Canada Child Benefit:

The Hidden Tax Rate

Children are expensive. No question about it. There are some obvious expenses like day care, clothing, food and diapers. Then there are some less obvious expenses, like owning a larger home or a larger car.

Thankfully, for low and moderate income earners, there is a special benefit called the Canada Child Benefit (CCB) that can help offset some of these expenses.

Benefits start at $6,500/year for each child under 6 and $5,400/year for each child between 6 and 17. These amounts get reduced as soon as a family’s taxable income passes $30,000. Eventually the benefit diapers entirely. For someone with two children under 6, the benefit disappears entirely once family income crosses $207,000.

The Canada child benefit gets clawed back for each incremental dollar in taxable income the family earns. It works essentially the same as a tax rate. Except its effect is slightly hidden.

The Canada child benefit isn’t the only income tested benefit that gets clawed back. There are more government programs that claw back benefits as you earn more income.

The Hidden Tax Rate:

The ‘tax rate’ effect of the Canada Child Benefit is slightly hidden because it doesn’t take effect until the following July.

The Canada Child Benefit is recalculated each year after you submit your taxes (Haven’t submitted? Then there’s no benefit. One very good reason to do your taxes each year).

New payments, which are based off your prior year taxable income, begin in July. There could be up to a year and a half of delay between increasing income and seeing a reduction in your child benefits. This delay makes it hard to see the link between higher income and reduced benefits. But it’s there.

Example: You receive a $5,000 raise on January 1, 2017. For a while you’ll have a higher net income because only income taxes will be withdrawn. Then, a full 18 months later, BOOM, there’s a reduction in your child benefits on July 1, 2018. You’ll have a higher net income for a while but then eventually your benefits will drop.

Even though there’s a delay, the net effect is the same, earning extra money causes your CCB to drop the same way as paying extra taxes. When your income goes up your CCB will go down. The money left in your pocket for spending is reduced.

Related Posts:

Your Real Tax Rate:

If you have kids its important to know what your real tax rate is. It’s very important when making financial planning decisions. Knowing your real tax rate will help you evaluate different investments. It will help you decide which tax sheltered account to use. It will help you pay less taxes overall.

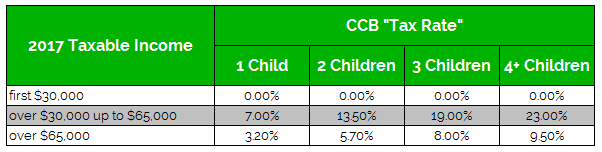

The impact of the CCB “tax rate” can be quite large. For a family with three children earning less than $65,000 per year there is a 19% claw back on every incremental dollar earned!

Getting a raise from $60,000 to $65,000 per year will result in an extra 19% tax on top of your normal tax rate. That raise will result in a $950 reduction in your child benefits the following year. This is on top of the $1,483 that is taken in regular taxes*

From the original $5,000 raise only $2,568 stays in your pocket. Nearly a 50% tax rate!

Here is a table of the hidden CCB “tax rate” for various incomes and number of children.

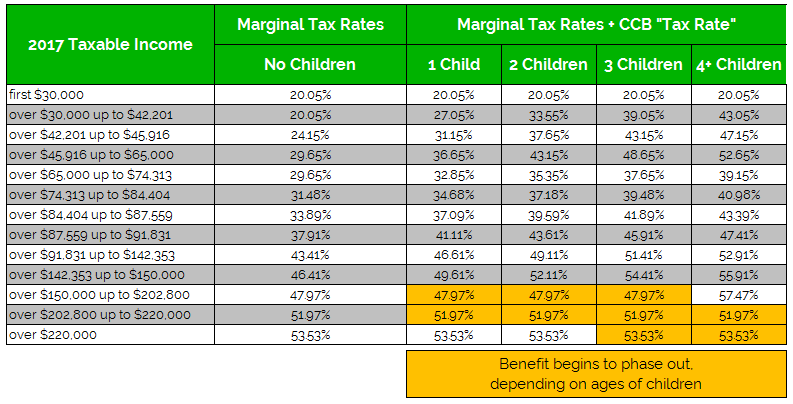

To get an idea of how this can change current tax rates we’ve integrated the hidden CCB “tax rate” into the Ontario marginal tax table. Notice how high the tax rates are even for low income families. A family with three kids earning between $45,916 and $65,000 has a marginal tax rate of 48.65%! Without children, you wouldn’t reach that tax rate until your income is over $200,000.

This gets even worse when you add other income tested benefits. Families with children can have marginal effective tax rates as high as 60-70%!

“The impact of the CCB “tax rate” can be quite large. For a family with three children earning less than $65,000 per year there is a 19% claw back on every incremental dollar earned!”

Tax Planning Opportunities:

For families with children or families who are planning to have children soon, knowing your real tax rate can create some unique tax planning opportunities. This can help you reduce the amount of tax you pay over your lifetime.

RRSP contributions lower your taxable income which is used to calculate the Canada Child Benefit so a larger RRSP contribution means you’ll get a higher CCB the following year. The timing and size of RRSP contributions creates an interesting tax planning opportunity.

For example, low income earners are usually told to use their TFSA account for retirement savings due to their low marginal tax rate. However, when a low-income family has children this changes because of the incremental CCB “tax rate”. It can make more sense to prioritize RRSP contributions because contributions will increase your Canada Child Benefit.

There are other opportunities. For example, a couple planning to have children soon may choose to prioritize TFSA contributions before their children are born and then switch to aggressive RRSP contributions. They may even choose to liquidate their TFSA’s to make even larger RRSP contributions to take advantage of their high “tax rate” and get a larger “tax refund” (RRSPs contributions would result in a regular tax refund plus an increase to their CCB in the following year).

Another example would be a family that has children reaching the age of 17. At this point CCB benefits will cease. It may make sense for families in this situation to prioritize RRSP contributions to increase their CCB benefits before they end. Potentially taking out RRSP loans that can be paid back in the following year when the tax refund is received and CCB benefits increase.

Are there other tax planning opportunities that you think might be interesting? Make a comment below.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Nice to see the post about the CCB being clawed back, which many seem to not consider when doing their RRSP planning. I found an RRSP contribution calculator that does take the CCB into account as well that is worth checking out. It is at https://www.rrspcontribution.ca

Very cool calculator Simon, thanks for sharing. That’s a neat way to visualize the effect RRSP contributions have on tax and benefits.