by Owen | May 24, 2022 | Behavioral Finance, Budgeting, Income, Investment Planning, Retirement Planning

Over the last few years the number of low-cost investment options has exploded in Canada. There are new and easy ways to create a low-cost diversified portfolio that isn’t dragged down by high investment fees.

There were always low-cost, do it yourself options, but they required a fair amount of manual work to make contributions, invest those contributions, and rebalance periodically (and let’s not forget, the stress of keeping yourself on course during a correction or recession).

But now there are new options available. In addition to a low-cost ETF portfolio or a low-cost mutual fund portfolio, there are options like low-cost “all-in-one” ETFs and low-cost robo-advisors.

These new options provide investors with new ways to invest in a low-cost portfolio without necessarily doing all the work themselves.

This has understandably put a lot of pressure on investment advisors who have historically charged extremely high fees on the investment products they sell.

The average investment fee on a mutual fund portfolio in Canada is around 2.3%. This can cause an enormous amount of drag on an investment portfolio. A $1,000,000 investment portfolio would experience a $23,000 annual drag from investment fees! That has a direct impact on how much retirement income you can create from your investment portfolio.

But switching from a high-priced mutual fund portfolio can be hard to do.

Even with the high fees, traditional investment options continue to dominate the investing landscape in Canada, but things are starting to change. For the first time ever, ETFs have outsold mutual funds. More money is flowing into ETFs than into mutual funds (bear in mind that you can also have high-priced ETFs, and low cost mutual funds, so this isn’t necessarily the best indicator).

But… if these low-cost investment options have been around for a while, why the slow change? Why aren’t more people switching?

There are three main risks people face when making a change of this kind, financial risk, emotional risk, and social risk. These risks can be difficult to overcome. Let’s understand each one and why they make breaking up with an investment advisor hard to do…

by Owen | May 16, 2022 | Behavioral Finance, Financial Planning, Investment Planning, Retirement Planning, Saving Money

When it comes to financial planning we often focus on the numbers, net worth, debt, rate of return etc. But half of financial planning has nothing to do with the numbers. Half of financial planning is about behavior. It’s about managing our behavior, our expectations, our emotions etc.

When it comes to personal finance, and specifically investing, we are often our own worst enemy. We make financial decisions based purely on emotion, often costing us more money down the road.

One of the most common mistakes we make is checking our investment portfolio too often. Investment portfolios are not something that should be checked daily or weekly (unless you’re day trading, which is a whole other conversation)

Checking our investment portfolios has become even easier with online brokerage accounts and financial aggregator apps like Mint.

But… just because it’s possible doesn’t mean you should.

The problem with checking your portfolio too often is that we don’t feel gains the same way we feel losses, even if they’re worth the exact same amount.

The emotional impact of a $10,000 loss is more than the emotional benefit from a $10,000 gain. It’s completely illogical, but that’s how we feel. We experience the emotional impact of losses more than gains. We remember losses more vividly, and for a longer period of time than we do for gains.

This is a problem when it comes to investing. Even though a well-diversified portfolio should gain over the long-term, it will likely experience some big swings in the short and medium-term. By checking our portfolios too often we experienced all those gains and losses, and because we feel losses more than gains, the net effect is that we can feel a bit sad.

What we need to do is check our portfolio less often, especially for medium and large portfolios. Let me explain why…

by Owen | Mar 28, 2022 | Behavioral Finance, Budgeting, Financial Goals, Financial Planning

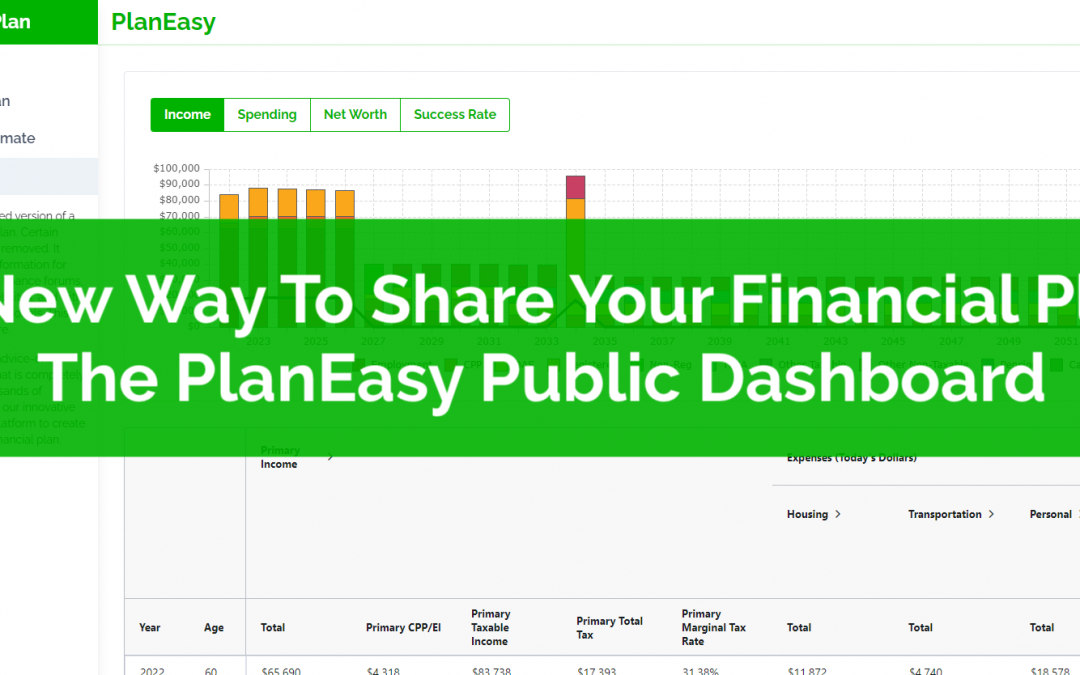

Talking about personal finances has always been somewhat taboo. It’s difficult to discuss personal finances with friends and family. Everyone has different values and goals. We all have different financial circumstances. And sometimes… talking about personal finances can lead to hurt feelings and personal strife.

This has led to many people avoiding personal finance discussions or discussing personal finances anonymously in online forums and communities.

But discussing personal finances in an online community can be difficult. Personal finances are personal. A financial plan can differ dramatically from one person to the next. To have a good discussion requires a lot of information, something difficult to do in an online community.

At PlanEasy we want to make financial planning easy. We want to make it easier to share and discuss personal finances online.

That’s why we’re introducing the PlanEasy Public Dashboard, a completely anonymous way for PlanEasy users to share their financial plan… let’s take a look at the Public Dashboard…

by Owen | Mar 20, 2022 | Behavioral Finance, Financial Planning, Investment Planning, Retirement Planning

Can you retire when the stock market is at an all time high? For many soon-to-be retirees this is an important question. It can be extremely nerve-racking to “pull the plug” and leave a stable income when investment values are at their peak.

But is this really a concern? Is it bad to retire when markets are at an all time high?

For many soon-to-be retirees, their investment portfolio will make up an important part of their future retirement income. Even retirees with a pension or full CPP/OAS will often have a small investment portfolio to support additional spending in retirement.

Many retirees worry about retiring at an all time high. They worry about a large decline in investment values soon after retirement. They believe this will dramatically impact their retirement plan. But is this concern justified? Or is this one of those biases that we’re all susceptible to?

Working for a few additional years would certainly help solidify a soon-to-be retirees financial plan, but at what cost? That lost time can never be recovered and could represent some “prime retirement years”. That income may also never be needed if everything goes to plan.

As it turns out, we’re actually at an all time high quite often, and the impact of retiring at an all time high isn’t even close to what we’d assume…

by Owen | Dec 26, 2021 | Behavioral Finance, Budgeting, Financial Goals, Financial Planning

Here we go again! It’s time for the New Year! It’s time for New Year’s resolutions and time for new beginnings (and it’s time to recover from all that holiday spending!)

After indulging in the gifts and the treats, a New Year’s resolution is the perfect time to change course, it’s the perfect time to focus on your personal finances, and there are lots of great financial goals to choose from!

Did you know that about half of us make a New Year’s resolution each year? While dieting, exercise, and eating right always seem to top the list, this year you should consider making a New Year’s resolution that is focused on your personal finances.

A New Year’s resolution is the perfect way to make a positive change in your life and it’s a great time to make a change to your personal finances too. The new year is the perfect time to reflect on your personal finance routine, take stock of your situation, and choose a great financial goal to focus on in the new year.

Why wait? Start your New Year’s resolution now. Don’t put all that pressure on New Year’s, start your resolution today!

If you’re looking for some inspiration we’ve got 18 great financial goals for your New Year’s resolution.

by Owen | Nov 15, 2021 | Behavioral Finance, Buying A Home, Down Payment, Financial Planning

One disconcerting phenomenon we’ve noticed recently is that many people, if they had to purchase their home again today, likely couldn’t afford it.

With changes to down payment rules and mortgage qualification, plus the recent increase in home prices, the “numbers” needed to qualify for a home purchase are higher than ever.

The fact is that many people, if they were to purchase again today, would be priced out of their own homes!

There are a few reasons for this, which we’ll explore below, but based on affordability today, many of us might not be able to afford the home we live in today if we had to purchase it again.

We will also share three examples below of people who purchased their home in the past but likely couldn’t afford the same home today if they had to purchase again.

Page 4 of 12«...23456...»