How To Maximize Your Canada Child Benefit (CCB) And Gain $1,000 to $10,000+

If you currently have children, or if you’re planning to have children soon, or if you know someone with children, then this blog post could help you increase the Canada Child Benefit (CCB) by $1,000’s or even $10,000’s.

The Canada Child Benefit is a generous government benefit. It’s available to families with children aged 17 and under. This benefit is based on taxable income and can be maximized with some careful planning.

By using just two common accounts, the TFSA and the RRSP, we can maximize the Canada Child Benefit (CCB) and also minimize income tax.

The net result is $1,000’s or $10,000’s in additional Canada Child Benefit (CCB) and potentially $100,000+ in additional net worth over the course of a financial plan.

In this blog post we’re going to go through a specific example of how one family can boost their Canada Child Benefit by over $55,000, and when combined with income tax reductions, improve their overall net worth by $300,000+

How The Canada Child Benefit (CCB) Works

First, its important to understand how the Canada Child Benefit (CCB) works. The Canada Child Benefit is an “income tested government benefit”. It’s based on household taxable income, specifically line 23600 on your tax return.

If taxable income increases the Canada Child Benefit decreases.

If taxable income decreases the Canada Child Benefit increases.

This change is based on the “clawback rate”. The clawback rate for CCB can range from 3.2% to as high as 23%. The clawback rate is based on the number of children as well as household income level.

At the extreme, a $1,000 reduction in taxable income will increase the Canada Child Benefit by $230!

The benefit amounts and income thresholds change each year with inflation. To get the latest benefit amounts, clawback rates, and income thresholds, and to estimate you new Canada Child Benefit (CCB) for this year, visit this blog post.

One important tool to help lower taxable income and increase Canada Child Benefits is an RRSP contribution. An RRSP contribution is a tax deduction, and it helps lower your taxable income. An RRSP contribution will help lower taxable income, lower income tax, and increase Canada Child Benefits.

How To Maximize Your Canada Child Benefit (CCB): A Case Study

To explore how we can maximize your Canada Child Benefit (CCB) using just RRSPs and TFSAs we’re going to look at a specific case study. This family will gain over $55,000 in Canada Child Benefit (CCB), and when combined with income tax reductions, will improved their overall net worth by $300,000+

The Situation: Sam, age 36, Michael, age 36, and three children ages 6, 4, and 2. They earn a combined $90,000 per year. Sam earns $65,000 per year and Michael earns $25,000 per year working part time and caring for the children. Sam and Michael are great savers. Their frugal spending habits means that they’ve been maximizing their TFSAs for the last 10+ years. This year they expect to save $12,000 in their TFSAs and they have LOTS of RRSP contribution room to take advantage of.

They’ve been focusing on their TFSAs, but they wonder if they have the right strategy. They wonder if they could lower their income tax and increase their government benefits by using the RRSPs instead.

Watch The Video! (Or Read The Case Study Below)

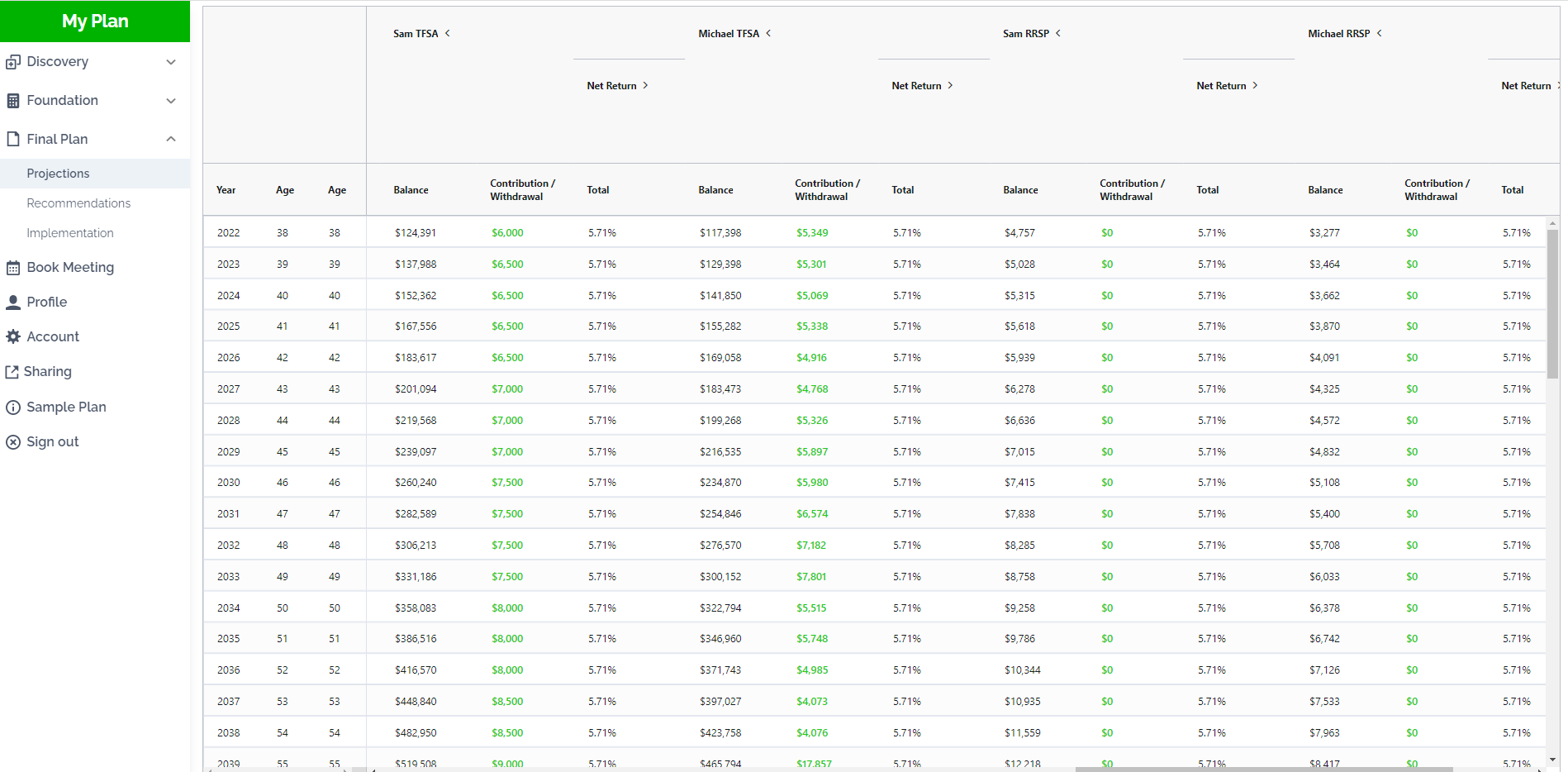

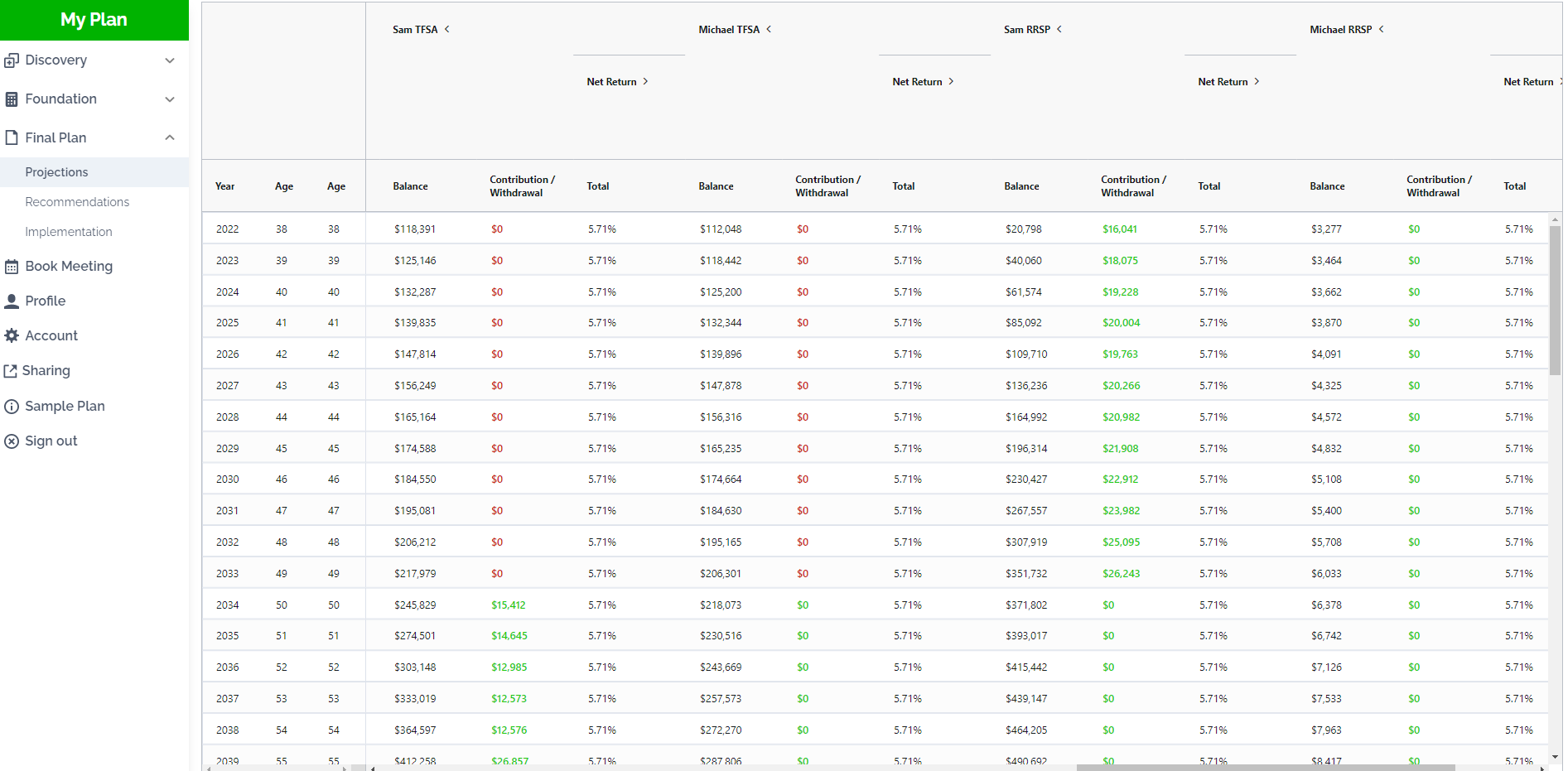

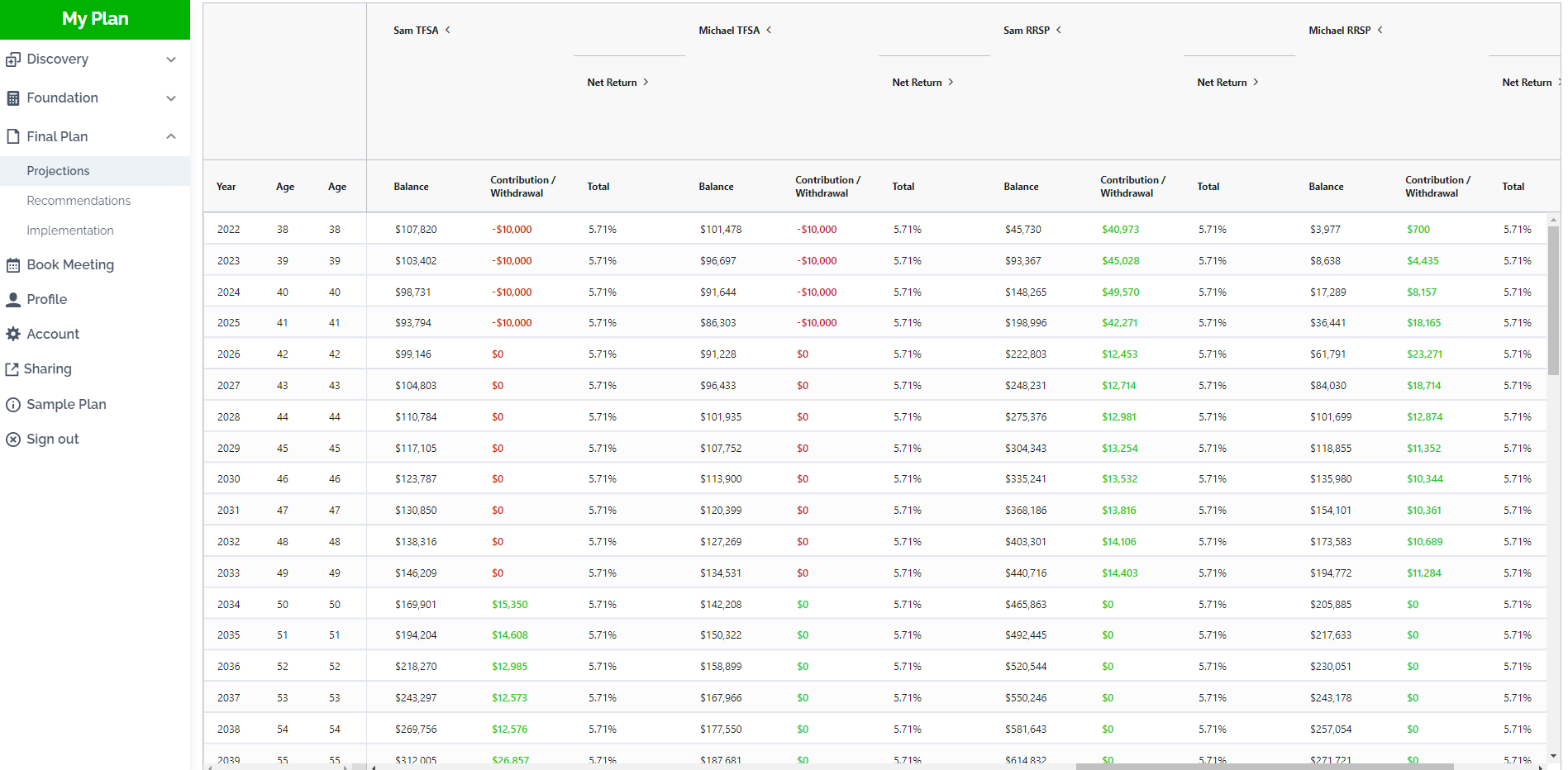

Base Scenario: Maximizing TFSAs First

First let’s take a look how Sam and Michael are currently maximizing their TFSAs as a first priority. This will give us a good baseline to compare with as we improve their TFSA and RRSP strategy and maximize their Canada Child Benefit (CCB).

All of Sam and Michael’s contributions are going to the TFSAs. After household expenses, mortgage payments, and RESP contributions, they have about $12,000 per year to add to the TFASs.

This is already an impressive savings rate and a great financial plan. Their net worth will grow substantially and retirement at age 60 looks very reasonable. But can we do better?

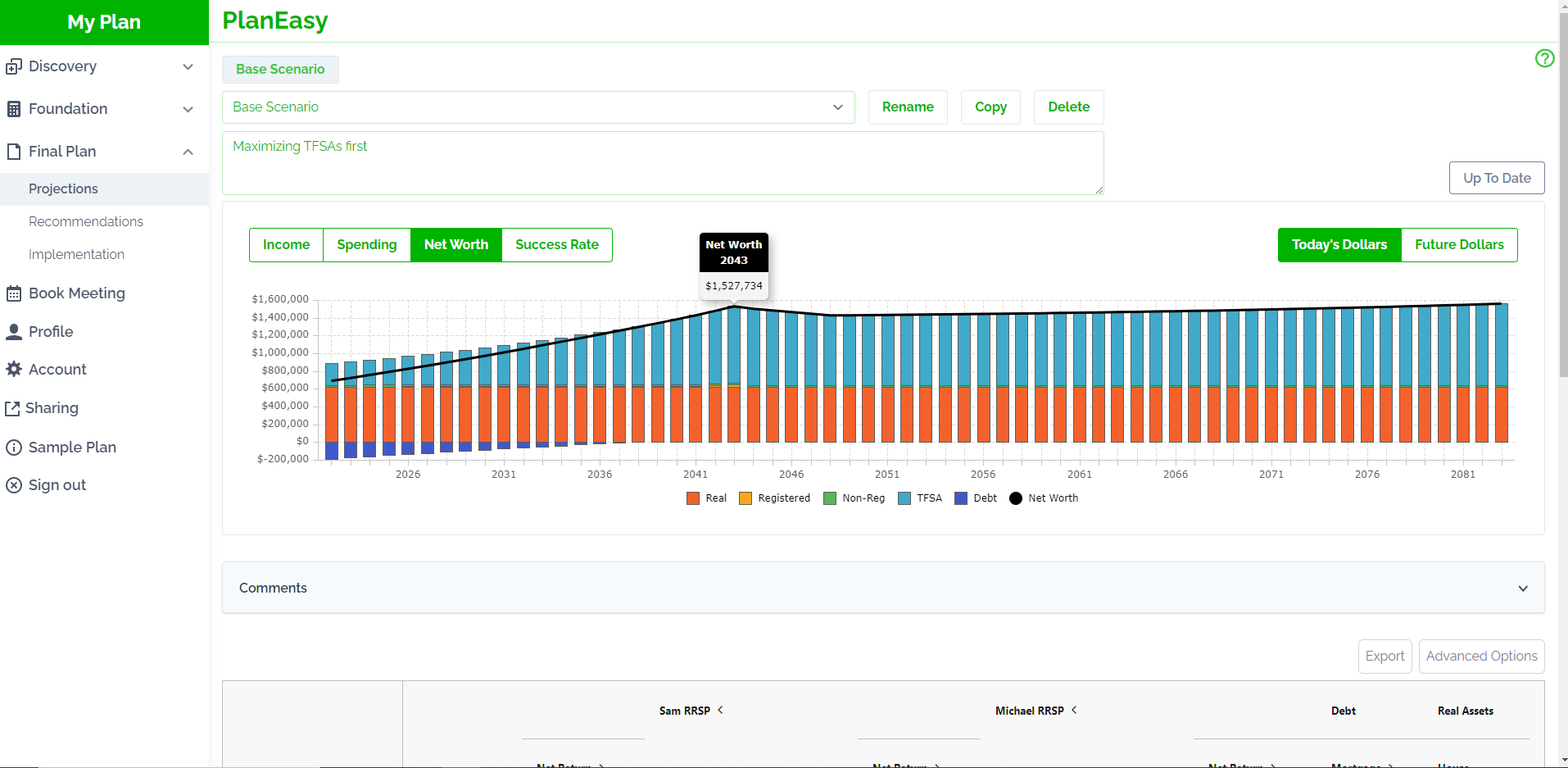

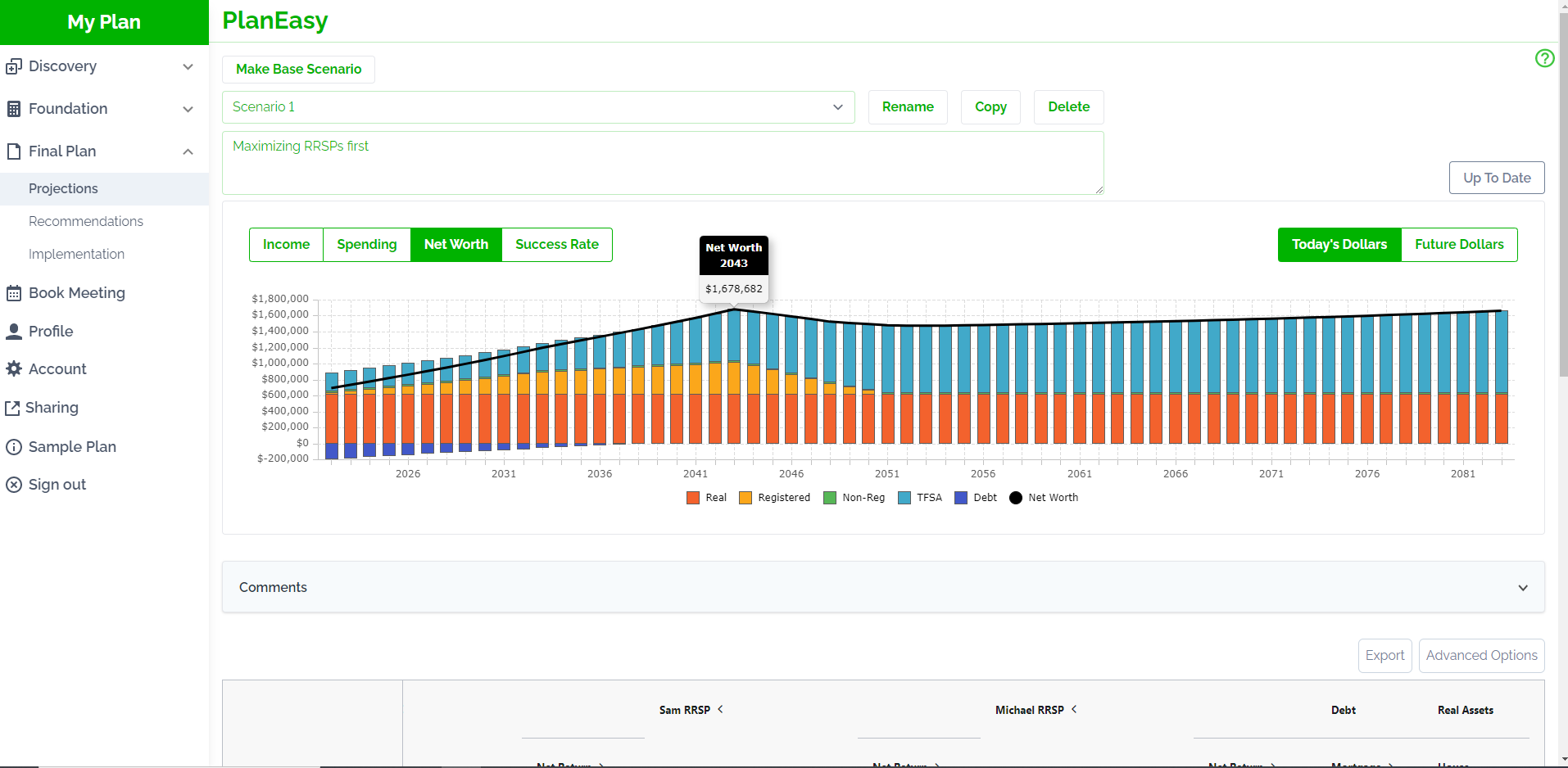

Scenario 1: Maximizing RRSPs First

The first thing we want to try is switching the focus from TFSA contributions to RRSP contributions. We know that RRSP contributions will create a tax deduction, which will lower taxable income, which will then increase Canada Child Benefits.

If you’re using the PlanEasy platform to create your financial plan this is easy to do. We will simply add an override to the TFSAs by double clicking the contributions in green. Then we’re going to set the TFSA contributions to $0 because we want all the extra money to go into the RRSPs first.

Then we just recalculate the plan to see the impact of this change.

Now that all of Sam and Michael’s contributions are going to the RRSP their Canada Child Benefit has already increased by $21,094, net worth at retirement has increased by $150,948 and total estate value has increased by $103,790. Not bad! But can we do more?!

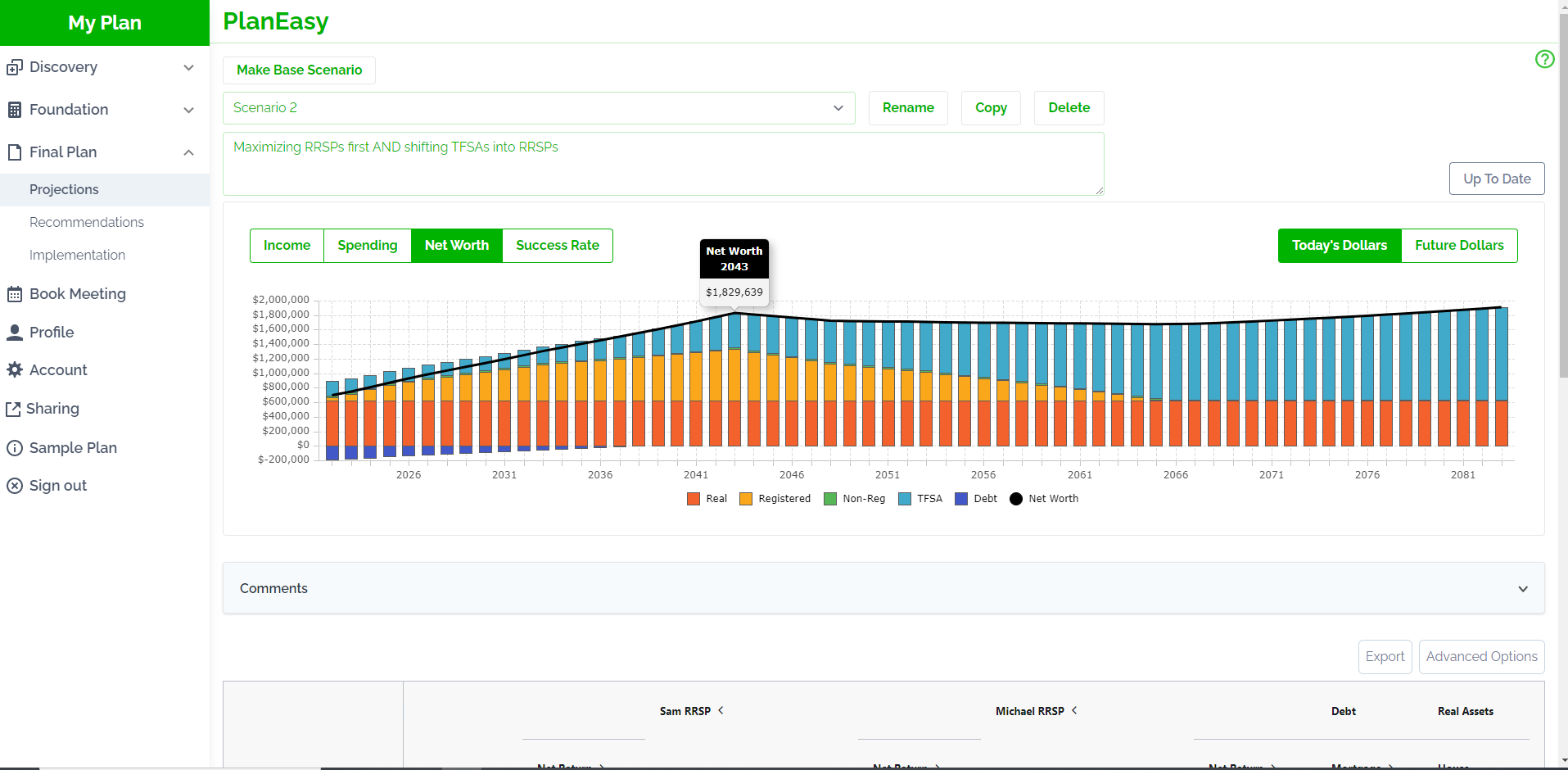

Scenario 2: Maximizing RRSPs first AND shifting TFSAs into RRSPs

We’ve just seen how impactful RRSP contributions can be, so can we take this a bit further by taking money out of the TFSAs and shifting it into the RRSPs? Sam and Michael have a lot of RRSP contribution room available, so we can use the assets in the TFSAs to make even larger RRSP contributions, providing a larger tax refund and even higher Canada Child Benefits.

Instead of overriding TFSA contribution to $0 we’re actually going to plan withdrawals of $10,000 per year per person for 4-years to help Sam and Michael maximize their RRSPs a bit faster.

Then we just recalculate the plan to see the impact of this change.

Now that Sam and Michael are using TFSA withdrawals to maximize their RRSPs faster the Canada Child Benefit has increased even further, its now +$53,400 versus the base scenario, net worth at retirement has increased by $301,905 and total estate value has increased by $351,328. Impressive! But can we still go a bit further?!

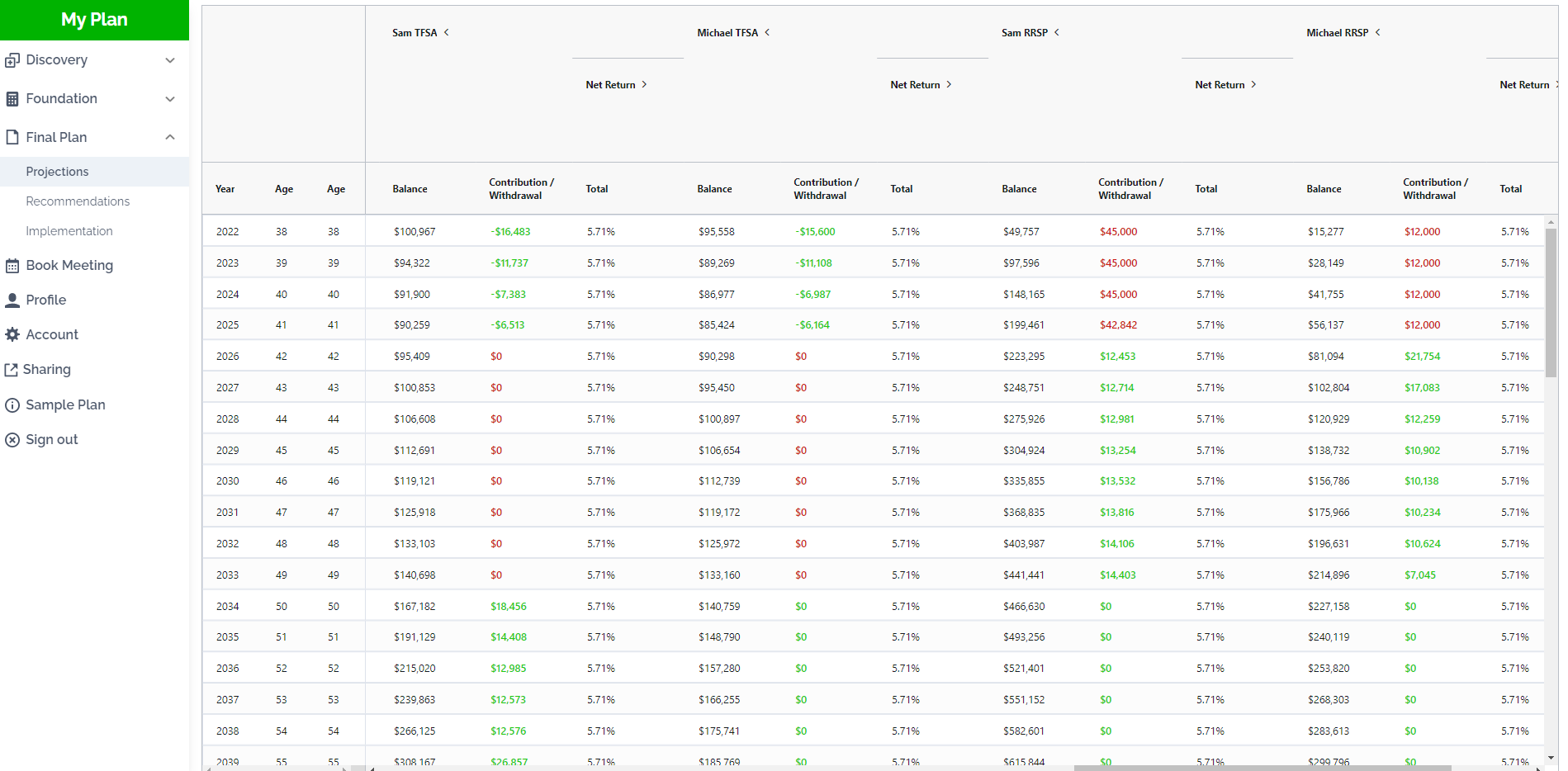

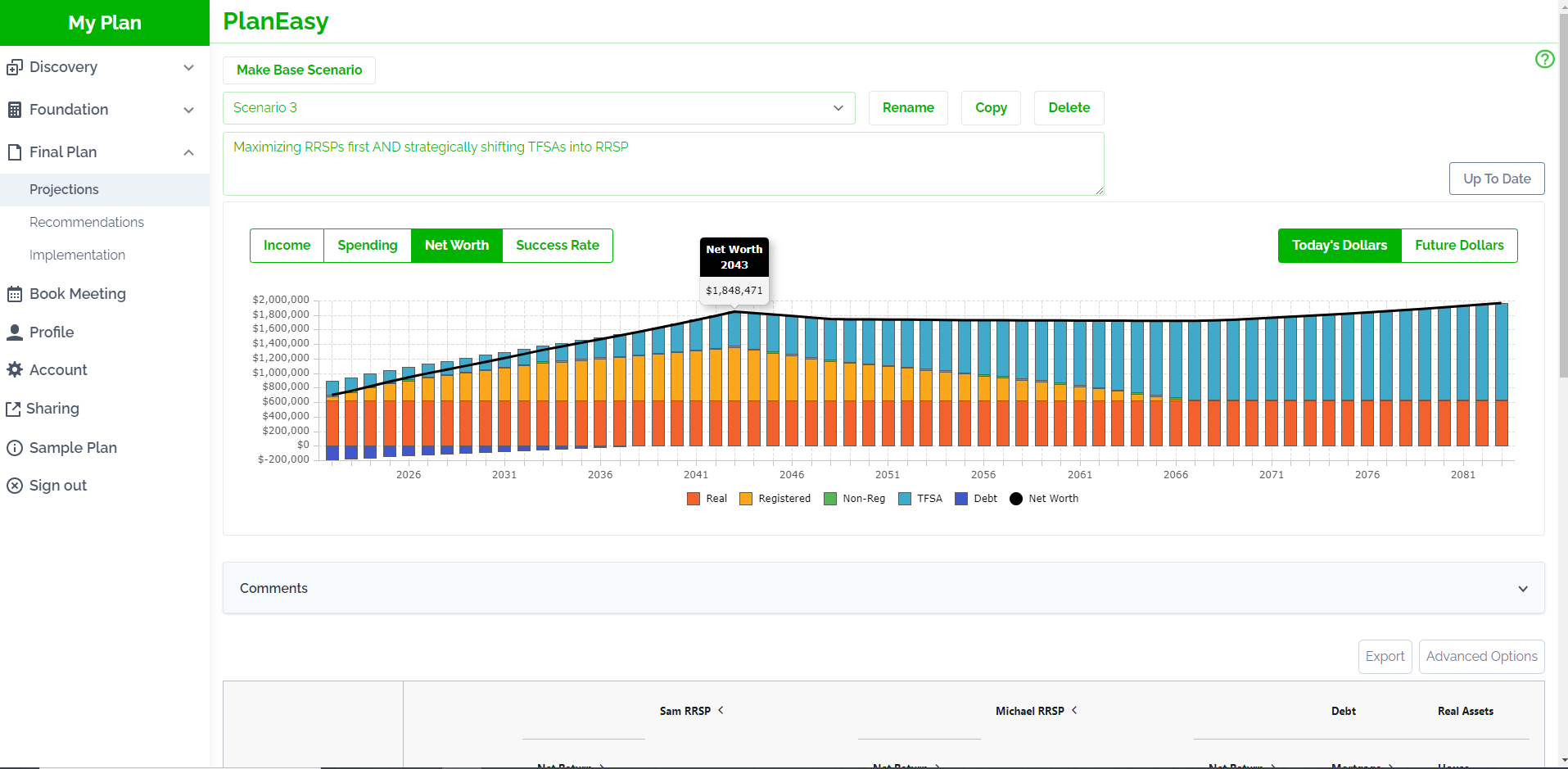

Scenario 3: Maximizing RRSPs first AND strategically shifting TFSAs into RRSP

As we saw in scenario 2, taking money out of the TFSAs to help maximize the RRSPs was a great idea, but can we be a bit more strategic about the amounts being withdrawn from the TFSAs and the amounts added to the RRSPs? Rather than setting the TFSA withdrawals, lets instead set the RRSP contribution goal and let the PlanEasy platform calculate the appropriate TFSA withdrawal.

We know that Canada Child Benefit is maximized at a certain income level, so we’re going to target RRSP contributions of $45,000 per year for Sam and $12,000 per year for Michael. This will bring their household taxable income down far enough to maximize the Canada Child Benefit. They won’t be able to do this forever, because they’ll run out of RRSP contribution room eventually, but for the next 4-years they can maximize their CCB by moving money from the TFSAs into the RRSPs.

Then we just recalculate the plan to see the impact of this change.

Now that Sam and Michael are using strategic TFSA withdrawals to make specific RRSP contributions, the Canada Child Benefit has increased even further, its now +$55,154 versus the base scenario, net worth at retirement has increased by $320,737 and total estate value has increased by $407,448. Wow!

Just a few small changes have resulted in over $300,000+ in net worth at retirement. That’s a lot of extra retirement spending!

How To Maximize Your Canada Child Benefit (CCB) And Gain $1,000 to $10,000+

Maximizing your Canada Child Benefit (CCB) can be easy to do. With a little careful planning you can use existing savings/investments to strategically contribute or withdraw from RRSPs and TFSAs to maximize your Canada Child Benefit and minimize income tax.

In the example above we helped this family increase their Canada Child Benefit by $55,000+ and their net worth at retirement by $300,000+ just by carefully planning RRSP and TFSA contributions.

Depending on your situation you may experience a higher or lower benefit from this type of planning. It depends on what you’re doing today, what you’ve done in the past, and what your expectations are for the future.

Every plan is slightly different, but if you haven’t done this type of government benefit planning yet, then there is likely a LARGE opportunity to be more strategic about your contribution and withdrawal strategy going forward.

If you want to create your own financial plan to maximize your Canada Child Benefit you can use the PlanEasy Platform to create your own financial plan, and if you need a bit more help, one of our advice-only financial planners is ready to help you.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments