How Mortgages Work When You’re A First Time Home Buyer

Buying a home is a HUGE decision. Not only is it a lot of money, but there are multiple contracts to sign, and multiple people/parties involved. It’s a lot of responsibility. Plus, it’s a decision many of us will make before our 30th birthday.

One of the contracts you’ll need to sign as a first-time home buyer is a mortgage contract.

Signing a piece of paper and getting $100,000’s in return can be a surreal experience. Often, you’ll only put up a small fraction of the purchase price yourself and the rest will come from the bank. You put up $20,000 and they give you an additional $380,000 to go buy a house. Crazy!

As a first-time home buyer, it can be a nerve-wracking to take on all that debt.

Before signing a mortgage contract it’s a good idea to understand the basics of how a mortgage works. How much your payments will be. When your payments will occur. And probably most important, how much of your payment goes towards your loan.

How Mortgages Work:

Banks lend money for home purchases. They will lend up to 95% of the home value. Banks consider the house as ‘collateral’ on the loan. They will take ownership of your home if you can’t make payments.

Because home values rarely decrease, banks are comfortable loaning a large percentage of the value to a first-time homebuyer. Mortgages are the only type of loan where banks are willing to lend you nearly 20 times your down payment. Before even thinking about buying a home its a good idea to understand how much you can afford and what size mortgage you qualify for.

In exchange for loaning you the money the bank will ask you to pay interest on the loan each year. At the moment, interest rates are between 3-4%. With a $400,000 mortgage, you pay between $12,000 and $16,000 in interest each year (depending on your exact mortgage rate) so buying the right size house can save you a lot of money! Because this gets built into your mortgage payment it can be easy to forget just how much money goes to interest each year.

Banks make money because they can borrow money at ~1-2% and then turn around and loan it to you for 3-4%.

Making Mortgage Payments:

Banks ask you to repay the loan over a 25 or 30 year period. The longer the repayment period the lower the payments (but them more interest you’ll pay over the long run!)

Each payment will have two parts. The first part of your payment covers the interest on the loan. The second part of your payment goes towards reducing the principal.

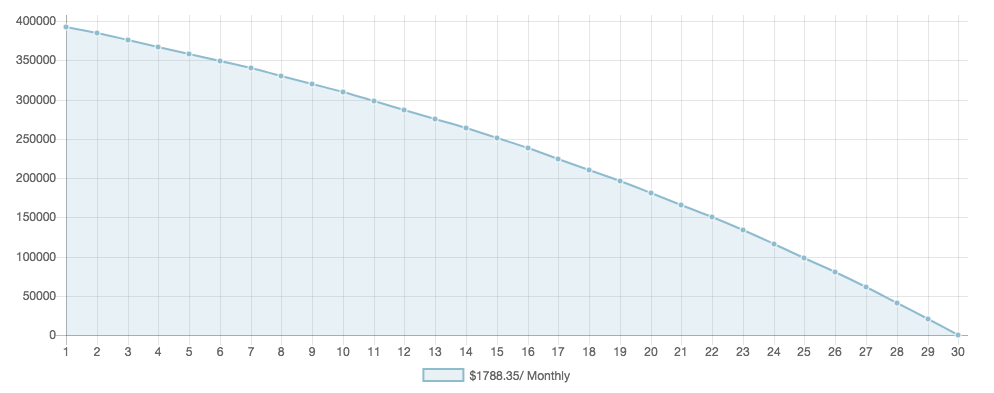

As time goes on, more and more of the payment goes towards principal, until eventually the entire mortgage is paid off (check out our mortgage payoff graph!)

To see how your payment is split between interest and principal you need to look at something called an amortization table. Most mortgage calculators include this option.

For example, for a $400,000 mortgage with monthly payments that is amortized over a 30 year period, here’s how a few of the $1,788.35 monthly payments get split…

- After Year 1: $1,115.16 (62%) goes to interest and $633.19 (38%) to principal

- After Year 5: $1,056.33 (59%) goes to interest and $ 732.02 (41%) to principal

- After Year 10: $911.98 (51%) goes to interest and $876.37 (49%) to principal

When you go to get a loan, you’ll have the option of choosing your payment frequency, monthly, semi-monthly, bi-weekly or weekly. Lining up the mortgage payments with pay checks can help simplify your finances. If you’re paid twice per month then maybe semi-monthly payments would work best. If you get paid weekly then maybe bi-weekly or weekly payments make more sense.

New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Coming Up With A Down Payment:

First-time home buyers can have a down payment as low as 5% of the purchase price. This is the absolute minimum. But even saving up that amount, on top of rent and other expenses, can be a daunting task. Saving up a higher down payment, like 10%, 15% or 20%, can help you decrease mortgage insurance fees, or even avoid them entirely.

Your down payment can come from a few places.

The main source for a down payment is usually personal savings. (Tip: Use a TFSA when saving for your down payment. This will help you avoid taxes on any interest you earn.)

It’s best to put your down payment into something safe like a GIC or high interest savings account. DON’T INVEST YOUR DOWN PAYMENT! You don’t want to lose your down payment if the stock market crashes.

For first-time home buyers, another common source for a down payment is family. Family members can provide money for a down payment but it must be “no strings attached”. The bank will usually ask for a letter saying that these funds are NOT a loan and there is no expectation of repayment. If it is a loan then it will affect how much mortgage you qualify for.

The other common source for down payment is from an RRSP. First time home buyers can use the Home Buyers Program (HBP) to withdrawal funds from their RRSP without paying any taxes. The HBP lets an individual take up to $25,000 from their RRSP and use that for a down payment (but you can’t withdrawal from a registered pension plan like a DCPP).

Warning! The HBP withdrawal must be repaid!

If you use the HBP you need to repay 1/15th each year. If you take out the entire $25,000 this means you need to repay $1,667 every year starting the second year after you withdrew funds (Hint: Usually it says on your notice of assessment how much you need to repay next year)

A couple can each take out $25,000 for a total of $50,000 for their down payment. Along with other savings this can be a good way to reach your down payment goal!

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments