Are Most People Taking CPP Early Or Late?

Are most people taking CPP early or late? Delaying CPP can have many advantages (and a few downsides). Delaying CPP to age 70 can see monthly CPP benefits increase by over 220% vs benefits taken at age 60.

Delaying CPP provides a lifelong inflation adjusted pension, and for those with no defined benefit pension this can be very appealing.

But as it turns out, very few people choose to delay CPP to age 70.

So, if delaying CPP has so much appeal, why aren’t more people choosing to delay?

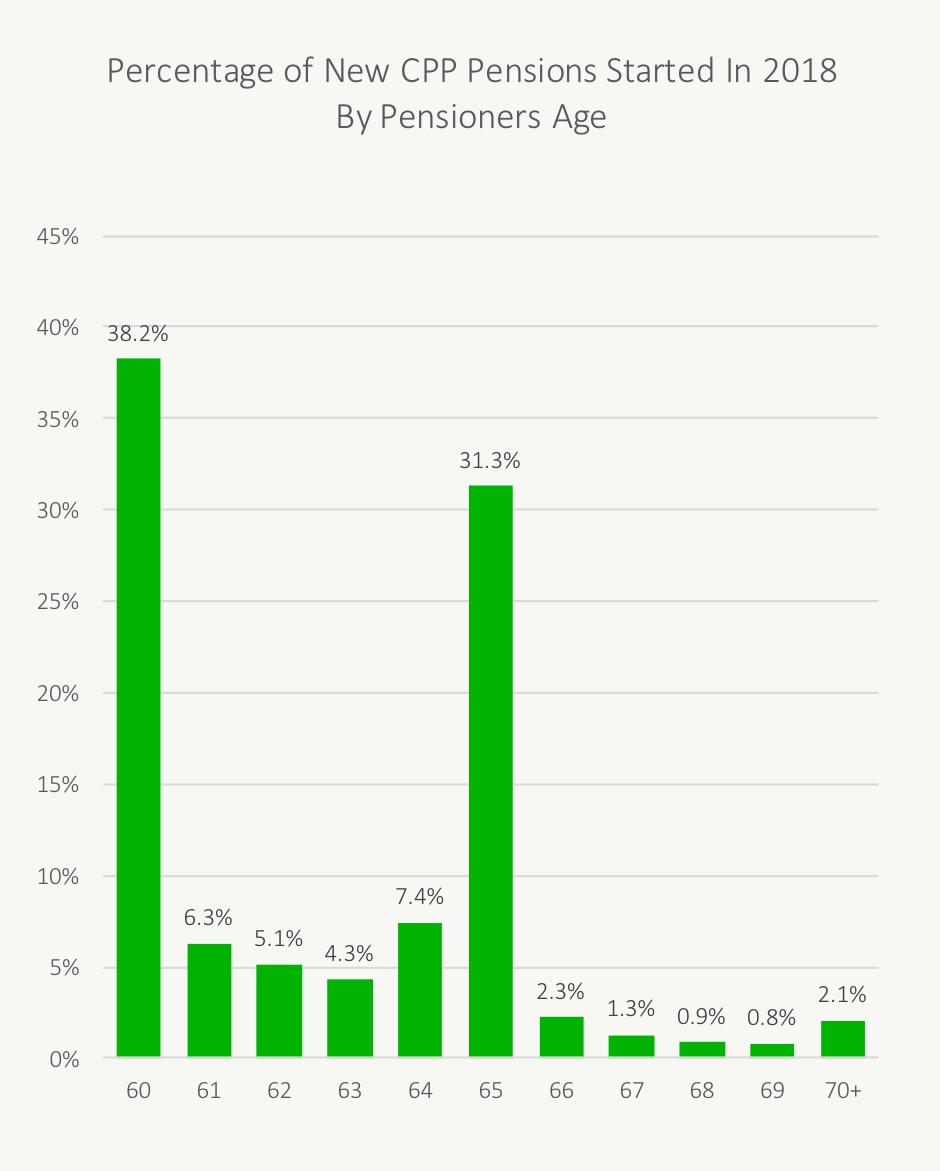

In the analysis below we’ll see that the vast majority of people are taking CPP at or before the age of 65. Using these statistics for CPP starting age we’ll see that very few people choose to delay CPP past age 65 and only a very small percentage choose to delay all the way until age 70.

If delaying CPP to age 70 has so many advantages, why are most people choosing to take CPP early?

Actual CPP Statistics For Starting Age

Getting statistics for when people choose to start CPP isn’t easy. These numbers aren’t hidden, but they aren’t exactly easy to find. Although I’ve heard anecdotally that very few people chose to delay CPP to age 70, it was very difficult to find statistics to back these figures up. But recently I came across the annual figures for CPP start age and they were very enlightening.

It turns out that nearly 4 out of 10 people choose to start CPP immediately at age 60 and another 5 out of 10 choose to start CPP between age 60 and 65. In fact, over 9 out of 10 people choose to start CPP at or before age 65.

That means that less than 1 out of 10 people are choosing to delay CPP past age 65 and if you look at the statistics, only 2.1% of people, so about 2 out of 100, are choosing to delay CPP all the way to age 70.

If delaying CPP has a clear advantage, why aren’t more people choosing to delay? Well… there could be a number of reasons…

Why You Might Want To Start CPP At Age 60

There are certain reasons why you might want to start CPP at age 60 and these reasons may be why we see so many people starting CPP as soon as possible.

These reasons will vary from person to person, some might apply to you, some may not. Deciding when to take CPP should be part of your overall pre-retirement plan.

There are definite advantages to delaying CPP that could help improve the success rate of your plan, so it’s important not to simply start CPP without understanding all the pro’s and con’s.

Possible Reasons To Start CPP At Age 60

- Not enough investment assets to wait to start CPP until age 70

- The extra cash flow is needed immediately

- Concerns about longevity/health

- A desire to “get what I paid for”

- Options like delaying CPP aren’t known or understood

- Economy has entered a recession and the value of investment assets are depressed

- Low-income retiree who expects to receive GIS benefits in the future

Whether or not these factors affect you and your financial plan should be something you discuss with your financial planner.

Financial Factors To Consider When Taking CPP Early Or Late

Even though it can be advantageous to delay CPP there may be financial factors to consider.

Delaying CPP requires a large amount of investment assets to close the income gap. This means that anyone with a low or moderate level of investment assets may choose to start taking CPP early. This can easily happen to anyone with a defined benefit pension.

Taking CPP early may also be driven by a need for cash flow. It just might not be possible to reach retirement spending goals without starting CPP immediately.

Taking CPP early may also be driven by the stock market returns at the time when the decision needs to be made. It’s less appealing to sell depressed investment assets during a recession and this may make starting CPP early more enticing.

Health Factors To Consider When Taking CPP Early Or Late

Starting CPP early may also be driven by health factors. For anyone who expects a shorter longevity it can make sense to take CPP early.

To reach the financial breakeven point when delaying CPP takes a long time, sometimes into your late 80’s or early 90’s depending on the circumstances. This can make delaying CPP less appealing to those who may not expect to live quite so long.

And, for those with immediate health concerns, there can be even more urgency to start CPP as soon as possible.

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

Tax/Benefit Factors To Consider When Taking CPP Early Or Late

The last reason that individuals may choose to take CPP early rather than delay is when they’re trying to maximize government benefits like GIS.

GIS benefits are clawed back at a rate of 50% to 75% for every dollar of taxable income and CPP payments count as taxable income.

This means that for a future GIS recipient, delaying CPP will just trigger more clawbacks in the future. If you expect to receive GIS in the future, which about 1/3rd of Canadian seniors do, then it makes sense to start CPP at age 60 even while still working to keep monthly payments as low as possible. The extra CPP income between age 60 and 65 can go into a TFSA before retirement.

Choosing To Delay CPP

Although the majority of people choose to take CPP early, and they may have a number of good reasons for doing so, choosing to delay CPP can be a very advantageous decision for many retirees.

Depending on your specific circumstances there can be financial benefits as well as “soft” benefits to delaying CPP.

Once you reach breakeven, the financial benefit of delaying CPP means you’re drawing less from your investment assets than you otherwise would have. This can be a real advantage later in life, especially with unexpected medical expenses or other unique spending needs.

Plus, the “soft” benefits of delaying CPP mean that you could have a more secure retirement plan, with less risk of running out of money in the future, and be less susceptible to changes in stock returns, bond returns and inflation rates.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

I thought i would give some feedback on the issue of when to take CPP. I am 64 and plan to take it at 65. I did not take it earlier as i have still been working and so no reason to possibly push my income into a higher tax bracket.

I do not need the funds now so it is simply a financial “investment” decision.

My parents both lived to 70ish but both were smokers. Grandparents lived to late 80’s. I am reasonable fit at this time.

My very simple math is as follows;

Assume pension is $1,000 per month ($12k per year) and at 65, 1,420 per month at age 70 ($17k per year)

At age 70 I have collected 5 years x 12,000 per year or $60,000

Break even on a simple basis means I need to “recover” the 60,000 over time from the increase. If I gain back $420 per month, it will take me 11.8 years to recover the $60,000 (60,000/420). Say 12 years. (I have not assumed any return on the $60k that I could make if I invested it which would push this 12 years out even further.

So at age 82, I have received about $204,000 before tax under either scenarios.

(I did the math for taking CPP at age 60 and 65 but I think in that case the break-even was about 74 years old)

One issue that I have not seen dealt with in these analysis is that a portion of the CPP can go spouse on death so that will change your “economics” as well. It would be interesting if someone has ran the numbers on the “What If” scenarios….die at 65/70/75 and spouse gets some benefit. My spouse is 6 years younger so that is more likely.

So I have decided that I will enjoy the funds much more for the next 17 years than I would later in life. I can donate more, do an additional trip or help out children/grandchildren.

I also financial coach on a volunteer basis and it seems that most people I talk to that take it early either have debts that need to be paid before retirement, need the money monthly now not later, or they have not actually done the math. Most people do not think long term and like the immediate gratification.

Hi Dale, thanks for your comment! You might enjoy these two posts… they go into more detail around CPP breakeven and consider the “opportunity cost” of drawing down investment assets while waiting for CPP to begin. The second post goes into detail on some of the soft benefits of delaying CPP.

https://www.planeasy.ca/taking-cpp-early-or-late-how-long-until-breakeven/

https://www.planeasy.ca/taking-cpp-early-or-late-the-soft-benefits/

Thanks for the comment!

Great article, thanks for the detail. One other reason for taking CPP early is if one retires early and to minimize non-contributory years that may negatively impact entitlement the longer one waits. Would that make sense? I have this situation with my wife who has been home for 5 years and is 57 now.

Hi Charlie, thanks for the comment! Yes, drop out years would be a consideration.

In general each $0 income year that cannot be dropped out would decrease CPP by 1/39th. So that’s a 2.56% decrease for each year of delay if that $0 income year cannot be dropped (this of course is offset by the benefit of delaying). This does end at age 65 though because the drop outs only impact years between age 18 and 65, so someone who is close to age 65 may still choose to delay to age 70 even with the impact of a couple of $0 income years being added to the calculation.

It would really depend on a case-by-case basis.

Great post as usual! I have a few comments:

The break even age should not be a consideration in the decision to delay. If there is even a small chance that you could live to a ripe old age, then that is the only age that should matter for planning purposes as that is the most expensive scenario. As Jonathon Clements is fond of asking, “What if you fail to die in a timely manner?”

The best reason to delay if you can afford to do so, is that it allows you to SAFELY spend down your nest egg earlier knowing that a larger CPP is waiting for you at age 70. This reduces overall market risk, longevity risk and inflation risk.

Clements also points out that delaying is a decision that you won’t live to regret. Literally.

Cheers

Great quotes Garth, thanks for sharing!

We’re certainly planning on delaying CPP ourselves, we like the benefits and are willing to draw down our investment assets while we wait. That being said, during a down market we might choose differently, so we shall see what happens in the future.

Thanks for your comment!