by Owen | Nov 1, 2021 | Financial Goals, Financial Planning, Income, Investment Planning, Retirement Planning, Tax Planning

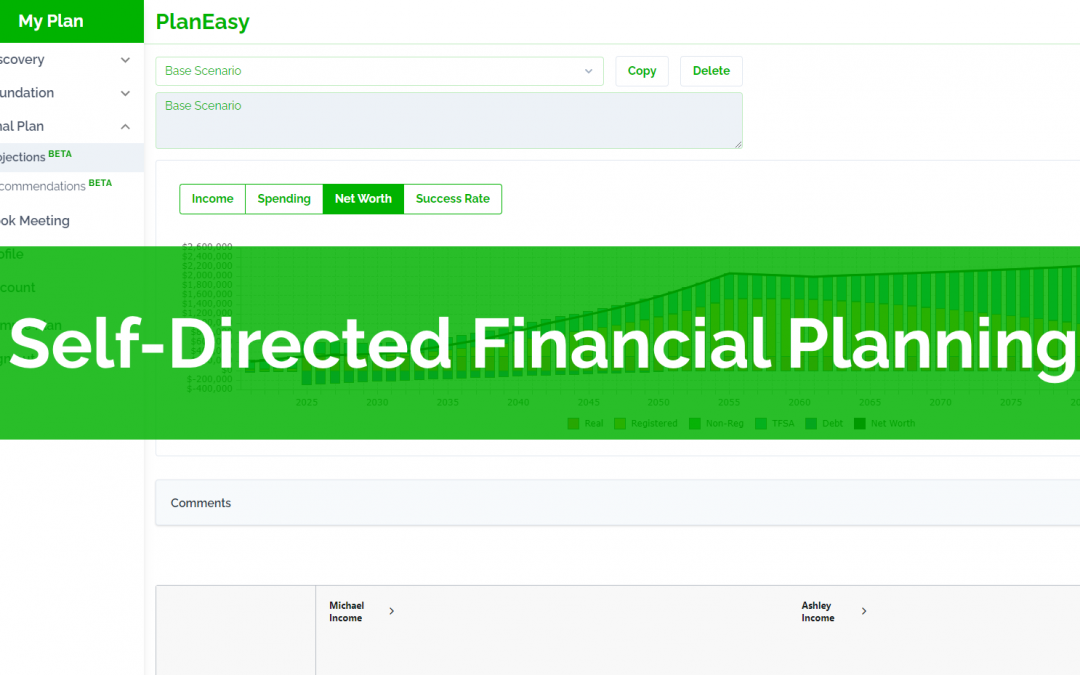

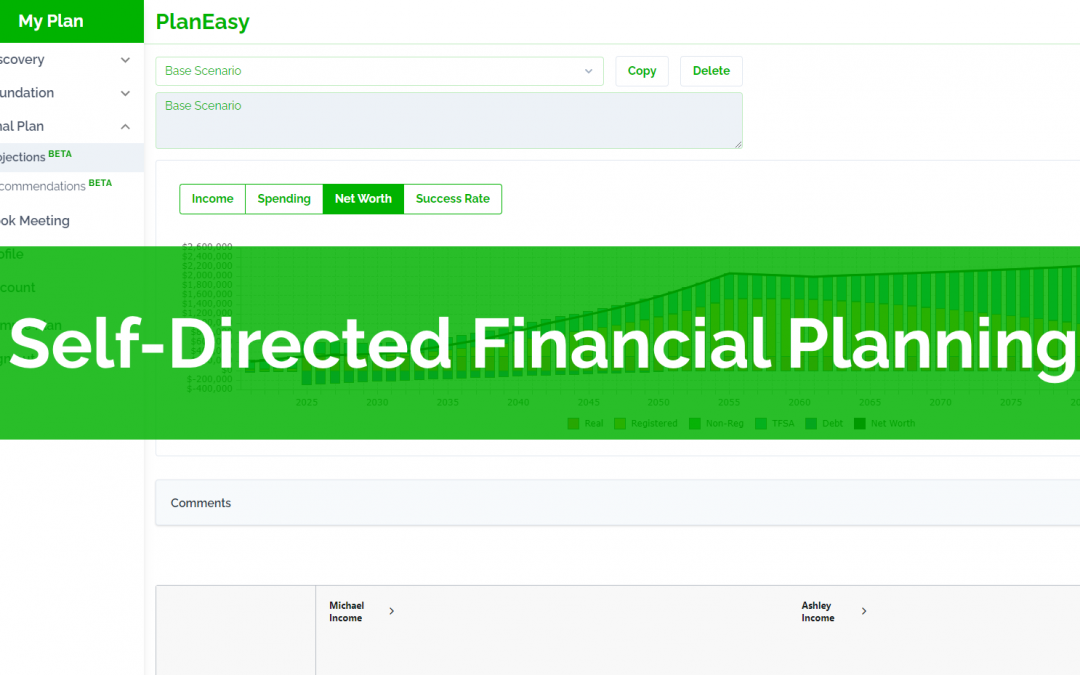

We’re excited to introduce self-directed financial planning, a new way to access advice-only financial planning.

At PlanEasy our mission is to make advice-only financial planning easy, accessible, and inexpensive, and our new self-directed financial planning platform helps make that even more of a reality.

Self-directed planning uses our innovative financial planning platform to create a truly customized financial plan in just three simple steps.

The platform intelligently tailors to every individual, couple, and household to create a unique financial plan that is customized to your exact situation.

Unlike other financial planning options, our platform is completely unbiased, there are no products, no sales goal, just advice.

Our platform helps you optimize your financial plan for income tax, tax credits, and multiple governments benefits including the big ones like Guaranteed Income Supplement (GIS) and the Canada Child Benefit (CCB) as well as multiple smaller government benefits too.

Most importantly, a self-directed financial plan is just a fraction the cost of a typical one-on-one advice-only financial planning engagement, making it easier and less expensive to create an unbiased financial plan.

Interested? Get early access to self-directed financial planning, join the waitlist now.

Let’s take a look at just a few of the ways a self-directed financial planning can help you make the most of your money…

by Owen | Oct 25, 2021 | Retirement Planning, Tax Planning

Can an RRSP be too big? That would be a nice problem to have, wouldn’t it?

Having an oversized RRSP means one of two things, either RRSP contributions have been on track for many, many years, or investment returns have been above average for a long time, or some combination of the two.

Having a large RRSP is a good problem to have, but it’s still a problem. With a large RRSP the problem becomes how to get that money out without losing a large percentage to income tax or government clawbacks.

At a certain level, withdrawals from an RRSP could trigger higher marginal tax rates and/or government benefit clawbacks. In these situations, it’s pretty easy to hit marginal effective tax rates of 50%+ in retirement. Losing half of an RRSP withdrawal to tax and benefit clawbacks is not ideal.

With an RRSP that is “too big” it’s possible to have a tax rate in retirement that is higher than when employed.

If you have a large RRSP, or if you have a modest RRSP but are still contributing, then there are a few issues that should be on your radar.

by Owen | Oct 18, 2021 | Budgeting, Financial Planning, Income, Retirement Planning

For those in the accumulation phase of their financial plan, withdrawals are not even on the radar yet, they’re entirely focused on contributions.

But for those getting close to retirement and the decumulation phase, their mindset starts to shift from contributions to withdrawals. They’ve been adding to these accounts for so long that they’re probably now wondering “how do I get my money out?”.

One unexpected realization people often have as they enter the decumulation phase is that it costs money to withdraw from an RRSP, sometimes a lot of money.

That’s right, withdrawing from an RRSP costs money. There is typically a fee charged on every RRSP withdrawal. These RRSP withdrawal fees are called “partial deregistration fees” and they can range anywhere from $50 to $100+ depending on the financial institution.

Finding out about these partial deregistration fees is a shock for those entering early retirement and for those who aren’t aware that these fees exist… or how to avoid them.

by Owen | Oct 11, 2021 | Financial Planning, Government Programs, Retirement Planning, Tax Planning

GIS Allowance is one of those unique government benefits. It applies only in very specific situations, but when it does apply, it can be very large.

GIS stands for the Guaranteed Income Supplement and it’s a government benefit for low- and moderate-income retirees. It is available after the age of 65 if OAS benefits have begun and if taxable income (line 23600 on your tax return) is below a certain threshold.

Allowance is another government benefit tied to GIS. Allowance is only available in very specific situations but it’s worth over $1,200 per month or $14,000 per year!

Given the size of GIS Allowance it can be very beneficial to understand how it works and when it applies. But, because it’s so rare, its often not considered when creating a retirement drawdown strategy. Unfortunately, not adjusting a financial plan for GIS Allowance will make retirement unnecessarily difficult for lower-income couples.

GIS Allowance is a government benefit that applies in only a few situations, but it is a benefit that is extremely large, and therefore it’s important to understand if and when you may qualify.

by Owen | Oct 3, 2021 | Retirement Planning, Tax Planning

When it comes to retirement there is a lot of focus put on the RRSP. The Registered Retirement Savings Plan seems like an obvious choice for retirement (it even has retirement in the name after all!). But for many of us an RRSP isn’t necessary, and it might even be counterproductive!

There’s a new retirement account on the block and it’s called the TFSA. Just over 10 years old, the TFSA is relatively new to the retirement savings game. Starting in 2009, it changed the way we look at retirement savings.

If you’re new to RRSP vs TFSA debate, it’s important to know that there are pros and cons for each account. RRSP’s do have the advantage in a few different areas, especially if you have high income or have a family and receive child benefits (either the Canada Child Benefit or a provincial child benefit). TFSA’s also have their share of benefits too. For low- and middle-income households, the TFSA has a few big advantages.

When deciding which is the right one for you need to look at multiple factors. Factors like income taxes, government benefits, creditor protection, and even human behaviour.

When deciding between the TFSA or the RRSP the key thing to remember is that you don’t actually NEED an RRSP to retire. Someone can easily retire with only a TFSA.

There are four things you need to know if you’re going to avoid the RRSP and only use the TFSA for retirement…

by Owen | Sep 20, 2021 | Behavioral Finance, Budgeting, Financial Goals, Financial Planning, Income, Retirement Planning, Saving Money, Tax Planning

In a world filled with uncertainty a financial plan has this amazing ability to predict the future.

It can help predict future income, expenses, assets, and debts. It can help predict if you’ll be financially secure in the future or if you’ll be eating cat food. It can help predict if you need to save more to achieve your goals or if you can spend more now and enjoy today. In can help predict if you’ll run out of money in retirement or if you’ll end up with millions.

A financial plan isn’t a perfect prediction of course. It’s based on certain assumptions. But good assumptions can create a good prediction. There will still be some chance of the future working out differently than planned, but with a path mapped out the future becomes very real and very achievable.

They say that “failing to plan is planning to fail”. A financial plan will help you know where you’re going. It will help you create a clear roadmap to follow. If you can hit the milestones on the roadmap then success is all but guaranteed.

Here are just a few ways that a financial plan can help you predict the future and make it a reality.

Page 9 of 19«...7891011...»