Important Considerations When Setting Up A Spousal Loan

For households where two partners earning drastically different incomes certain income splitting strategies can provide a large advantage. Splitting income can lead to a large decrease in overall income tax. And an income tax reduction of even just a few thousand per year can quickly add up to become hundreds of thousands with compounding.

It’s important to note that Income splitting strategies aren’t for everyone. Some are easier to execute than others and some can even lead to higher income tax if executed in the wrong circumstances. It can be tempting to use every available strategy in an attempt to lower your overall income tax rate but certain strategies require careful consideration.

A spousal loan is one income splitting strategy that requires careful consideration.

The basic idea behind a spousal loan is relatively simple. The goal is that non-registered investments accrue investment income in the hands of the lower income spouse rather than the higher income spouse. But the CRA doesn’t just allow this to happen. A spousal loan needs to be set up to transfer cash from the higher income spouse to the lower income spouse.

The concept is relatively simple but there are some important considerations to review based on your particular situation before setting up a spousal loan.

Disclaimer: This post is for educational purposes only. Always seek professional advice when considering advanced income splitting strategies. Use a lawyer to help create the loan agreement and an advice-only financial planner to help understand how a spousal loan fits within your overall financial plan.

Consideration #1: Have Other Strategies Been Exhausted First?

It can be very tempting to set up a spousal loan with the goal of lowering your overall household tax rate, but have you executed other income splitting strategies first? Have you exhausted other available (and easier) ways to split income?

A spousal loan isn’t the easiest income splitting strategy to set up. As a best practice, it will necessitate professional help (although you could do it yourself).

By using some of the easier income splitting strategies you may lower your overall household income tax rate to a point where a spousal loan is no longer worth the trouble.

Lastly, it’s always important to maximize tax advantaged accounts first. Generally, it’s advantageous to maximize TFSA and RRSP before investing in a non-registered account (there are a few very limited situations where investing in a non-registered account BEFORE investing in an RRSP might be advantageous, and in those situations a spousal loan likely wouldn’t apply).

Consideration #2: Is It Worth The Trouble?

The other important consideration when considering a spousal loan is to understand if it’s really worth the trouble?

As a best practice a spousal loan should be set up using a lawyer. A lawyer will help complete the loan agreement. This will help ensure there is no potential issues with the CRA in the future. This will cost money to set up and needs to be considered.

A spousal loan also requires a very clean paper trail. Ideally each spouse has their own bank account to have a clear separation of cash flow. For couples who do the majority of their banking using a joint account this may require new individual accounts to be set up. This can be done inexpensively using an online bank like Simplii or Tangerine but it still requires additional work.

Lastly, a spousal loan requires interest to be paid. It may seem like semantics but for a spousal loan to be legitimate in the eyes of the CRA there must be interest payments each year. At a minimum this interest payment needs to be at the prescribed rate (currently 2%) and it needs to be paid by January 30th of each year. This requires careful attention because we certainly don’t want the loan to be considered illegitimate and income attributed back to the higher income spouse.

It’s important to consider if this extra effort and extra expense is worth the additional tax savings (there might not even be any tax savings over the short-term, see the next section!)

Consideration #3: What Type Of Income Is Being Created?

Not all types of income taxed equally. One of the important considerations when looking at a spousal loan is what type of income is currently being created in the non-registered account today.

Capital gains, bond income, interest income, Canadian dividends, foreign dividends, etc etc. They are all taxed differently, even when you’re in the same tax bracket.

Before looking at a spousal loan strategy it’s important to make sure you’re properly executing an asset location strategy. Asset location is important when someone has all three accounts, TFSA, RRSP and non-registered. An asset location strategy takes advantage of the fact that taxes can be minimized when holding certain types of assets in certain types of accounts.

Once you’ve put each type of asset in the right account to minimize tax, it may not be advantageous to execute a spousal loan.

There are a couple of parts to a spousal loan, one part is that investment assets are now creating investment income in the hands of the lower income spouse, but another is that interest income is now being created in the hands of the higher income spouse (at the prescribed rate, currently 2%). Depending on the type of asset being held in the non-registered account it could work out that the interest income being created is HIGHER than the investment income. For tax efficient investments, ones that create mostly capital gains, this could very easily be the case. If this is the case then next year’s tax bill may end up higher with a spousal loan strategy!

Let’s look at two extremes…

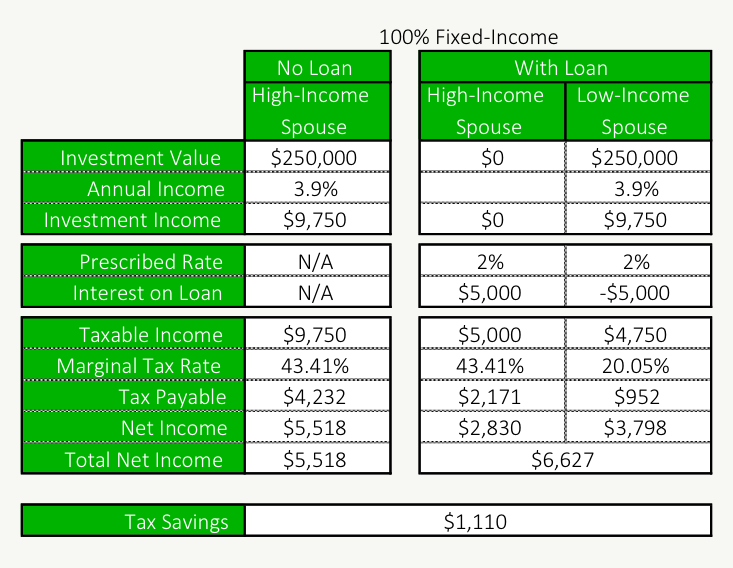

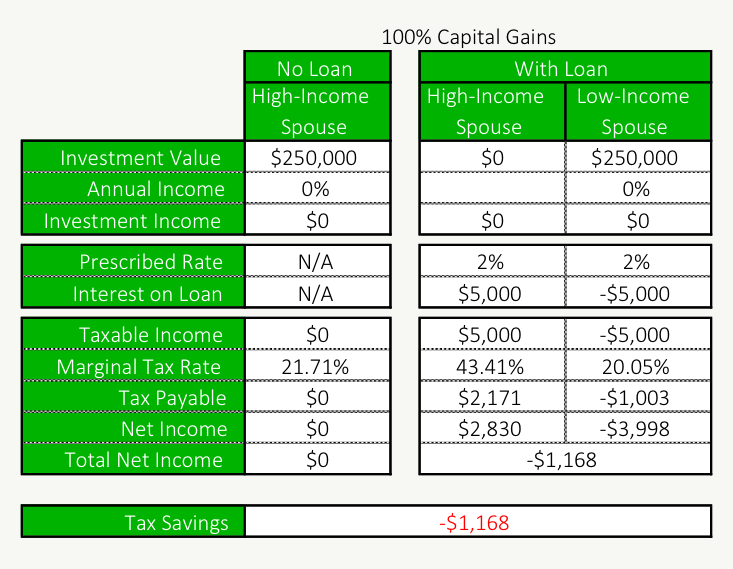

Assumptions: Example for Ontario. First year of spousal loan only. Assumes tax credits for lower-income spouse can be used to offset other tax payable during tax year. Higher income spouse with income between $95,259 to $147,667. Lower income spouse with income under $43,906.

Disclaimer: These are examples only and may change depending on your situation, income level, and current tax rates. Please speak with a professional when deciding if a spousal loan is the right strategy for your situation.

Spousal Loan With Fixed Income

When the non-registered assets are fixed income then it can make sense to use a spousal loan strategy to minimize the overall tax bill for the household (that being said, it may not be advantageous to hold fixed income in a non-registered account based on an asset location strategy).

Spousal Loan With Capital Gains

When the non-registered assets create capital gains it may not make sense to use a spousal loan. A spousal loan may actually create more tax payable in the beginning.

The advantage of capital gains is that income tax can be deferred until the assets are sold. This can be years or even decades in the future. The spousal loan creates interest income in the current tax year and results in higher tax payable if the assets aren’t sold.

Is A Spousal Loan Right For You?

Depending on your situation and the type of income you’re earning in your non-registered account a spousal loan may be a good fit for you, but it also may not be worth the trouble.

Always seek professional advice when considering advanced income splitting strategies like spousal loans. Use a lawyer to help create the loan agreement and an advice-only financial planner to help understand how a spousal loan fits within your overall financial plan.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments