Is Asset Location Really Necessary?

Asset location is the idea that certain assets are more tax efficient when held in certain types of accounts. Different assets classes, and more specifically different types of income, are taxed differently in Canada. Dividends are treated differently than capital gains which are treated differently than interest income. Even certain investments inside “tax free” accounts like the TFSA and RRSP can sometimes lose money to taxes but many people may not realize this.

When you’re just starting out you might hold bonds/fixed income, Canadian equities, US equities, and global equities all in one account (probably the TFSA if you’re just starting out). When you’re just using one account, asset location is less of a concern, but once you start to use a second account (maybe an RRSP), then you may want to ensure you have the right asset in the right place to minimize the drag of taxes.

This becomes especially important after you’ve maximized your TFSA and RRSP and have started to use a non-registered account. Non-registered investments are fully taxable at your marginal tax rate so it’s a good idea to put the most tax efficient investments inside your non-registered account.

Taking advantage of an asset location strategy requires a bit of work. Rather than having the same asset allocation in each account (which is super easy to manage), it means having different assets in each account and managing asset allocation across the entire portfolio.

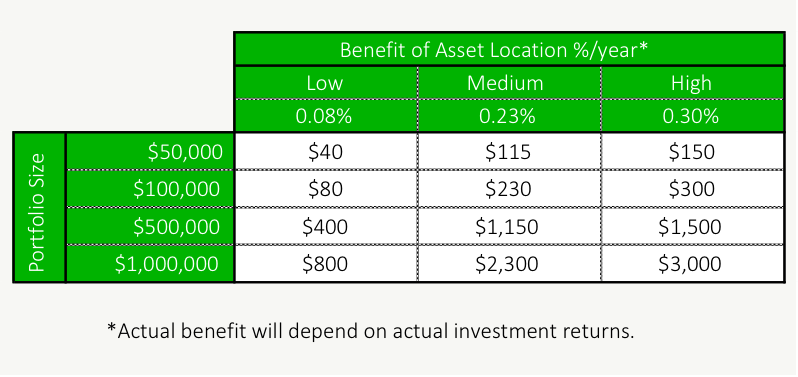

How much money do you need to have in non-registered assets before asset location adds value? $50,000? $100,000? $500,000? $1,000,000? Let’s take a look…

Tracking Asset Allocation and Rebalancing Gets Complicated

When using an asset location strategy one of the big complications is that you no longer have the same asset allocation in each account. Instead you might hold certain assets in certain accounts to be more tax efficient.

This causes complication, a lot of complication. Different investments will perform differently over time. This creates the need to rebalance your portfolio from time to time to get back to your target asset allocation. Best practice is to do this at least once per year. But with an asset location strategy there is an extra step. When you hold different assets in different accounts you need to look at assets across ALL your accounts, you need to look at your entire portfolio when rebalancing.

Not only that, but you may want to adjust for taxes too. Holding $50,000 in equities in a TFSA is different than holding $50,000 of equities in an RRSP. The RRSP is pre-tax, whereas the TFSA is after tax.

Comparing apples to apples the $50,000 in equities in an RRSP might actually be $42,500 (assuming an average 15% withdrawal tax in retirement). When we try to rebalance do we use the $50,000 value for the equities in the RRSP or the $42,500, or something else? This makes rebalancing more difficult. It also makes it important to understand your tax rate on withdrawal.

Switching To An Asset Location Strategy? Beware Of Triggering Taxes

Starting with an asset location strategy from the outset is ideal, but what do you do if you’ve already been investing across 2 or 3 different accounts?

Changing assets inside a TFSA or RRSP is easy to do. There is no concern about triggering capital gains tax inside these tax-sheltered accounts.

Changing assets in a non-registered account however can be an issue. Depending on the type of investment, there might be a lot of capital gains already accrued. Switching these investments would trigger income tax that we might not want to pay for another 10-20 years until retirement.

Triggering tax early might offset the benefit of asset location, so make changes only after understanding all the tax implications.

Typical Asset Location Strategy

Asset location strategy can vary from person to person. It can depend on personal tax rates, both now and in the future.

The example we’ll provide below is the typical recommendation but this may not apply in every situation…

- RRSP: Ideal for bonds and US investments (if US investments are held directly to avoid 15% withholding tax on US dividends)

- TFSA: Ideal for international equities and/or Canadian equities

- Non-Registered: Ideal for Canadian equities

Typically, with an asset location strategy, we want to hold US equities in our RRSP and we want to hold them directly as US securities. The RRSP is covered by an agreement with the US that lets any US securities inside the RRSP avoid withholding tax on US dividends. This withholding tax is 15%. This withholding tax can be recovered in a non-registered account (but requires some work) and is entirely lost in a TFSA (because there is no agreement with the US for a TFSA).

Also, within an asset location strategy we typically want to hold Canadian equities in a non-registered account (all other things being equal). Canadian equities benefit from preferential tax treatment on dividends. This means we would rather hold them in a non-registered account. If we’re going to pay tax on a non-registered asset we typically would prefer to pay tax on Canadian equities due to this preferential tax treatment (Warning: This can vary depending on tax brackets and expected rate of return and dividend rate).

The last asset location strategy is to hold bonds in the RRSP, especially when it’s a bond fund like ETF or mutual fund. This is important when interest rates have gone down and bonds are trading above par. When bonds are trading above pay, and you purchase a bond ETF or mutual fund, you typically get a capital loss. The details are a bit complicated but it’s important to understand when bonds are in this situation, and you hold them in a non-registered account, you get interest income from the bonds that will be taxed at your marginal tax rate, but you also get a capital loss as the bonds mature, which is only at half your marginal tax rate. Not the most efficient form of income in a non-registered account.

How Much Is Asset Location Worth?

Given the added complication of employing an asset location strategy its important to consider if its actually worth the extra work and complexity. The extra work may involve doing extra calculations and investment trades on an annual basis. The added complexity might mean that you do not rebalance on a consistent schedule which could cause increased risk in your investment portfolio and potentially decrease your returns.

The exact value of asset location will vary from person to person. It depends on your marginal tax rate both now and in the future. Whether or not an asset location strategy makes sense for you may require some additional work and it may involve a professional.

In general asset location can provide between 0.23% and 0.30% in additional return through tax efficiency but this assumes predictable returns. On average you might only expect 0.08% in additional tax efficiency when variable year to year returns are considered.

So, should you worry about asset location? Perhaps not when your portfolio is small. The added benefit of asset location wouldn’t likely outweigh the extra work and complexity (unless you’re really into this sort of thing!). Even with a $100,000 portfolio the estimated benefit might only be $80 to $300 per year.

One of the best things an individual investor can do is remain disciplined and consistent. An asset location strategy makes this more difficult to do.

But as your portfolio grows an asset location strategy may become more attractive, even with the added work and complexity.

If you are considering an asset location strategy make sure to get some advice from an expert. You’ll want to understand your tax rate today, and what you might expect your tax rate to be in the future, before executing an asset location strategy.

Disclaimer: Tax and benefits strategies can vary from person to person. This post is for educational purposes only. Please speak with a professional to determine if a particular tax strategy will add value to your financial plan.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Another killer blog post Owen!

Great job 🙂

Thank you Karen!

Great article.

Thanks for reading Paul!