A Debt Payoff Plan:

$46,000+ Of Student Debt In 2.5 Years

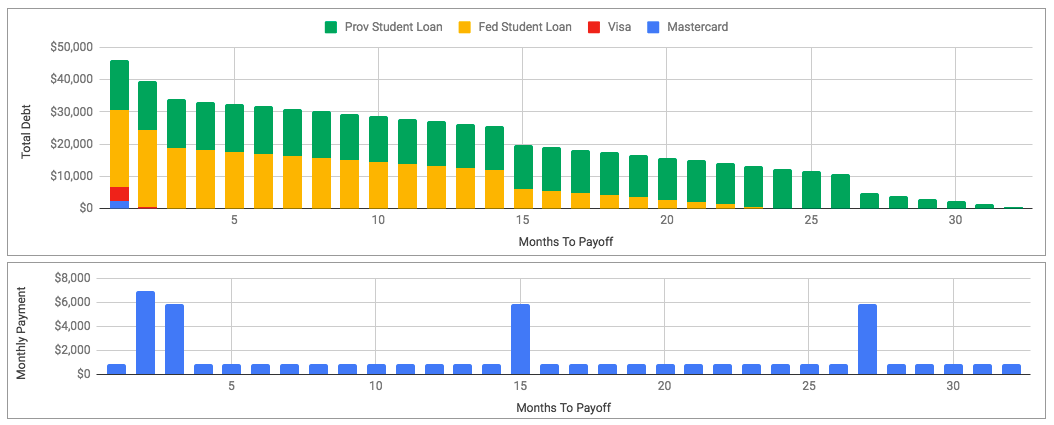

I love a good debt payoff story. There is something satisfying about seeing someone pay off a mountain of debt in a short period of time. This story comes from a reader who has a total of $46,174 in student and credit card debt. They used our debt payoff calculator to create a debt payoff plan that kills this mountain of debt in just over 2.5 years! Amazing!

When it comes to paying off debit it can sometimes feel like an endless struggle. It seems like interest is constantly work against you (which it is!). Payments are being made every month but the balance never goes down as fast as you hope.

This blog post isn’t quite a debt payoff story, not yet anyway. This post is about a debt payoff plan. Every debt payoff story starts with a good debt payoff plan. This plan aims to pay off almost $50,000 of debt in just over 2.5 years.

Let’s see how they’ll do it!

(The numbers/details have been changed slightly to make it anonymous)

The Situation:

There is $46,174 of debt spread across two student loans and two high interest credit cards. Progress was being made against this debt but what really caused a big change was a recent promotion/job change earlier this year. This has put them in a better position to eliminate their debt fast.

Here is a summary of the debt:

- Provincial Student Debt: $15,442 at 4.95%

- Federal Student Debt: $23,921 at 6.95%

- Visa (maxed): $4,500 at 22%

- Mastercard: $2,311 at 29%

The Plan:

The plan is to pay off all $46,000+ in debt over just 32 months using a combination of extra monthly payments and a few lump-sum payments. Without the extra payments, making just the $648 minimum payment each month, their debt payoff story would last almost 9 years and rack up $21,858 in interest payments. By making extra payments they’ll shorten their debt payoff time to just over 2.5 years and cut their interest payments to just $3,098! Wow!

The plan has three parts. The first part involves some side income of $200-$300 per month. This income is being put directly towards the debt and increases the overall payment by an average of $250 per month. A bit of side income can make a huge difference when paying off debt. These extra payments will go towards the high interest debt first because they chose to follow the debt avalanche strategy and not the debt snowball strategy.

On top of extra monthly payments, they’re also anticipating a $5,000 annual bonus to be paid every February. While not 100% guaranteed, there is a good history of bonus payments at their new company and they feel $5,000 is a reasonable assumption to make. This annual bonus will also go directly towards their debt.

The last part of the plan is the sale of their vehicle. This is part of the plan that I really like. Selling unused “stuff” is one of the best ways to free up extra cash to throw at your debt. Because of the new job, they no longer need their vehicle so they’ve opted to get rid of it completely and pay down their debt instead. The vehicle is worth approximately $6,000 and will go directly towards their debt once sold.

$46,000 of Student Debt Gone!

In total, they are making $49,272 in payments towards their debt. There is $15,000 coming from three annual bonuses. Another $6,000 coming from the sale of their car (I love the car free lifestyle!) Plus, another $7,750 in extra monthly payments coming from their side income. Finally, there are $20,522 in regular monthly payments being made as well.

It’s an aggressive plan but one that seems very achievable. What’s more is that they’re creating some amazing saving habits that will help them save for the future as well. They’re saving a total of $1,315 per month (not counting the car sale but including the annual bonuses). This is more than enough for a comfortable retirement plus some money for a down payment in the future.

Create your own debt payoff plan and share your story with us by sending an email to support (at) planeasy. We love seeing your debt payoff plans!

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments