How Canadian Dividends Can Both Help And Hurt In Retirement

In the last post we highlighted how Canadian dividends receive special tax treatment which can lead to very low and even negative tax rates at some income levels. But before you go and shift your portfolio towards Canadian dividends it’s important to understand how Canadian dividends can either help or hurt your situation, especially in retirement.

Canadian dividends are taxed in a particular way which can lead to some unintended consequences, especially when government benefits are involved. While Canadian dividends can lead to lower tax rates, they can also lead to higher benefit clawbacks on GIS and OAS benefits.

If you can avoid these pitfalls then Canadian dividends, when used strategically, can allow you to withdraw from an RRSP and pay no additional tax.

In this blog post we’re going to look at three examples of how Canadian eligible dividends can both help and hurt in retirement.

Investment Planning First, Tax Planning Second

Before we get into the examples it’s important to highlight that tax planning should always come after investment planning.

It’s important to start with a clear investment plan, ideally using a low-cost and highly diversified investment option, before getting into more specific tax planning.

Tax planning should never drive investment decisions.

Start by creating a goal for investment fees, asset allocation, geographic diversification, sector diversification, company diversification, rebalancing schedule AND THEN choose how to divide those assets between accounts to minimize income tax.

Sometimes this will mean holding Canadian equities in a non-registered account to benefit from the low tax rate, but as well see below, sometimes this will mean the opposite, it all depends on your situation.

Example 1: Low-Income Retirement With GIS Benefits

In our first example we have an individual with below average CPP benefits, full OAS benefits, a maximized TFSA with about $120,000 and a non-registered account with $30,000. They have modest retirement income and receive the Guaranteed Income Supplement (GIS), which about 1 in 3 retirees in Canada receive.

They’ve decided to invest their $30,000 non-registered account in Canadian equities providing an average dividend of 5% annually. This is $1,500 per year in dividend income, an important part of their overall plan for retirement spending, but as we’ll see below this decision has an unintended effect. Let’s see how these dividends impact their tax and benefits…

Cash Dividend: $1,500

Grossed Up Amount: $2,070 ($100 x 138%)

Tax Rate: 20.05% (Combined Federal and Ontario)

Tax Before Credit: $415.04 ($2,070 x 20.05%)

Dividend Tax Credit Rate: 25.0198% (Combined Federal and Ontario)

Dividend Tax Credit: $517.91 ($2,070 x 25.0198%)

Tax After Credit: $0 -$102.87 ($415.04 – $517.91)

Watch The Video!

Because this person already has very low taxable income the benefit of the dividend tax credit is reduced. The dividend tax credit is a “non-refundable tax credit” which means it cannot reduce tax below zero. When income is low the basic personal credit and the age amount credit are typically more than enough to reduce income tax to zero. For most people receiving GIS benefits, the dividend tax credit will not provide a large advantage.

In lower income situations when GIS is involved, its actually not income tax we’re worried about, instead it is the clawback on government benefits…

Cash Dividend: $1,500

Grossed Up Amount: $2,070 ($100 x 138%)

GIS Clawback Rate: 50.0%

GIS Reduction: $1,035 ($2,070 x 50.0%)

Effective Tax Rate: 69.0% (($0 + $1,035) / $1,500)

The gross up on Canadian eligible dividends means that the income used to calculate GIS benefits is artificially inflated. This has a very negative effect on GIS benefits. When we add together the income tax ($0) plus government benefit clawback ($1,035) we can quickly see that the effective tax rate on $1,500 in Canadian eligible dividends is 69%!

In situations where GIS benefits are involved there is less incentive to hold Canadian dividend paying equities in a non-registered account.

Example 2: Average Retirement Income With Strategic RRSP Withdrawals

In our second example we have an individual with a larger amount of financial assets plus a small pension. They have average CPP, full OAS, a modest pension that provides $13,000 per year, plus a maximized TFSA, a small RRSP due to their pension reducing contribution room, and about $200,000 to $250,000 in non-registered investments producing $10,000 per year in eligible Canadian dividends.

Let’s take a look at how this dividend income can actually help them draw from their RRSP and still pay very little tax…

Cash Dividend: $10,000

Grossed Up Amount: $13,800 ($100 x 138%)

Tax Rate: 20.05% (Combined Federal and Ontario)

Tax Before Credit: $2,766.90 ($13,800 x 20.05%)

Dividend Tax Credit Rate: 25.0198% (Combined Federal and Ontario)

Dividend Tax Credit: $3,452.73 ($13,800 x 25.0198%)

Tax After Credit: -$685.83 ($2,766.90 – $3,452.73)

Strategic RRSP Withdrawal: -$3,420.60 (-$685.83 / 20.05%)

Because the dividend tax credit helps reduce income tax it actually creates an opportunity to withdraw from the RRSP. In Ontario, in the first tax bracket, the tax on $10,000 in eligible Canadian dividends is -$685.83 which is exactly the tax payable on a $3,420.60 withdrawal from the RRSP.

In situations like this there is a larger incentive to hold Canadian dividend paying equities in a non-registered account.

Blog post continues below...

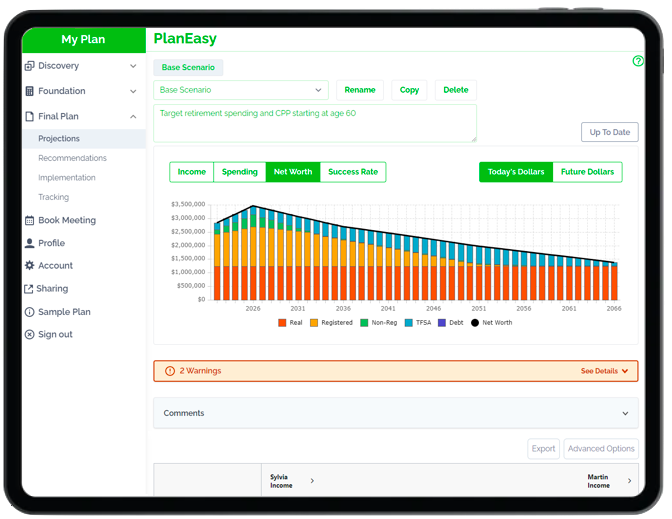

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

Example 3: High Retirement Income With OAS Clawbacks

In our third example we have an individual with a high amount of retirement income that crosses into OAS clawbacks. They have above average CPP, full OAS, a maximized TFSA, a very large RRSP, and about $200,000 to $250,000 in non-registered investments producing $10,000 per year in eligible Canadian dividends.

Let’s take a look at how dividend income can trigger additional OAS clawbacks and lead to a higher effective tax rate on Canadian eligible dividends than perhaps was expected…

Cash Dividend: $10,000

Grossed Up Amount: $13,800 ($100 x 138%)

Tax Rate: 31.48% (Combined Federal and Ontario)

Tax Before Credit: $4,344.24 ($13,800 x 31.48%)

Dividend Tax Credit Rate: 25.0198% (Combined Federal and Ontario)

Dividend Tax Credit: $3,452.73 ($13,800 x 25.0198%)

Tax After Credit: $891.51 ($4,344.24 – $3,452.73)

Despite being in the 31.48% tax bracket, their tax rate on eligible Canadian dividends is just 8.92%. This is seemingly lower than the tax rate on capital gains of 15.74%, which is half their marginal tax rate. But as we’ll see below, when we add the clawback on OAS benefits this is not actually the case…

Cash Dividend: $10,000

Grossed Up Amount: $13,800 ($100 x 138%)

OAS Clawback Rate: 15.0%

OAS Reduction: $2,070 ($13,800 x 15.0%)

Tax Reduction on OAS Reduction: $651.64 ($2,070 x 31.48%)

Net OAS Reduction: $1,418.36 ($2,070 – $651.64)

Effective Tax Rate: 23.10% (($891.51 + $1,418.36) / $10,000)

The gross up on Canadian eligible dividends means that the income used to calculate OAS clawbacks is artificially inflated. This has a negative effect on OAS benefits. When we add together the income tax ($891.51) plus the after-tax OAS clawback ($1,418.36) we can quickly see that the effective tax rate on $10,000 in Canadian eligible dividends is actually 23.10%, quite a bit higher than just the tax rate alone.

In situations where OAS clawbacks are being triggered in retirement, the benefit of Canadian dividend paying equities in a non-registered account is less than they may appear. It is still an attractive form of income, but when OAS clawbacks are included its now slightly more attractive to earn capital gains in a non-registered account instead of Canadian eligible dividends.

How Canadian Dividends Can Both Help And Hurt In Retirement

With good planning it can be very attractive to earn Canadian eligible dividends in a non-registered account. But as we saw above, in certain situations this can backfire, creating additional benefit clawbacks and increasing effective tax rates.

Depending on your situation it may be advantageous to hold Canadian equities in a non-registered account OR it may be better to hold them in a TFSA or RRSP.

Remember that tax planning should always come after investment planning. Create a solid investment plan first, and then decide where to hold assets to minimize income tax and minimize GIS and OAS clawbacks.

If you would like help creating a more detailed tax plan for your retirement, then we would be happy to help. Create an account on our platform and book a free Discovery Call to see if this type of planning can help decrease tax in retirement, increase your retirement success rate, and perhaps even help you retire earlier or with a higher amount of retirement income.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments