Can They Retire On $250,000?

A solid retirement plan can help unlock hidden opportunities and it can help make retirement easier and more enjoyable. In this blog post we’re going to explore a retirement planning case study with only $250,000 in financial assets at retirement.

We’re going to help them maximize government benefits, minimize taxes, and increase spending in retirement.

To do this we’re going to use a few different retirement planning strategies…

- Retirement Spending Phases

- RRSP Meltdown

- GIS Maximization

- Strategic RRSP Contributions 65-71

- Strategic RRSP Withdrawal At 72

- CPP & OAS Timing

Don’t forget to watch the video where we build this retirement plan in real time. If you enjoy this case study and would like us to do a case study based on your situation, then please leave a comment.

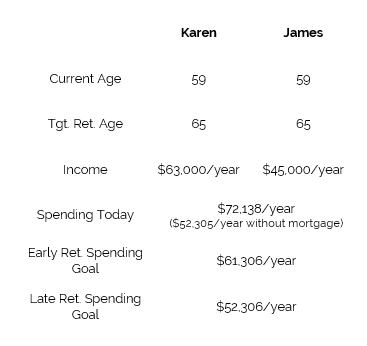

Meet Our Couple

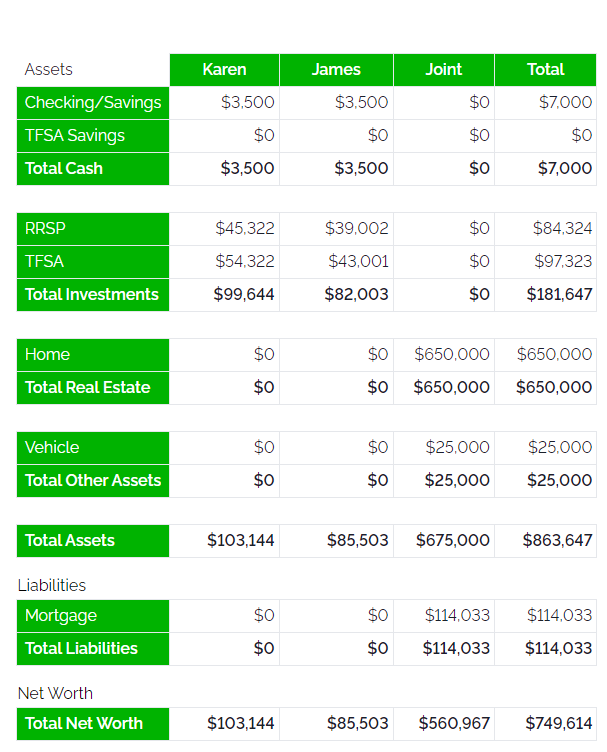

Karen and James are both age 59 and will turn 60 early next year. They plan to retire in about 5 years at age 65. They have a home, a mortgage, and some reasonable savings between TFSA and RRSP. Their kids are grown and independent. At the moment they save $500 each per month. This is split between TFSA contributions of $250 and RRSP contributions of $250. In total they’re saving about $1,000 per month.

Karen and James want to make the most of their retirement. They would love to take a trip once per year, nothing too expensive, maybe a cruise or a few weeks down south each winter. They’re hoping that they can actually spend a bit more than they are today.

They have modest spending, but they know their retirement assets aren’t large, and they worry if they’ve saved enough for retirement.

Let’s take a look at their current situation.

Net Worth

Income and Spending

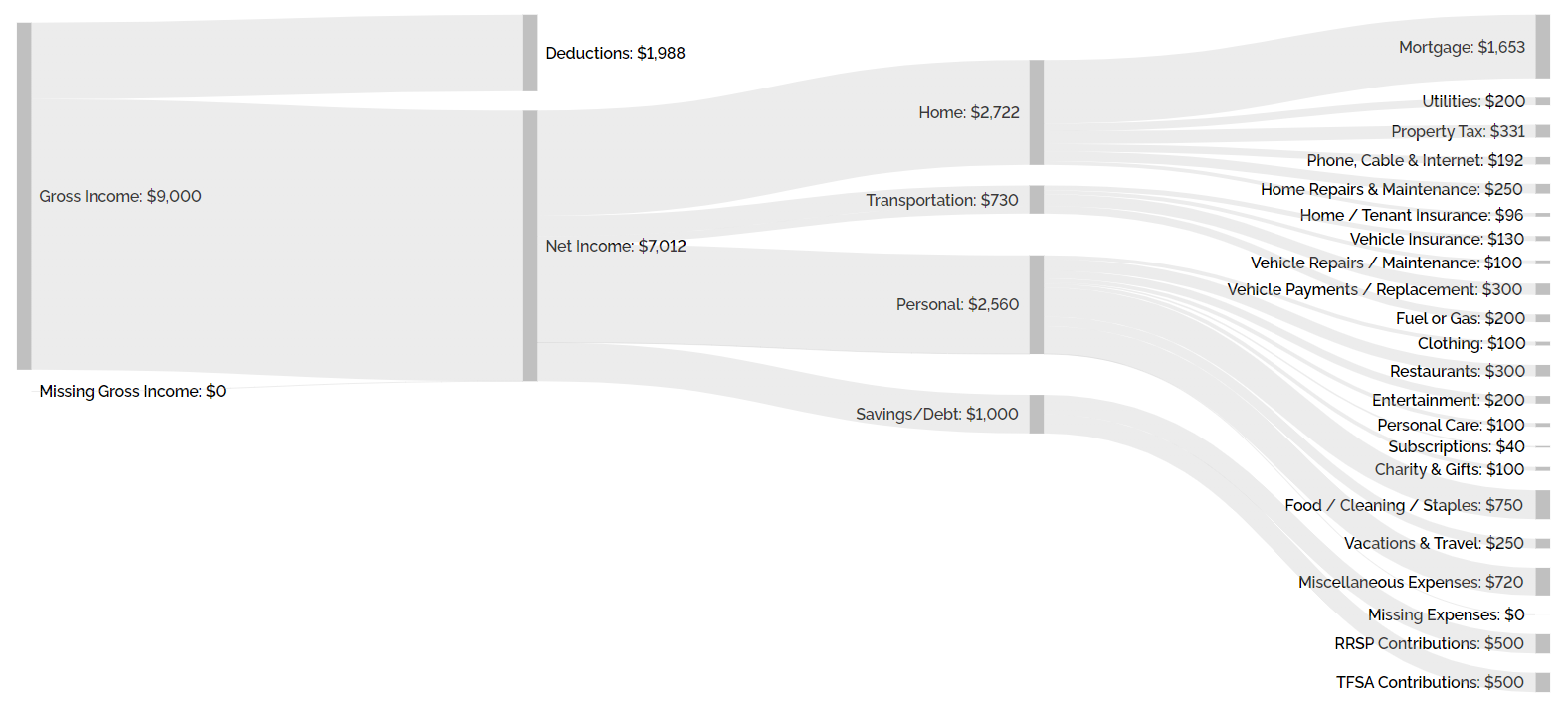

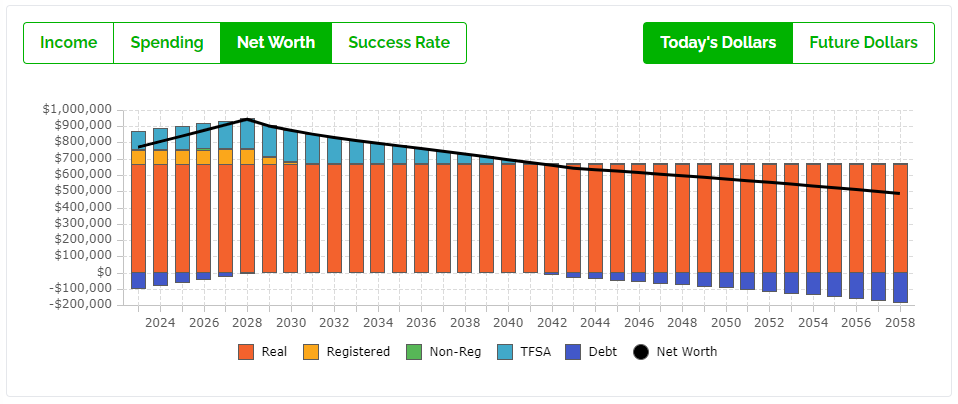

Baseline Projection

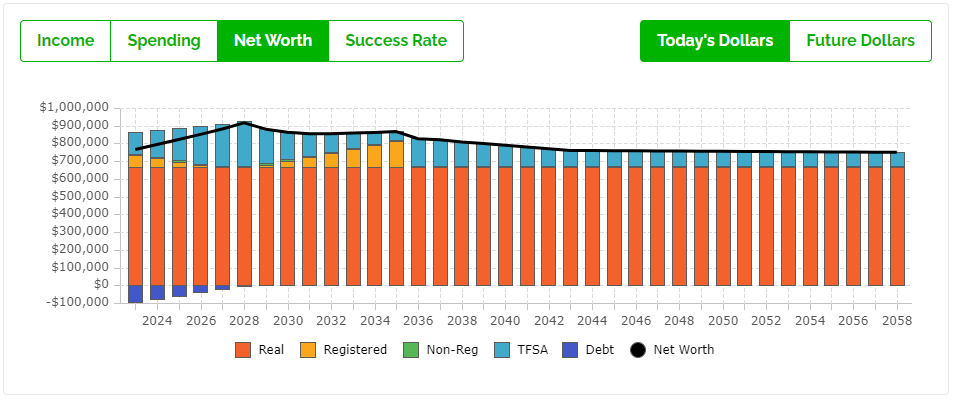

We’ll start with a baseline projection for their net worth in retirement. This will give us a sense of their goals and if they are realistic.

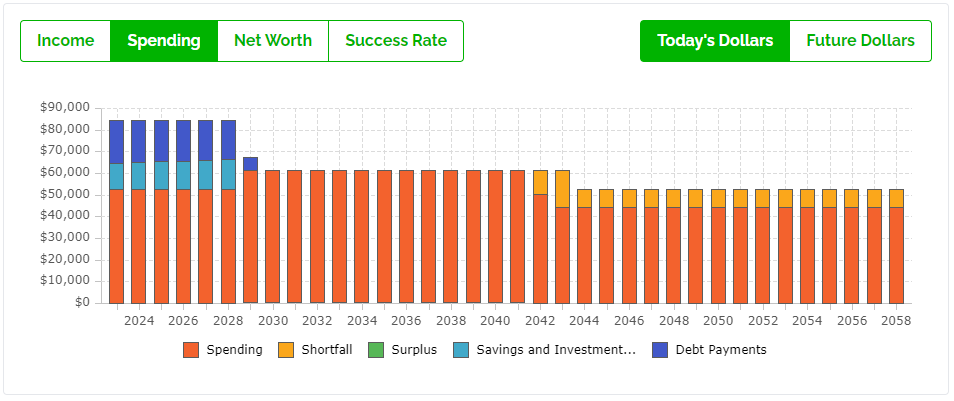

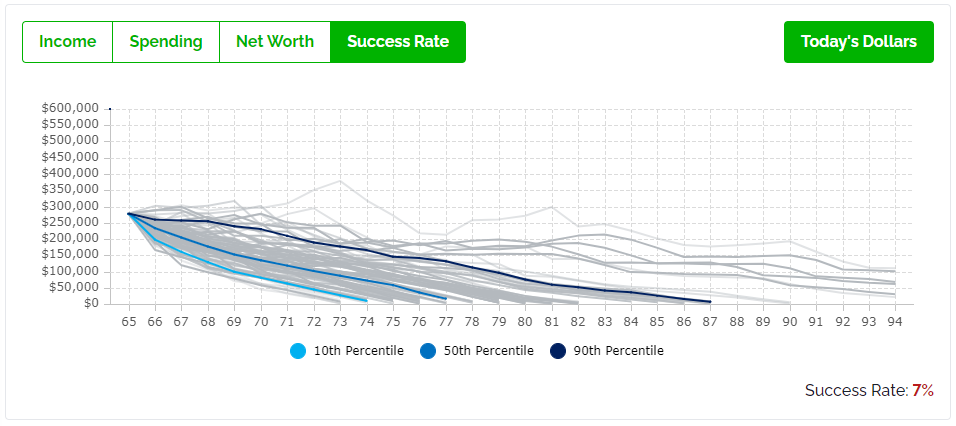

Based on their current plan the result would be a success rate of 7% and debt of $184,285 in late retirement but with their home equity they would still have a net worth of $486,512. They’re tapping into home equity in this baseline scenario, but that’s not a great starting point so let’s explore a few options below.

Reduced Spending

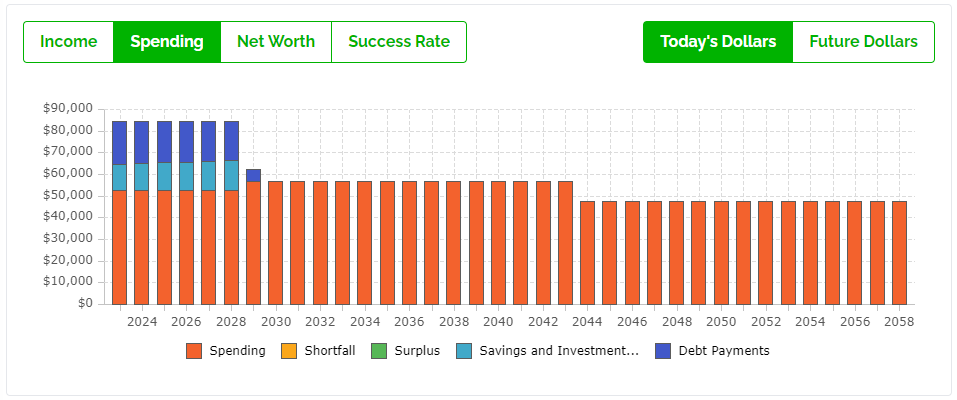

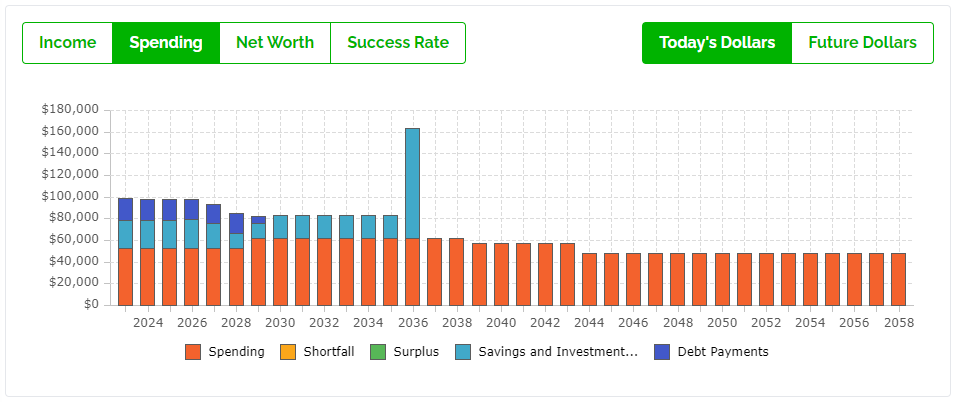

To get a more realistic starting point we’ll reduce their spending by $5,000 per year in retirement. This will give us a better place to start and hopefully we can add back some of this spending later if we find some additional opportunities.

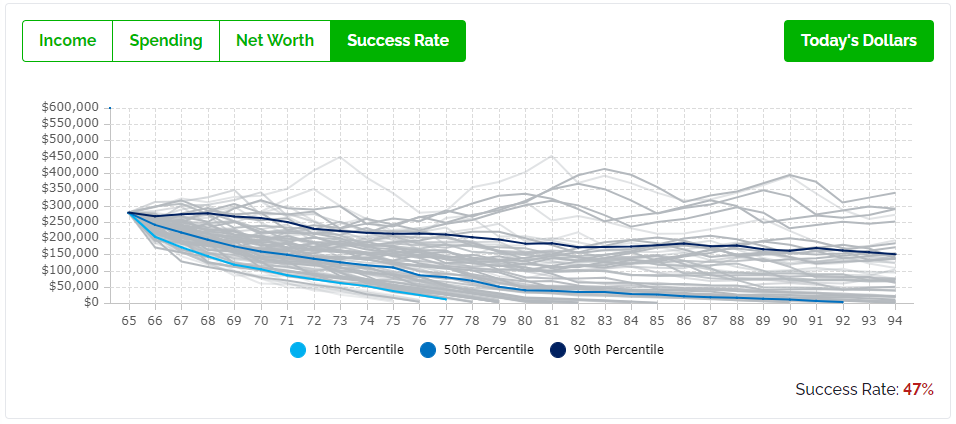

We will reduce their early retirement spending to around $56,000 per year and their late retirement spending to $47,000 per year. Based on their current spending this is still more disposable income than what they have right now with mortgage payments removed.

This eliminates the shortfall in spending, eliminates the need for debt in late retirement, but still results in a rate low success rate of 47%.

RRSP Meltdown

Due to their lower income the RRSP assets aren’t great in retirement. This is because Karen and James are eligible for GIS benefits and any RRSP/RRIF withdrawals they make will trigger GIS clawbacks of 50% to 75%. (Learn more about GIS and how it works)

When they make a $1,000 withdrawal from their RRSP/RRIF they will incur a $500 reduction in their GIS benefit the following year. This makes RRSP contributions before retirement and RRSP withdrawals in retirement very unattractive.

The solution in this case is to “meltdown” the RRSPs before retirement, specifically before the age of 64. GIS benefits at age 65 are based on prior year income, so we want to aim for the RRSPs to be full withdrawn by age 63.

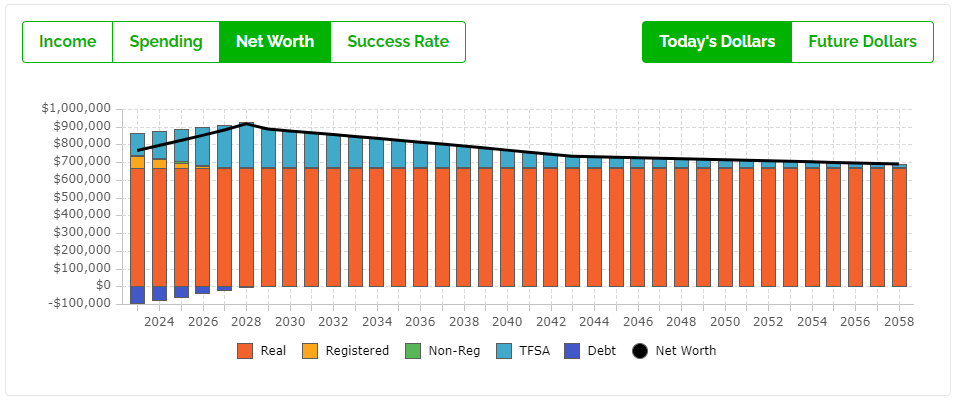

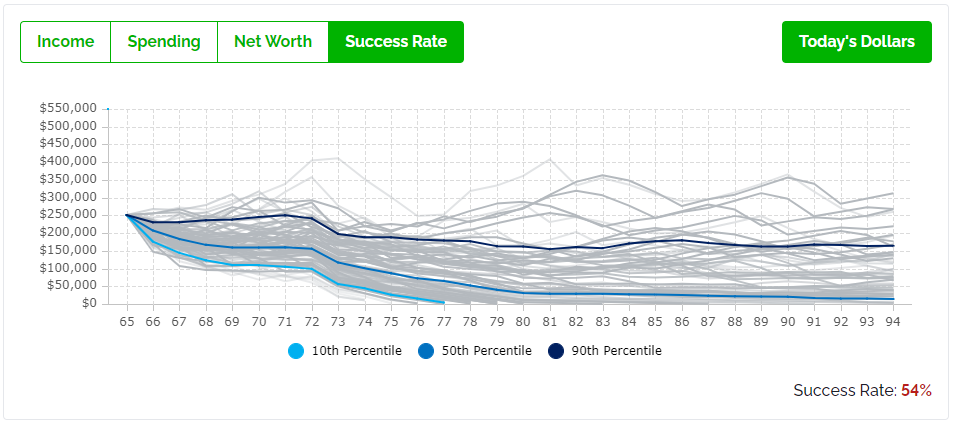

This will require a withdrawal of $10,000 per year for Karen and $9,000 per year for James. Doing this will trigger some extra tax at a 20-30% tax rate before retirement but it helps avoid a 50% clawback on GIS after age 65. Doing this boosts their net worth by $13,000 and their success rate by 7% to 54%.

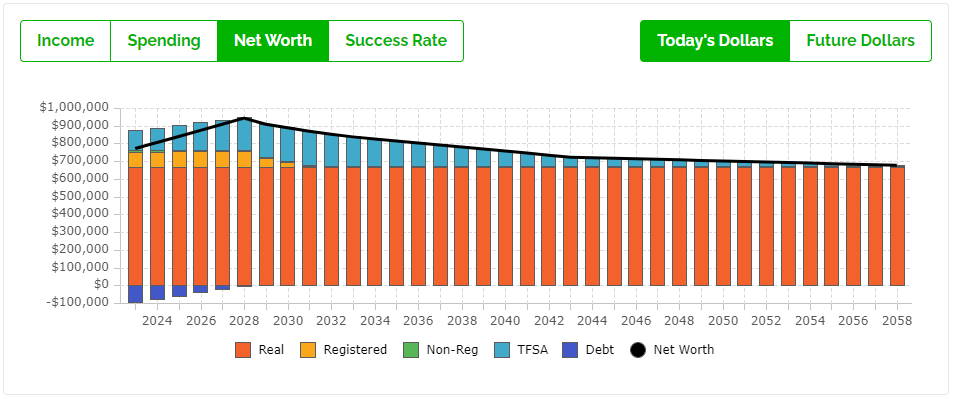

When they retire age 65, they have 100% of their financial assets in their TFSAs which are worth a projected $252,396.

GIS Maximization

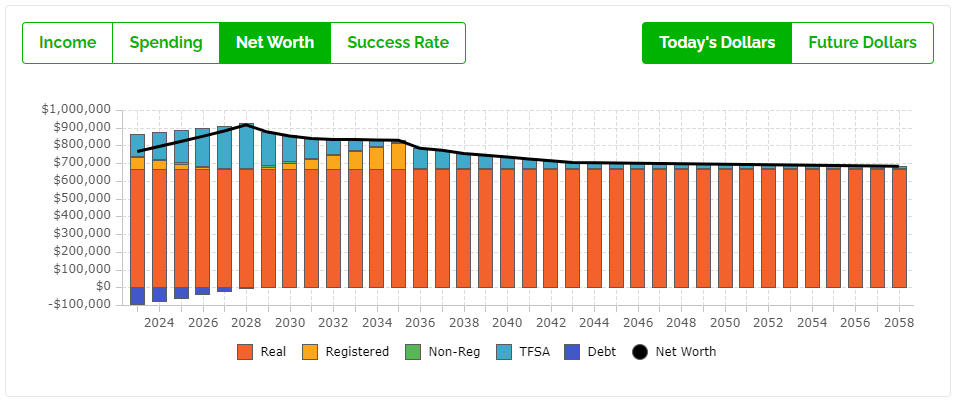

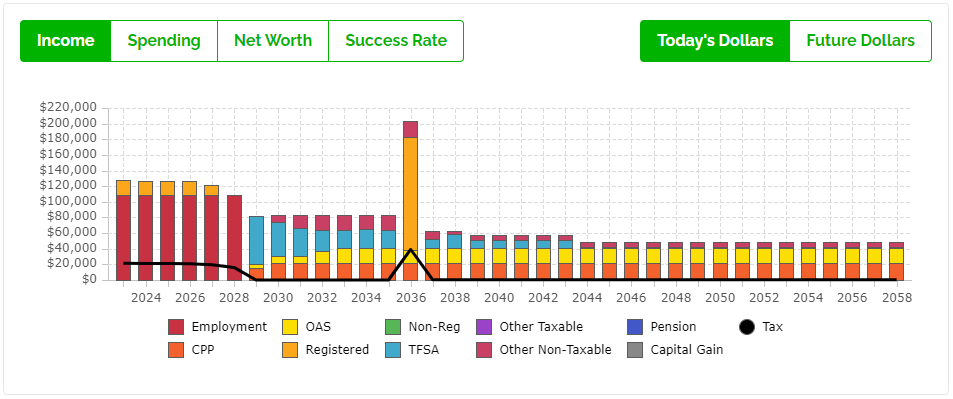

There is more we can do to help Karen and James qualify for GIS benefits. There are a number of strategies to help increase GIS and we’ll be focused on making strategic RRSP contributions from age 65 to 71 and then a strategic RRSP withdrawal at age 72.

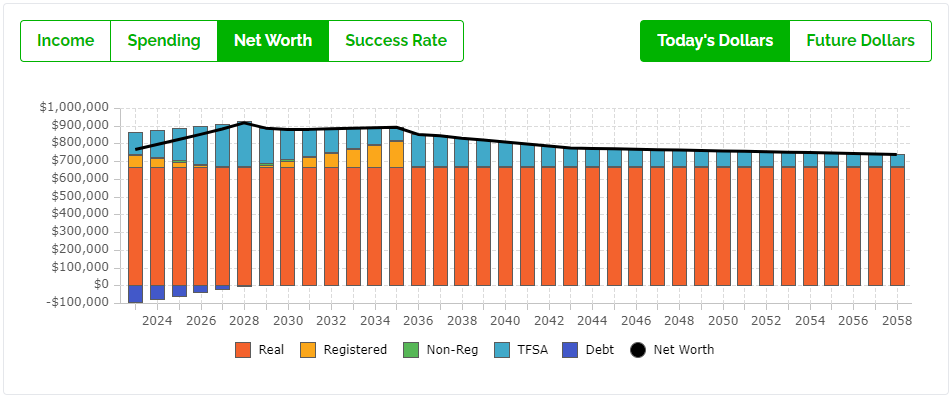

This is a complex strategy, and it only works because they have enough assets in their TFSAs, but it helps improve their plan considerably if executed correctly. Their net worth increases $48,709 and their success rate increases by 23% to 77%.

You can see in the Net Worth chart below how their Registered assets build up and then are quickly drawn down.

One of the benefits of this strategy is that they receive more GIS benefits from 65-72 which improves their success rate considerably. GIS is an inflation adjusted benefit, so it helps reduce risk in those first 6-7 years of retirement.

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

Start OAS Later

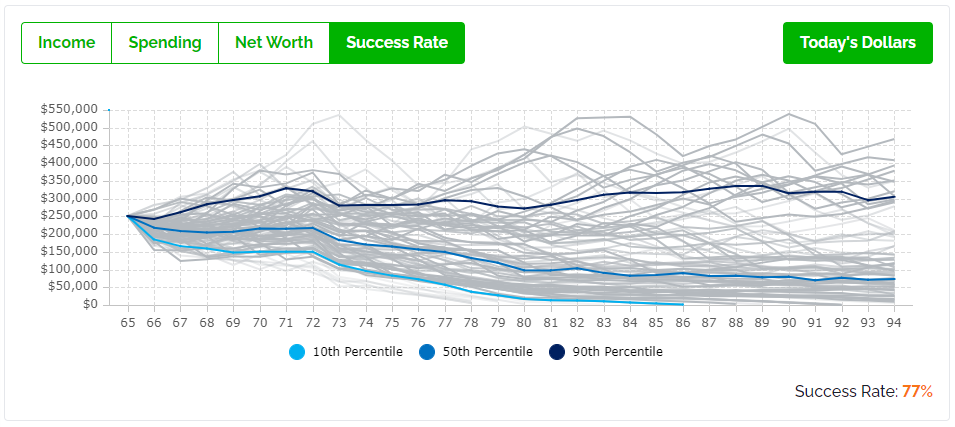

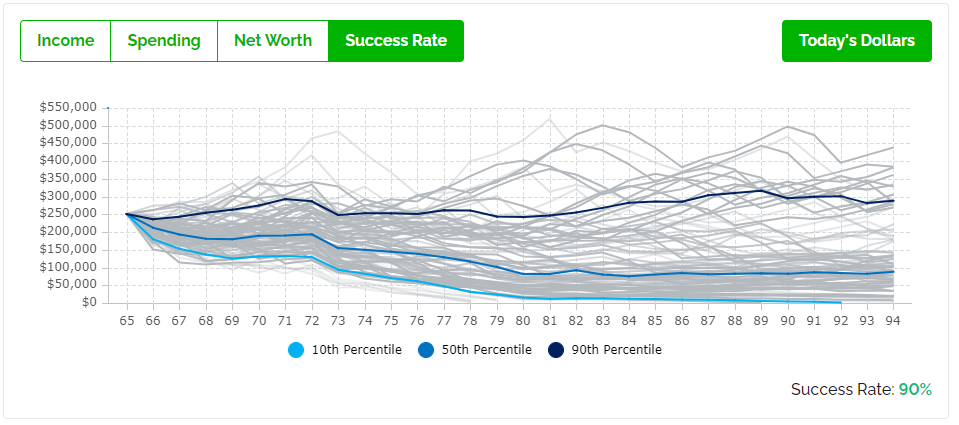

There is one interesting strategy that was identified by the built in AI Strategies module and that is for James to delay OAS to age 68. The benefit of the delay is that the GIS calculation is slightly different when only one partner in a couple is receiving OAS and when James delay’s his OAS benefit by 3-years it will increase by 21.6% for the rest of his life. This help’s increase success rate to 90%.

The reason Karen and James would delay OAS instead of CPP is because OAS benefits are exempt from the GIS clawback calculation while CPP benefits are not. So, although delaying CPP would provide a larger increase, it would also trigger more GIS benefit clawbacks in the future.

Add Some Spending Back

Now that we’ve improved the plan considerably let’s see if we can add some spending back into the plan. Karen and James originally wanted to spend about $61,000 per year in early retirement. We had to reduce that to make the plan more successful. But as we can see in the success rate chart above, in 9 out of 10 historical periods their plan will result in a surplus of financial assets in late retirement.

They might be able to use some of those assets for spending in early retirement, as long as they reduce this extra spending back to $56,000 per year if investment returns are low or negative and/or if inflation rates are high.

Let’s increase their spending back to $61,000 per year from age 65 to 75. They’ll be able to spend more in the first 10-years of retirement, but only if investment returns are average or above average. In about half of historical periods this extra spending seems reasonable, but in the other half they will need to revert to their “safe” spending level of $56,000 per year.

This gives Karen and James three levels of retirement spending, $61,000/year from 65 to 75, $56,000/year from 75 to 80, and $47,000 per year from 80+.

Create Your Own Retirement Plan

If you enjoyed this case study and would like to create a retirement plan like this for yourself then you can use the PlanEasy platform to start working on your retirement plan right now for under $100. Use this link to get started…

app.planeasy.ca/start-discovery

If you would like us to create another case study with a specific situation, please leave a comment below.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Great case study and example! Thanks Owen!

Thanks Riley!