How To Estimate Retirement Spending

Retirement spending is one of the most important assumptions in a retirement plan. Making the right retirement spending assumption can make the rest of a retirement plan much easier. Making the right assumption can also make a retirement plan much more successful.

Making the wrong retirement spending assumption however could mean running out of money in retirement, or it could mean working longer than necessary, or it could mean accumulating millions of dollars late in retirement. All things we would prefer to avoid.

Of course, there are some simple “rules” for retirement spending like assuming 70% of pre-retirement income, but given how important retirement spending is in a retirement plan these generic rules can lead to issues in the future.

When creating a retirement plan it’s important to make the right retirement spending assumption. This means avoiding generic rules and instead understanding your unique spending needs today and how they might change in retirement. This also means understanding the impact of being wrong with your retirement spending assumption and how doing a “trial run” of retirement spending can help improve the level of confidence you have in your retirement plan.

Using Current Spending As A Base

How do you make an informed retirement spending estimate? One very effective way is to use your current spending as a base.

Current spending is an excellent base to help make retirement spending assumptions because it perfectly reflects your current lifestyle. It’s much better than using some generic rule like 70% of pre-retirement income.

Category by category, much of your spending will likely remain similar when entering into retirement. Fixed expenses like property tax, utilities, insurance, phone, cable, internet etc. etc. will likely not change in retirement. Other variable spending categories like food/staples, which is often based on ingrained habits and lifestyle, will likely remain similar as well.

But current spending may not reflect changes in categories like travel, hobbies, entertainment and restaurant spending. It’s important to use current spending as a base but then make adjustments for the retirement lifestyle you’d like to have.

This approach also highlights one of the dangers of increasing lifestyle spending right before retirement. Increased spending in the 5-10 years before retirement will likely transition into retirement and will increase the amount of savings and investments required to support retirement spending.

The most common way this happens is when extra cash flow increases after children leave the home and/or when the mortgage is paid off. These are important periods to manage pre-retirement spending and avoid excessive lifestyle inflation.

Median Retirement Spending

One way to gauge if you’ve made a good assumption for retirement spending is to benchmark against the median for Canada.

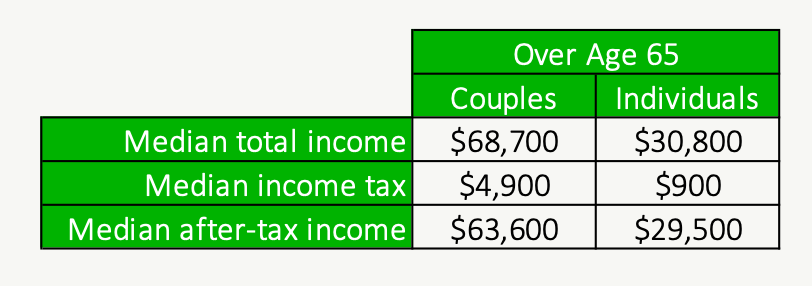

According to Statistics Canada the median income for those over 65 is…

This represents a good benchmark for retirement spending. It can help understand if your retirement spending estimate is too low or too high. This is a quick way to check if your retirement spending estimate is reasonable or not.

The Impact Of Taxes In Retirement

It’s also important to understand the impact of taxes in retirement, particularly how it relates to incremental retirement spending.

As we saw above, at the median level of retirement spending in Canada, income tax can be quite reasonable. This is because tax credits help reduce income tax for retirees. For those over age 65 there are tax credits like the basic exemptions, the age amount tax credit, the pension income tax credit etc. etc. These tax credits help keep income tax low for those who have retirement spending at or below the median in Canada.

But, when retirement income goes above this level it gets taxed at the marginal tax rate of 20%, 30%, or more. This will depend on your province/territory. In fact, how much you need to have at retirement can be greatly impacted by the tax rates where you live.

If incremental retirement spending is being supported by registered assets like RRSP, RRIF, or LIRA, then the relationship between taxes and retirement spending becomes extremely important.

At a 20% marginal tax rate, to create an extra $10,000 in after-tax spending in retirement we need to withdraw $12,500 from the registered account ($10,000 for spending but $2,500 extra to pay tax on withdrawal).

Even worse, at a 30% marginal tax rate, to create an extra $10,000 in after-tax spending in retirement we need to withdraw $14,286 from the registered account ($10,000 for spending but $4,286 extra to pay tax on withdrawal).

When withdrawing from an RRSP, RRIF, LIF etc, that last little bit of retirement spending needs to be supported by a very large amount of registered investment assets. At a 30% marginal tax rate, spending an extra $10,000 per year in retirement requires around $357,143 in investment assets to be sustainable!

Making The Right Assumptions For Retirement Spending

As you can see, retirement plans are very sensitive to spending assumptions, so it’s important to make the right assumptions for retirement spending before entering retirement. Taking a bit of time to ensure retirement spending is right will help avoid issues later in retirement.

Making the right retirement spending assumption can mean the difference between a very successful retirement and the possibility of running out of money in the future.

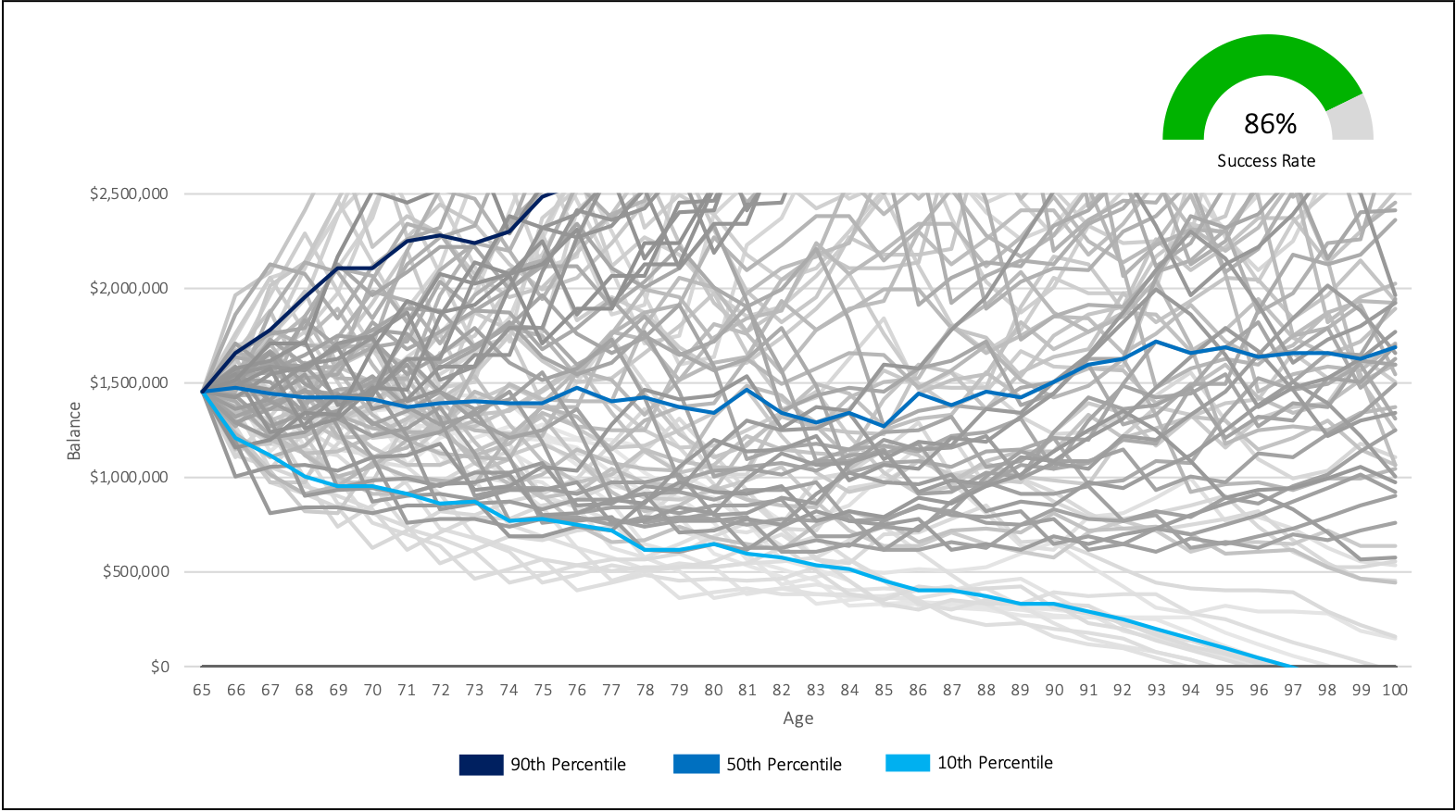

The success rate of a retirement plan might look good on paper…

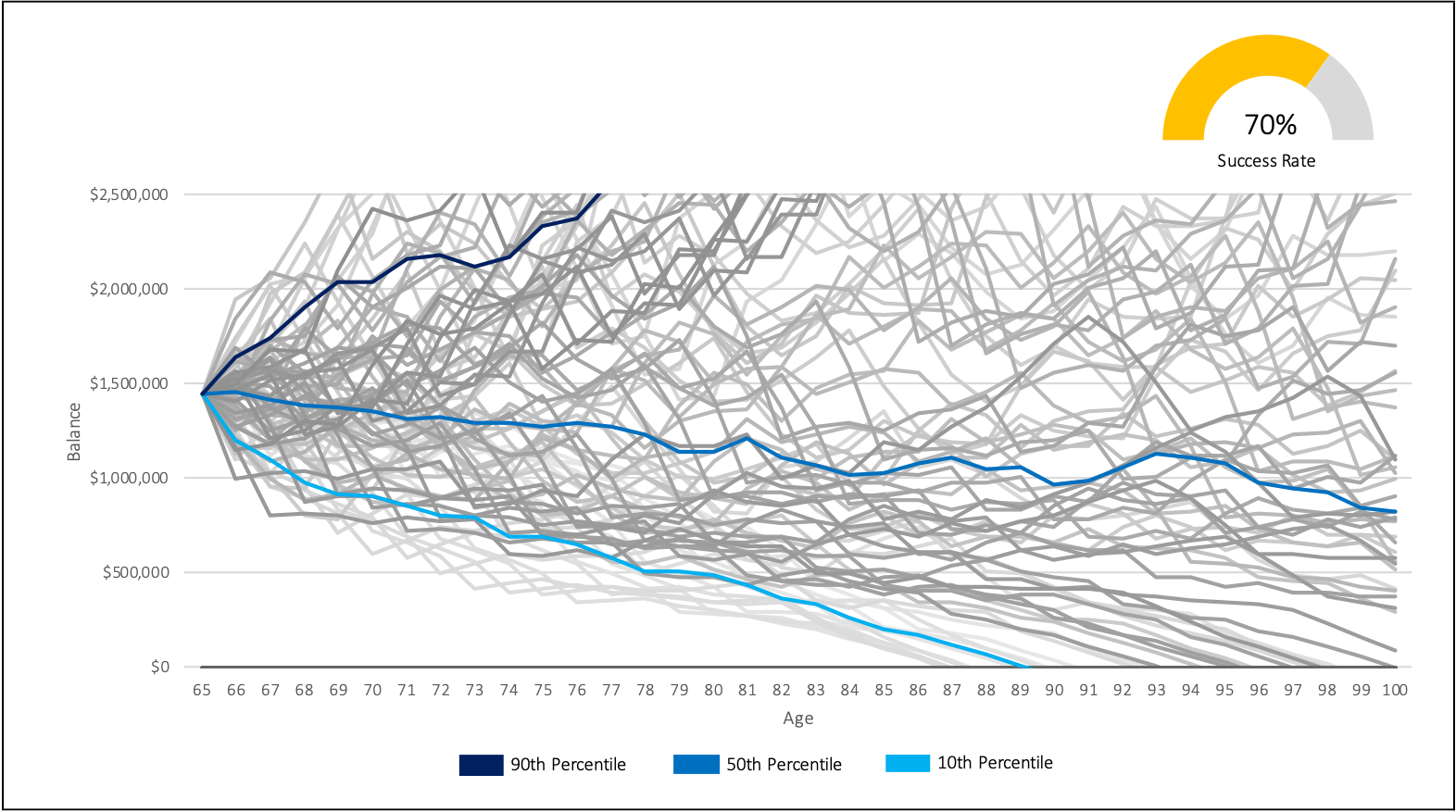

But if retirement spending has been under-estimated by even $500/month, that extra spending can have a large effect on the success rate of a retirement plan…

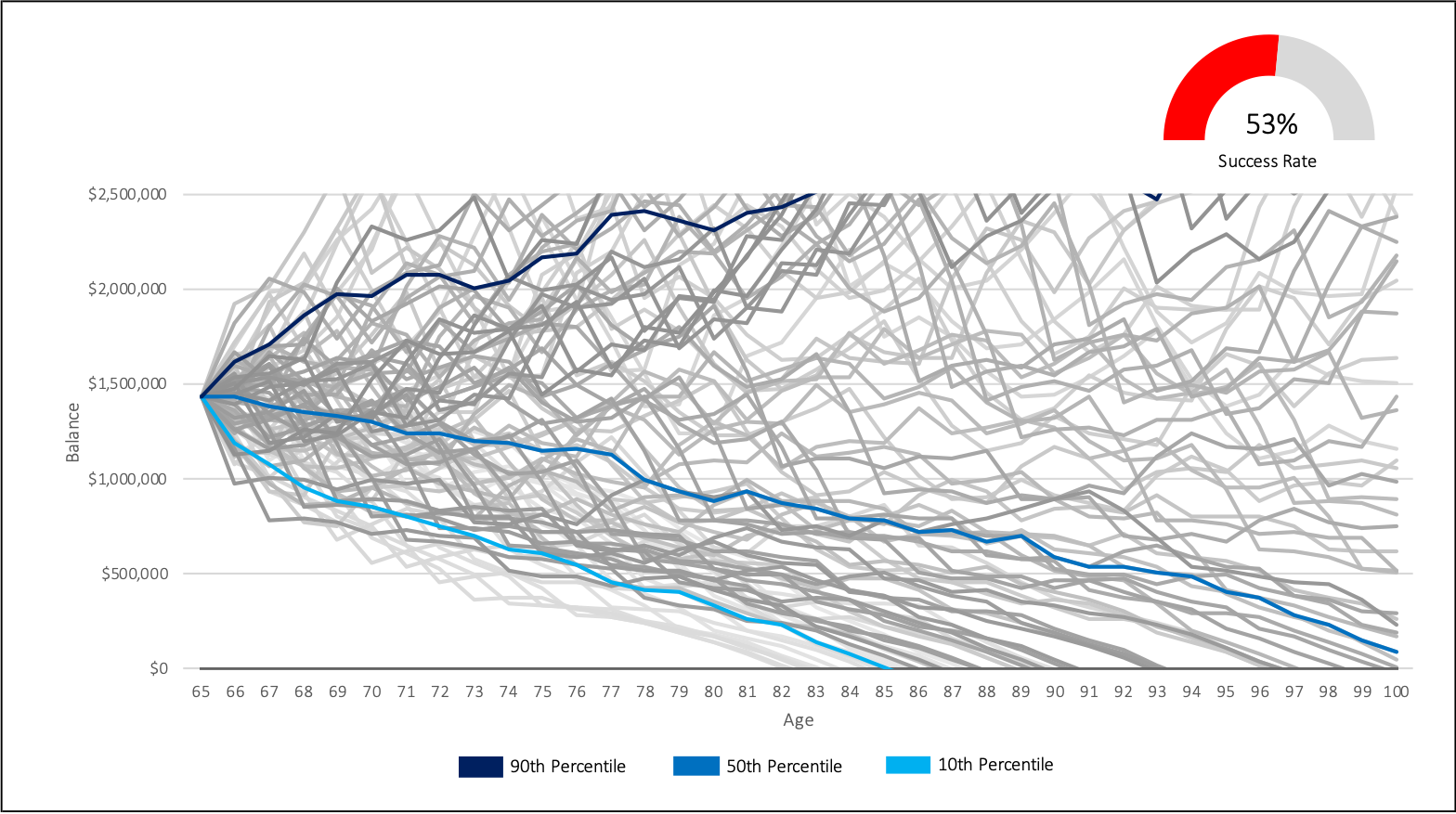

And if retirement spending has been under-estimated by $1,000/month things look even worse…

Tip: Do A Trial Run Of Retirement Spending

One way to feel very confident about your retirement spending estimate is to do a “trial run” of your retirement budget in the 12-18 months before retirement.

Set up your accounts/budget to live off your anticipated retirement spending level (even though your actual income may be much higher). By simulating a fixed retirement income, it will quickly become apparent if retirement spending estimates were close to target or way off base.

The benefit of doing a trial run is that you now have time to adjust your retirement spending expectations and/or continue working for a few more years to pad your retirement investments.

When it comes to retirement spending assumptions, a little bit of planning can help ensure a very successful retirement.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments