Building A Wealth Snowball

A lot of focus gets placed on the BIG personal finance decisions, buying a home, using a TFSA versus an RRSP, which investments to use etc etc. But really, it’s the small decisions, the ones we make daily, weekly, monthly, these are the decisions that have the largest impact on our personal finances.

When we look at someone’s financial journey, it’s typically not made up of leaps and bounds but rather small steps and steady progress. There typically isn’t one defining moment that leads to someone’s wealth. It’s usually a repeated process of saving and investing.

Like a snowball, wealth usually starts small, but it builds quickly. It generates more and more momentum as it gets larger until it becomes something unstoppable.

To build a wealth snowball is simple. It requires commitment in the beginning, with new contributions made on a regular basis. It requires growth, those contributions need to be invested and any investment income needs to be reinvested. And it requires time, time for the wealth snowball to gain momentum.

Given those three factors, at some point in the future, the wealth snowball will be driven not by contributions but by growth. New contributions will be dwarfed by annual investment growth and the snowball will grow faster and faster.

The important thing when building a wealth snowball is to stay on track, ensure spending is less than income, ensure the leftover gets invested regularly, and keep focused on the long-term because it takes a bit of time before growth overtakes contributions.

Income vs Spending

The starting point for building a wealth snowball is simple, it’s spending less than you earn. If there is nothing left to invest each month, then it becomes impossible to build a wealth snowball.

The first step is to have monthly spending that is less than monthly income. This left-over amount becomes the start of a wealth snowball that will grow over time.

The lower spending is, and the higher monthly savings are, the faster the wealth snowball will grow in the beginning.

Growing The Snowball With Investments

With regular monthly contributions the next important factor is how those contributions are invested.

A high-interest savings account doesn’t have the growth necessary to build a large wealth snowball. To build a wealth snowball we need an investment that can provide a higher growth at a reasonable level of risk.

Thankfully there are multiple new ways to invest. Over the last 5-10 years we’ve seen the introduction of low-cost ETF investing, robo-advisors, and now “all-in-one” ETFs. These options make it easier than ever to create a highly diversified portfolio that is low cost.

When contributions are made to a low-cost, highly diversified investment portfolio, the wealth snowball will grow dramatically…

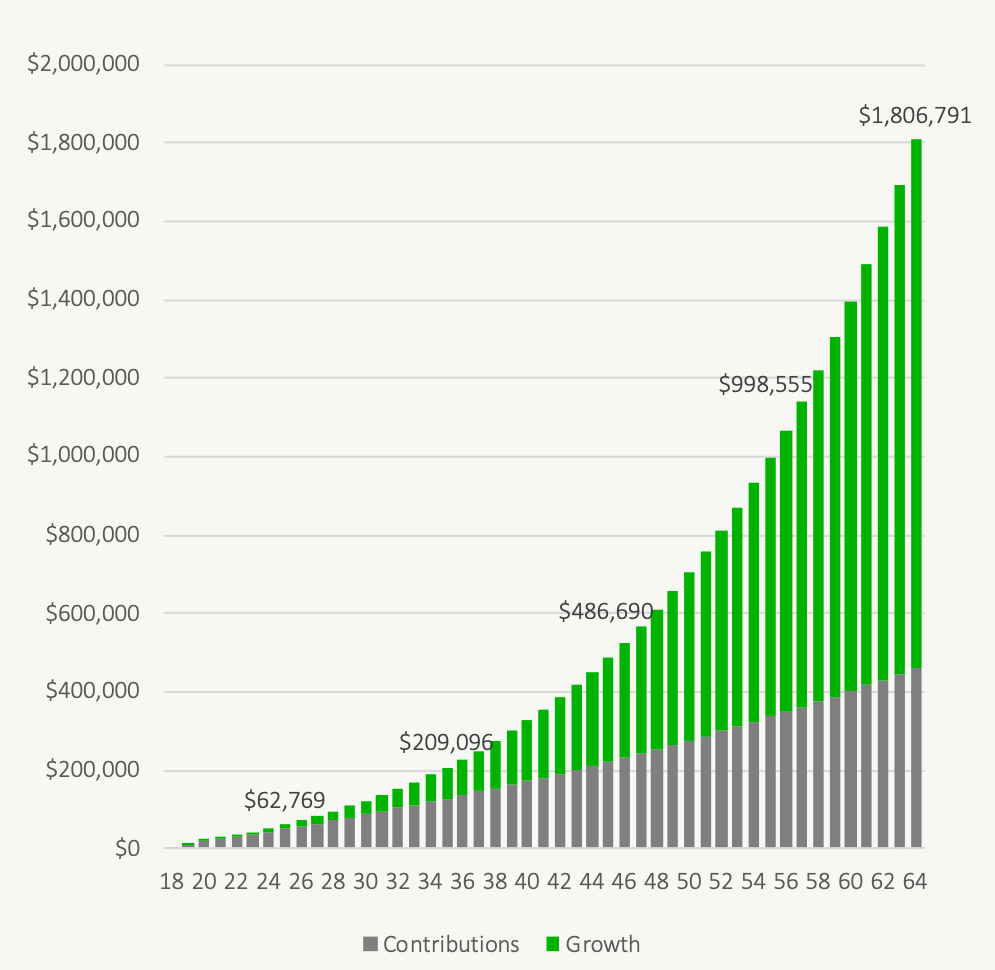

*We assume a contribution of $500/month from age 18 to age 64 and that these contributions increase with inflation. We assume investment returns after fees of 5.55% based on a 75/25 portfolio of equities/fixed-income.

Contributions vs Investment Growth

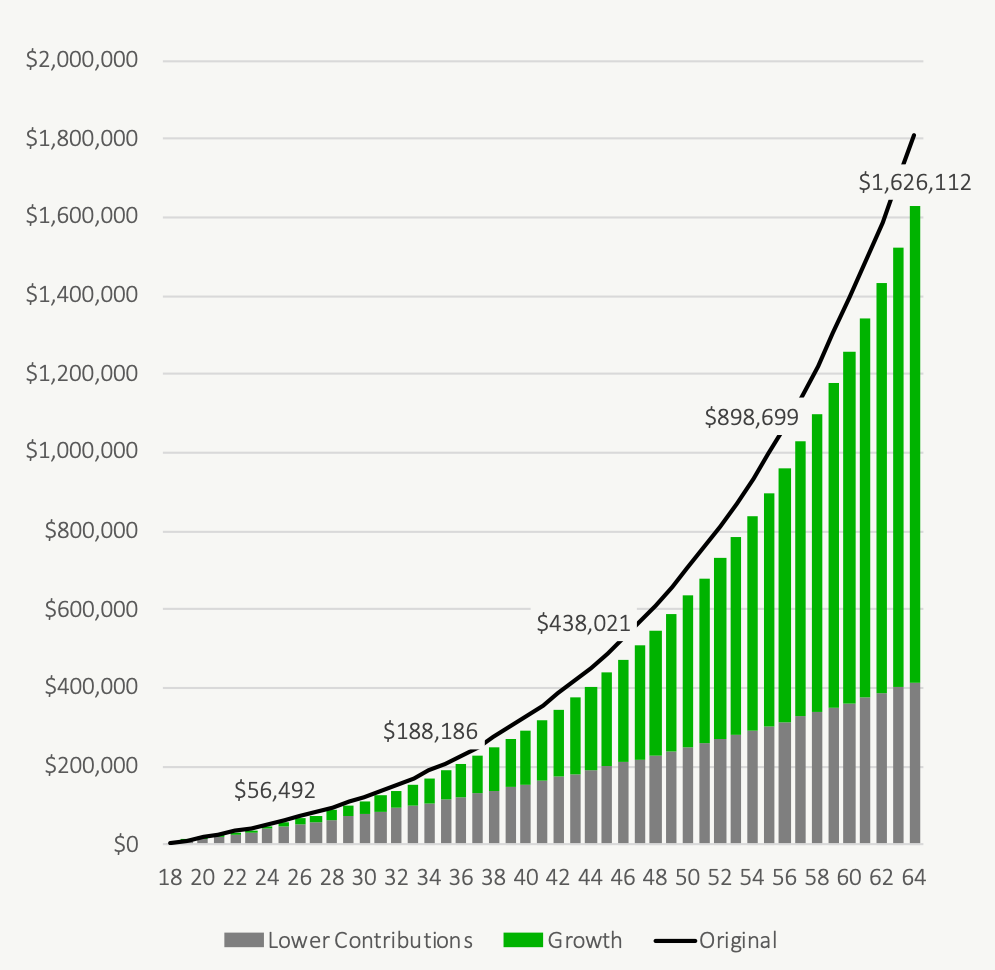

One of the reasons the wealth snowball is so powerful is that over time, investment gains begin to dwarf contributions. Compounding takes hold and begins to grow the snowball faster and faster.

How long it takes to reach this point depends on the growth rate we’re assuming for investments. As the snowball starts to take shape it’s the monthly contributions that do most of the work. But over time, investment growth creates more and more momentum and drives the snowball to amass more and more wealth.

With a reasonable assumption for annual investment gains we would expect investment growth to overtake contributions after about 15-20 years. This highlights the commitment required in the beginning to grow the wealth snowball to a decent size. For the first 15-20 years it’s contributions that do the majority of the work.

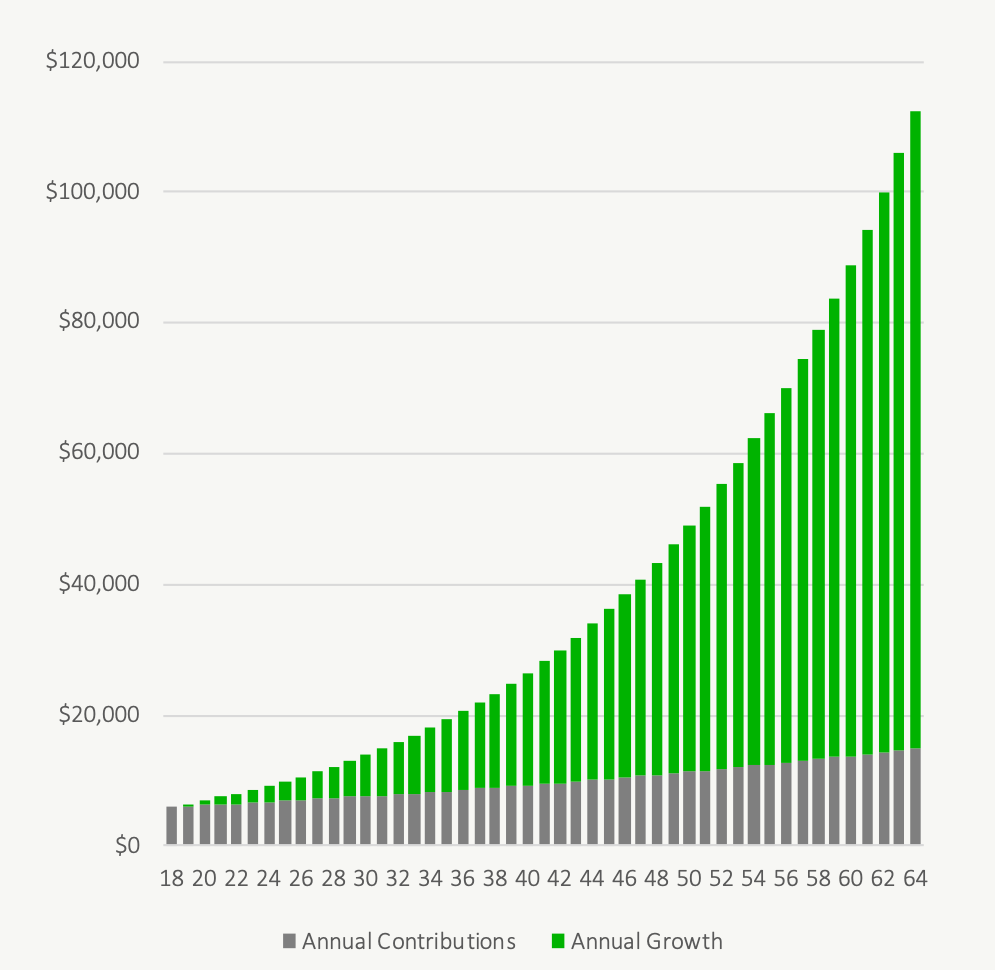

By the end however, contributions are adding just a small portion to the snowball’s annual growth. Investment returns now provide the vast majority of wealth accumulation (by a factor of 5x-6x!). This is how annual contributions compare to annual investment growth over time.

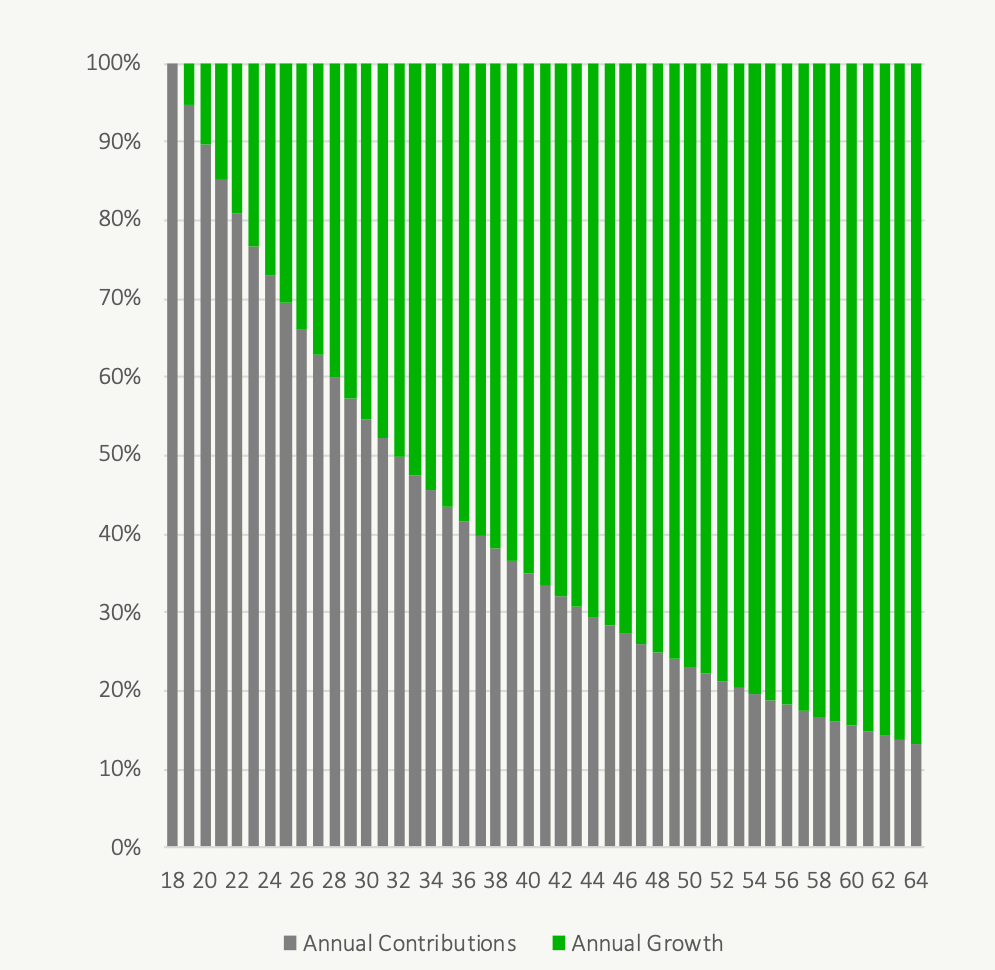

Here is the ratio of annual contributions to annual investment growth over time. Notice how in the beginning the wealth snowball is driven by contributions, but over time this switches and the wealth snowball is driven by investment returns. It takes 15-years (age 32) before annual growth is equal to annual contributions (50%/50%). After this point annual investment growth drives more and more of the annual increase. By the end, annual growth is larger by a factor of 6.5x.

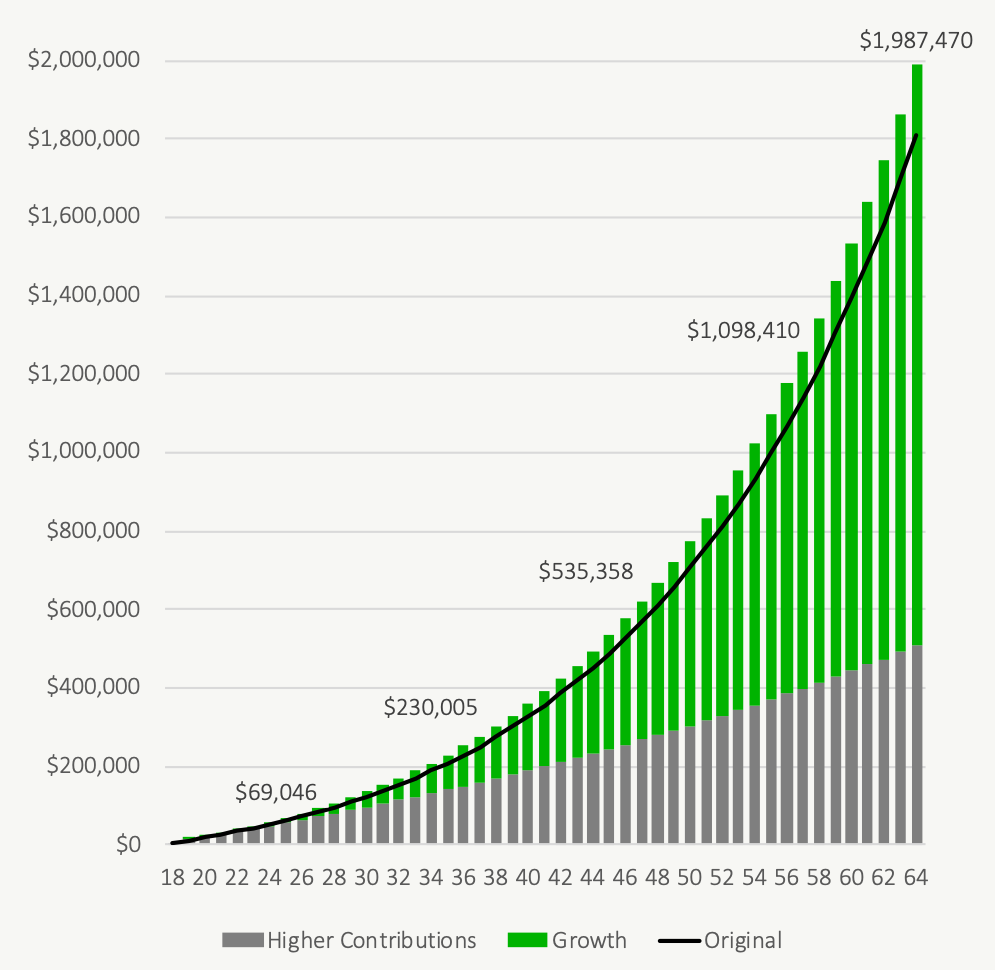

Slightly Higher Contributions, Vastly Higher Wealth

Because of how important contributions are in the beginning, a seemingly small increase in contributions can lead to a vastly higher amount of wealth.

Adding $50 to monthly savings is a seemingly small amount. That’s less than $2 per day or about $12.50 per week. That’s a relatively small amount of money. It’s lunch once per week or a daily coffee. But for the wealth snowball it’s more significant. This extra $50 monthly contribution translates into $180,000+

But this power is also something that can work against the wealth snowball. Cutting into monthly savings, even by a small amount, can have a dramatic difference in wealth accumulation over time. Removing $50 from each monthly contribution will cut the size of the wealth snowball by the same $180,000+. It highlights the importance of the small things. The daily discipline to stick to a plan and the benefit of having strong spending habits.

Building A Wealth Snowball

When building a wealth snowball, it requires a few things. It requires commitment in the beginning, the first years are important because the wealth snowball is driven by these contributions in the early years.

It requires growth. Those contributions need to be invested in a low-cost highly diversified portfolio and any investment income needs to be reinvested on a regular basis.

It also requires time. Time for the wealth snowball to gain momentum. In later years investment gains do most of the work, but it takes time and patience to reach this point.

Lastly, it requires contributions to be made on a regular basis over a long period of time. This discipline is important because even a small change in monthly contributions, a seemingly insignificant amount at the time, can translate into hundreds of thousands of dollars over the long-term.

Building a wealth snowball is the easiest way to secure financial freedom. A little bit of effort, over a decent period of time, is all it takes to get the wealth snowball rolling.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

The taxes you pay grow faster than savings. Even the stock market crashes you do not get pay less taxes. But if you

can make it then you will get “claw-backs” from the government. Any win-win formula?

Hi Cecilia, the plan/charts above assume an investment contribution of $500 per month, inline with the current TFSA contribution limit. That means no tax on investment growth and no reason to worry about government clawbacks 🙂

For anyone who already has a large RRSP balance, “clawbacks” can be a concern, but with some careful drawdown planning those clawbacks can be reduced significantly.