Case Study: Young and Ambitious

Jamie

The Situation

Jamie (age 25) just graduated 2-years ago. She recently got promoted and is now earning $73,000 per year. She has a good career path and expects her income to grow an average of 7% per year until age 35-40. Her goal is to be at an Account Director or maybe even VP in 10-15 years.

Jamie is focused. She wants a financial plan that is tailored to young professionals like her. She wants to feel good about her financial future. She wants to know exactly what to do each year. She has student loan debt that she would like to get rid of. She has a personal line of credit at a fairly high interest rate. She also has a bit of credit card debt from a recent vehicle repair. The debt is weighing Jamie down and she would like to make a plan to pay it off as soon as possible. She can allocate an extra $400 per month to go towards her debt but wants to know which debt to pay off first.

Her goal is to buy a small condo worth $450,000 in the next 5-years or perhaps a larger townhouse with a partner.

Jamie loves to travel and doesn’t want to compromise on travel spending, but she is willing to look at other categories to reduce spending, especially if it means paying off debt faster.

Her employer doesn’t have a pension plan but does match her 2% contribution to a Group-RRSP. She’s not focused on retirement right now but still wants to make sure she can retire in her mid 50’s and do more extensive travel. She’s also interested in the idea of taking “gap years” every so often even if it means working until age 60.

Jamie reads the typical money advice for young adults on personal finance blogs but now wants to create a more detailed financial plan.

The Goal

With a detailed financial plan Jamie can feel confident that she’s doing the right thing with her personal finances and that she’s on the right track to reach her future goals. She’ll be able to buy a condo, travel on a regular basis, and even take some sabbaticals in the future.

The Approach

Self-Directed Plan plus four 60-Minute Sessions over 1-year.

Jamie used the PlanEasy platform to create her own financial plan and then reviewed it with an advice-only financial planner during a separate 60-minute session. With the help of the PlanEasy platform, Jamie created her financial plan by…

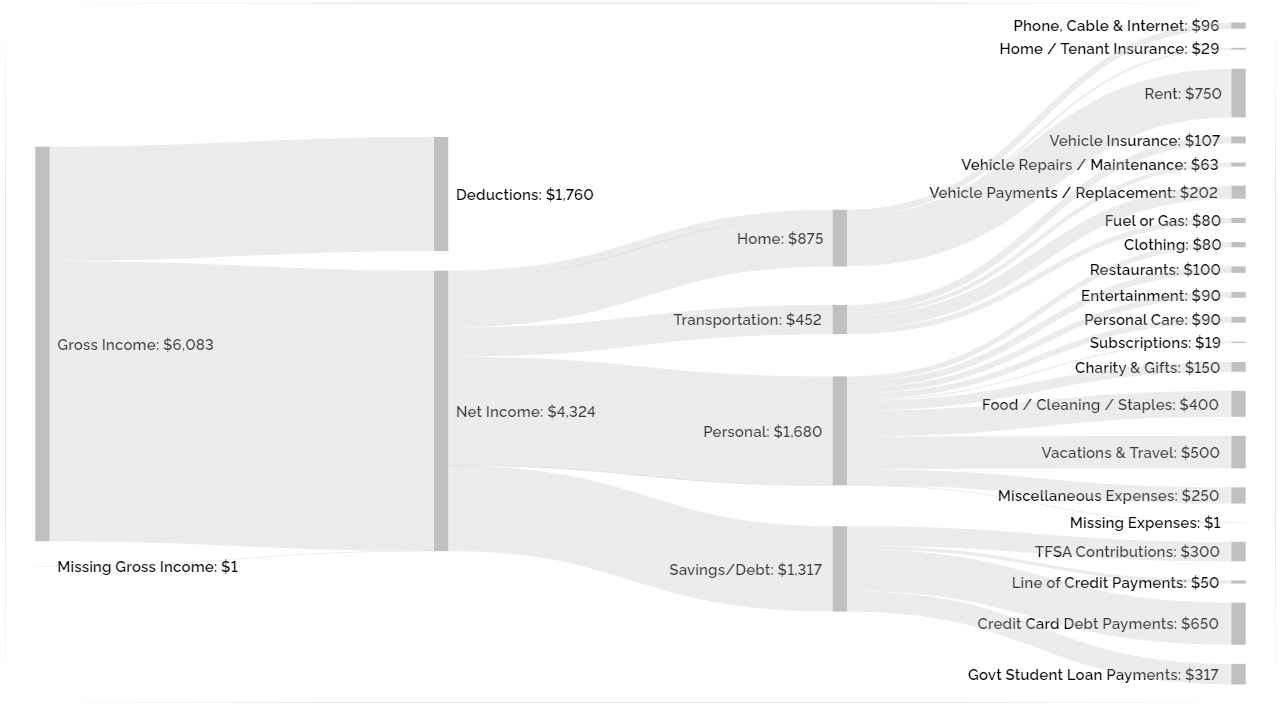

- Visually mapping income, spending, savings, and debt payments

- Anticipating increases in income with future promotions

- Testing a few different debt repayment strategies

- Creating a risk profile, investor profile, and a basic investment plan

- Planning for future infrequent expenses so she won’t be surprised by an unexpected expense ever again

- Calculating the ideal amount to keep in an emergency fund

- Planned for a down payment and home purchase in the future

- Restructuring investment contributions for optimal tax and benefit efficiency

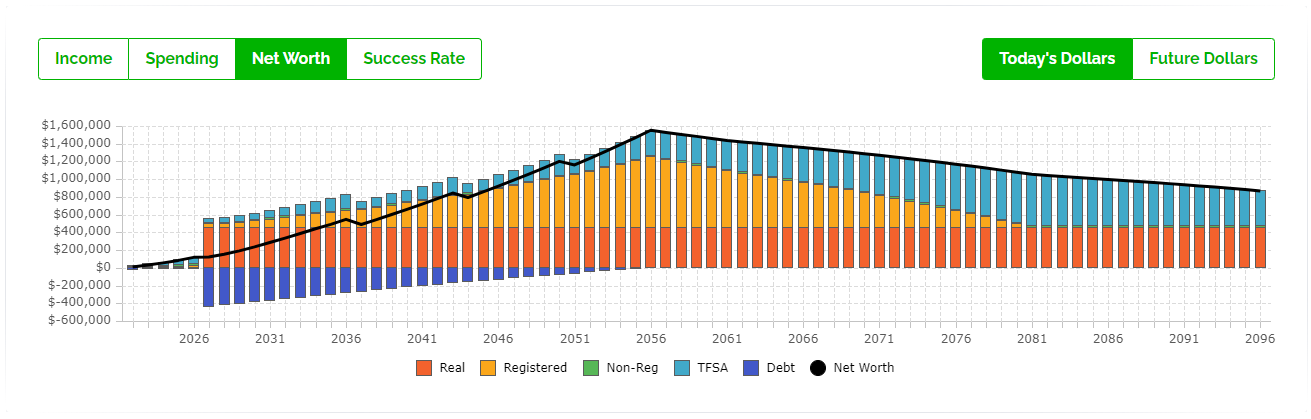

- Projecting future savings rate and net worth and created a clear goal to work toward each year

- Planned for regular travel & vacations each year plus three future sabbaticals

The Plan

Jamie started by mapping her current income and spending to get a good sense of where her money is going today. She entered the values from her most recent paystub and entered expenses based on the last 6-months of credit card statements. In the past she wasn’t saving for vehicle repairs or upgrades, so the first step was to create dedicated “funds” for these future expenses with monthly contributions. Overall, she has a good savings rate but most of that is going towards debt payments at the moment.

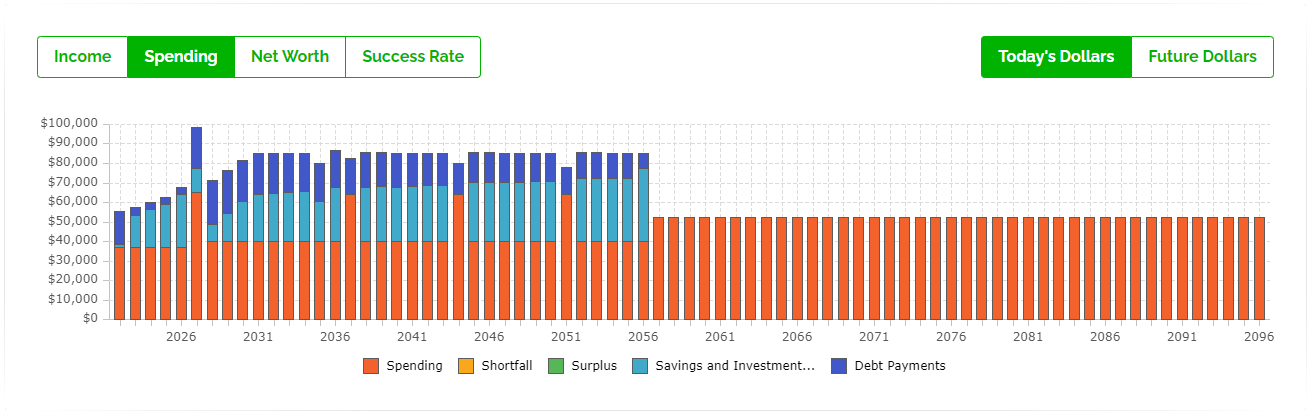

Jamie also wanted to map out a debt payoff plan. If the TFSA contributions of $300 per month are temporarily redirected to debt payments that would provide $700 per month towards debt repayment. The credit card debt should be eliminated in the next 7-months and the line of credit about 6-months after that. With these debts gone, this will then free up some cash flow to build a small emergency fund. At her current level of spending, and being a renter with no dependents, she’ll target $12,000 in emergency savings after the higher interest debt is paid off. The student loan doesn’t have to be paid off right away, not only is the interest rate low, but it provides a small tax deduction.

After building an emergency fund Jamie has a lot of capacity to save. She plans to target a 5% down payment in a TFSA savings account (and a TFFHSA in the future). She won’t use the RRSP Home Buyer Plan because she expects her income to increase in the future, that RRSP contribution room will be more valuable when Jamie is in a higher income tax bracket and/or if she has children (RRSP contributions can help boost the Canada Child Benefit). She plans to purchase a condo in 2027 and the PlanEasy platform automatically includes the extra spending for closing costs etc.

Jamie also plans for a sabbatical every 7-years starting at age 40. It’s an ambitious plan because it means no income for 12-months plus additional spending for travel. She plans to save aggressively in between sabbaticals to help fund the year off but this causes her net worth to dip slightly during each sabbatical. This may extend her retirement date slightly but would still allow for an age 60 retirement.

Next Steps

Jamie has an ambitious plan. She’s planned for a healthy amount of travel spending each year. She’ll pay off her debt within the next 13-months. She’ll be able to purchase a home in 5-years. She’ll also be able to take a 12-month sabbatical every 7-years starting at age 40.

Jamie’s rising income will make this plan possible. She now has very clear goals to strive towards each year. This was exactly the type of detailed planning Jamie was looking for.

Jamie can now focus on her career and update the plan once or twice a year as her situation changes. Now that her plan is all set up, Jamie can log into the PlanEasy platform and make changes on her own. As she gets promotions or merit increases, Jamie can adjust income assumptions and see the effect on her plan right away. If there is a big change, Jamie will book another call with an advice-only financial planner to update her plan.

Want to see Jamie’s plan in more detail? Click the link below to see her “PlanEasy Public Dashboard” that includes all her income and spending information, detailed projections, and success rate.