Never Get Surprised By An Unexpected Expense Again!

Some surprises are great… but one surprise no one likes is an unexpected expense. An unexpected expense can wreak havoc on your personal finances. Unfortunately, unexpected expenses are extremely common, especially for those who own homes and vehicles.

For those of us who own large depreciating assets like vehicles, homes, boats, RVs etc., planning for unexpected expenses is an important financial habit. We need to prepare for future repairs and upgrades, even if they’re not entirely predictable.

At PlanEasy we call these types of expenses “infrequent expenses”. Unlike your regular monthly bills, infrequent expenses are not regular and are much less predictable. It’s hard to predict both the size and timing of infrequent expenses but they are still expenses that we need to prepare for.

If you own a depreciating asset like a home or vehicle then you can be guaranteed to have some large expenses in the future. To prepare for these expenses you need to set aside a certain amount of money each month, otherwise you’ll feel a nasty cash flow pinch in the future, or in a worst-case scenario, end up in debt. For those with a large home and 1-2 vehicles, setting aside $500 to $1,000+ per month is a pretty common goal. How much are you setting aside for infrequent expenses? Is it enough?

To manage these infrequent expenses, we can use a “fund” or “funds”. A fund is a small pot of money that you contribute to regularly. It’s set aside in a high-interest savings account and waits there ready to help when these types of expenses occur. We don’t like to think of this as savings, and its not an emergency fund, this is future spending that just hasn’t quite happened yet.

Why Plan For Infrequent Expenses?

Infrequent expenses are unpredictable by nature, but they’re not entirely unexpected. At some point depreciating assets like homes and vehicles need to be upgraded and repaired, that’s something we should expect. It’s the exact timing of those repairs and upgrades that is harder to predict.

These expenses can also add up over time. By planning for infrequent expenses, we can average these large and very lumpy expenses to make them more predictable and easier to manage.

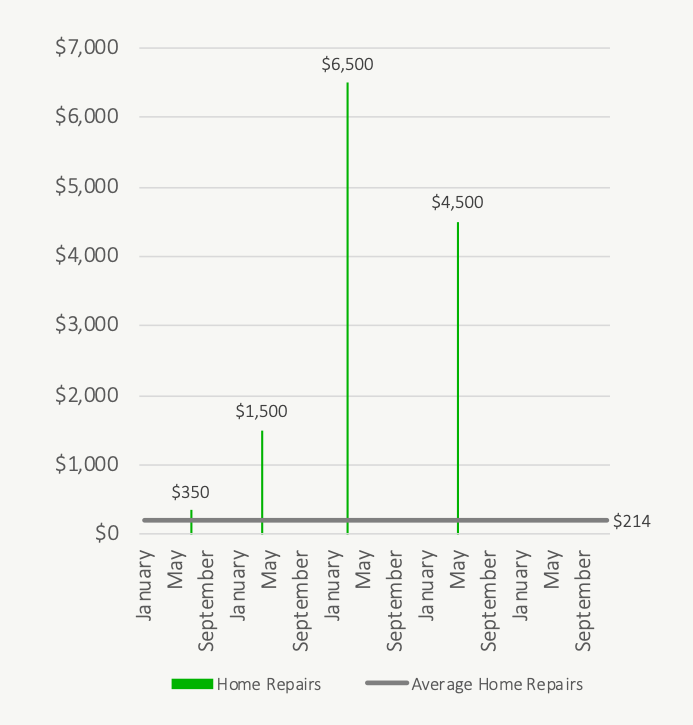

Here are some lumpy home repairs versus the monthly average…

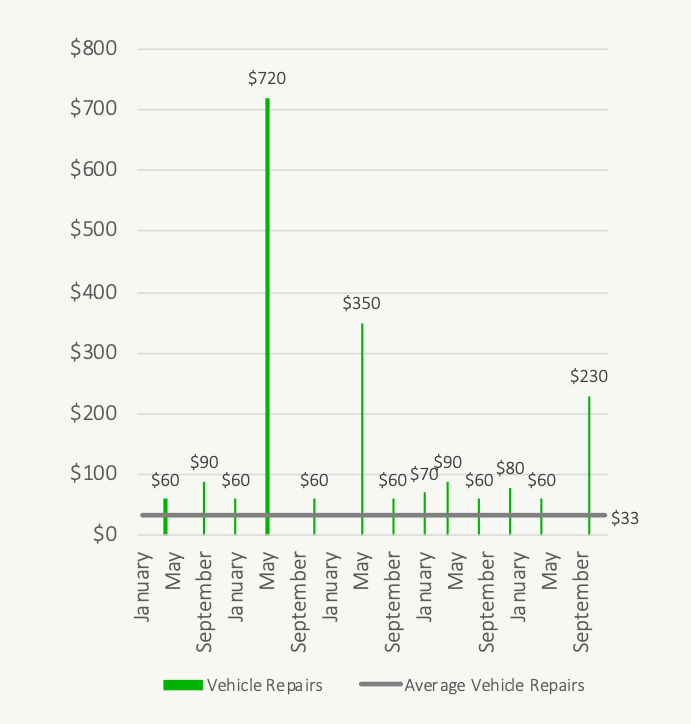

And here are some lumpy vehicle repairs versus the monthly average…

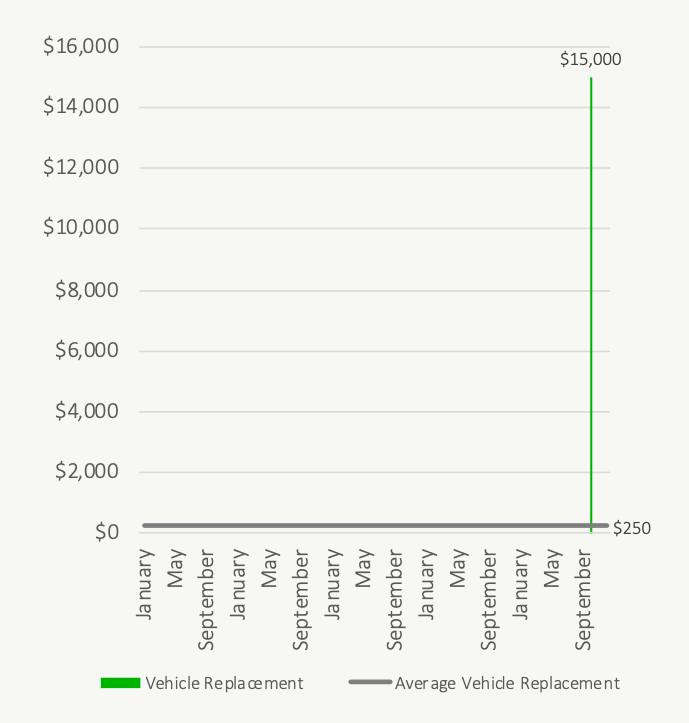

And finally, the largest of all, here is a used vehicle upgrade (after trade-in) versus the monthly average…

Converting these large/lumpy expenses into a more predictable monthly expense makes managing income and spending much easier.

What Type Of Infrequent Expenses Should You Plan For?

Certain expenses are less frequent, lumpy, and unpredictable. These expenses are perfect examples of infrequent expenses. These expenses are typically related to depreciating assets like homes and vehicles, but the concept can be extended to other types of infrequent expenses too.

For example, we bike a lot and plan for bicycle repairs, we also plan for vacations too. Along with vehicle repairs, vehicle upgrades, and home repairs, we also set aside a monthly amount in a “fund” for bike repairs and vacations.

Here are some examples of different “funds” you may want to create as part of your monthly budget…

- Vehicle repairs

- Vehicle upgrades

- Home repairs

- Boat repairs and upgrades

- RV repairs and upgrades

- Bicycle repairs and upgrades

- Electronic upgrades

- Vacations

- Etc.

How Much Should You Set Aside For Infrequent Expenses In Your “Funds”

How much you need to set aside for infrequent expenses will depend on several factors. The more depreciating assets you own, the more “funds” you need to create. It also depends on how much you can do on your own. Someone who is a DIYer may spend less on repairs and upgrades. It also depends on where you live as repair costs can vary greatly from city to city.

If you own a home, setting aside 1% of structure value is a good rule of thumb, but here are some factors to consider…

- the size of your home

- the age of your home

- the structure value versus land value

- the type of ownership, condo versus freehold

- the ability to DIY

If you own a vehicle, setting aside $0.05 to 0.08 per km for repairs/maintenance is a good rule of thumb, but here are some other factors to consider…

- vehicle reliability (varies by make/model)

- age of vehicle

- type of km driven (city/highway)

- the ability to DIY

For vehicle upgrades, it depends entirely on taste, the cost of a new/used vehicle and the upgrade frequency will have a large effect on the cost of vehicle upgrades, but in general around $200 to $400 per month is a reasonable estimate for future vehicle upgrades depending on the make/model/frequency.

These rules of thumb can be a good benchmark, but it always depends on personal preferences. It’s a good idea to start with an educated guess but then be prepared to adjust the monthly amounts in the future if you’re setting aside too much, or too little.

Blog post continues below...

Advice-Only Retirement Planning

Are you on the right track for retirement? Do you have a detailed decumulation plan in place? Do you know where you will draw from in retirement? Use the Adviice platform to generate your own AI driven retirement decumulation plan. Plan your final years of accumulation and decumulation. Reduce tax liability. Estimate "safe" vs "max" retirement spending. Calculate CPP, OAS, GIS, CCB etc. And much more!

Start your retirement plan for just $9 for 30-days!

You deserve financial peace of mind as you enter retirement. Start planning now!

How To Manage These “Funds”

One of the best ways to manage these funds is to set up monthly automated contributions to a separate high-interest savings account. Most no-fee accounts allow for multiple savings accounts to be set up and named individually, this makes it extremely easy to manage these funds.

Each month (or bi-weekly depending on your pay cycle) a predetermined amount is automatically moved from your checking account in a specific “fund”. Then, as these infrequent expenses occur these “funds” can be drawn down and moved back into your checking account to pay a repair bill.

This automation and separate account structure will help keep these funds out of sight and out of mind. This pot of money will slowly build up, always ready to be drawn upon as these infrequent expenses occur.

What Does An Infrequent Expenses Fund Look Like In Practice?

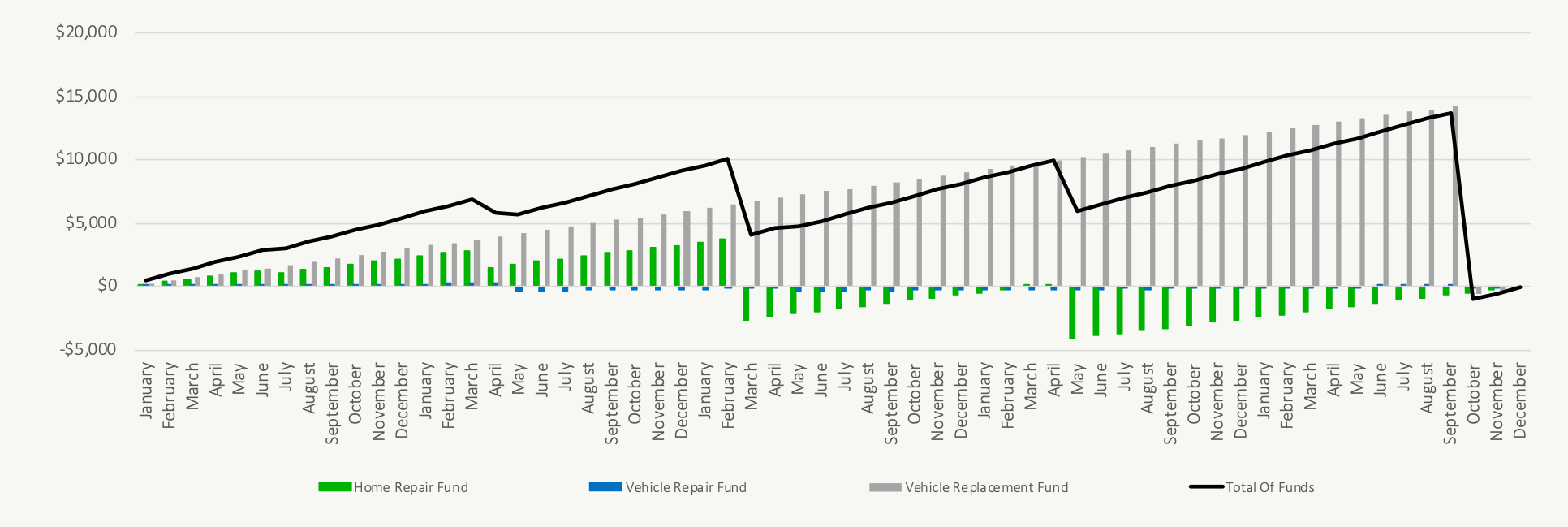

So, what does this look like in practice? Each month the individual “funds” are built up based on the automatic contributions, then as expenses occur, they are drawn down. This leads to a sawtooth like behavior where funds build up and then drop down again. Over time we never want these funds to get too big, that’s a clear sign the original estimates were too high, but we also don’t want them to get too small either.

We might even see some funds go below zero, where we have to borrow from another fund temporarily, as long as the total fund never goes below zero that is ok (but even if that happens this is where an emergency fund would step in).

This is what it might look like in practice…

Preparing for infrequent expenses is an important financial habit and can provide a significant amount of peace of mind. The “set it and forget it” approach makes these different funds easy to manage. Converting these large/lumpy expenses into a more predictable monthly expense makes managing income and spending much easier too.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

I watched few of your videos on youtube and liked the content. You are doing an awesome job to educate Canadians on different aspects of financial and retirement planning.

I am a DIY investor and am interested in the DIY plan. I live in Alberta.

I got a plan done by CashflowsandPortfolios a couple of years ago and would like to run a few more scenarios myself.

Please let me know when a DIY plan service is available for Albertans.

Thanks and regards.