by Owen | May 2, 2022 | Financial Planning, Government Programs, Retirement Planning, Tax Planning

Income splitting is often talked about in reference to high-income earners, but what about the average Canadian family? How does the average Canadian family split income and minimize tax? A spousal RRSP is one way for the average Canadian family to easily split income in retirement.

For high-income earners there are income splitting strategies like spousal loans or “income sprinkling”. Spousal loans are for families with lots of non-registered savings and a large difference in marginal tax rates between spouses. “Income sprinkling” can be used by families who own a corporation (although with the new TOSI rules has changed dramatically).

But what about your average Canadian household? Are there are income splitting options for them?

One very easy and accessible type of income splitting is a spousal RRSP. Unlike other income splitting strategies this one is very easy to set up, it doesn’t require a lawyer, and it’s easy to understand.

The big benefit of a spousal RRSP is that the average family can use it to “equalize” their registered assets before retirement. This allows for a more equal distribution of income in retirement and a lower overall tax bill for a household.

In addition to lower income tax it also opens up more opportunities to maximize government benefits in retirement.

But you might be wondering, isn’t it possible to split income after age 65 anyway, why would I need a spousal-RRSP?

While it’s true that after age 65 income splitting is much easier to do, it’s still a best practice to try to equalize registered assets before age 65. This allows for the maximum flexibility when creating a retirement drawdown strategy, especially when retiring early.

Equalizing registered assets can be extremely beneficial, especially before the age of 65 when there are fewer income splitting opportunities, for this reason we sometimes want to look at using a spousal RRSP to help split income in the future.

by Owen | Apr 25, 2022 | Budgeting, Financial Planning, Government Programs, Income, Retirement Planning

Retirement planning is complex and includes many important considerations like retirement spending, income tax planning, income splitting, maximizing government benefits, deciding when to take CPP and OAS etc. etc.

All of these individual parts work together to create a great retirement plan. They are so important that even a small mistake can mean lower retirement spending or a higher chance of running out of money in the future. It could mean $10,000’s in extra tax or $10,000’s in reduced government benefits.

With a typical retirement plan spanning 30-40+ years it’s easy to understand how small change in assumptions can have a big effect on a retirement plan.

There are also many small decisions to consider when planning retirement, like when to convert RRSPs to RRIFs, when to start CPP, when to start OAS, how much to draw from investment assets, which investment assets to draw from first etc. etc.

In this post, we look at some of the important parts of retirement planning. What they are, what you should consider, and some additional resources to help.

by Owen | Apr 4, 2022 | Financial Planning, Retirement Planning, Tax Planning

The RRSP is a great financial planning tool. Investments grow tax-free within the account. Contributions to an RRSP reduce taxable income. And in some unique circumstances, it may even be advantageous to make contributions in one year and then deduct them in future years.

RRSP contributions and withdrawals will decrease and increase taxable income respectively. This effect can be seen on the tax return.

So, how do tax returns work when there is an RRSP contribution? What effect does an RRSP contribution have on the tax return?

And what about in the future? What happens when RRSP withdrawals are made? What effect does an RRSP withdrawal have on the tax return?

These are important questions. The benefit of strategic RRSP contributions and withdrawals can be $10,000’s or more.

Understanding how RRSP contributions and withdrawals affects your tax return is very important for Canadian retirement planning. We’ll go through the basics of how RRSPs work, as well as a few examples to show how an RRSP contribution or withdrawal shows up on the tax return.

by Owen | Mar 28, 2022 | Behavioral Finance, Budgeting, Financial Goals, Financial Planning

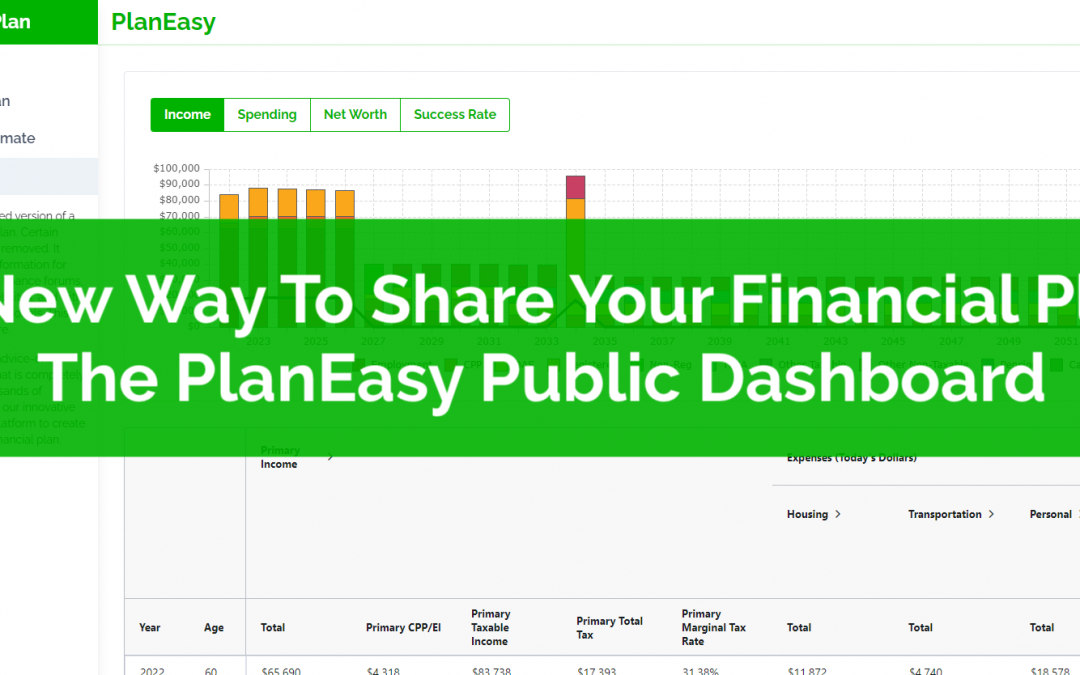

Talking about personal finances has always been somewhat taboo. It’s difficult to discuss personal finances with friends and family. Everyone has different values and goals. We all have different financial circumstances. And sometimes… talking about personal finances can lead to hurt feelings and personal strife.

This has led to many people avoiding personal finance discussions or discussing personal finances anonymously in online forums and communities.

But discussing personal finances in an online community can be difficult. Personal finances are personal. A financial plan can differ dramatically from one person to the next. To have a good discussion requires a lot of information, something difficult to do in an online community.

At PlanEasy we want to make financial planning easy. We want to make it easier to share and discuss personal finances online.

That’s why we’re introducing the PlanEasy Public Dashboard, a completely anonymous way for PlanEasy users to share their financial plan… let’s take a look at the Public Dashboard…

by Owen | Mar 20, 2022 | Behavioral Finance, Financial Planning, Investment Planning, Retirement Planning

Can you retire when the stock market is at an all time high? For many soon-to-be retirees this is an important question. It can be extremely nerve-racking to “pull the plug” and leave a stable income when investment values are at their peak.

But is this really a concern? Is it bad to retire when markets are at an all time high?

For many soon-to-be retirees, their investment portfolio will make up an important part of their future retirement income. Even retirees with a pension or full CPP/OAS will often have a small investment portfolio to support additional spending in retirement.

Many retirees worry about retiring at an all time high. They worry about a large decline in investment values soon after retirement. They believe this will dramatically impact their retirement plan. But is this concern justified? Or is this one of those biases that we’re all susceptible to?

Working for a few additional years would certainly help solidify a soon-to-be retirees financial plan, but at what cost? That lost time can never be recovered and could represent some “prime retirement years”. That income may also never be needed if everything goes to plan.

As it turns out, we’re actually at an all time high quite often, and the impact of retiring at an all time high isn’t even close to what we’d assume…

by Owen | Mar 7, 2022 | Financial Planning, Government Programs, Retirement Planning

For many people, CPP and OAS will make up a significant portion of their retirement income. A reduction in CPP and OAS income due to CPP survivor benefits or OAS survivor benefits can be very stressful. Even more so because this reduction will follow the unexpected death of a partner or spouse.

Many people may not realize, but OAS and CPP survivor benefits are reduced by anywhere from 40% to a full 100%!

For higher income households, who may have significant assets in either RRSPs or TFSAs, it’s not uncommon for CPP and OAS to make up 25%-30% of their retirement income.

For lower and moderate-income households, government pensions like CPP and OAS can provide 50%-75% of their retirement income.

For very low-income households, CPP and OAS, when combined with other low-income benefits like GIS, can easily make up 100% of retirement income for some couples.

In all of these situations, losing even some of these benefits can result in a big change to retirement plans, and what many people may not realize is the extent to which some of these benefits can be reduced when a partner passes away.

Although difficult and unpleasant to even think about, the impact of a partner’s death is an important consideration for many retirement plans. It’s important to understand what changes there might be to both retirement income and retirement spending if the unfortunate were to happen.

For some plans, those which have a large amount of investment assets, the risk is much smaller. Investment assets inside RRSPs and TFSAs can be transferred through spousal rollovers with no tax consequences. So, the disruption to these plans may be smaller.

But for some plans, the change in CPP and OAS income due to an unexpected death can be quite large, especially in certain circumstances. In the worst-case scenario, the loss of CPP and OAS combined can easily represent more than $20,000 per year in lost retirement income!

Here’s what to watch out for when it comes to CPP survivor benefits…

Page 7 of 19«...56789...»