Are you saving enough for retirement?

“How much money do I need to retire?”

It’s time for a definitive answer. Don’t agonize over calculators. Don’t worry if you’ve missed something. Don’t be misled by guidelines. Get peace of mind. Get an expert financial planner and let us do the math.

It’s time for a custom financial plan, one that’s tailored to your exact situation and goals, and built by an unbiased fee-for-service financial planner.

Start a custom financial plan today for only $1,000+HST (Plus! Get a 10% discount if you book before January 31st).

Are you saving enough for retirement?

“How much money do I need to retire?”

It’s time for a definitive answer. Don’t agonize over calculators. Don’t worry if you’ve missed something. Don’t be misled by guidelines. Get peace of mind. Get an expert financial planner and let us do the math.

It’s time for a custom financial plan, one that’s tailored to your exact situation and goals, and built by an unbiased fee-for-service financial planner.

Start a custom financial plan today for only $1,000+HST (Plus! Get a 10% discount if you book before January 31st).

Get certainty.

Spending estimates.

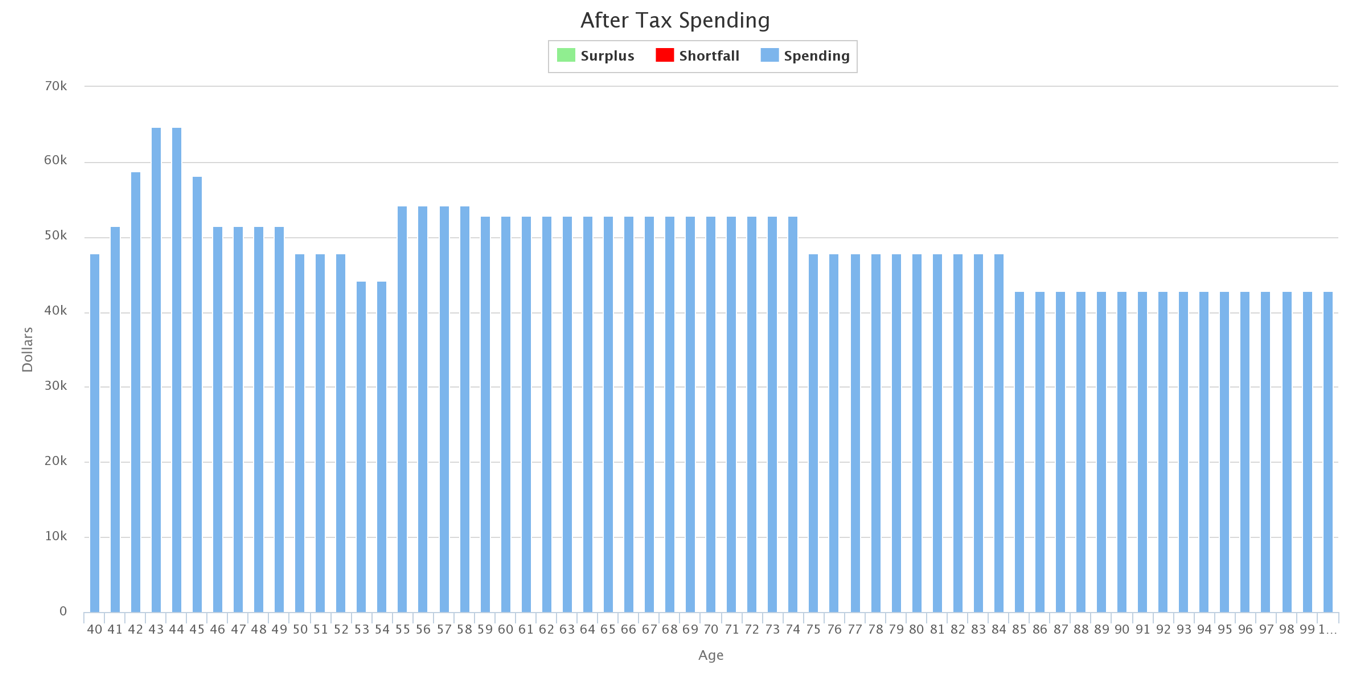

Do you know exactly what your cost of living will be when you retire? Will you be able to cover those unexpected expenses? Have you included infrequent expenses, the ones that only happen every few years? What lifestyle do you want in retirement?

We help you anticipate changes in your spending and double check to make sure you haven’t missed anything.

Get certainty.

Spending estimates.

Do you know exactly what your cost of living will be when you retire? Will you be able to cover those unexpected expenses? Have you included infrequent expenses, the ones that only happen every few years? What lifestyle do you want in retirement?

We help you anticipate changes in your spending and double check to make sure you haven’t missed anything.

Get detail.

Income planning.

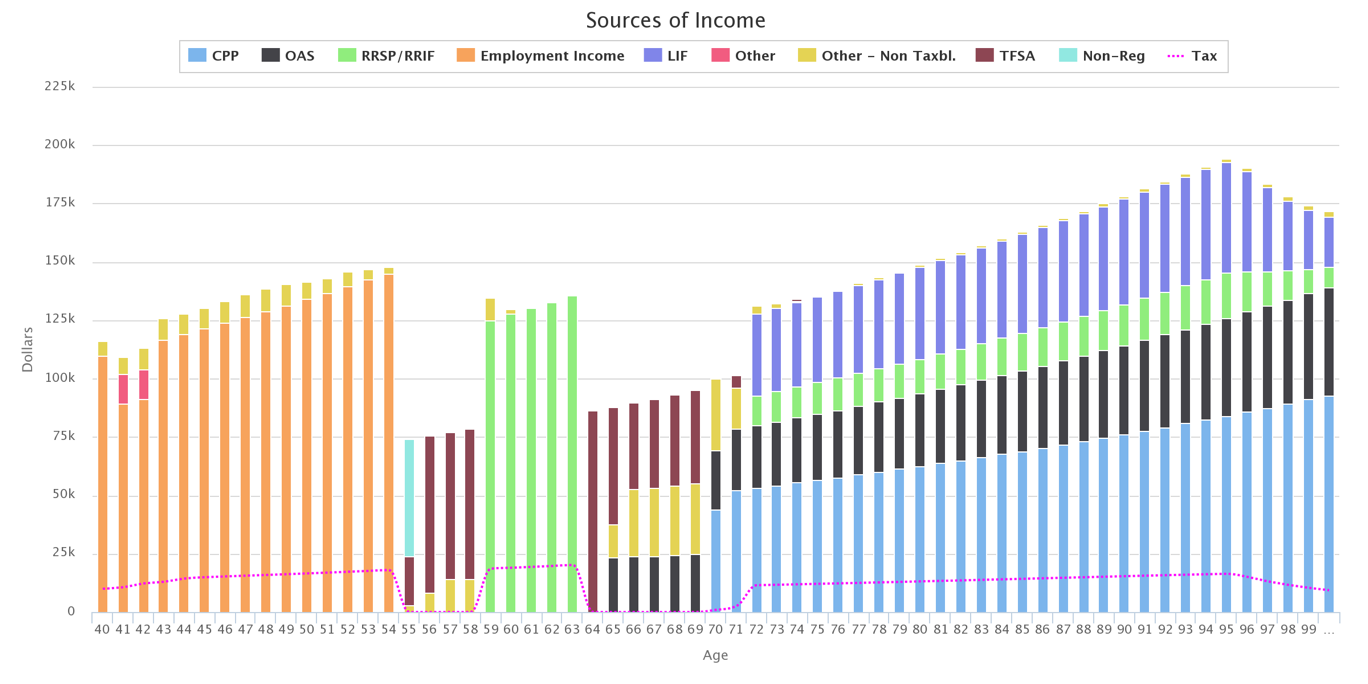

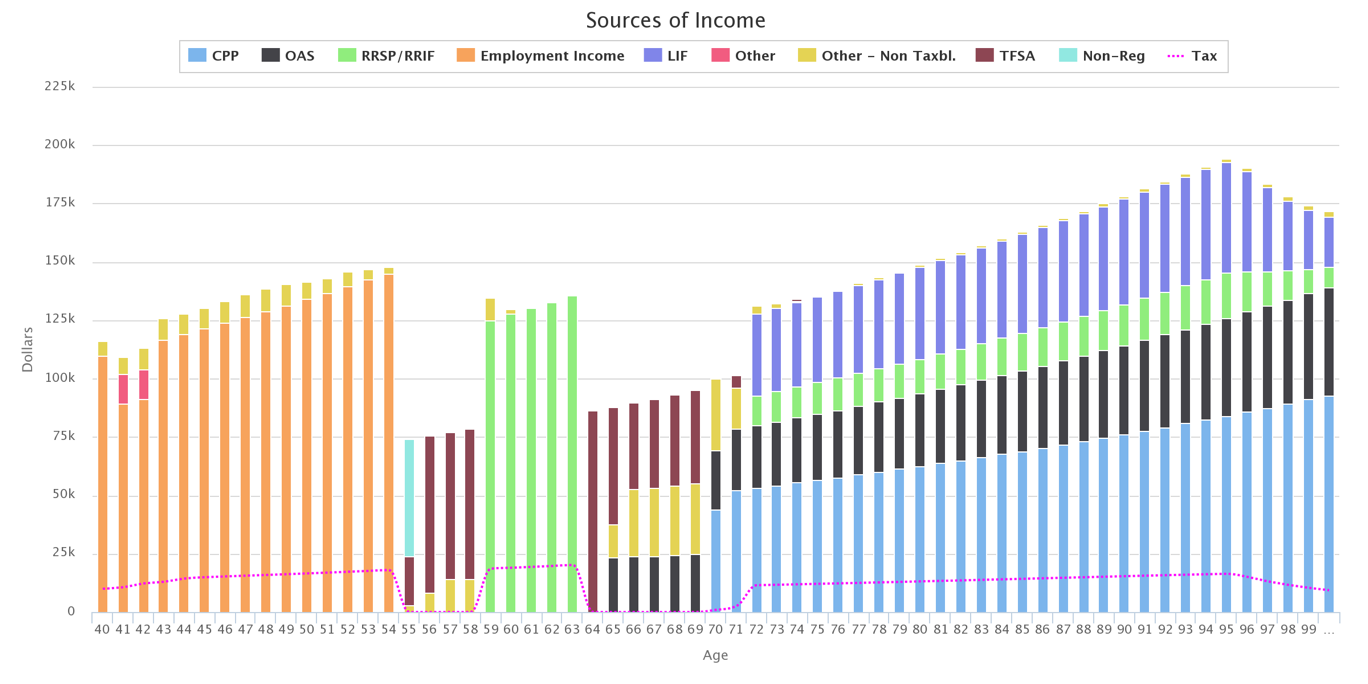

Will your savings generate enough cash each year to support your expenses? Will you have enough to live comfortably? How do you turn your savings into regular income? What can you expect from government benefits like CPP and OAS?

There are 7-10+ common retirement income sources, each with their own tax and claw back rules. We find the best way to turn your assets into income. We plan which accounts to draw from, when to draw from them, and how much to draw. We calculate income taxes and government benefits to ensure you’re meeting your spending goals.

Get detail.

Income planning.

Will your savings generate enough cash each year to support your expenses? Will you have enough to live comfortably? How do you turn your savings into regular income? What can you expect from government benefits like CPP and OAS?

There are 7-10+ common retirement income sources, each with their own tax and claw back rules. We find the best way to turn your assets into income. We plan which accounts to draw from, when to draw from them, and how much to draw. We calculate income taxes and government benefits to ensure you’re meeting your spending goals.

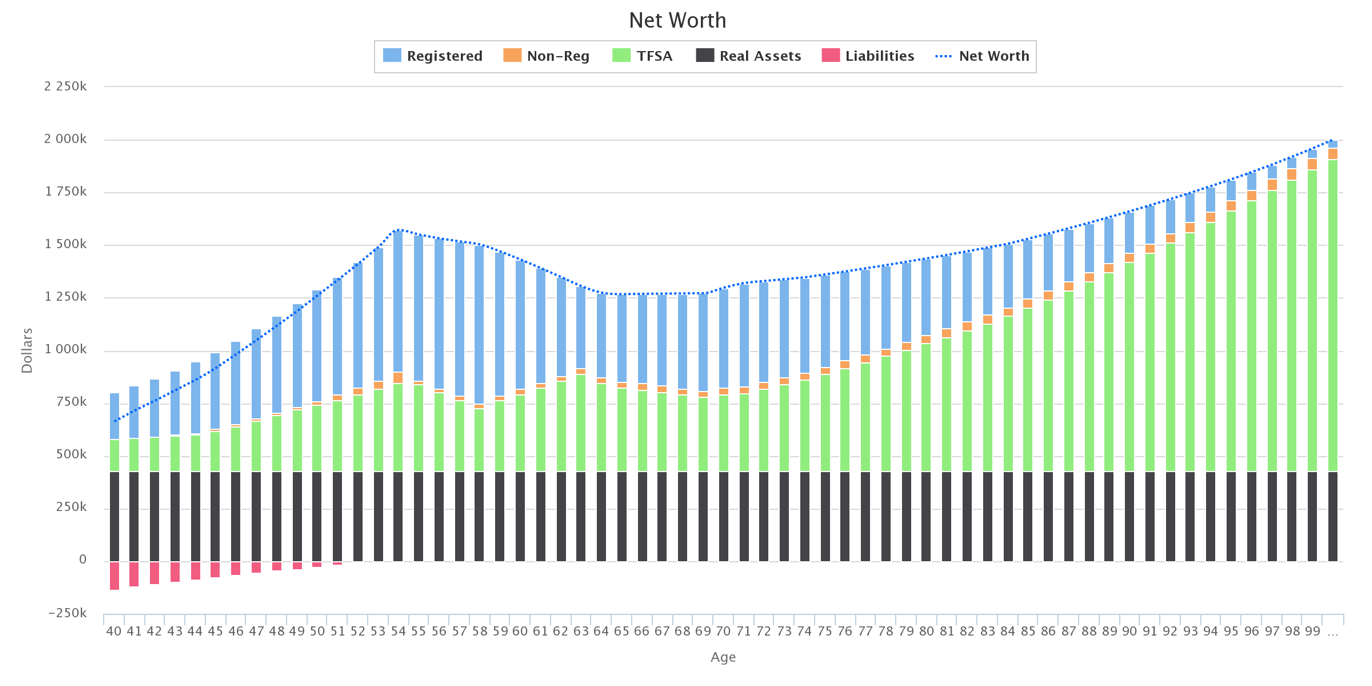

Get optimized.

Grow your savings.

Have you optimized your savings & investments for taxes and government claw backs? Are you using tax-advantaged accounts to their maximum? Will you be able to reach your short and long-term goals without making changes?

We take your savings and project them into the future. We’ll show you how your assets will grow in the future and tell you if you’re on track to reach your goals.

Get optimized.

Grow your savings.

Have you optimized your savings & investments for taxes and government claw backs? Are you using tax-advantaged accounts to their maximum? Will you be able to reach your short and long-term goals without making changes?

We take your savings and project them into the future. We’ll show you how your assets will grow in the future and tell you if you’re on track to reach your goals.

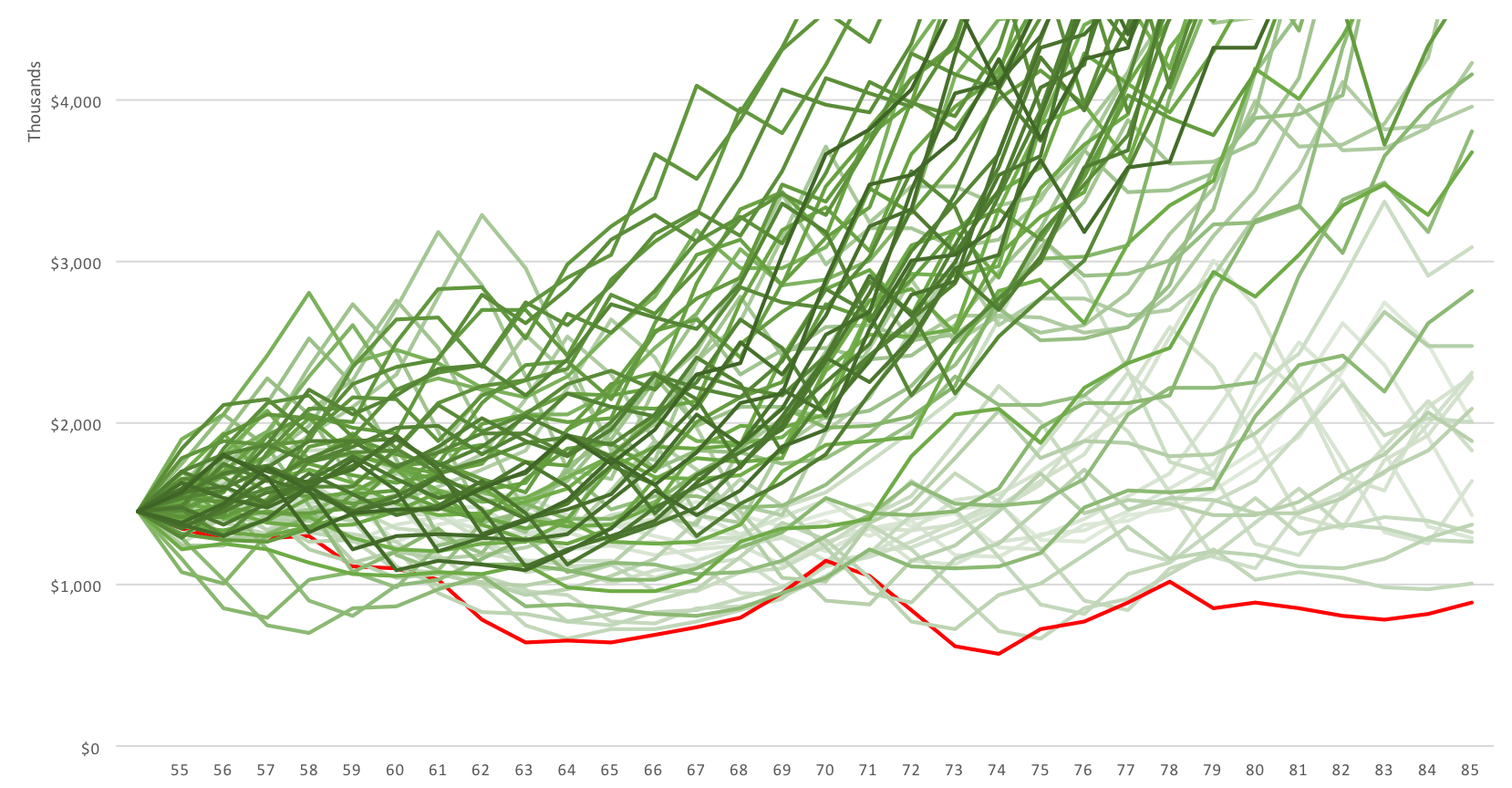

Get security.

Multiple scenarios.

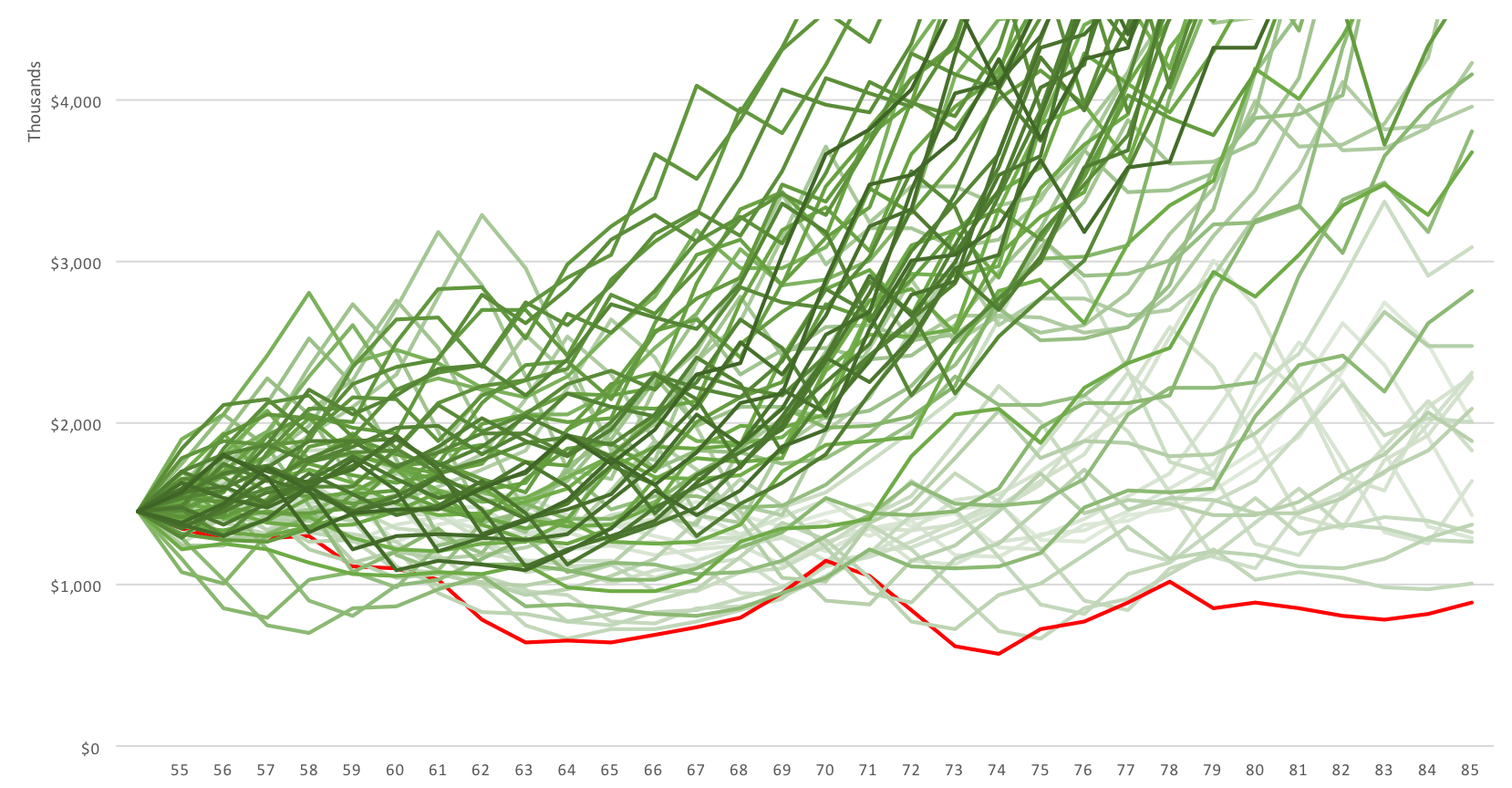

How much can you safely withdrawal from your investments each year? Will your savings last as long as you will? What happens during a bad investment year? What happens if there are a few bad years in a row?

We run your plan through dozens of historical scenarios to ensure you will never run out of money. Get the peace of mind of knowing that your money will last, even in the worst case scenario (red line).

Get security.

Multiple scenarios.

How much can you safely withdrawal from your investments each year? Will your savings last as long as you will? What happens during a bad investment year? What happens if there are a few bad years in a row?

We run your plan through dozens of historical scenarios to ensure you will never run out of money. Get the peace of mind of knowing that your money will last, even in the worst case scenario (red line).