How To Update Your Financial Plan

Despite being extremely sophisticated, a rocket ship only gets to its destination by making small adjustments along the way. These adjustments help account for small changes in weather, weight, fuel efficiency etc.

Personal finances are very similar, it’s not nearly as complicated as rocket science of course, but to reach our target we need to make small adjustments to our personal finances along the way. These adjustments help account for changes in income, increases in spending, changes in our situation and goals etc.

A financial plan isn’t meant to be static. A financial plan is meant to be dynamic and ever evolving.

For that reason, a financial plan should be updated at least once per year (we actually revisit our financial plan three times per year).

And one of the best times to update a financial plan is in the new year. With changes in tax rates and gov. benefits, upcoming RRSP contribution deadlines, and tax season approaching, it’s a natural time of the year to revisit personal finances.

There are a few key areas in a financial plan that should be updated each year…

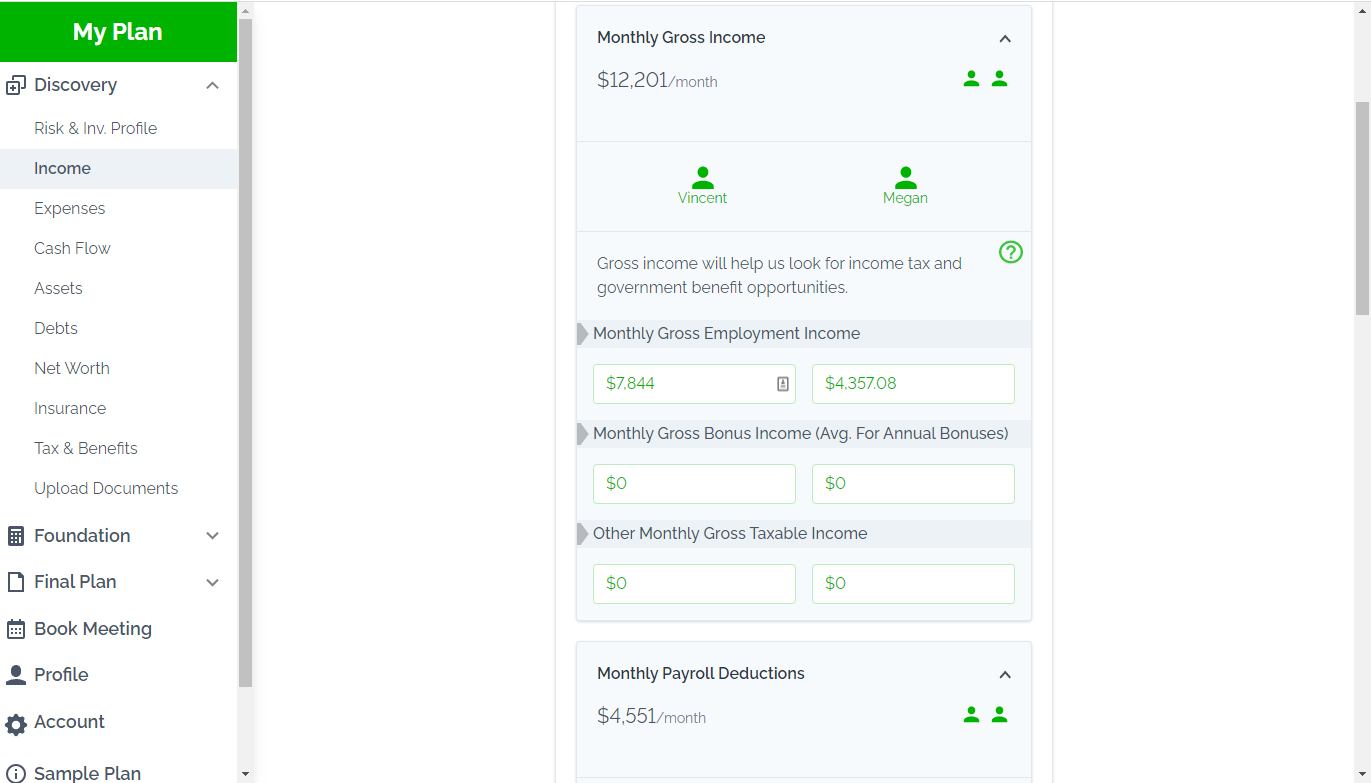

Updating Income

Raises, promotions, career changes, job loss, these income changes have a large impact on a financial plan. We want to capture these income changes to see if there are any new opportunities or unexpected headwinds.

When changing careers or employers there may also be changes to employment benefits, pension matching, and deductions that we want to capture.

If government pensions like CPP and OAS have already started, then there will be slightly increases due to the annual inflation adjustment.

Plus, private pensions may also increase year over year depending on whether or not they are adjusted for inflation.

Lastly, there may also be changes in non-taxable benefits from the Canada Child Benefit (CCB) or Guaranteed Income Supplement (GIS). These will change from year to year based on last year’s taxable income.

If you’re using the PlanEasy platform to create your financial plan, then you’ll want to update the Income section in Discovery.

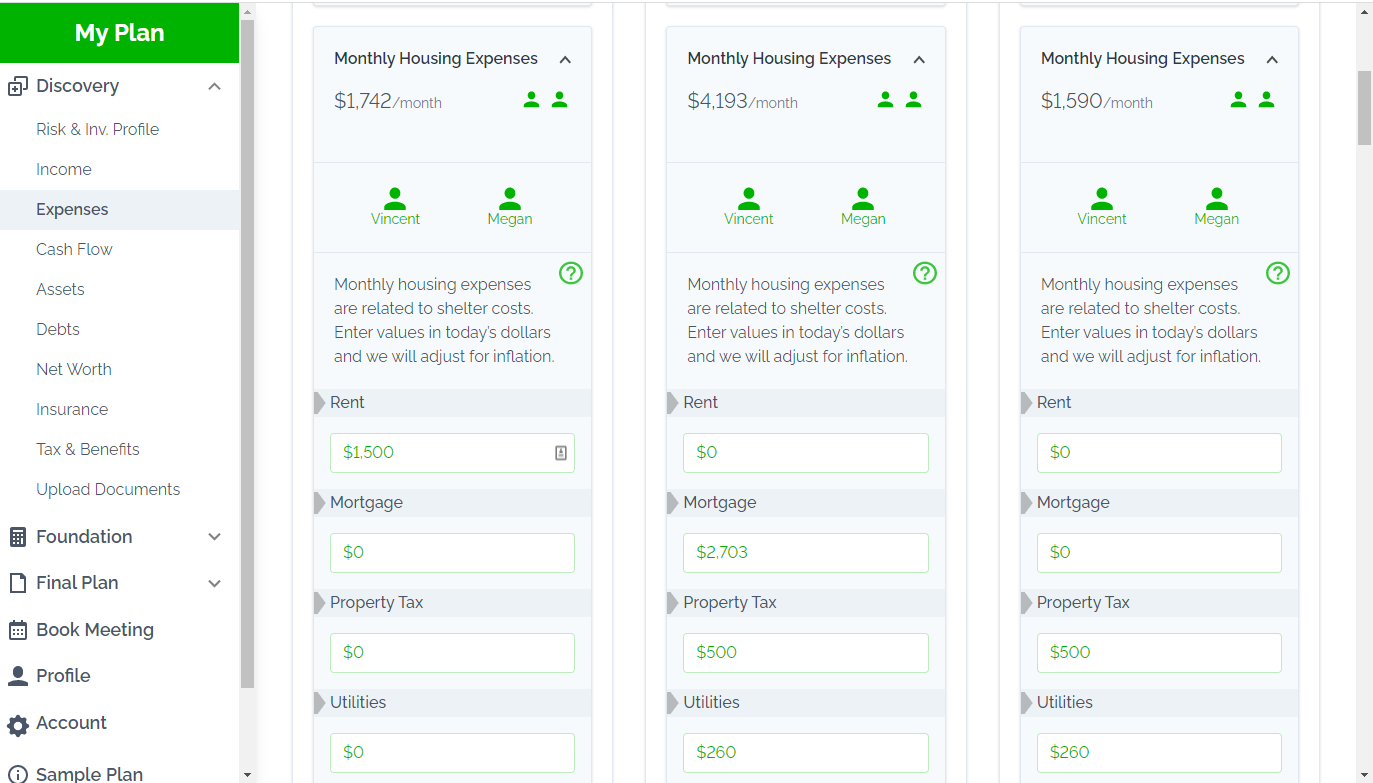

Updating Expenses

Expenses naturally change over time. The cost of goods and services will rise each year with inflation. We should expect that overall spending will increase slightly from year to year.

We also know that our personal goals and values can change over time. We may not be spending money the same way as before. Maybe it’s a new hobby, an extra vacation etc. etc. We may choose to spend money differently than we did in the past.

Different spending categories will also increase faster than others. Rapidly rising costs in some spending categories, like food, might have been offset by reductions in other categories.

If you’re using the PlanEasy platform to create your financial plan, then you’ll want to update the Expenses section in Discovery.

Each year we also want to get more specific with current spending estimates by category. We want to update spending categories that have changed dramatically from prior years.

This refinement of spending estimates also helps prepare for retirement in the future. Having a strong understanding of current spending makes a future retirement spending estimate more reliable. And because every $1,000/year in retirement spending must be supported by $25,000 to $50,000 in financial assets, it’s important to have a good understanding of spending before retirement. If a spending estimate is “off” by just $4,000/year that could mean being short by $100,000 to $200,000 in financial assets at retirement. This greatly increases the risk of running out of money in retirement.

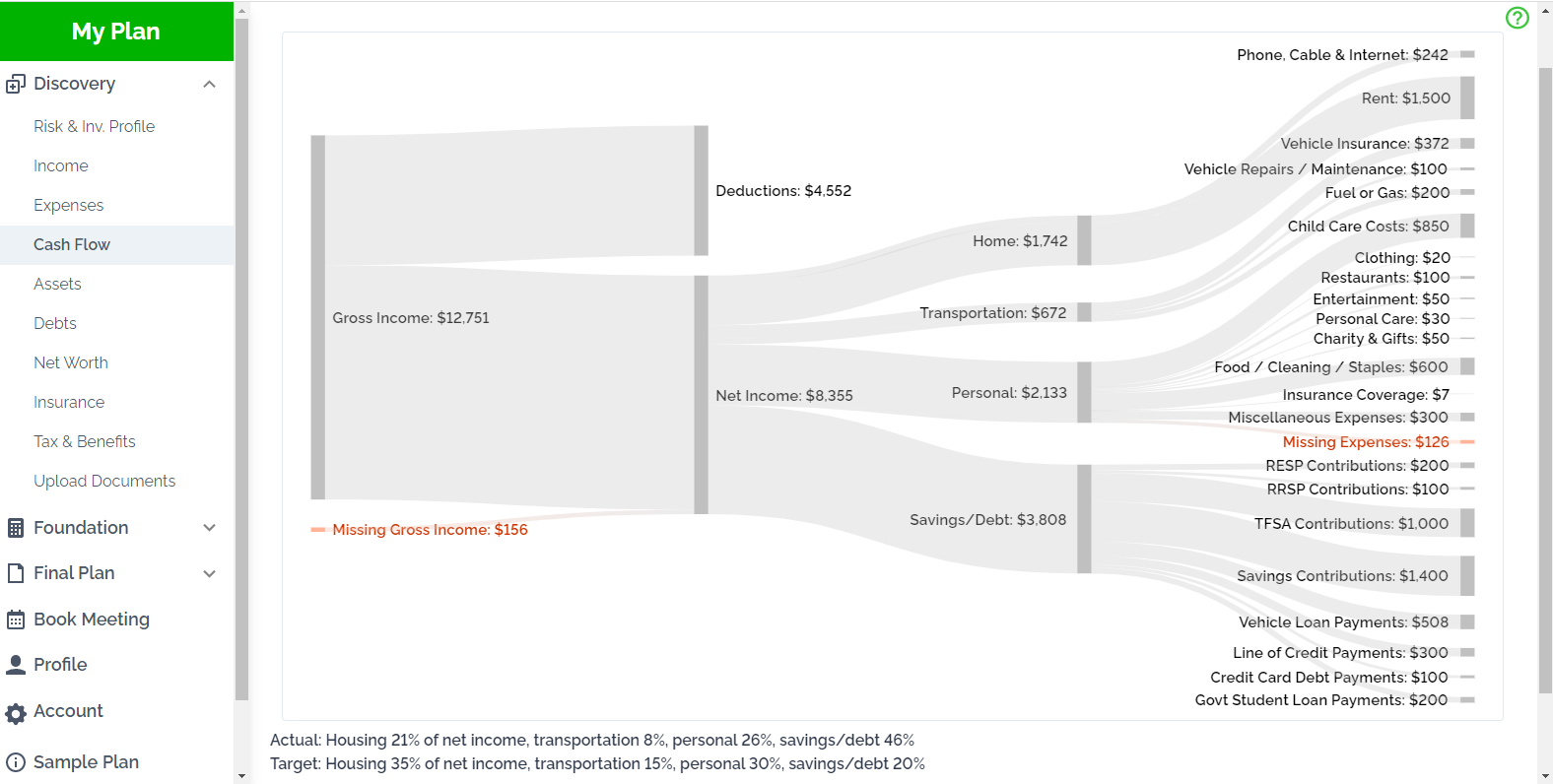

This is also a great time to visualize spending and saving. Where is your money “flowing”? Does that line up with your personal values and goals?

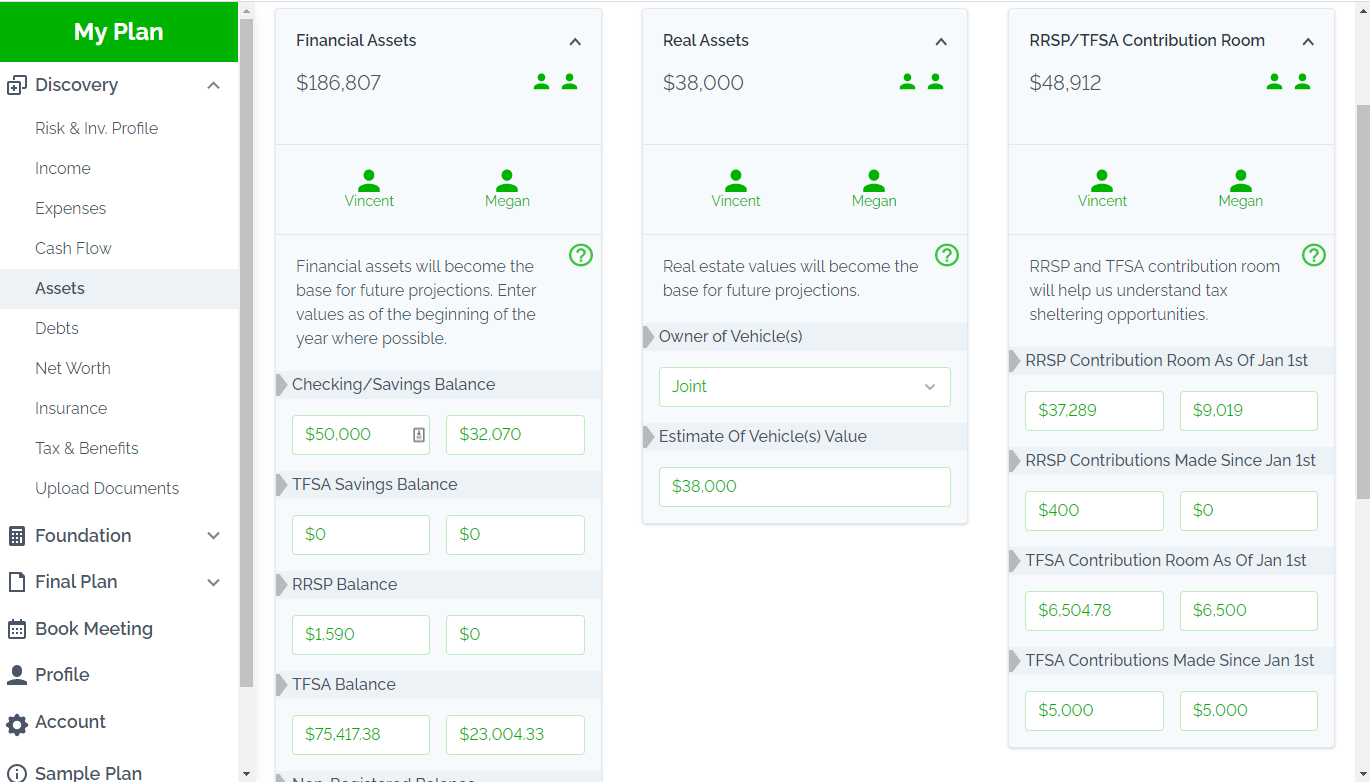

Updating Assets

As long-term investors we hope that our assets will grow year over year (although that is by no means guaranteed) and the new year is a perfect time to update the account balances in RRSPs, TFSAs etc. to reflect this growth.

In the accumulation phase we’re hoping that these balances have grown significantly year over year with investment growth and new contributions.

In the decumulation phase we’re hoping that investment growth has at least partially offset withdrawals used to support retirement spending and income tax payments.

If you’re using the PlanEasy platform to create your financial plan, then you’ll want to update the Assets section in Discovery.

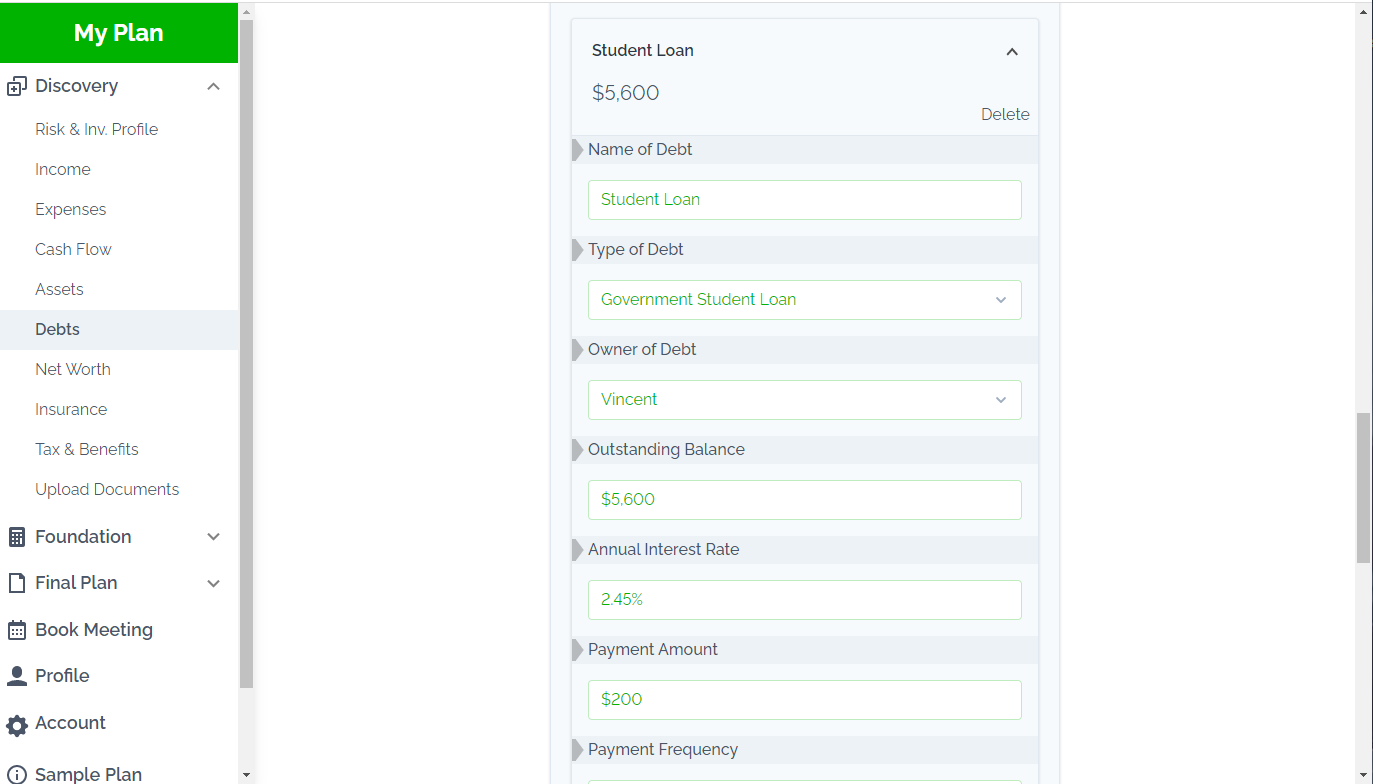

Updating Debts

Paying off debt is an important goal, and we hope to see debt balances decline over time. If you’re in the debt payoff phase of your financial plan, then after a year of payments those debt balances should be significantly lower.

By updating debt balances we can get a new view of the debt payoff plan.

Another change that could have happened in the last year is that interest rates could have increased or decreased. Refinancing a mortgage or line of credit could mean changes to interest rates and/or monthly payments. These are also important factors to update in a debt payoff plan.

Lastly, we want to add any new debt, perhaps for a renovation, vacation property purchase, new vehicle purchase etc.

If you’re using the PlanEasy platform to create your financial plan, then you’ll want to update the Debts section in Discovery and ensure existing debts are updated and any new debts are added.

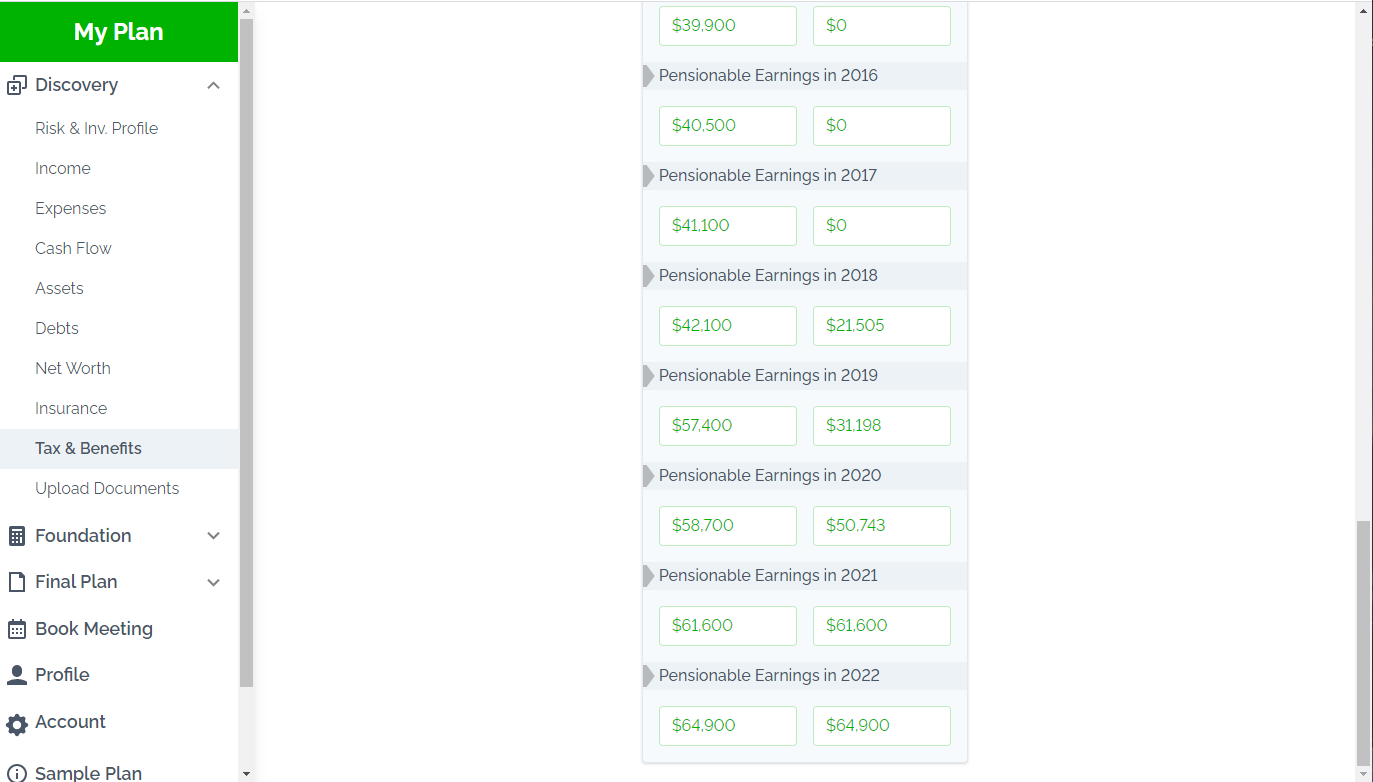

Updating Benefits

Certain benefits will also change over time. In retirement, benefits like CPP and OAS are based on certain factors. Each year we want to update the estimate for CPP and OAS by updating these factors.

In particular, we want to update CPP pensionable earnings, which affects how much CPP you’ll receive in retirement. Now that the previous year has ended, it’s time to add pensionable earnings for the prior year. For now, a good estimate for pensionable earnings is simply your employment income and self-employment income for the year Then in the future this estimate can be updated with the actual value from your CPP Statement of Contributions (once it’s updated).

If you’re using the PlanEasy platform to create your financial plan, then you’ll want to update the Tax and Benefits section in Discovery.

Defined benefit pensions will also change from year to year based on actual income and years of service. For everyone with a defined benefit pension, we also want to update the financial plan with the most recent estimate for future pension benefits and start age. This will either come from a recent pension statement or a pension calculator.

Updating Personal Situation and Goals

Last but certainly not least, we need to update a financial plan for changes in personal situation and goals.

Family changes like new children, new relationships, changing relationships, all have big impacts on a financial plan.

New purchases of assets like homes and vacation properties should also be updated.

And depending on employment changes, there could be new employer matched retirement accounts like Group-RRSPs, Defined Contribution Pension Plans (DCPPs), Deferred Profit Sharing Plans (DPSPs), and Employee Share Purchase Plans (ESPPs).

If you’re using the PlanEasy platform to create your financial plan, then you’ll want to update the Profile section.

Updating Your Financial Plan Each Year

Updating your financial plan each year is an important part of reaching your financial goals. Rather than letting yourself get too far off course, it’s easier and more efficient to make small “course corrections” from time to time, this keeps you on a more direct course towards your target.

This is the perfect time of year to revisit your financial plan and make those small course corrections to keep yourself on track.

Just like a rocket ship speeding towards its destination, we want to keep your personal finances on track without veering too far off course.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments