by Owen | Jan 15, 2018 | Budgeting, Saving Money

The average person makes anywhere from 100 to 200+ transactions per month. It’s unlikely that the average person can recall each and every transaction they’ve made over the last month (heck, sometimes I can’t even remember what I DID yesterday let alone what I spent money on).

Having a short memory makes us terrible at understanding our spending habits. Some people are natural budgeters, they can recall perfectly what they spend their money on. But for the majority of us, we need to track our spending to understand where our money is going.

Tracking your spending doesn’t have to be difficult. With the help of technology it can be super easy. Even going old school with pen & paper isn’t that difficult.

Tracking your spending is the only real way to understand your spending habits and make changes.

by Owen | Dec 11, 2017 | Saving Money

Saving money is the cornerstone of a good financial plan. Without a healthy savings rate there isn’t really a way to achieve your other financial goals.

Getting to a healthy savings rate can be a real challenge though. There are so many demands on our cash. Money comes in and goes out so quickly that it can be hard to put some aside.

One awesome trick to help you save money is the 52 week challenge. This is a simple but effective way to get into a saving habit. If you’re struggling with how to start saving money, then this could be the solution.

There are many variations of the 52 week challenge out there but this is my personal favorite…

by Owen | Dec 4, 2017 | Saving Money

Find yourself going over budget? Always making impulse purchases? Do you know what the problem might be?

Ego depletion.

You’re probably thinking… “What the heck is ego depletion?”

Ego depletion is a psychology concept. When we make lots of decisions or are under a lot of stress, our brain gets tired, our self control starts to loosen, and we start to make impulsive decisions. These impulsive decisions can be a real budget killer.

This doesn’t necessarily impact spending. Ego depletion can cause you to stray from your diet, your exercise routine, or…

Avoiding ego depletion is the BEST way to save more money because it lets you avoid all those extra purchases that really kill your budget.

by Owen | Sep 18, 2017 | Budgeting, Income, Saving Money

Today we have a guest post about house hacking from Erik. Erik a personal finance and self-improvement junkie who blogs over at The Mastermind Within. House hacking is one of those things I wish I knew about when I was a bit younger. It’s entirely possible to house hack your way to zero housing costs. Housing represents 35% of the average household’s budget so reducing that, even by a little bit, can mean a huge increase in your capacity to save.

In this post, Erik shares the 5 reasons why he believes house hacking is the best early age wealth building strategy. I hope you enjoy it!

by Owen | Sep 11, 2017 | Saving Money

Eating healthy can be hard. It can also be expensive. But it doesn’t have to be either these things. With a little work, eating healthy can cost you less than you currently spend on groceries each month.

For the average household, groceries account for over 10% of their annual spending. That’s over $6,100 per year! If you have children it’s even higher; families with children have an average expenditure of $8,753 per year!

Cutting 10-20% from your grocery bill can mean $1,000’s per year in savings. Saving money on groceries can help you fund the simple retirement plan or help you reach other financial goals.

But saving money on food doesn’t mean eating crap. Below you’ll find seven different ways to cut down on your grocery bill and still eat well.

In our home I’m responsible for 80-90% of the cooking and because I do most of the cooking I also do the meal planning and grocery shopping too. This means the grocery budget is entirely my responsibility.

For the four of us, two adults and two children, our grocery budget is $4,800 per year. That’s $400 per month or about $100 per week. We spend about 45% less than the average family with children.

To make this work we use the seven strategies below to help reduce our grocery budget while still eating healthy.

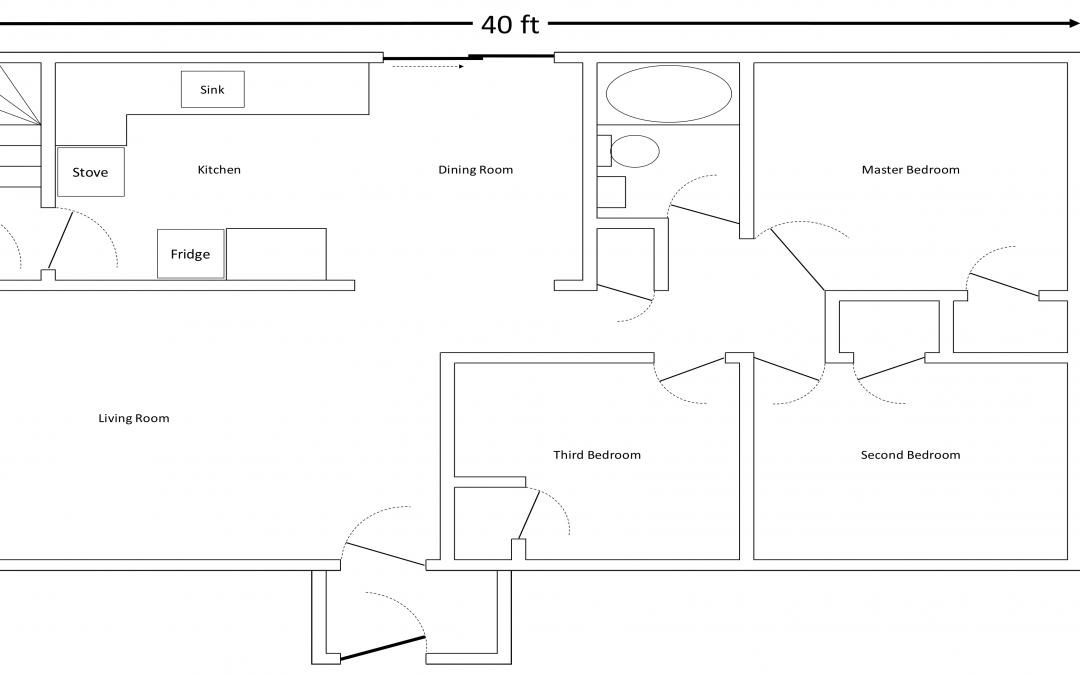

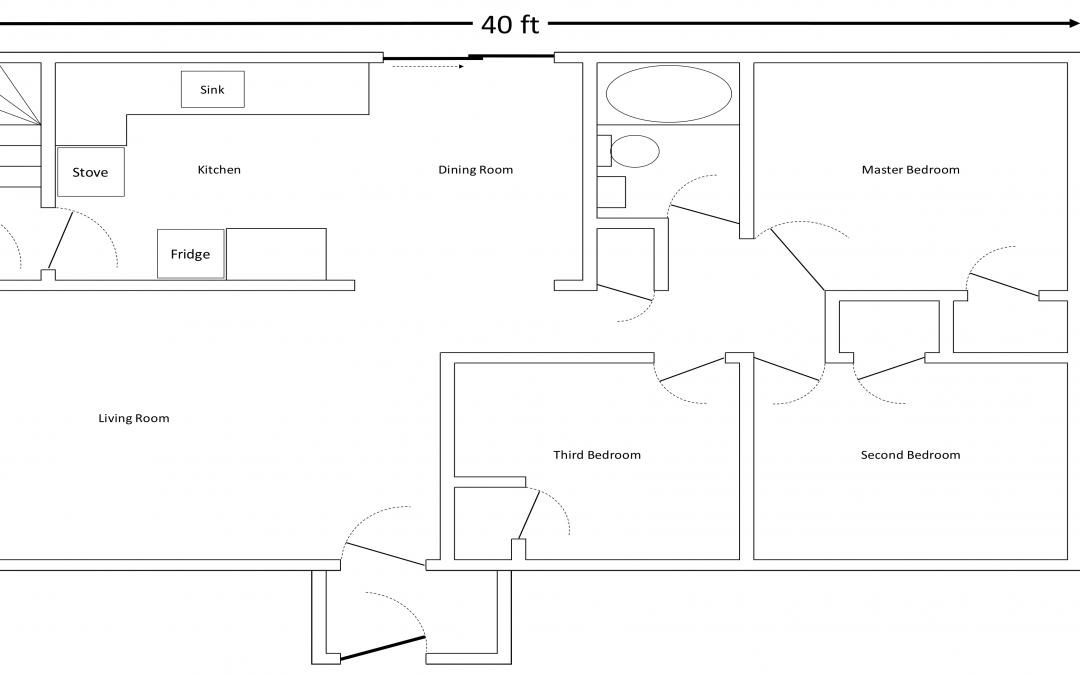

by Owen | Aug 7, 2017 | Buying A Home, Saving Money

Living small is a great way to save money. Today we’ve got a guest post on 1500 Days To Freedom about how our family of four lives in just 1,000 square feet.

1500 Days To Freedom is a blog written by Mr.1500 (he blogs anonymously). The blog is about his family’s goal to achieve financial independence by amassing $1,000,000 of investments in just 1500 days. Check out our guest post about living small and please make sure to check out the rest of the site too!

In the guest post you’ll find a detailed layout of our house. We live in a three bedroom bungalow that measures just 40ft by 25ft. We have a full size kitchen, living room and dining room but our bedrooms range from just ~80 square feet to ~120 square feet.

We chose to live small for many reasons, all of which are covered in the post, but one important reason was that it lets us save big. Our annual housing costs are approximately $15,000 lower than other family homes in our area.

Living small also allowed us to buy a house in a great location. This helps us save big on transportation every year.

In total, for both housing and transportation, our annual budget is only $13,220 per year.