by Owen | Jul 25, 2022 | Behavioral Finance, Financial Goals, Financial Planning, Income, Investment Planning, Retirement Planning

Does the 4% rule make a good retirement plan? Before we answer that question let’s first explore what the 4% rule is and some of its pros and cons.

The 4% rule is a great personal finance rule of thumb.

Like many rules of thumb, it provides good direction for financial goals, it’s simple, it’s easy to understand, and it’s relatively accurate.

Unlike other personal finance rules of thumb, the 4% rule is also backed up by quite a bit of academic research, so if there was any personal finance rule of thumb to use, it would certainly be the 4% rule.

Let’s review what the 4% rule is in more detail, the pros and cons, and why you may or may not want to use the 4% rule for your retirement plan.

by Owen | Jul 18, 2022 | Financial Planning, Government Programs, Income, Retirement Planning

If you’re preparing for retirement, then you may have looked up your CPP estimate to get an idea of how much you might receive from the Canada Pension Plan (CPP) in the future.

But did you know that your CPP estimate is probably wrong?

If you’re wondering “How much CPP will I get” then its important to know that your CPP estimate is based on some pretty big assumptions. Unless you’re about to start CPP tomorrow, your actual CPP could be much different than your estimate.

When Service Canada creates your CPP estimate there are a few important assumptions they’re making about your future income and years of work. These assumptions are necessary to create an estimate of your future CPP benefits because CPP benefits are based on contributions which in turn are based on employment income.

But if your future employment income is different than their assumptions this could lead to your actual CPP being much lower or possibly much higher than estimated.

In this blog post we’re going to look at the three major assumptions that impact your CPP estimate and why the amount you receive from CPP could be thousands per year different than what the estimate suggests. We’re also going to look at how you can use a CPP calculator to get a better estimate of your future CPP benefit.

by Owen | Jun 13, 2022 | Financial Planning, Government Programs, Income, Retirement Planning

When is the best time to start CPP benefits? In some cases, delaying CPP until age 70 is a wise choice. But in other cases, it might be best to start CPP at age 60.

In this blog post we’re going to look at six good reasons to start CPP at age 60.

Starting CPP at age 60 will mean a smaller monthly benefit but it also means getting CPP income earlier. Starting CPP at age 60 will decrease the size of the benefit by 36% versus the calculated amount at age 65, but even this reduced amount can be $10,000 per year or more!

This reduction in CPP benefits is called the actuarial adjustment and it’s 0.6% for each month that CPP starts before age 65. The maximum reduction is 36% if CPP starts at age 60 but this same rule applies to any start age in between. Start CPP 2-years early at age 63? That’s a 14.4% reduction (24-months x 0.6% per month). Start CPP 3.5-years early at age 61.5? That’s a 25.2% reduction (42-months x 0.6% per month).

Despite the reduction in monthly benefits there are a few very good reasons to start CPP at age 60…

by Owen | May 24, 2022 | Behavioral Finance, Budgeting, Income, Investment Planning, Retirement Planning

Over the last few years the number of low-cost investment options has exploded in Canada. There are new and easy ways to create a low-cost diversified portfolio that isn’t dragged down by high investment fees.

There were always low-cost, do it yourself options, but they required a fair amount of manual work to make contributions, invest those contributions, and rebalance periodically (and let’s not forget, the stress of keeping yourself on course during a correction or recession).

But now there are new options available. In addition to a low-cost ETF portfolio or a low-cost mutual fund portfolio, there are options like low-cost “all-in-one” ETFs and low-cost robo-advisors.

These new options provide investors with new ways to invest in a low-cost portfolio without necessarily doing all the work themselves.

This has understandably put a lot of pressure on investment advisors who have historically charged extremely high fees on the investment products they sell.

The average investment fee on a mutual fund portfolio in Canada is around 2.3%. This can cause an enormous amount of drag on an investment portfolio. A $1,000,000 investment portfolio would experience a $23,000 annual drag from investment fees! That has a direct impact on how much retirement income you can create from your investment portfolio.

But switching from a high-priced mutual fund portfolio can be hard to do.

Even with the high fees, traditional investment options continue to dominate the investing landscape in Canada, but things are starting to change. For the first time ever, ETFs have outsold mutual funds. More money is flowing into ETFs than into mutual funds (bear in mind that you can also have high-priced ETFs, and low cost mutual funds, so this isn’t necessarily the best indicator).

But… if these low-cost investment options have been around for a while, why the slow change? Why aren’t more people switching?

There are three main risks people face when making a change of this kind, financial risk, emotional risk, and social risk. These risks can be difficult to overcome. Let’s understand each one and why they make breaking up with an investment advisor hard to do…

by Owen | Apr 25, 2022 | Budgeting, Financial Planning, Government Programs, Income, Retirement Planning

Retirement planning is complex and includes many important considerations like retirement spending, income tax planning, income splitting, maximizing government benefits, deciding when to take CPP and OAS etc. etc.

All of these individual parts work together to create a great retirement plan. They are so important that even a small mistake can mean lower retirement spending or a higher chance of running out of money in the future. It could mean $10,000’s in extra tax or $10,000’s in reduced government benefits.

With a typical retirement plan spanning 30-40+ years it’s easy to understand how small change in assumptions can have a big effect on a retirement plan.

There are also many small decisions to consider when planning retirement, like when to convert RRSPs to RRIFs, when to start CPP, when to start OAS, how much to draw from investment assets, which investment assets to draw from first etc. etc.

In this post, we look at some of the important parts of retirement planning. What they are, what you should consider, and some additional resources to help.

by Owen | Nov 1, 2021 | Financial Goals, Financial Planning, Income, Investment Planning, Retirement Planning, Tax Planning

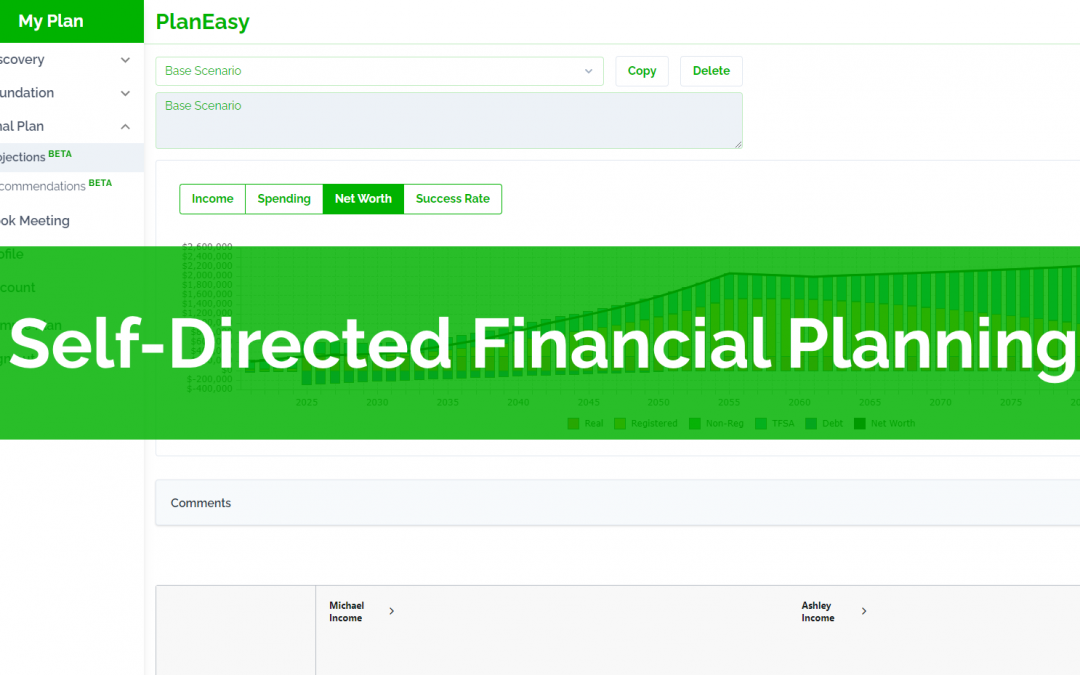

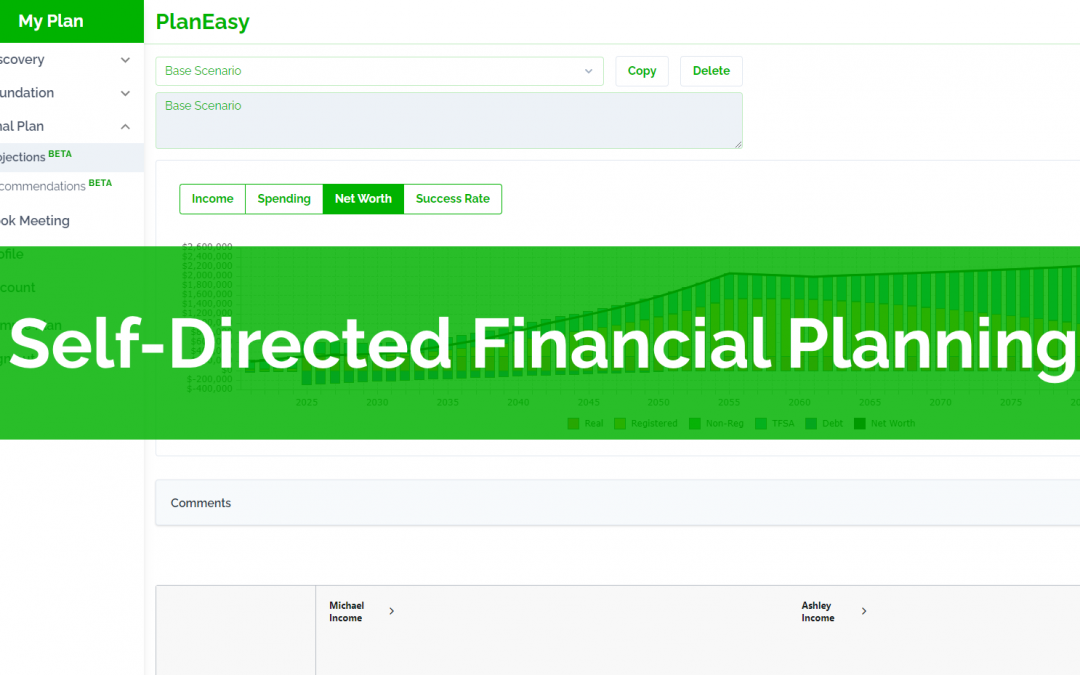

We’re excited to introduce self-directed financial planning, a new way to access advice-only financial planning.

At PlanEasy our mission is to make advice-only financial planning easy, accessible, and inexpensive, and our new self-directed financial planning platform helps make that even more of a reality.

Self-directed planning uses our innovative financial planning platform to create a truly customized financial plan in just three simple steps.

The platform intelligently tailors to every individual, couple, and household to create a unique financial plan that is customized to your exact situation.

Unlike other financial planning options, our platform is completely unbiased, there are no products, no sales goal, just advice.

Our platform helps you optimize your financial plan for income tax, tax credits, and multiple governments benefits including the big ones like Guaranteed Income Supplement (GIS) and the Canada Child Benefit (CCB) as well as multiple smaller government benefits too.

Most importantly, a self-directed financial plan is just a fraction the cost of a typical one-on-one advice-only financial planning engagement, making it easier and less expensive to create an unbiased financial plan.

Interested? Get early access to self-directed financial planning, join the waitlist now.

Let’s take a look at just a few of the ways a self-directed financial planning can help you make the most of your money…