Are You Saving Too Much For Retirement?

Target Retirement Savings By Age

You need less for retirement than you think. Numbers are often thrown around for retirement, $1 million comes up often, probably because it’s an nice round number. Now they’re saying $1 million isn’t even enough. Now they’re saying you need more, maybe as much as $2 million.

The truth is…. that’s utterly ridiculous. The average Canadian won’t need $2 million to retire and if you’re targeting that amount (or even $1 million) you might be saving TOO MUCH for retirement.

Where are these lies coming from? My guess is from the financial services industry in general. In general, the financial services industry gets compensated for investments under management, products sold, and debt/mortgages. This leads to quite a bit of biased information coming from the financial services industry.

The sad truth is that the more money you save the more “they” get paid. They don’t want you to settle for $1,000,000 in savings when $2,000,000 could mean more in annual fees. How much more? About $23,500 more in annual fees.

That’s not a typo. You read that right. The average mutual fund fee in Canada is around 2.35%. Annual fees on a $2 million portfolio are $47,00 per year, PER YEAR, when it’s invested in the average mutual fund portfolio.

No wonder they keep telling us to save, the more we save the more they earn.

The crazy thing is that the fees on a $2 million mutual fund portfolio are enough to fund the average retirement. Imagine, the FEES ALONE are enough for the average retirement, and yet they continue to tell us we need to keep saving.

So how much do you actually need for the average retirement? How much should you have saved? What is the target retirement savings by age? It’s less than you think. But first, let’s cover a few assumptions.

Retirement Assumptions

When we’re talking about the average retirement we’re going to use roughly the median income for seniors in Canada. For an individual, we’re going to use $36,050 and for a couple we’re going to use $64,800. If you’re earning an above average income today, or you want to have a more luxurious retirement, then you may need to boost your savings accordingly.

This income may not seem like a lot, but we’re also going to assume that they have a paid off home or condo, this means living expenses in retirement will be much lower than they are today.

We’re also going to assume they retire at the typical retirement age of 65. This means they will immediately qualify for CPP and OAS. We’re going to assume they get the full OAS of $7,210 per person per year. And we’ll assume the average CPP of $8,077 per year. We’ll also assume they’re eligible for seniors’ tax credits that will eliminate all (or at least most) of their income tax each year.

We’re also going to assume that they use a TFSA for retirement savings. This means there are no taxes to worry about on withdrawals. We’re also going to assume a somewhat assertive 80/20 portfolio of stocks and bonds leading up to retirement and a slightly more conservative portfolio of 70/30 stocks and bonds after retirement.

In all the calculations, we’re assuming a constant rate of return, which isn’t actually realistic. You could be ahead of your target retirement savings this year and then fall way behind the next year due to poor returns or a stock market correction. This matters less when you’re far away from retirement, but can make a big difference if you’re only a few years away.

Lastly, we’re going to assume we want this money to last from age 65 until age 100. We’re assuming a nice long 35-year retirement, which is pretty conservative.

If any of these assumptions don’t fit your particular situation then you may want to consider a custom financial plan with an advice-only financial planner to help you determine exactly what your goals are and how much you need to save.

How Much Do You Need? Less Than $1 Million

Based on these assumptions we have two numbers that we need to target for after-tax income in retirement.

For a single individual, we need to target income of $20,763 per year coming from savings. To get that number we start with our target spending of $36,050 per year and subtract CPP of $8,077 per year and OAS of $7,210 per year.

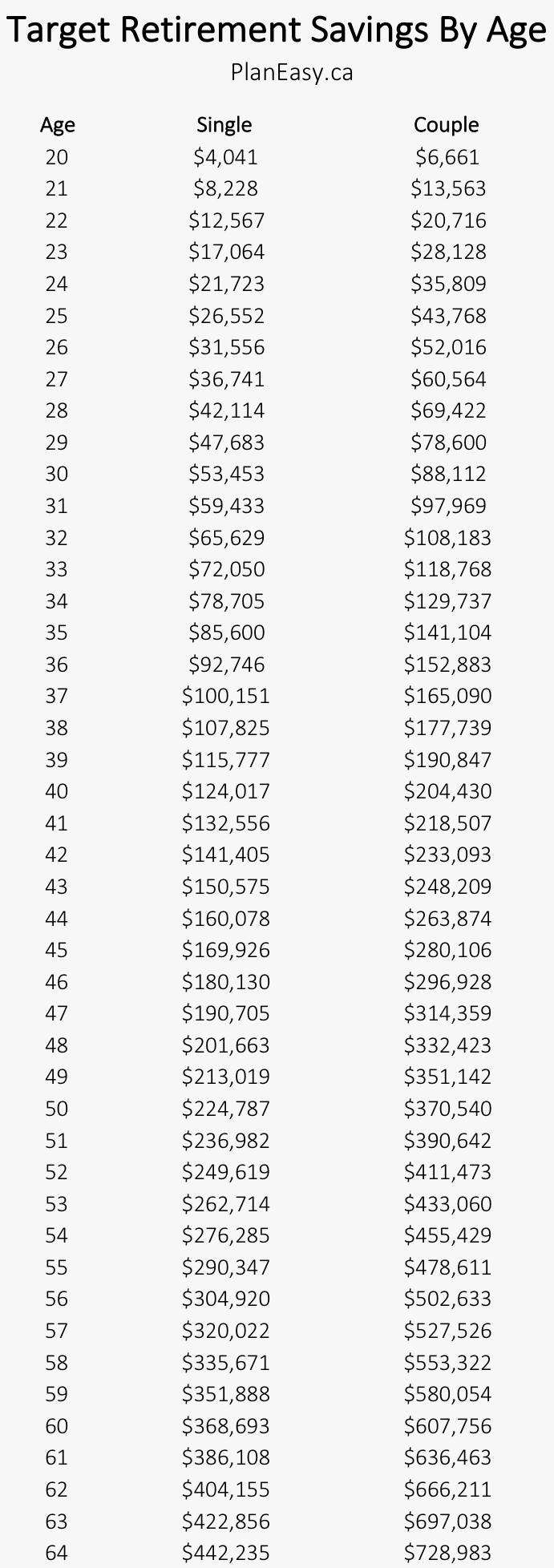

To get $20,763 of annual income from their TFSA in retirement they need to have $442,235 saved by the time they turn 65.

That’s our savings goal for our individual, $442,235 at age 65 (in today’s dollars).

For a couple, we need to target income of $34,225 per year coming from savings. To get that number we start with our target spending of $64,800 per year and subtract CPP of $16,154 per year and OAS of $14,420 per year.

To get $34,225 of annual income from their TFSA in retirement they need to have $748,983 saved by the time they turn 65.

That’s our savings goal for our couple, $748,983 at age 65 (in today’s dollars).

Even for a couple we’re way below $1 million, let alone $2 million.

Related Posts:

- What is a Good Retirement Budget?

- Retirement Planning for Young People

- Retirement Planning for Young People

Target Retirement Savings By Age

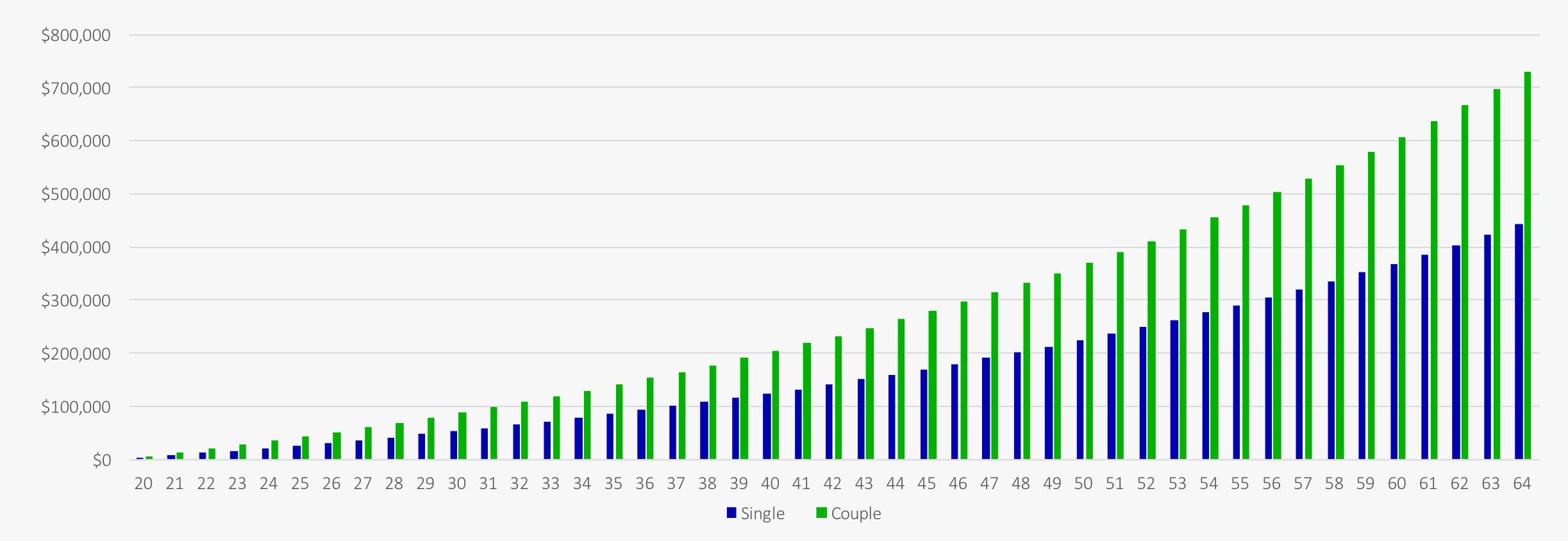

Now that we know how much we need by age 65 we can work backwards and figure out exactly how much we need to target in retirement savings for each age.

Thanks to the power of compound interest the target retirement savings by age are very realistic at younger ages. Saving early on will let compound interest do much of the work. By age 30 our couple will need a total of $88,112 in retirement savings. By age 40 they need $204,430. By age 50 they need $370,540.

Warning! Because we’re assuming these savings are in a TFSA if you have money in an RRSP you need to reduce those amounts by 20-30% before comparing vs the target retirement savings by age. This is because RRSPs are pre-tax and any withdrawals will require income tax to be paid plus they will reduce your government benefits too. Find out if you should be using a TFSA or an RRSP, the difference could be huge!

Notice how quickly the target retirement savings ramps up as you approach retirement age. This is thanks to compound interest. By saving early you can let compound interest do a lot of the work.

We’ve added a table below with the target retirement savings by age to make it easier to look up specific values by age. Remember the assumptions above when using these values. If you have an above average income today and/or have expectations of an above average retirement, then you may need to save more than the values below. If this is the case you may benefit from a custom financial plan from an unbiased financial planner to help you determine exactly how much you need.

Disclaimer: There is no one-size fits all retirement plan. Each situation is unique. This post is for entertainment and informational purposes only. For a retirement plan that fits your specific situation please speak with a fee-for-service financial planner.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

So your saying we DO need $1,000,000.

It is quite common that companies match RRSP contributions, meaning that most Canadians are putting their retirement savings into RRSPs … not TFSAs. Advisers can argue all they want about whether TFSAs or RRSPs are best for retirement savings, but unless we want to give up the RRSP matching from our employer, it’s no question that retirement savings happens in an RRSP.

Per your pre/post tax warning above we need to have 20 to 30% more that $700,000 in RRSPs … where does that leave us … ~$1,000,000

You’re absolutely right Thomas, RRSPs create an extra burden, only part of those savings are yours and the rest belongs to the government.

In this example, if we assume Ontario tax rates, the couple would need approximately $936,000 if only using RRSPs. Their withdrawals would be taxed at a marginal rate of 20.05%.

So what happens if I’m 40 years old and 25 years away from retirement?? You indicate that I need 748,983 saved in today’s dollars to retire. OK now some math:

Assuming a conservative 2% inflation and 25 years to retirement

748,983 * 1.02^25 = 748983 * 1.64 = $1,228,785

This is over a million dollars. People tend to forget about the ravages of inflation which eat away your buying power.

Hi Mike, yes, inflation will certainly increase these values in the future, but the goal is to provide a benchmark for people today. In today’s dollars a 40-year old couple needs around $200,000 assuming they keep contributing and investing over the following 25-years, that’s a much better benchmark than saying they need $1.2 million in 2046 dollars, which is much more abstract and discouraging.

Great start to the article, also worth mentioning; Many Canadian home owners are planning to use a reverse mortgage as part of their plan now. This can very quickly add the hundreds of thousands of dollars needed in late stage savings. Assuming they do not intend to leave their house to anyone, this will boost their savings to levels that would probably not have been possible throughout their working life.

Not only that, but many Canadians also have other sources of income for retirement including rental units inside or outside of their home.

With that said, there are many ways to both supplement and increase retire income. Being creative will help.

Thanks for the comment Jennifer! In general I don’t love reverse mortgages, but they can be a useful tool in very certain situations. They can be especially useful for home owners trying to maximize government benefits like GIS late in retirement because the cash flow from a reverse mortgage is not taxable and won’t impact government benefit calculations.