Congratulations! You’re on the waitlist!

We will e-mail you before the bootcamp launches for an exclusive preview.

Check out our latest blog posts…

The Benefits Of Retirement Planning

Retirement planning is complex and includes many important considerations like retirement spending, income tax planning, income splitting, maximizing government benefits, deciding when to take CPP and OAS etc. etc.

All of these individual parts work together to create a great retirement plan. They are so important that even a small mistake can mean lower retirement spending or a higher chance of running out of money in the future. It could mean $10,000’s in extra tax or $10,000’s in reduced government benefits.

With a typical retirement plan spanning 30-40+ years it’s easy to understand how small change in assumptions can have a big effect on a retirement plan.

There are also many small decisions to consider when planning retirement, like when to convert RRSPs to RRIFs, when to start CPP, when to start OAS, how much to draw from investment assets, which investment assets to draw from first etc. etc.

In this post, we look at some of the important parts of retirement planning. What they are, what you should consider, and some additional resources to help.

How Do Tax Returns Work When There Is An RRSP Contribution or Withdrawal

The RRSP is a great financial planning tool. Investments grow tax-free within the account. Contributions to an RRSP reduce taxable income. And in some unique circumstances, it may even be advantageous to make contributions in one year and then deduct them in future years.

RRSP contributions and withdrawals will decrease and increase taxable income respectively. This effect can be seen on the tax return.

So, how do tax returns work when there is an RRSP contribution? What effect does an RRSP contribution have on the tax return?

And what about in the future? What happens when RRSP withdrawals are made? What effect does an RRSP withdrawal have on the tax return?

These are important questions. The benefit of strategic RRSP contributions and withdrawals can be $10,000’s or more.

Understanding how RRSP contributions and withdrawals affects your tax return is very important for Canadian retirement planning. We’ll go through the basics of how RRSPs work, as well as a few examples to show how an RRSP contribution or withdrawal shows up on the tax return.

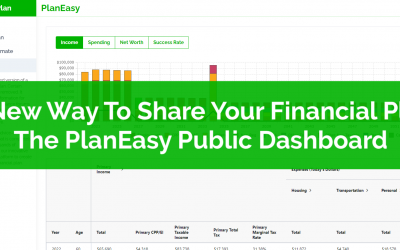

A New Way To Share Your Financial Plan: The PlanEasy Public Dashboard

Talking about personal finances has always been somewhat taboo. It’s difficult to discuss personal finances with friends and family. Everyone has different values and goals. We all have different financial circumstances. And sometimes… talking about personal finances can lead to hurt feelings and personal strife.

This has led to many people avoiding personal finance discussions or discussing personal finances anonymously in online forums and communities.

But discussing personal finances in an online community can be difficult. Personal finances are personal. A financial plan can differ dramatically from one person to the next. To have a good discussion requires a lot of information, something difficult to do in an online community.

At PlanEasy we want to make financial planning easy. We want to make it easier to share and discuss personal finances online.

That’s why we’re introducing the PlanEasy Public Dashboard, a completely anonymous way for PlanEasy users to share their financial plan… let’s take a look at the Public Dashboard…