free inside the RESP.

If an RESP isn’t part of your financial plan already, and you have children under the age of 15, then there could be an opportunity to take advantage of this great account. At PlanEasy help families ensure they are making the most of their RESP. Click “Start Planning” to see if PlanEasy would be a good fit for you.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Great program. Too bad that there has not been an adjustment for inflation since 2007.

You’ve got that right Garth. The RESP and CESG should be indexed to inflation. At the very least treat the RESP the same way as the TFSA an increase the annual contribution in $500 increments and the CESG in $100 increments. By now we would have been at a $3,000 contribution per year and a $600 CESG per year.