Does The Average Retirement Plan REALLY Need $1,700,000 To Retire?

In this blog post we’re going to look at an average retirement plan with $1,700,000 in financial assets. Why $1,700,000? Because that’s what a recent bank survey suggested that the average Canadian feels they need to retire.

Now, banks are in the business of selling financial products, so they may be somewhat biased when it comes to how much you should be saving for retirement. They’re probably happy for you save and invest more for retirement because it means more investment fees for them. But let’s give them the benefit of the doubt and let’s see if $1,700,000 is really the right retirement goal for the average Canadian household.

Having done many, many, advice-only retirement plans I suspect that this number is grossly overstated, and a much smaller amount is likely sufficient to have a comfortable retirement for the average household.

To test if this is true, we’re going to build an “average retirement plan” with $1,700,000 in financial assets.

Of course, no retirement plan is ever average. Some people have more CPP, some less. Some people have defined benefit pensions, others do not. Some people want to spend more in retirement while others are content with spending less. There is no such thing as an “average retirement plan” but we’re going to make some broad assumptions to test whether or not $1,700,000 is a reasonable goal for retirement assets or if it’s grossly overstated.

Spending Assumptions

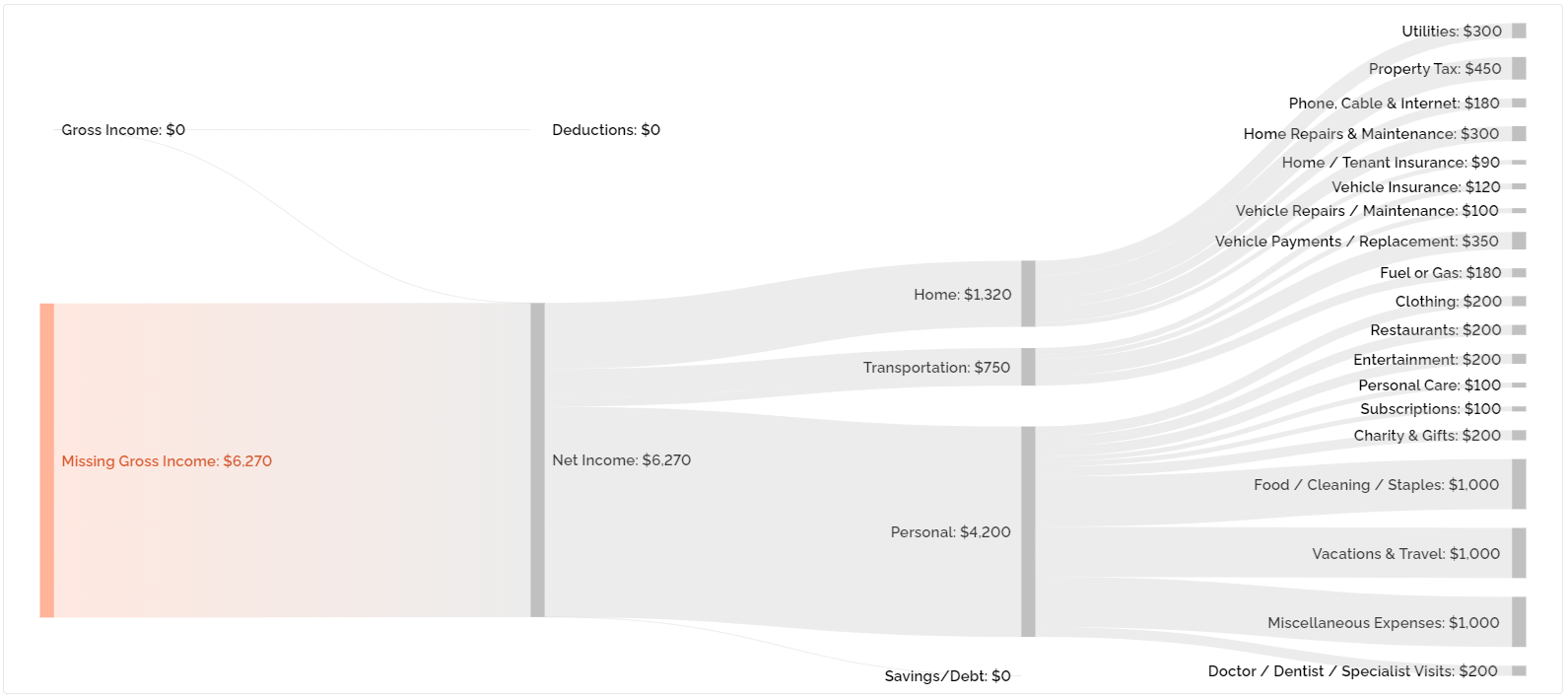

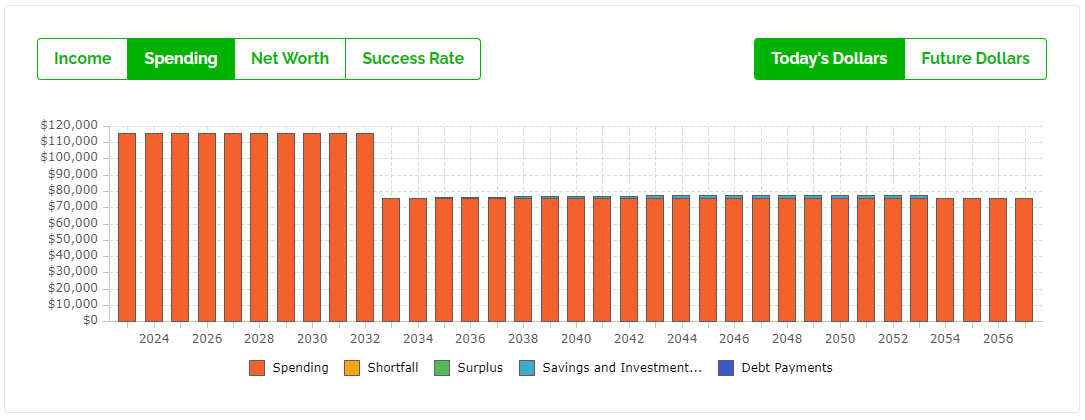

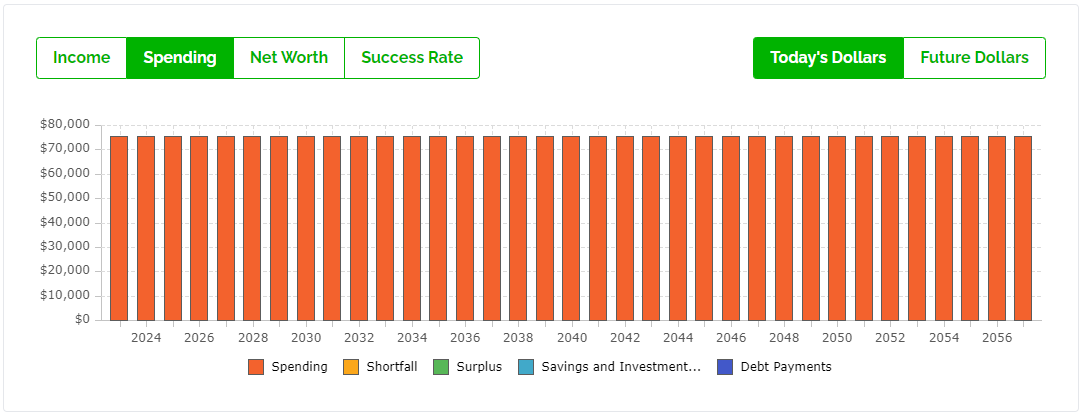

Retirement spending is one of the most important factors in a retirement plan. A recent Stats Canada survey suggested that the average after-tax retirement income is around $65,900 in 2020. We’re going to assume a bit of inflation since then and we’ll aim average retirement spending of around $75,000 per year in our hypothetical retirement plan.

This is what our retirement budget looks like. There is a large gap in income because we don’t have CPP, OAS, or investment withdrawals planned yet.

CPP and OAS Assumptions

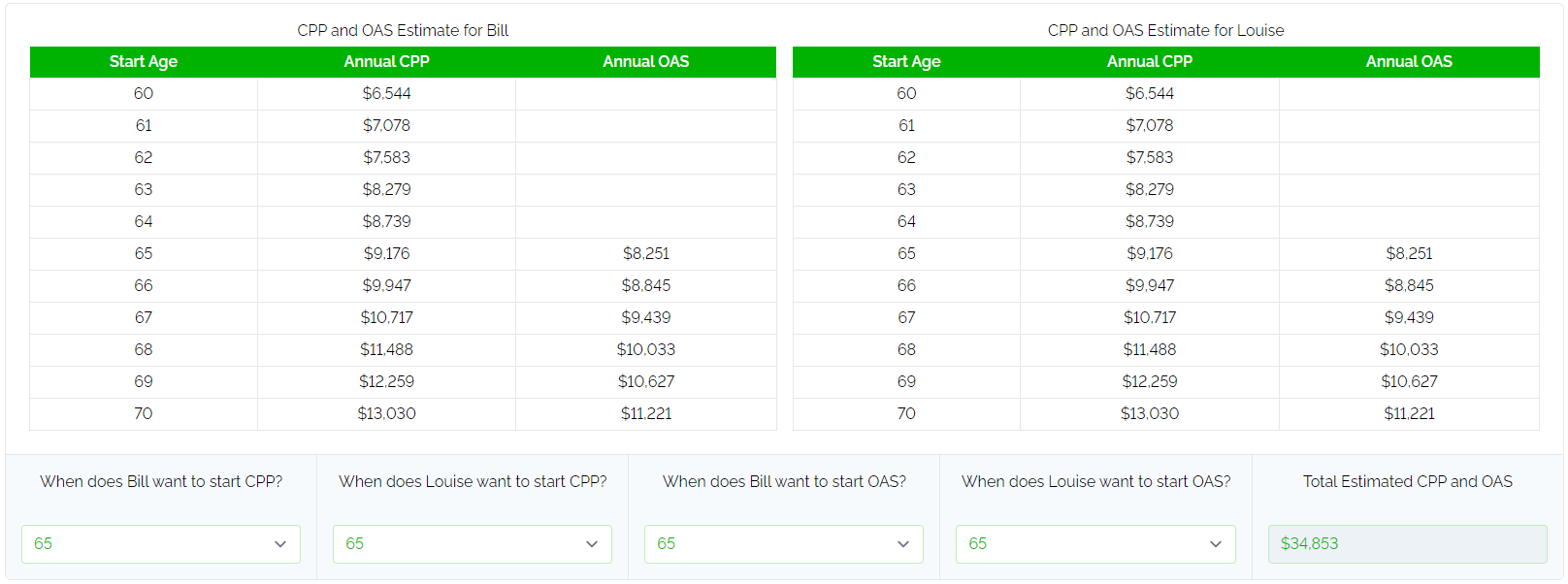

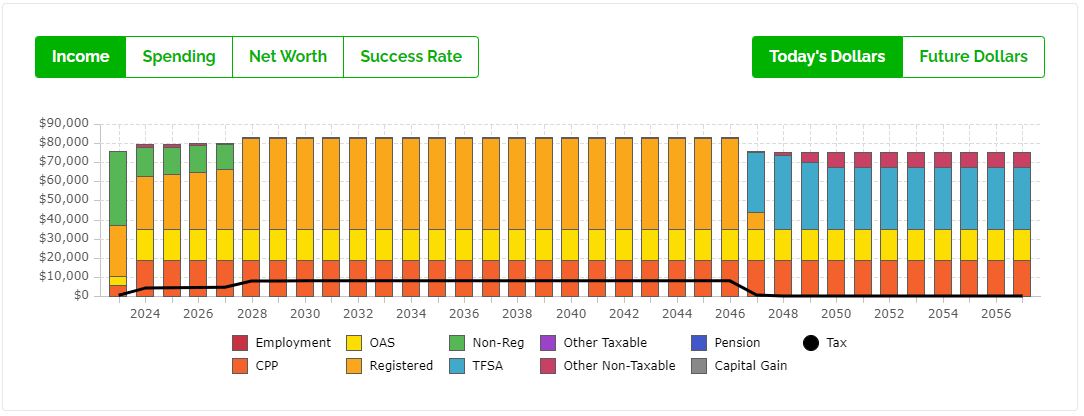

Canada pension plan (CPP) and Old Age Security (OAS) make up a large percentage of retirement income for the average household, so it’s important to have a good estimate of these benefits before retirement begins.

OAS is based on residency in Canada so for the purpose of this plan we’ll assume full OAS benefits, but this may be different if you immigrated to Canada.

CPP on the other hand is based on contributions. It takes 35-39 years of full contributions to receive the maximum CPP benefit, and most people do not receive the maximum. The average CPP benefit is between $8,000 and $9,000 per year so that’s what we’ll assume for this “average retirement plan”.

These assumptions are pretty big, and pretty important, your CPP and OAS could be dramatically different. If each person in this hypothetical couple had an extra $4,000 per year in CPP benefits that could decrease their required retirement savings by as much as $200,000.

By assuming the average CPP and OAS benefit we may be underestimating these government retirement benefits and therefore overestimating retirement assets needed.

Projections and Success Rate

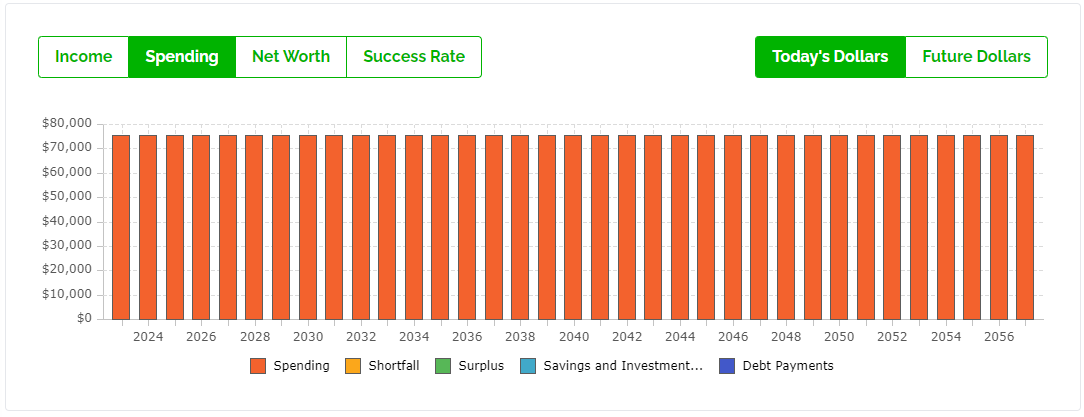

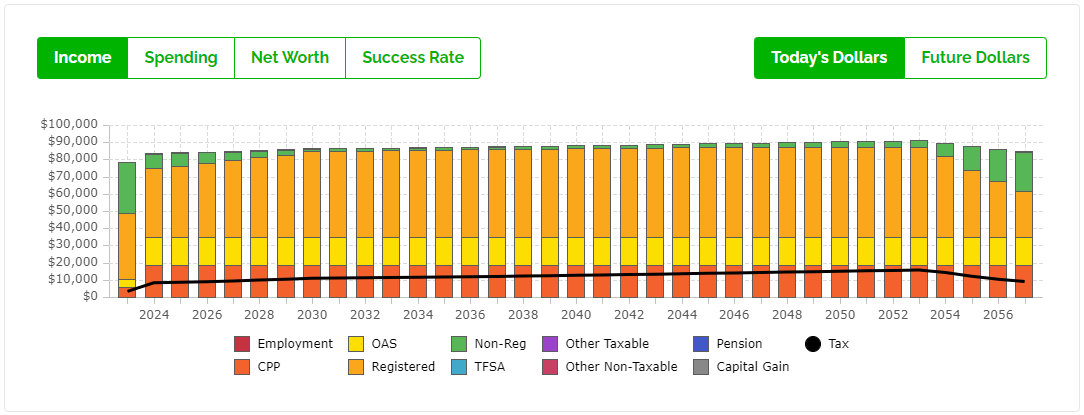

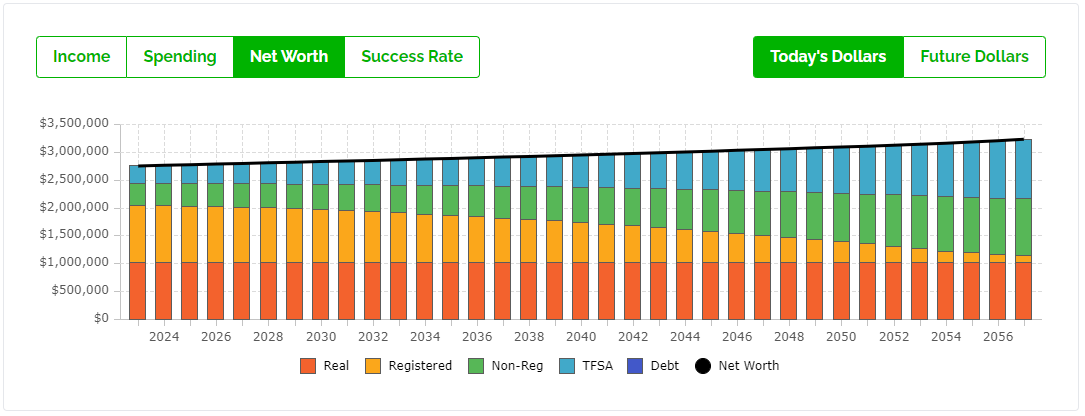

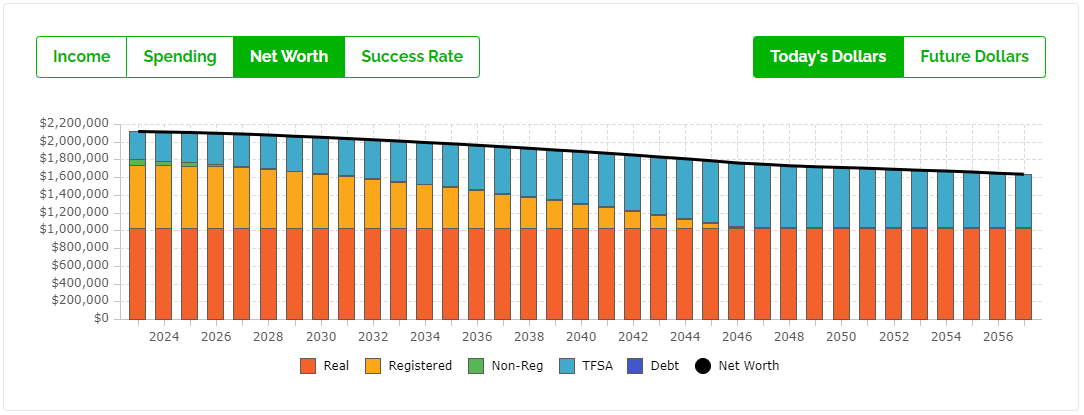

Based on the survey results we’re assume $1,700,000 in financial assets are the start of retirement. This is split between partners with a total of $1,000,000 in RRSPs. $300,000 in TFSAs, and about $400,000 in non-registered investments and savings.

Based on the projections, this is more than enough to support an average retirement spending goal of $75,000 per year after tax.

In fact, it looks like net worth actually GROWS in retirement! If you were to actually aim for $1,700,000 in retirement assets, with average CPP and OAS, and average spending of $75,000 per year you would be saving way too much for retirement.

Extra Spending With $1,700,000 In Retirement Assets

If you actually have $1,700,000 in financial assets at the start of retirement it likely means you can support much higher retirement spending.

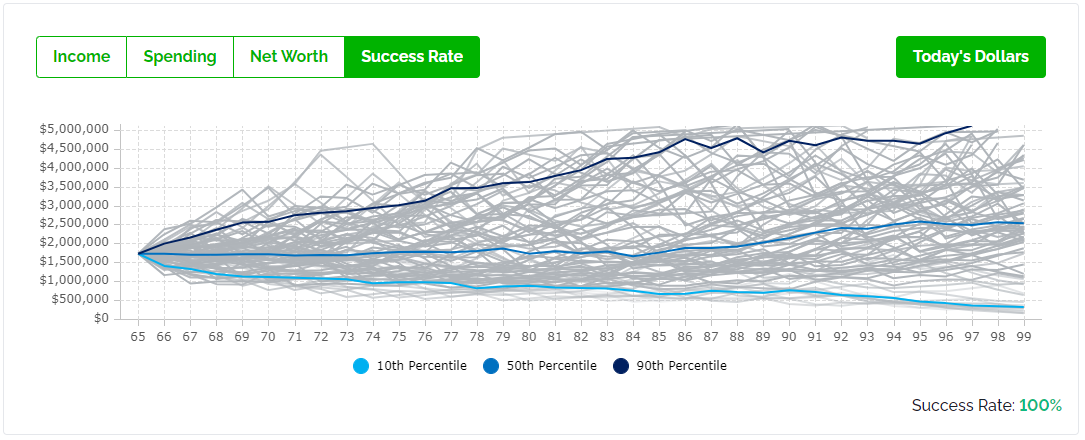

Just for fun, we’re going to add $40,000 per year in discretionary spending from age 65 to 75. This means that the first 10-years of retirement would be fairly lavish, with lots of discretionary spending for travel, gifts, etc. We’re then going to assume that spending drops back to $75,000 per year at age 75 until late retirement. But remember, even that spending assumption still had $12,000 per year for travel!

Even with this extra spending the retirement plan with $1,700,000 in financial assets looks quite good. There is some sequence of returns risk in early retirement due to the extra spending, but that’s not necessarily a large concern as long as that extra $40,000 per year remains entirely discretionary. There could be a need to decrease that amount if they faced some poor investment returns or high inflation rates in early retirement.

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

Average Retirement Plan With $1,100,000 In Retirement Assets

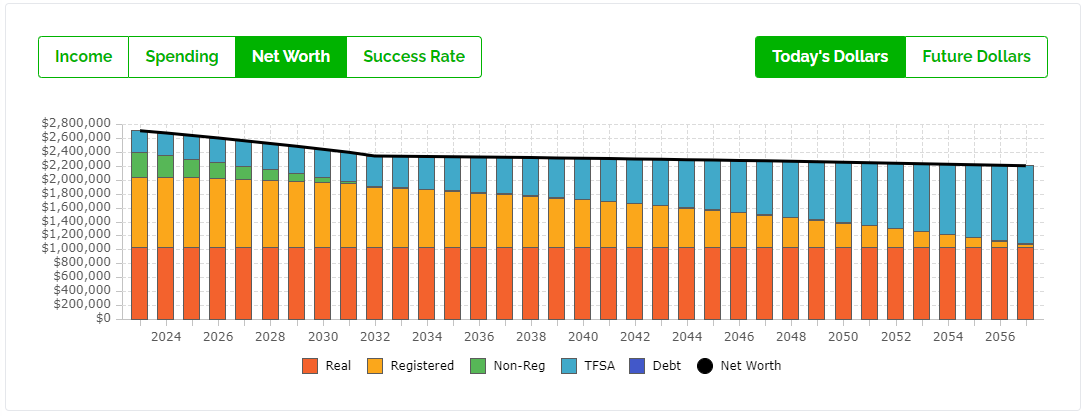

Now lets look at a slightly more realistic scenario. Let’s assume the same $75,000 in retirement spending as before, but lets decrease retirement assets to $1,100,000. We’ll assume a total of $700,000 in RRSPs. $300,000 in TFSAs, and about $100,000 in non-registered investments and savings. Still a good sized portfolio, but much less than the original $1,700,000.

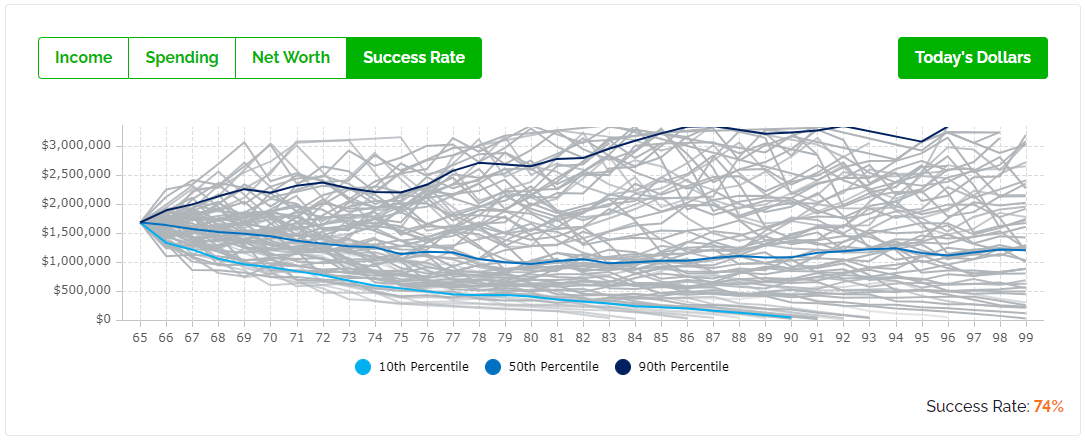

As we can see below, this retirement plan is much more realistic. The success rate is not the best, but this can be improved by delaying CPP to age 70, increasing future government retirement benefits, decreasing investment risk, and decreasing longevity risk.

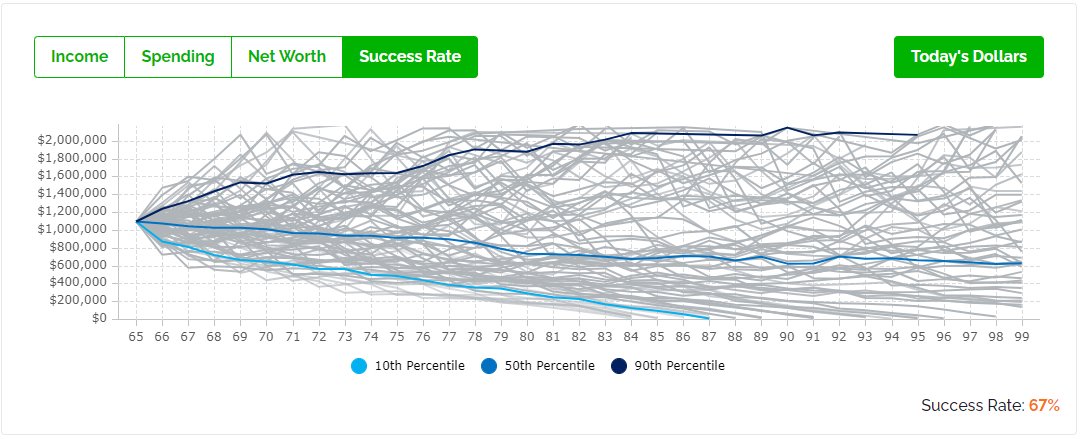

This is what the plan looks like with $75,000 per year in retirement spending, $1,100,000 in retirement assets, and CPP and OAS at 65.

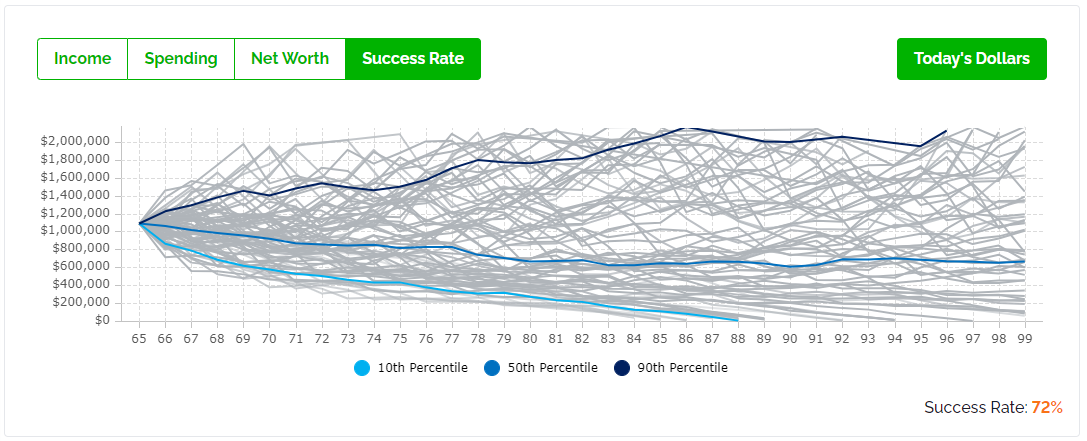

If we change CPP start age to be age 70 rather than 65 then the success rate increases above 70%. There is still some sequence of returns risk in early retirement so this couple may need to cut back on discretionary spending in extreme cases but with $1,100,000 in financial assets it’s a pretty strong retirement plan.

Does The Average Retirement Plan REALLY Need $1,700,000 To Retire?

So, does the average retirement plan REALLY need $1,700,000 to retire? No, definitely not. Every retirement plan is different but $1,700,000 is grossly overstated for the average Canadian household.

Every plan is different however, so if you want to know what YOUR retirement goal should be then don’t hesitate to reach out to us, we help clients build detailed retirement plans that help plan how to save for retirement and then how to decumulate those assets in retirement.

As we saw above, the facts will have a big impact on your retirement plan, so it’s important to have a plan that is specifically built using your facts and assumptions.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments