by Owen | Aug 7, 2017 | Buying A Home, Saving Money

Living small is a great way to save money. Today we’ve got a guest post on 1500 Days To Freedom about how our family of four lives in just 1,000 square feet.

1500 Days To Freedom is a blog written by Mr.1500 (he blogs anonymously). The blog is about his family’s goal to achieve financial independence by amassing $1,000,000 of investments in just 1500 days. Check out our guest post about living small and please make sure to check out the rest of the site too!

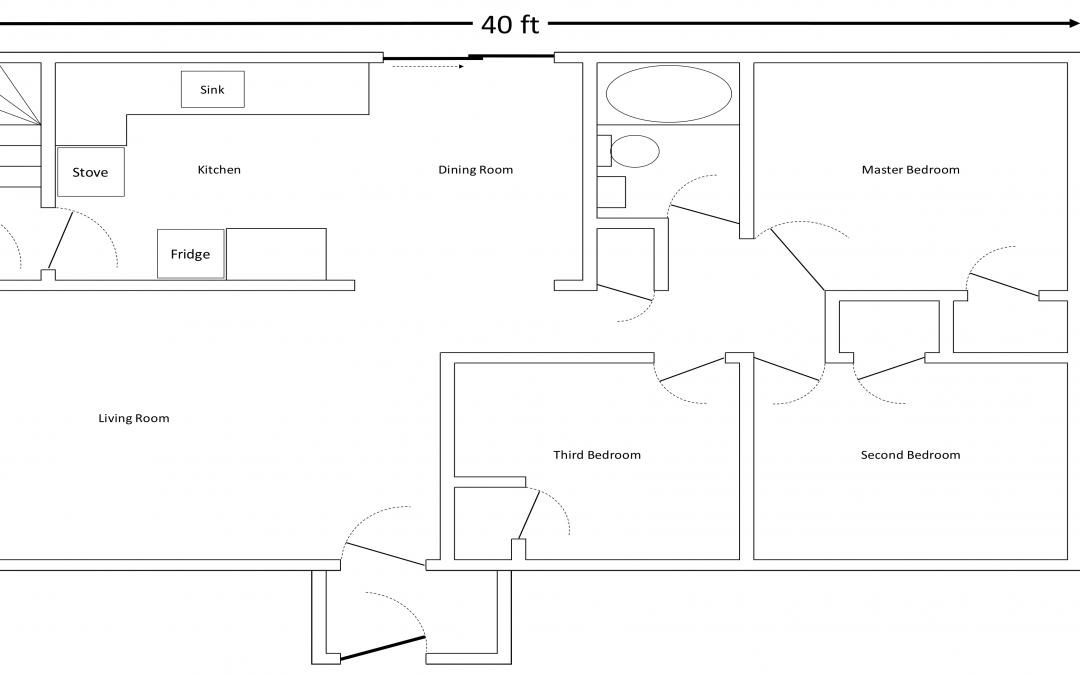

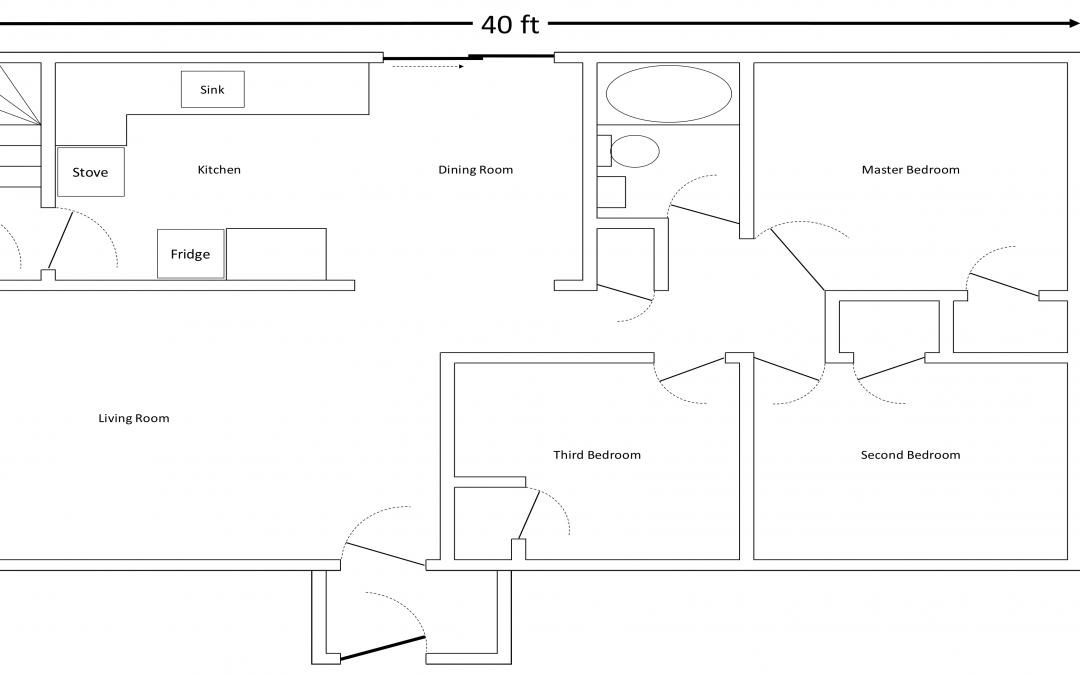

In the guest post you’ll find a detailed layout of our house. We live in a three bedroom bungalow that measures just 40ft by 25ft. We have a full size kitchen, living room and dining room but our bedrooms range from just ~80 square feet to ~120 square feet.

We chose to live small for many reasons, all of which are covered in the post, but one important reason was that it lets us save big. Our annual housing costs are approximately $15,000 lower than other family homes in our area.

Living small also allowed us to buy a house in a great location. This helps us save big on transportation every year.

In total, for both housing and transportation, our annual budget is only $13,220 per year.

by Owen | Jun 19, 2017 | Buying A Home, Saving Money

When first buying a home it’s hard to comprehend the sheer number of new expenses there are. There are mortgage payments, home insurance, property taxes, maintenance, water, sewer, electricity and gas, just to name a few.

When coming from a rental you may be blissfully unaware of all the new home expenses that you now need to budget for.

These extra expenses are tied directly to the size of your home. A larger home means larger expenses.

Before purchasing a new home consider all the expenses attached to your decision. Buying “just enough home” is a great way to save money. Buying “too much home” can cost thousands per year in extra expenses.

This is one of the main reasons my wife and I live with our two daughters in a small 1,000 sqft bungalow. Although we could afford a much larger home we chose to purchase something much smaller…

by Owen | Jun 12, 2017 | Retirement Planning

Simplicity is a beautiful thing.

It’s difficult to keep things simple. Taking a complex process and making it simple is a challenging task. A lot of effort goes into making something simple.

Retirement planning is no different. It can be a difficult and complex process. With lots of estimates, plus difficult calculations, it can be overwhelming. There are multiple income sources like CPP, OAS and pensions. There are multiple accounts like RRSPs, TFSAs, LIRAs, RRIFs and LIFs.

It doesn’t need to be that difficult.

Planning for retirement when you’re young can be as simple as doing one thing. By doing this one thing year in and year out you’ll set yourself up for a solid retirement.

What is the simple retirement plan?

It’s just one thing…

by Owen | Jun 8, 2017 | Government Programs, RESP/Kids Education

When you first have children, there is a lot going on. Sleep deprivation, diapers, crying, screaming, feeding, more diapers, cribs, car seats, more crying. It’s overwhelming. So it’s entirely understandable that making RESP contributions for your child is the last thing on your mind.

Even for someone like me, who’s a bit of a personal finance geek, opening an RESP and making contributions was the least of my concerns. For at least 12 months I put off opening an RESP.

Putting off opening an RESP for a little while is ok. But put it off too long and you may miss some free money from the government.

Here’s what you need to know about opening an RESP, making RESP contributions and catching up on the free money from the government.

by Owen | May 25, 2017 | Buying A Home, Down Payment

Feel like it’s impossible to put together a down payment as first-time home buyer? Don’t despair. We’ve got some great tips to help you out.

With the average price of a home in Canada above $500,000 that puts a lot of pressure on first-time home buyers.

Putting together a 20% down payment means you need to scrape together $100,000 plus closing costs. That’s creates a huge barrier for many first-time home buyers.

Use these tips to help boost your down payment as a first-time home buyer.

by Owen | May 22, 2017 | Pay Off Mortgage

Today we’ve got a guest post on The Frugal Farmer. Laurie has an awesome personal finance blog where she talks about getting out of debt, building wealth and also homesteading in the Midwest.

When we bought our first home it was in the middle of the financial crisis. It came with a $240,000 mortgage. It was a ridiculous sum of money. It also seemed like a very risky time to buy, people were being laid off, the stock market was tanking, and we took on a massive amount of debt. It was the largest amount of money we had ever owed.

Financially, we’re pretty risk averse. We didn’t like the idea of owing someone a large amount of money. We knew we wanted to be mortgage free one day, but our dream to pay off the mortgage early started as a joke. We’d talk about it. We’d laugh. It seemed impossible.

Page 26 of 27«...2324252627»