Did Our Investment Plan Cost Us Thousands?

Like any good investor we have an investment plan, and one part of that investment plan involves rebalancing. We have a very specific rebalancing schedule and rebalancing rules. These rules help us know when we should and should not rebalance. But did these rules just cost us thousands?

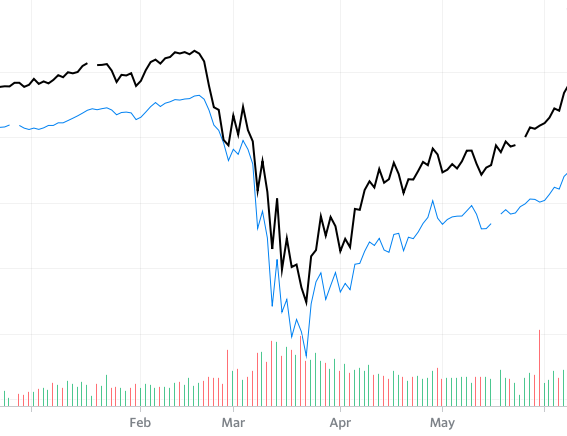

In early 2020 the quick drop in investment values and equally quick recovery was an investment rollercoaster and it left more than a few people feeling slightly nauseous. It was incredible how quickly investment values declined, and it was equally incredible how quickly they recovered.

In hindsight, had we rebalanced during that dip, we could have been thousands of dollars richer today, perhaps even 10’s of thousands.

Why didn’t we rebalance during the drop? It wasn’t in our plan.

Our Rebalancing Plan

Our rebalancing plan has two main components. The first is the frequency & timing of when we rebalance. We do a “financial check-in” three times per year in mid-January, mid-May, and mid-September. We’ve had the same schedule for 10+ years. These times work for us because they’re “quieter” times of the year.

It’s during these financial check-ins that we decide if we need to rebalance our investment portfolio between equities and fixed income. If it’s not mid-January, mid-May, or mid-September then we do not look at our portfolio and we definitely do not rebalance.

The second component of our rebalancing plan is a threshold for how far off target we need to be before we sell to rebalance. We have a 5% threshold for selling to rebalance. If our stock/bond allocation is within 5% of our target, then we do nothing. If it is more than 5% off our target then we will either sell equities and buy bonds to get back on target, or the opposite, sell bonds and buy equities to get back on target.

The combination of the frequency rule and threshold rule makes it extremely clear when we should be rebalancing and when we should just keep our hands off.

Keep Those Hands Off

One of the best things a self-directed DIY investor can do for their portfolio is to just keep their hands off and let it do its thing.

There have been many studies done on individual investors and investor behavior. On average the individual investor performs worse than the index simply because they cannot keep their hands off. The average individual investor underperforms the index by 0.33% to 2.61%. They do this by trying to time the market. They TRY to buy low and sell high, but on average they end up buying high and selling low.

One of the biggest investment risks is our own behavior. That’s why we all need an investment plan. That’s why we need specific rebalancing rules. And that’s why these rules should be set up in advance. It’s all to prevent us from messing around with our portfolio.

Did Our Investment Plan Cost Us Thousands?

So, did our investment plan cost us thousands? Yes, I’m hindsight it probably did. Had we rebalanced during the dip of early 2020 we could have made thousands (or even 10’s of thousands) during the recovery.

Instead we followed our investment plan and looked at our investments in January and again in May. Between those two times we just didn’t look, and we did nothing.

What ended up happening is that by the time we checked our investments in May 2020 the markets had recovered far enough that our 5% rebalancing rule was not triggered. We were a bit above our target equity allocation in January, and we were a bit below our target equity allocation in May, but in both cases, it was not by 5%. As a result, we did nothing.

Could we have made some extra money had we timed the market and rebalanced in mid-March? Maybe. Maybe this time. But there have been many other times over our investment history where our rebalancing rules have prevented us from making a very poor investment decision or have forced us to rebalance when our emotions (and the news media) said differently.

If you don’t have clear rebalancing rules for your investment portfolio, now is a great time to write them down. It doesn’t have to be complex, simply jot down how often you’ll rebalance and how far off your target asset allocation you need to be before you sell to rebalance.

Putting together a simple investment plan will help avoid poor and emotional investment decisions in the future and can even improve your long-term returns.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments