How Much Money Do You Need To Retire?

Three Real Life Examples

How much money do you need to retire? Well that depends, the more appropriate question might be how much do you want to spend? In this post we’re going to look at three real life retirement examples, one high spending around $200,000 per year, one moderate spending around $70,000 per year, and one low spending at $30,000 per year.

Retirement planning is always driven by spending assumptions in retirement. Spending levels have an enormous impact on how we can plan draw down, how we can manage taxes, and most importantly… how successful the plan is during periods of low investment returns. This is why it’s so important to accurately estimate spending when doing a retirement plan.

Spending doesn’t just include your regular day to day spending, it should also include things like one-time expenses for children’s weddings or once-in-a-lifetime trips. And it should always include an estimate for infrequent expenses like home repairs, vehicle repairs, and vehicle upgrades.

Determining how much money you want to spend in retirement will go a long way to helping to determine how much money you need to retire.

That being said, spending is important, but it isn’t everything…

Other income sources like government pensions, private pensions, and government benefits are also an important factor to consider. Income from government pensions can easily represent 25% to 50% of a retirees spending goal in retirement. Government benefits like GIS and GAINS in Ontario can easily add up to $10,000+ per year for low-income retirees.

The other factor to consider is how much income tax you’ll be paying in retirement. Not all income sources are created equal. Income from a defined benefit pension can be split between partners before age 65, a huge tax planning advantage. Income from CPP, OAS, RRSPs etc are all fully taxable whereas income from TFSAs or non-registered accounts are not. In some provinces non-registered eligible dividends from a Canadian company can actually have a negative tax rate, a big advantage when determining how to best draw down assets in retirement.

To determine how much money you need in retirement often requires a very custom financial plan. This retirement plan looks specifically at your income sources, your financial assets, and your spending goals to determine how much you actually need to retire (and often it’s less than you think!).

In this post we’re going to look at three real life retirement planning examples. These examples are from case studies that we’ve done in the past with the Financial Post or other personal finance websites. We’ve chosen three in particular. One high income retirement planning example. One moderate income retirement planning example. And one low income retirement planning example.

Example: High Income Retirement Planning

This example is based on a Financial Post case study that we did recently. It was based on a couple who had retired and sold their home. They moved into a high-end rental condo a few years back but were being forced to move because the owner was taking back the unit.

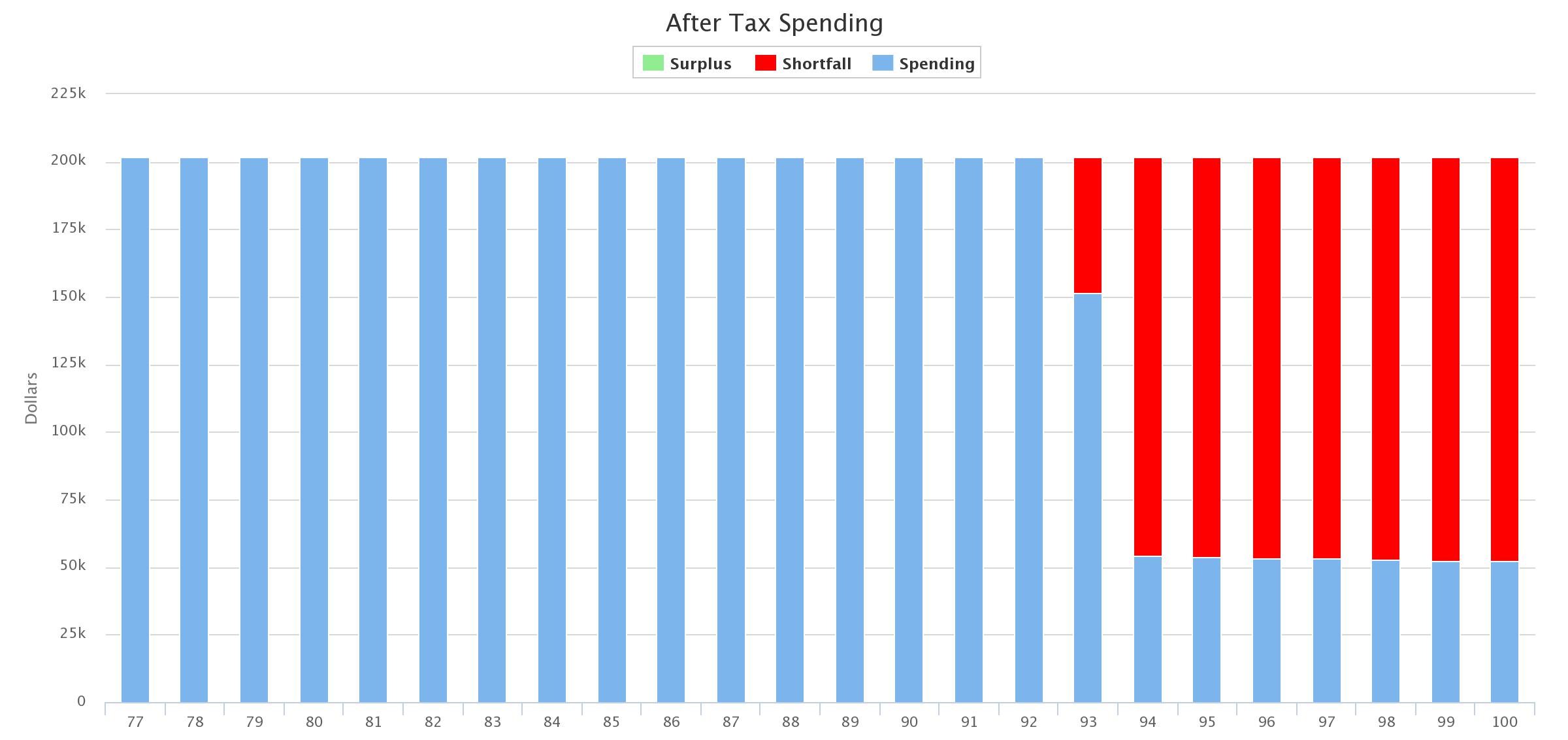

Because of the move their anticipated rental costs would go up $2,000 per month, nearly a 40% increase! With a high income/spending already, with lots of money being spent on travel each year, the increase in rent put a lot of pressure on their plan and they faced some difficult decisions ahead.

Due to their high income and spending, government pensions were less important for their plan. The main concern was that they had a very high chance of outliving their financial assets, especially if the market were to perform poorly over the next 5-10 years, unless some changes were made.

Spending

High Income Example

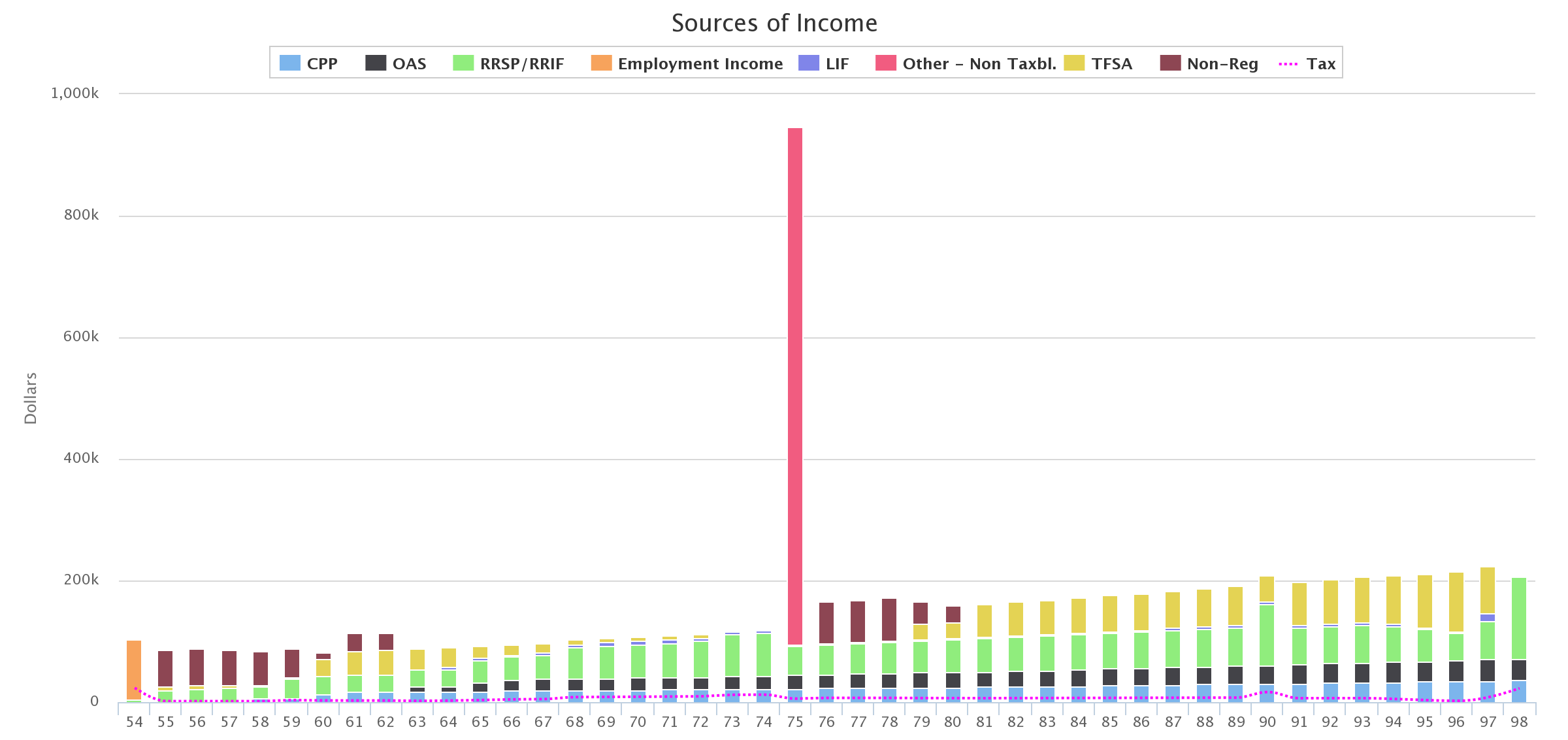

Income

High Income Example

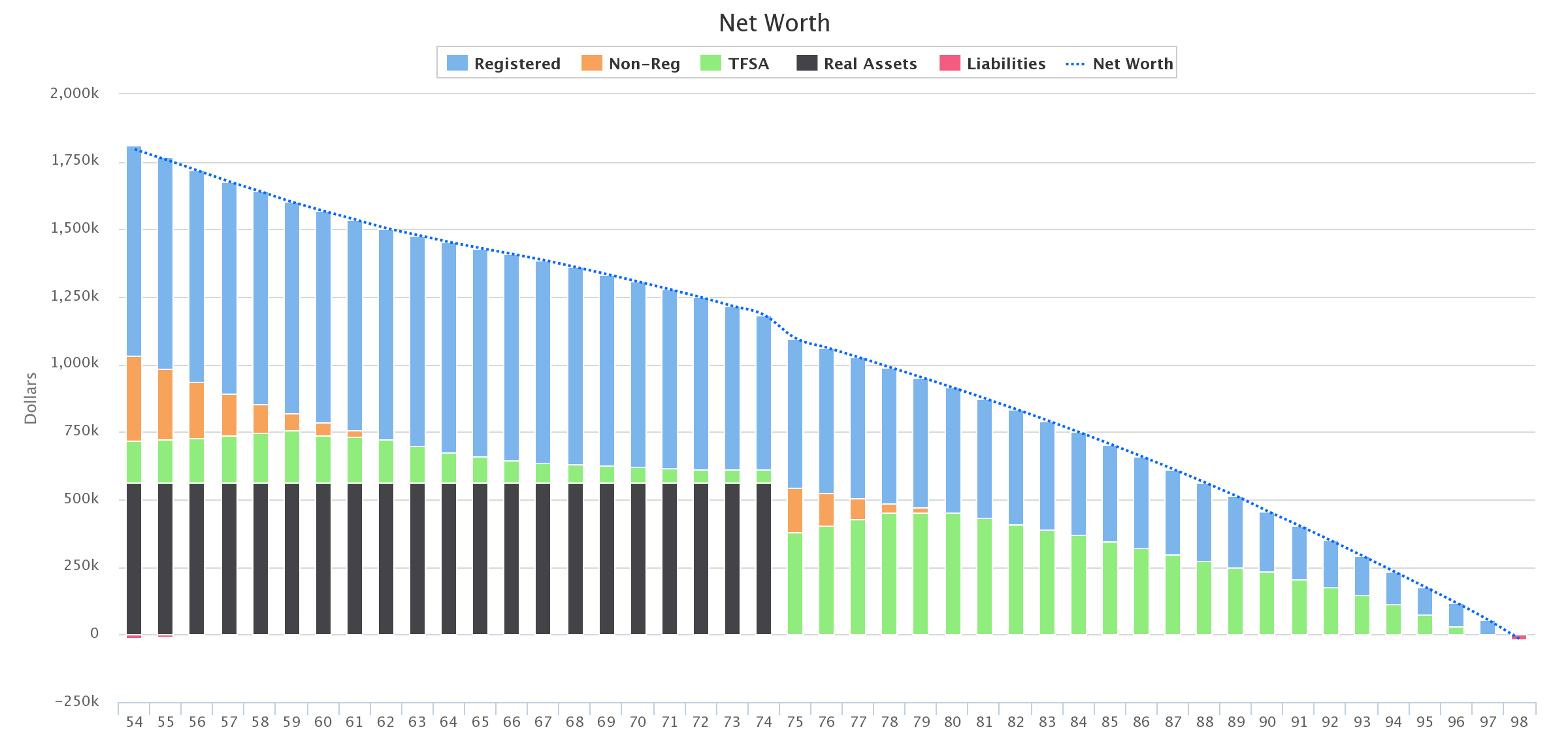

Net Worth

High Income Example

Example: Moderate Income Retirement Planning

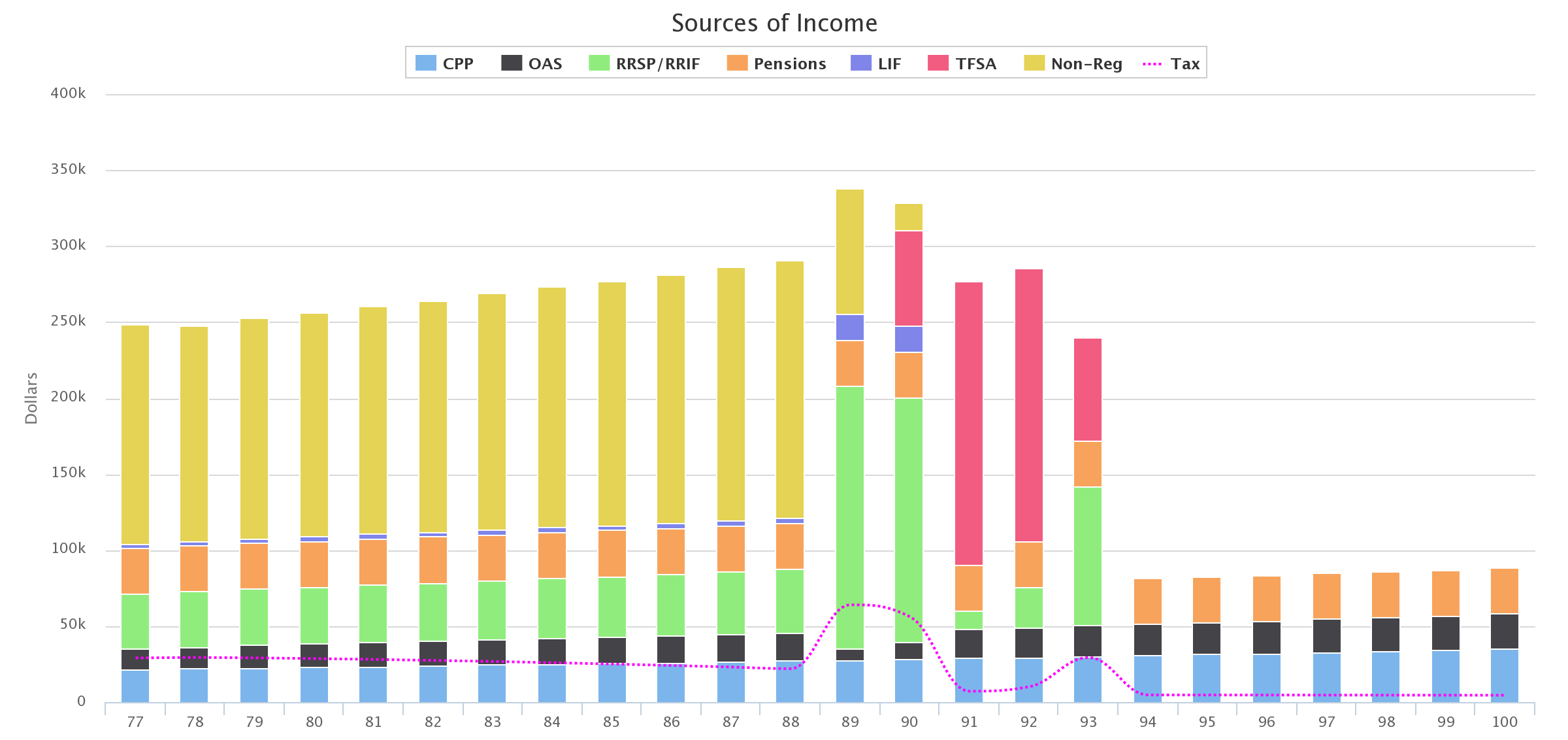

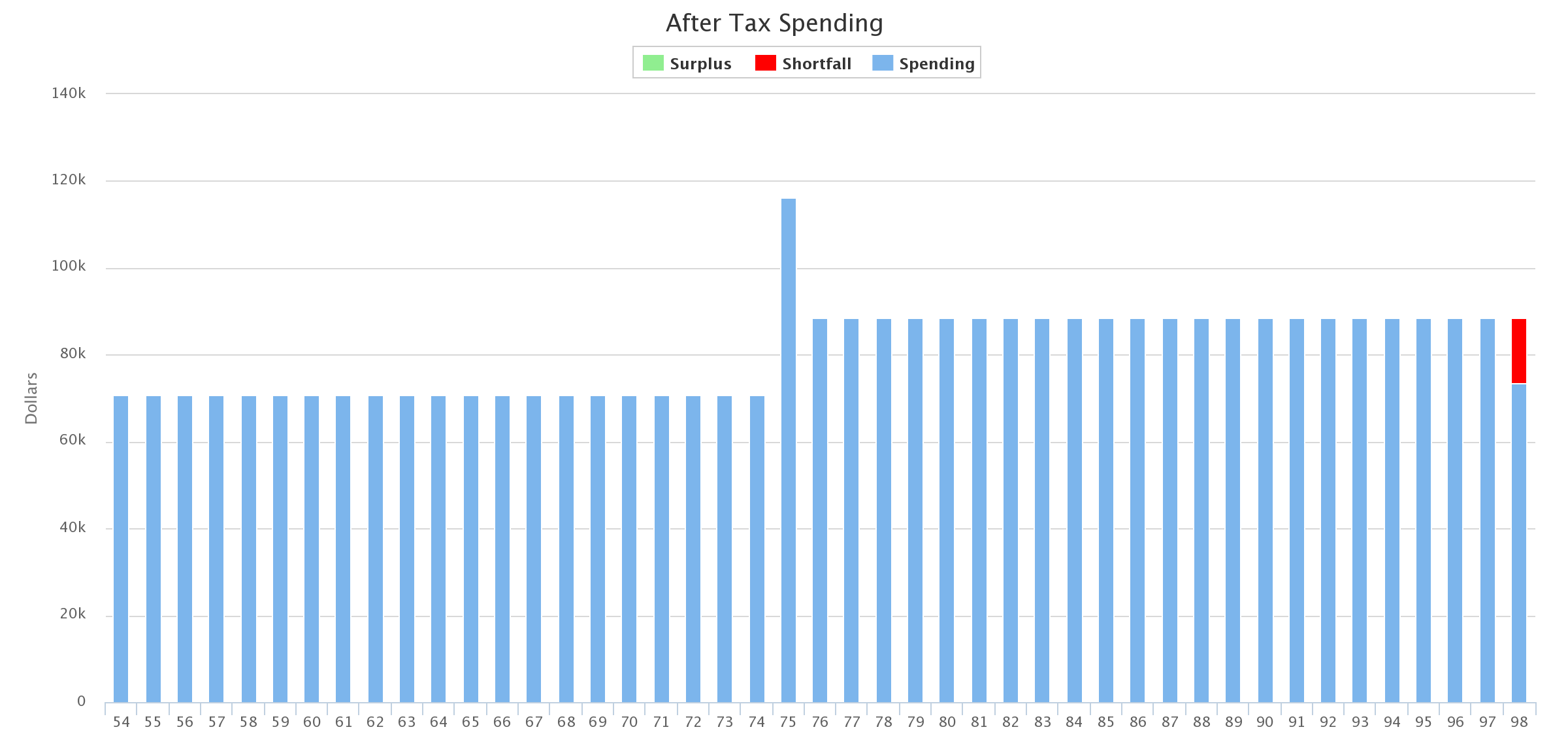

This example is based on a case study we did with a personal finance blog called MyOwnAdvisor. Mark has let us share a few case studies in the past and this one was similar. The couple had moderate goals for retirement, inline with the average couple in Canada, but faced some challenges because they wanted to retire early in their mid-50’s.

They had a plan to sell their home around age 75 and move into a rental. Less work and maintenance was the main goal but this also helped them free up a significant amount of capital and avoid running out of money later in retirement.

With a long retirement period they faced some risk if their investment portfolio performed poorly but with average returns and the planned sale of their home in the future their plan is solid.

As long as they have some spending flexibility if investment returns are below average, they will have a very successful and stress free retirement.

Spending

Moderate Income Example

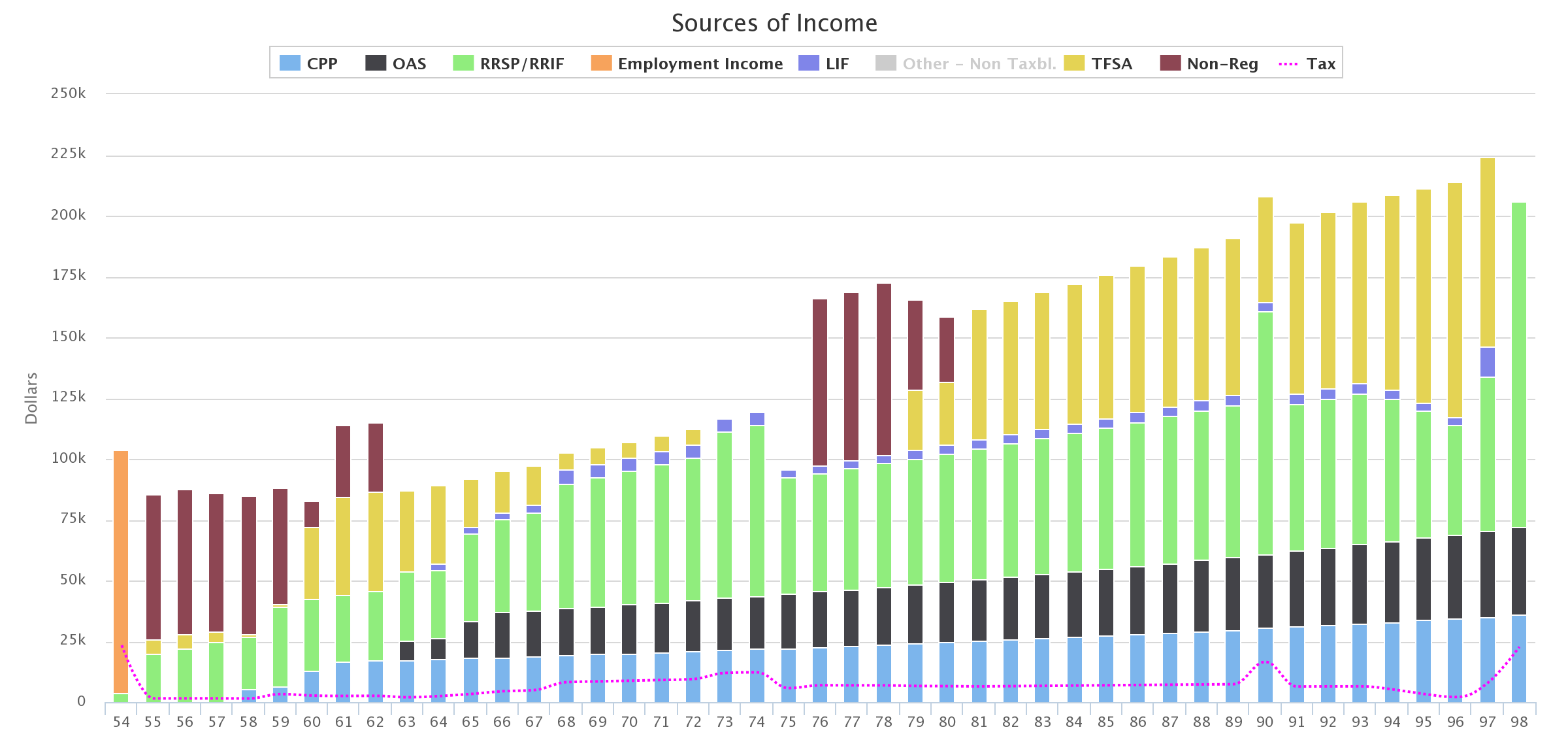

Income

Moderate Income Example

Income (With Home Sale Hidden)

Moderate Income Example

Net Worth

Moderate Income Example

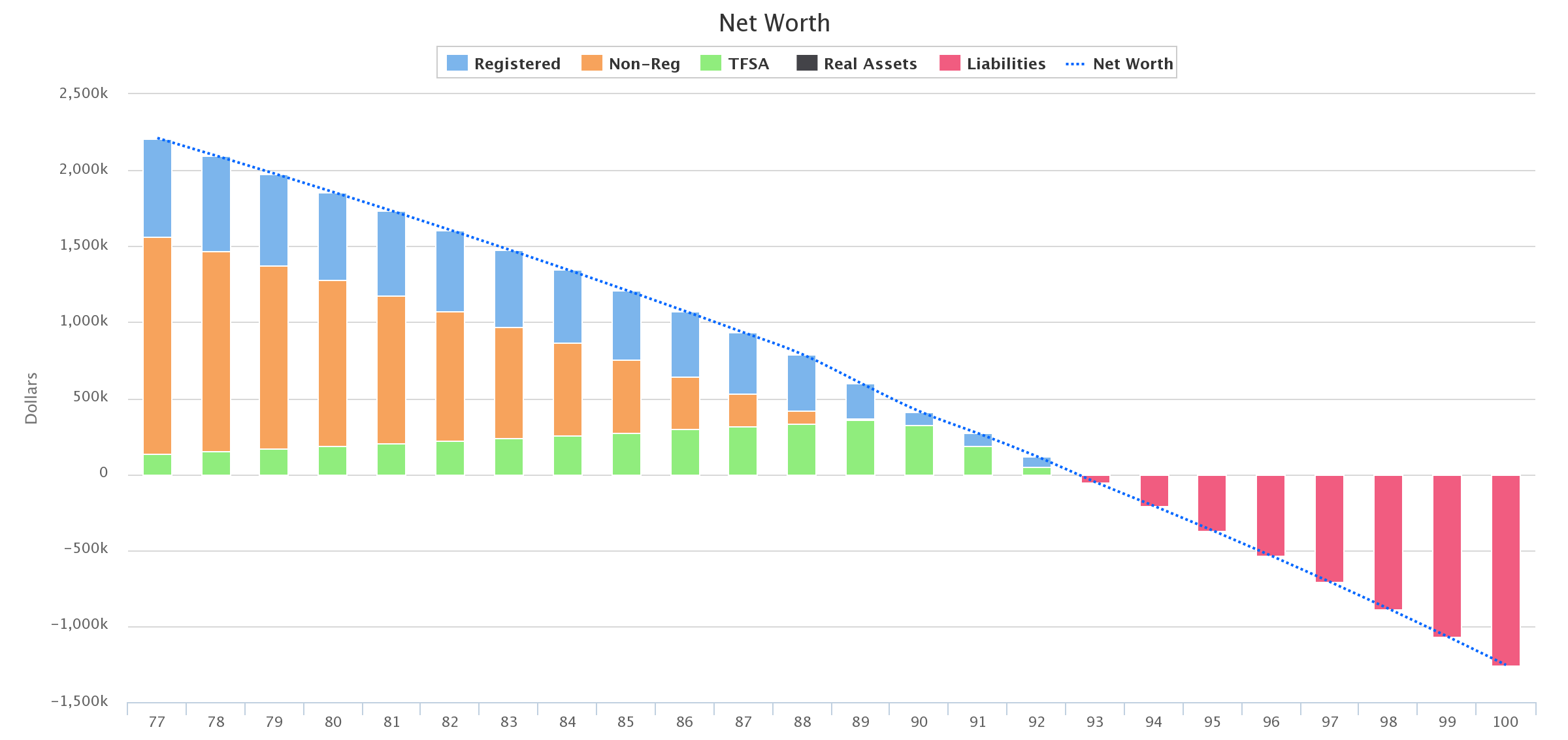

Example: Low Income Retirement Planning

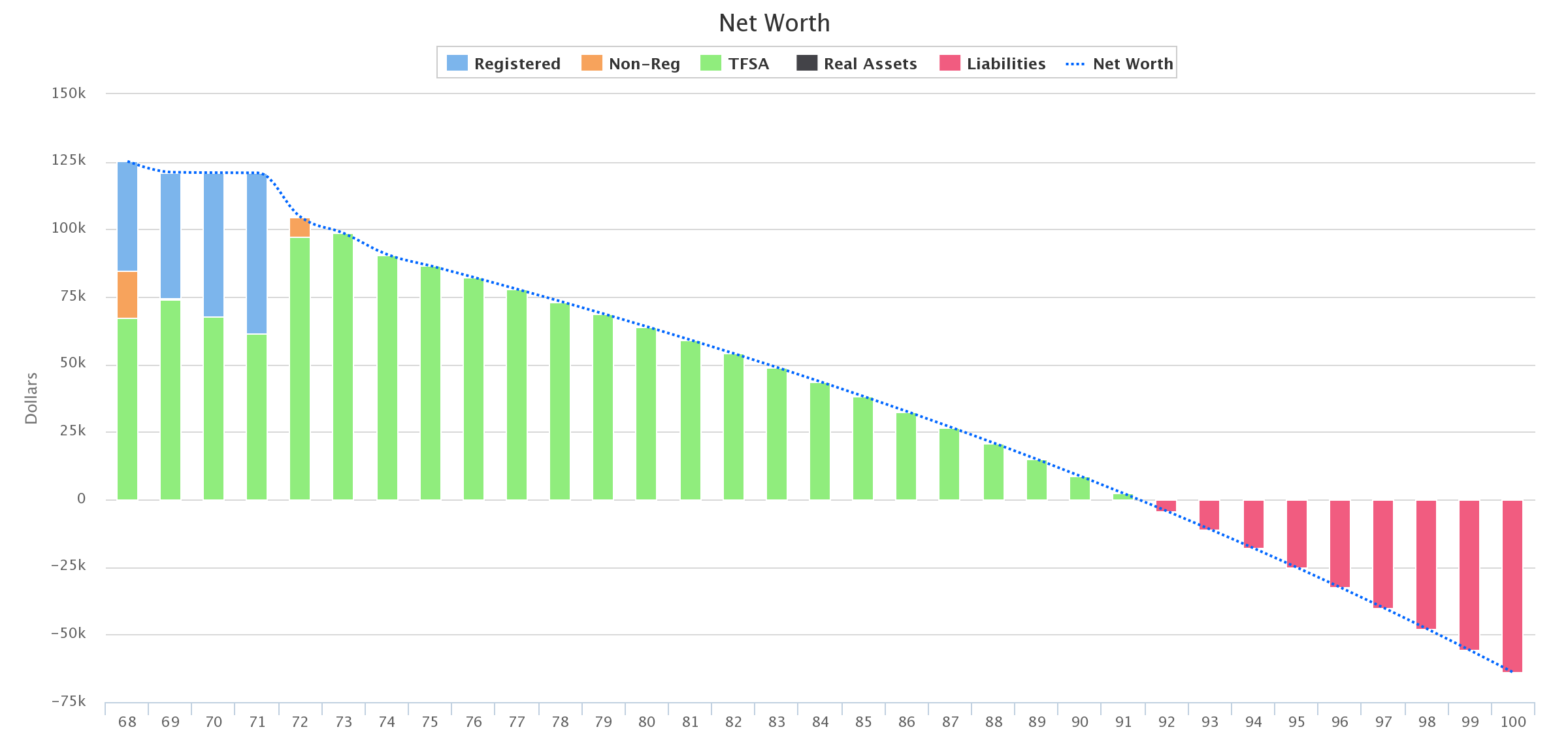

At PlanEasy we do free low-income planning for individuals and couples who are eligible for government benefits like GIS. Recently we did a low-income plan for a retiree who was receiving GIS at age 68 and had just over $100,000 in financial assets that needed to last another 30+ years.

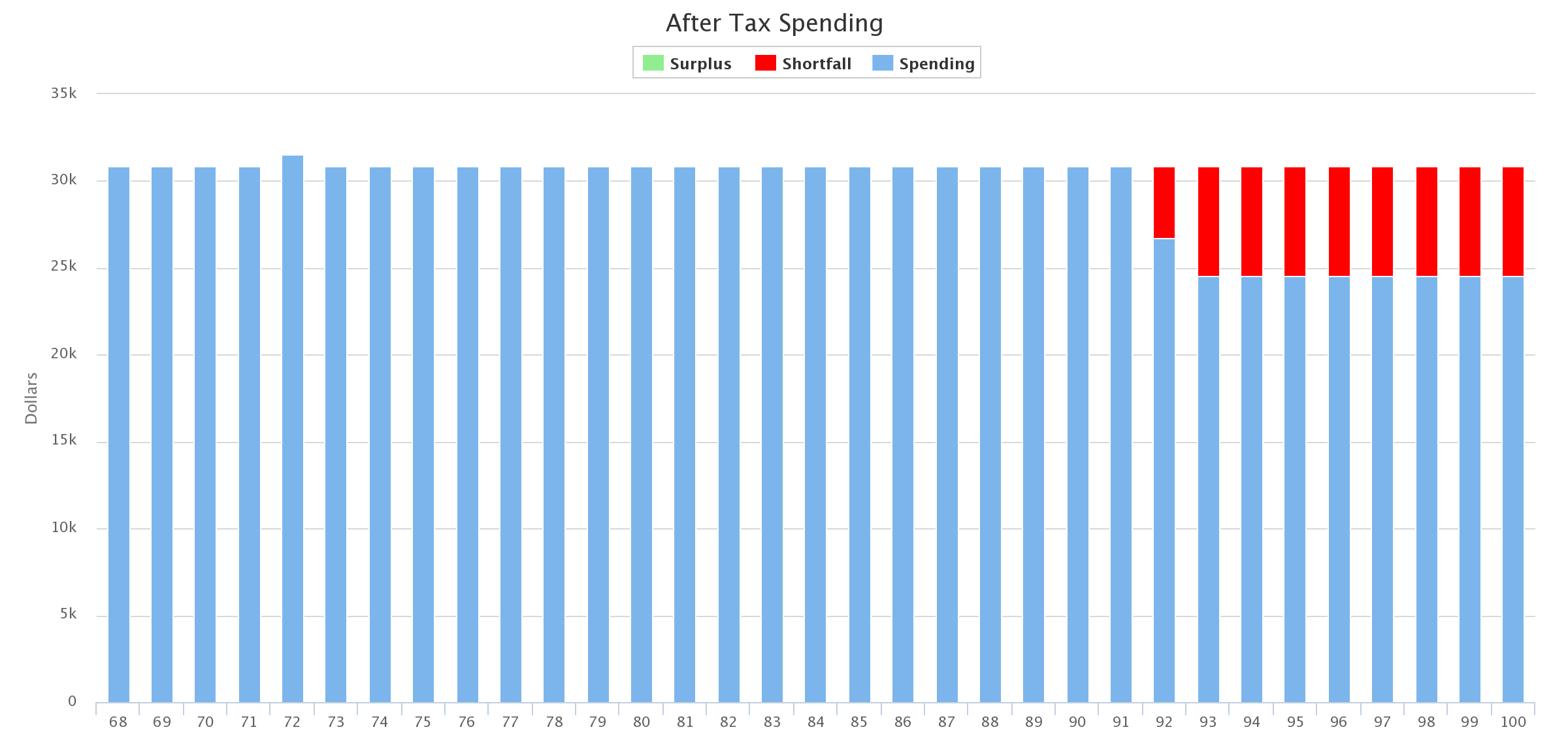

Their spending goal was a little over $30,000 per year. This would cover rent, food, clothing, and public transportation etc. The challenge was how to draw down assets in a way that wouldn’t trigger unnecessary clawbacks on GIS.

GIS is one of the most generous government benefits in Canada. But the Guaranteed Income Supplement (GIS) also has one of the highest “claw back” rates at 50% to 75%. This makes low-income planning very unique and very challenging. For every $100 that this retiree earned, received from CPP, or withdrew from their RRSP, they would see their GIS reduced by $50 to $75 the following year.

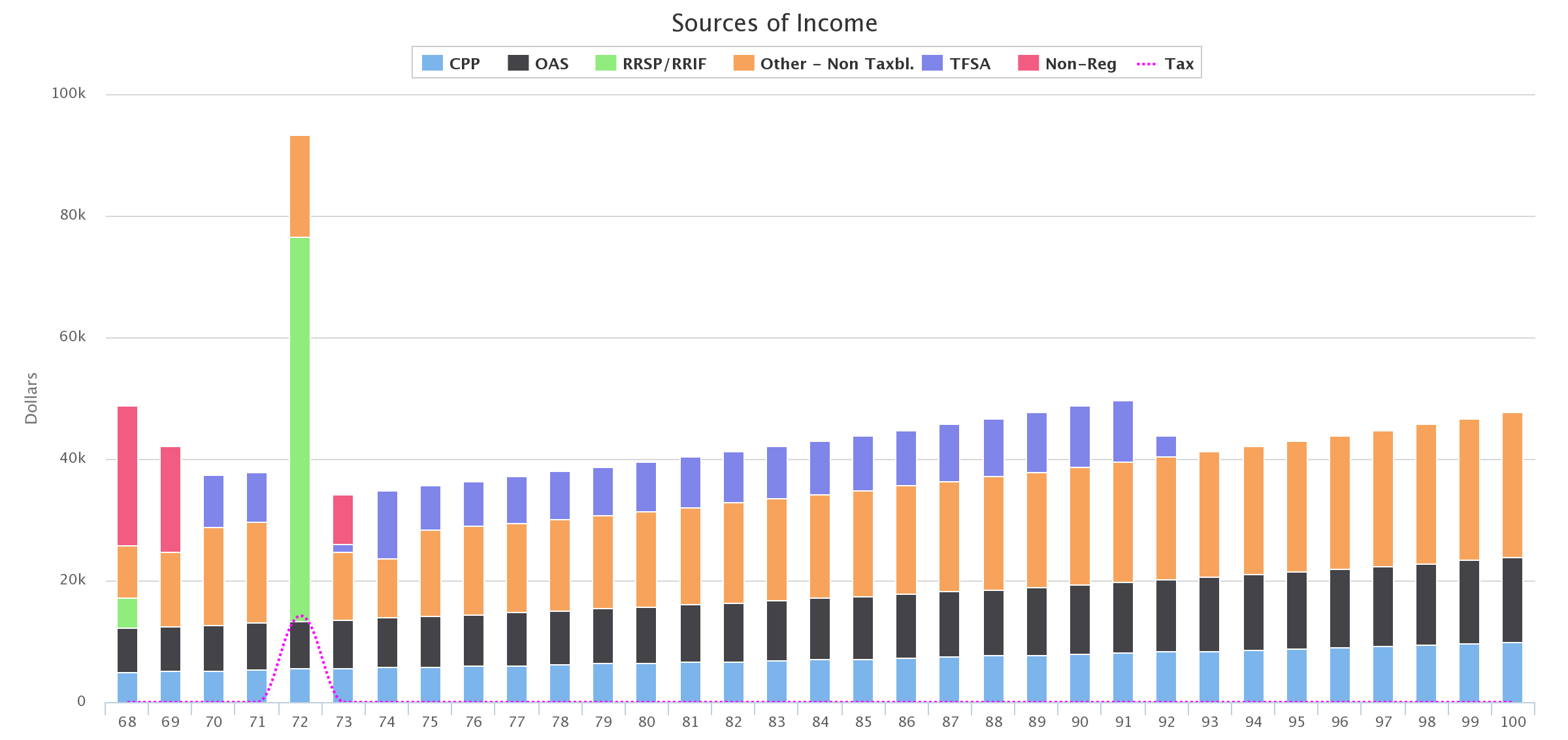

To avoid these clawbacks we strategically planned RRSP contributions (yes… contributions) between age 68 and 71. This maximized GIS for 4-years by offsetting CPP income. Then we planned one large RRSP withdrawal at age 72 when mandatory RRIF withdrawals begin. This allowed us to maximize GIS over the course of 8-10 years. The net result is an additional $10,000+ in government benefits.

There is still a small shortfall late in retirement. This could be mitigated by earning some part-time income earlier in retirement. GIS allows retirees to now earn up to $5,000 per year in employment income without triggering clawbacks on their GIS benefit. This could be advantageous if it’s possible to earn $400/month but it may also impact other benefits like the Trillium benefit in Ontario and the SAFER benefit in BC so this would need to be considered.

Spending

Low Income Example

Income

Low Income Example

Net Worth

Low Income Example

How Much Money Do You Need To Retire?

So how much money do you need to retire? As we can see from the examples above it entirely depends on how much you want to spend in retirement.

A low income retiree can make due with as little as $100,000 to $150,000 if they can keep expenses low.

A moderate income retiree couple can have a very stress free retirement with around $1,000,000 to $1,200,000 (even less if they chose to retire in their 60’s instead of in their 50’s)

A high income retiree couple could have a tough time making it work even with $2,000,000+ in financial assets. It just depends on how much they want to spend.

How much you need to retire will depend on a number of factors that are all unique to you and your goals. No example or case study will match your situation perfectly. They can be a good guide… but the best way to figure out how much you need to retire is to create a custom financial plan.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

What a fabulous post-Owen.!!!

Thank you Aleem, glad you liked it!