How To Build a GIC Ladder Into Your Portfolio

With interest rates higher, GICs have become more attractive as an investment option and a 5-year GIC ladder can be a great addition to your portfolio. GICs can be considered part of your fixed-income allocation and in some cases GICs can even outperform bonds of equal length.

If you’re adding GICs to your investment portfolio then you’ll want to consider building a GIC ladder. A GIC ladder is a common way to invest in GICs.

When investing in GICs, a GIC ladder can help take advantage of the benefits of GICs while reducing the downsides.

GICs are typically locked in for a specific term. This could be shorter-term like 90-days or longer-term like 1-year, 2-years, 3-years, 4-years, 5-years etc.

Laddering GICs will help take advantage of longer-term GIC rates while also improving liquidity with some shorter-term GICs.

When a GIC ladder is working well, there will always be at least one GIC maturing every year which can then be used to purchase a new longer-term GIC. Here’s why you may want to set up a GIC ladder and how to do it…

What Is A GIC Ladder?

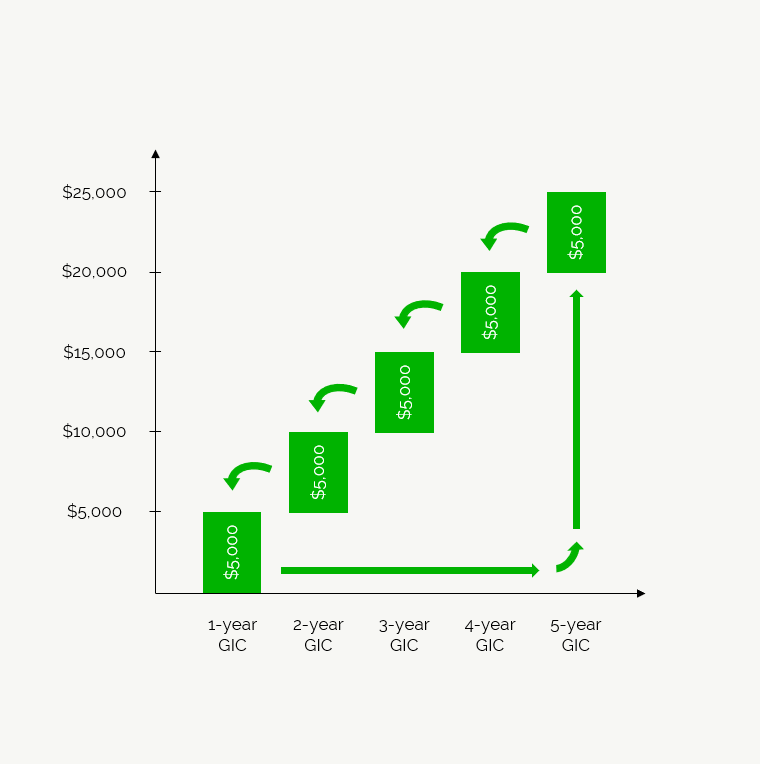

When investing with GICs it’s very common to set up a “GIC ladder”. A GIC ladder is exactly how it sounds. It’s a series of GICs that stack on top of each other with different terms.

In a typical 5-year GIC ladder the GICs are staggered to ensure at least one GIC will mature each year. This improves liquidity but allows an investor to take advantage of higher interest rates available with longer term GICs.

Initially a GIC ladder would be set up by splitting a lump-sum into five separate amounts and purchasing GICs with terms of 1-year, 2-years, 3-years, 4-years, 5-years. Then as GICs mature they can be rolled into a new 5-year GIC. This ensures at least 1/5th of the total amount will mature each year.

Why Ladder GICs?

GICs are typically locked in for a specific term. This could be shorter-term like 90-days or longer-term like 1-year, 2-years, 3-years, 4-years, 5-years etc.

GICs typically haver better interest rates on longer term GICs. Typically, a 5-year GIC will have a better interest rate than a 1-year GIC. This extra return is compensation for locking in the GIC for a longer-term.

Although longer-term GICs have better rates, the downside is that money is locked in for a longer period of time. This means a loss in liquidity. That money is locked-in and unavailable until the end of the term.

To reduce this downside a GIC ladder can be used.

When a GIC ladder is initially set up the total amount to be invested is split into equal parts and invested in different length GICs, this allows the investor to benefit from higher rates on the longer-term GICs that are purchased but also benefit from liquidity when the shorter-term GICs that are purchased eventually mature.

Laddering GICs provides the benefit of liquidity in the short-term and the benefit of higher rates in the long-term.

Watch The Video!

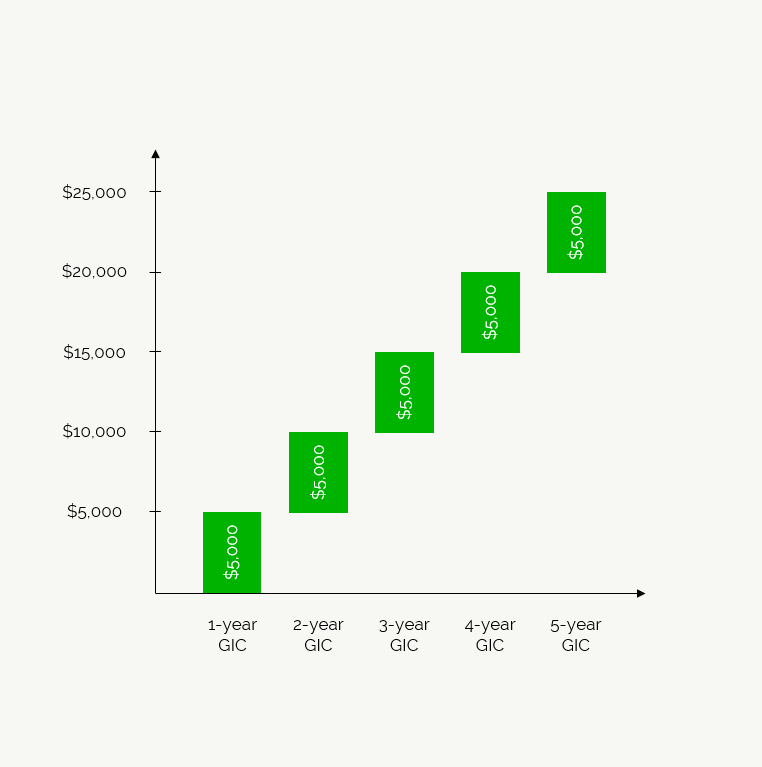

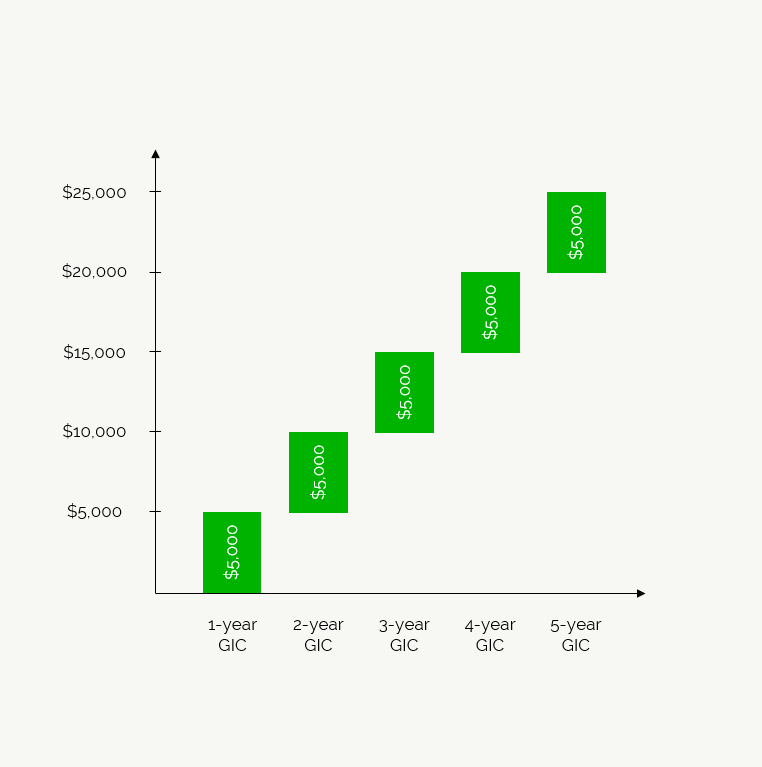

Example Of A GIC Ladder

This is what a GIC ladder would look like for a total amount of $25,000. The GICs stack on top of each other to create rungs in a ladder (or in this visual, more like steps in a staircase). In the next section we’ll go through how to set up a 5-year GIC ladder step-by-step.

How To Build A GIC Ladder?

Let’s go through the steps to build a GIC ladder. We’ll also go through what happens after one year when the first GIC matures. This is important to help maintain the GIC ladder.

Step 1: Define the total amount to be invested in GICs.

Remember that GICs should only make up a portion of your fixed-income allocation and your total fixed-income allocation should be in line with your risk profile. To ensure you can rebalance your portfolio it’s important to maintain some bonds within your fixed-income allocation. In this case we have $25,000 to invest in GICs which represents 5% of the portfolio and part of the 25% fixed-income allocation in a 75/25 portfolio.

Step 2: Divide the total amount into 5 equal portions.

If you’re setting up a 5-year GIC ladder, then the total amount needs to be divided into 5 equal portions.

Step 3: Each portion will be invested in a different length GIC, 1-year, 2-year, 3-year, 4-year, and 5-year.

By dividing the original amount into 5 equal portions and investing those portions into different length GICs we now have 5 equal “rungs” in our GIC ladder (or in this visual, 5 steps).

Step 4: After 1-year the original 1-year GIC will mature and can be reinvested into a new 5-year GIC.

After 1-year the GICs move down one “rung” in the ladder. The 5-year GIC now has 4-years remaining, the 4-year GIC now has 3-years remaining, the 3-year GIC now has 2-years remaining, and the 2-year GIC now has 1-year remaining. The 1-year GIC will mature and can be reinvested back into a new 5-year GIC which becomes the top “rung” in the ladder.

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

How To Build a GIC Ladder

As you can see, building a GIC ladder is relatively straightforward. Once set up the GIC ladder only requires maintenance once per year when the lowest rung of the GIC ladder matures and needs to be reinvested.

GICs can be a great addition to the fixed-income portion of your portfolio. There are pros and cons to consider with GICs, but if used correctly they can provide diversification and stability to a portfolio.

GICs also can provide significant peace of mind. Unlike equities or bonds, GIC value do not fluctuate over time.

Although GICs can seem “boring” and may appear to provide “low-growth”, the benefits of allocating a small portion of the portfolio to GICs can greatly outweigh the downsides for many investors.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments