by Owen | Mar 19, 2018 | Buying A Home, Down Payment

Mortgage insurance is one of those things that most first-time home buyers run into when buying a home. Unless you’re lucky enough to save up a 20% down payment you probably need to get mortgage insurance on your home.

So, what is mortgage insurance exactly? And why do you need it?

Mortgage insurance is a requirement for all homes with under 20% down payment (Some banks even require it for down payments of 20%+. But in those cases it’s the bank making that decision, it’s not actually mandatory).

Mortgage insurance helps protect the lender in case you default on your mortgage. It’s a way to provide stability to the housing market. The largest provider of mortgage insurance is the CMHC, a federally backed agency. This means that the federal government is essentially backing the Canadian housing market, and this adds a lot of stability for buyers, sellers and lenders.

by Owen | Mar 12, 2018 | Buying A Home, Pay Off Mortgage

Getting a mortgage for the first time can lead to all kinds of questions… one of those questions might be “how to do repay my mortgage?” or maybe you’re wondering “how do I make mortgage payments?”.

As a first-time home buyer you probably have no experience with mortgage payments, and you probably have a few questions. Sure, maybe you overheard your parents talk about their mortgage, or maybe you have a few friends with mortgage payments already, but if you’ve never had a mortgage yourself, you’re probably wondering how you make payments.

By comparison paying rent seems easy. When you’re a renter you sign a lease, hand over some checks, and the money comes out of your bank account each month. Pretty simple right?

But there is something about a mortgage that makes the whole thing seem a bit more daunting.

Things get even more confusing when you realize there are different types of payments. You have regular mortgage payments, top-up payments, and lump sum payments. You can also choose the frequency of payments, monthly, semi-monthly, bi-weekly etc.

Often these are things you’ll need to consider before signing your mortgage contract.

In this post, we’ll cover some of the different types of payments, fees you may face if you break your mortgage and some tips for changing payment dates and payment frequency.

This is good information to know before you sign your mortgage contract.

by Owen | Mar 5, 2018 | Buying A Home

Buying a home is a HUGE decision. Not only is it a lot of money, but there are multiple contracts to sign, and multiple people/parties involved. It’s a lot of responsibility. Plus, it’s a decision many of us will make before our 30th birthday.

One of the contracts you’ll need to sign as a first-time home buyer is a mortgage contract.

Signing a piece of paper and getting $100,000’s in return can be a surreal experience. Often, you’ll only put up a small fraction of the purchase price yourself and the rest will come from the bank. You put up $20,000 and they give you an additional $380,000 to go buy a house. Crazy!

As a first-time home buyer, it can be a nerve-wracking to take on all that debt.

Before signing a mortgage contract it’s a good idea to understand the basics of how a mortgage works. How much your payments will be. When your payments will occur. And probably most important, how much of your payment goes towards your loan.

by Owen | Feb 26, 2018 | Budgeting, Buying A Home

Before thinking about buying a home you need to decide how much house you can afford. Housing represents 35%+ of a typical household budget but buying the right amount of house will depend on your other financial goals.

Buying a house is one of the biggest financial decisions you’ll ever make. Amazingly, about half of us will make this decision before our 30th birthday.

According to Statistics Canada 50.2% of Canadians have purchased a home by age 30. Not surprisingly this is down from previous generations where 55.5% had already purchased their first home by age 30.

Making one of the biggest financial decisions of your life can come with a lot of questions, especially when you’re making this decision at such a young age.

One of those questions might be “how much house can I afford”?

Like many big questions, there isn’t just one answer. If anything, this question just causes more questions.

To figure out how much house can you can afford, you really need to ask yourself a few more questions before coming to the right answer.

by Owen | Aug 7, 2017 | Buying A Home, Saving Money

Living small is a great way to save money. Today we’ve got a guest post on 1500 Days To Freedom about how our family of four lives in just 1,000 square feet.

1500 Days To Freedom is a blog written by Mr.1500 (he blogs anonymously). The blog is about his family’s goal to achieve financial independence by amassing $1,000,000 of investments in just 1500 days. Check out our guest post about living small and please make sure to check out the rest of the site too!

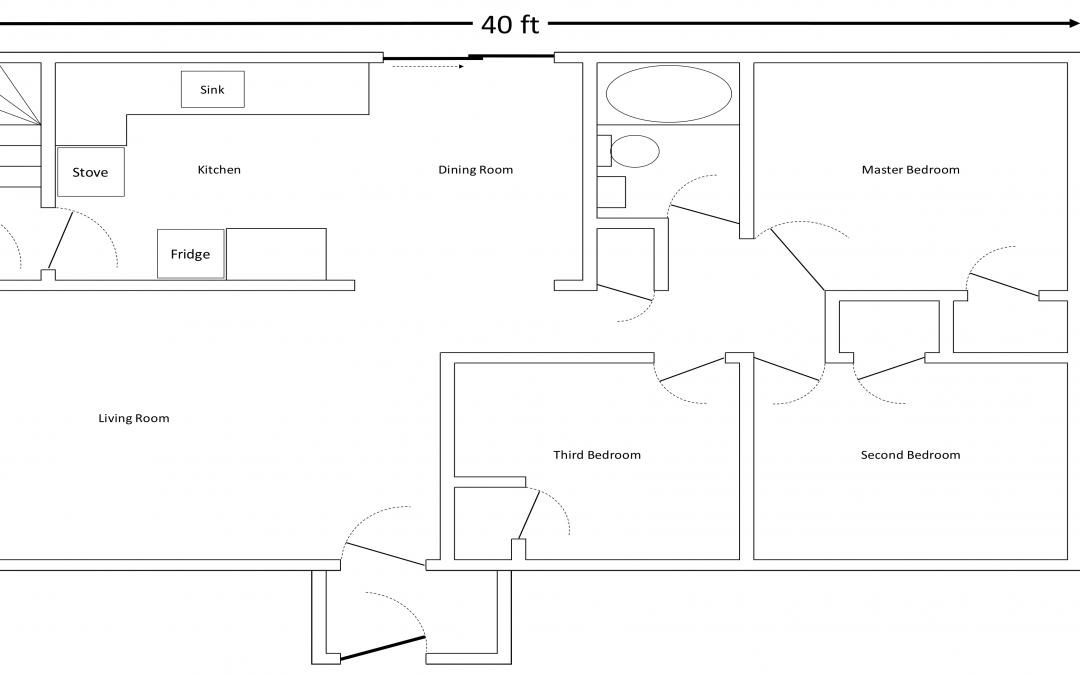

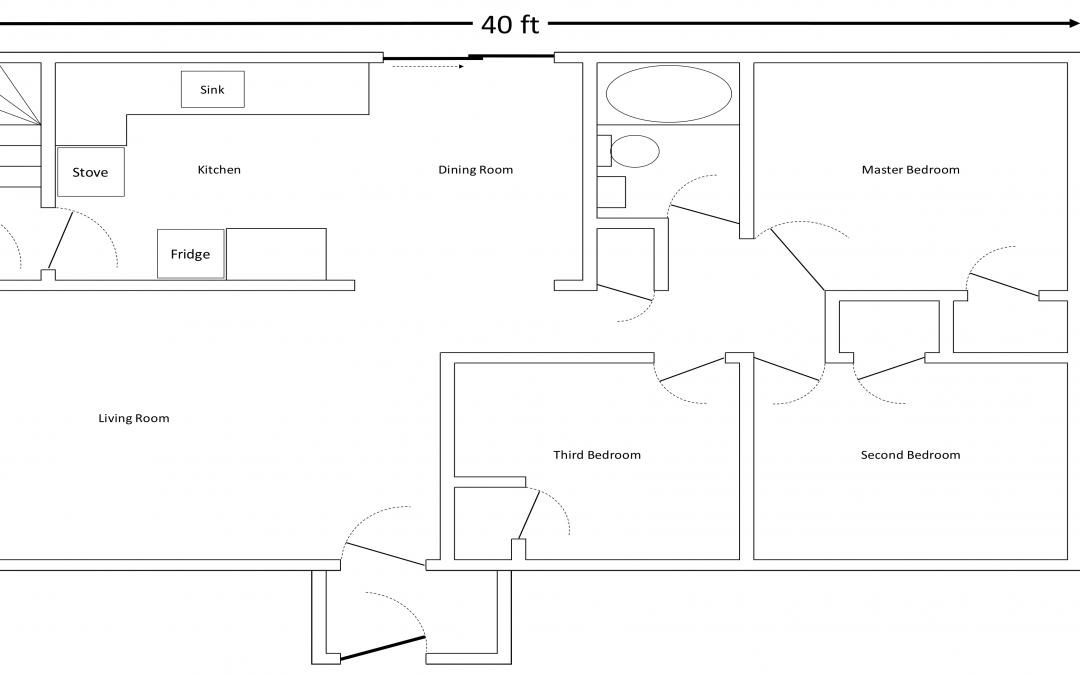

In the guest post you’ll find a detailed layout of our house. We live in a three bedroom bungalow that measures just 40ft by 25ft. We have a full size kitchen, living room and dining room but our bedrooms range from just ~80 square feet to ~120 square feet.

We chose to live small for many reasons, all of which are covered in the post, but one important reason was that it lets us save big. Our annual housing costs are approximately $15,000 lower than other family homes in our area.

Living small also allowed us to buy a house in a great location. This helps us save big on transportation every year.

In total, for both housing and transportation, our annual budget is only $13,220 per year.

by Owen | Jun 19, 2017 | Buying A Home, Saving Money

When first buying a home it’s hard to comprehend the sheer number of new expenses there are. There are mortgage payments, home insurance, property taxes, maintenance, water, sewer, electricity and gas, just to name a few.

When coming from a rental you may be blissfully unaware of all the new home expenses that you now need to budget for.

These extra expenses are tied directly to the size of your home. A larger home means larger expenses.

Before purchasing a new home consider all the expenses attached to your decision. Buying “just enough home” is a great way to save money. Buying “too much home” can cost thousands per year in extra expenses.

This is one of the main reasons my wife and I live with our two daughters in a small 1,000 sqft bungalow. Although we could afford a much larger home we chose to purchase something much smaller…