Active Investing With Part Of Your Portfolio

In general, there are two types of investing, passive investing, and active investing. Passive investing means purchasing broad index funds that will match market returns at the lowest possible cost. It means focusing on the aspects of investing that are directly in the investors control like investment fees, asset allocation, and diversification.

Active investing, on the other hand, means purchasing specific investments with the hope of outperforming the market over the long run. Active investing can be very appealing and very exciting, but it has its risks. When you’re an active investor there is the possibility of beating the market return and growing your portfolio substantially over time, but there is also the possibility of losing everything.

The issue with active investing is that it generally doesn’t deliver. After investment fees, time, effort etc., the active investment portfolio typically does not outperform the market. In fact, individual investors are known to be very poor active investors, trying to time the market, putting all their eggs in one basket, taking on too much risk etc. etc.

As we’ll see below, even the pros don’t have a great track record with active investing. Over a long period of time the majority of actively managed funds fail to outperform their passive peers.

Despite the risk of lower returns, active investing is still very appealing for many investors.

So how do you get the benefit of passive investing with its low fees, high diversification, more consistent returns, and still have a bit of fun with active investing?

The solution is to allocate a small portion of your portfolio to active investing. Basically, the idea is to create your own personal “hedge fund” with a portion of your portfolio. It’s a small amount of money which can be more actively managed without risking your entire nest egg. But how do you do this properly and without risking the rest of your portfolio?

Active Investing Doesn’t Work Most Of The Time

Before we get into how to set up your own active investing portfolio it’s important to understand that active investing is very difficult and doesn’t deliver most of the time.

It’s also important to understand that the average person is at a massive disadvantage in the market. Most of the trading volume is driven by large institutions, so when purchasing an investment, the individual investor is likely buying from a more sophisticated institutional investor with piles of resources and expertise. For the active investor, the question should always be, “if I’m buying, that means someone is selling, why are they selling and what do they know that I do not?”.

And even those sophisticated institutional investors, with their piles of resources and expertise, don’t get it right most of the time. After fees, most actively managed funds fail to beat the market. Even with piles of resources and money they fail to outperform the market consistently.

According to Morningstar’s Active/Passive Barometer…

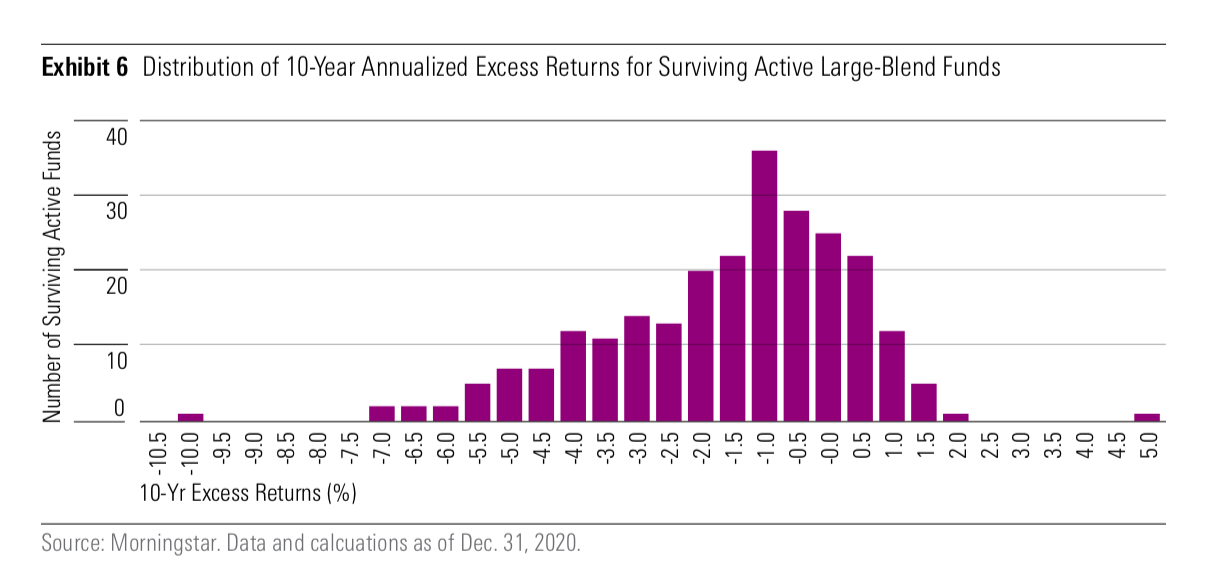

“In general, actively managed funds have failed to survive and beat their benchmarks, especially over longer time horizons; only 23% of all active funds topped the average of their passive rivals over the 10-year period ended December 2020.”

Not a great track record over longer periods of time, and the results of active investing tend to skew negative…

How To Set Up A Small Active Investment Portfolio

Despite the challenges with active investing if you’re still interested in actively investing a portion of your portfolio it’s important to do it right.

The best way to try active investing is to designate a small percentage of your portfolio to active investing and segregate these funds into a separate account. Typically, this percentage is low, at most 5%-10% of your portfolio should be dedicated to active investing.

Carving off 5%-10% of the total portfolio can allow you to start active investing but doesn’t create a substantial amount of risk for the entire portfolio. At the same time, if the actively managed portion of your portfolio increases in value it can still have a positive impact on the total portfolio value.

It’s also a best practice to segregate this active investment portfolio in a separate account. By separating the active investment portfolio from the passive investment portfolio, it becomes much easier to keep them separate and track performance, tax consequences etc. etc.

What Account To Use For Your Active Portfolio?

For the average person, setting up an active portfolio is easiest inside a TFSA. Keeping your active portfolio inside a TFSA means there is less tracking for tax purposes. No need to worry about adjusted cost base, capital gains tax, dividends etc. In fact, in a TFSA there is no need to worry about income tax at all, even when withdrawing in the future (especially if the portfolio grows substantially).

The only caveat is that TFSAs are not good for day trading or extreme active investing. When investing turns into a business, the TFSA can be stripped of its tax advantages by the CRA.

The other consideration is that if the active portfolio decreases in value, the TFSA room is lost forever.

If an active portfolio is funded with a $10,000 TFSA contribution and subsequently goes to $0 then that TFSA contribution room is lost forever and with it the power of tax-free compounding. The loss of tax-free compounding can have a significant impact over the long-term so consider this carefully before starting an active investment portfolio inside your TFSA.

The nice thing about TFSAs however is that although you have to respect your total contribution limit across all accounts, there is no restriction on the number of TFSA accounts that can be open. This allows one larger TFSA to be set up for passive index investing and a second smaller TFSA to be set up for active investing.

Rules For Active Investing

There are a few important rules when creating an active investment portfolio that is part of a larger passive investment portfolio.

Rule #1: Segregate active investments from passive investments

As a best practice, an active investment portfolio should be segregated from the larger passive investment portfolio. This makes it easier to track performance, tax consequences etc. It also ensures that passive investments do not accidentally become active investments in the future.

Rule #2: Never re-fund the active investment portfolio if it declines

The active portfolio should be seeded with an initial contribution but should not be refunded if the portfolio declines. If the active investment portfolio is performing poorly then we do not want to drag down the rest of the portfolio. Avoid the temptation to re-fund the active investment portfolio, it should grow on its own, if it doesn’t, that should be a sign to avoid active investing in the future.

Rule #3: Set rules to take risk off the table if the active portfolio increases

If the active investment portfolio performs well, we want to set clear guidelines for when risk should be “taken off the table”. Set these guidelines in advance to make the decision less emotional. For example, if the active investment portfolio increases to become 15% of the total portfolio, then we want to shift half into passive investments, reducing the active portion back to 7.5% of the total portfolio.

Rule #4: Diversification rules still apply

Even though this smaller investment portfolio is being actively managed it is still a best practice to keep a high level of diversification. Ideally, individual investments should not make up more than 3%-5% of the total portfolio. By segregating 5% of the total portfolio for active investing this means that there should be at least 2-3 positions (if not more) to maintain a high level of diversification.

Active Investing With A Portion Of Your Portfolio

Active investing can be appealing for many investors, it feels exciting, it has the potential to grow your portfolio, but on average it can lead to lower returns in the future. Make sure you understand the risks of active investing before jumping in.

Short-term performance can also lead to a false sense of security. Actively managed portfolios tend to underperform their passive peers over longer periods of time. Outperforming the market over a period of a few years doesn’t necessarily mean that trend will continue long-term.

If you’re interested in active investing with a part of your portfolio, remember the rules… keep your active investment portfolio separate from your passive investment portfolio, never refund your active investment portfolio if it declines, reduce risk if your active portfolio grows substantially, and always maintain a high level of diversification.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments