You Need An Emergency Fund

Out of all the ‘best practices’ in personal finance, emergency funds are probably the simplest and most effective. There is nothing easier to set up and nothing that provides more peace of mind than an emergency fund.

Emergency funds are boring, they are simple, and they hopefully never get used.

The purpose behind an emergency fund is simple. An emergency fund should provide quick access to cash in the event of an emergency. An emergency should be something truly unexpected like a job loss, a health emergency, an unexpected repair, an accident etc. Using an emergency fund for an expected expense is NOT the right way to use an emergency fund (more on that later).

Emergency funds can also be called an ‘e-funds’, ‘rainy day’ funds, or ‘oh $h!t’ funds. Whatever you call it, the purpose is the same, to help ease the financial burden during an emergency.

Yet, as simple as emergency funds are, they sometimes get used incorrectly. In this post we explore what an emergency fund is, how to set one up, how large it should be, and what NOT to do with an emergency fund.

What Is An Emergency Fund?

An emergency fund is a certain amount of money that is held in a separate high interest savings account for emergencies. An emergency could be a job loss, health emergency, an unexpected repair, an accident etc.

The idea behind an emergency fund is simple, but don’t get fooled by its simplicity, an emergency fund can be very powerful.

The goal of an emergency fund is to provide quick access to cash if the unexpected were to happen and there are many benefits to having an emergency fund.

The Benefits Of An Emergency Fund

There are a number of important benefits that result from having an emergency fund. Some are purely psychological while others can help you avoid financial trouble like debt payments, interest costs, extra taxes etc.

You don’t even need a fully funded emergency fund to experience some of these benefits, even a small emergency fund can have a huge benefit.

Here is a quick summary of just some of the benefits of an emergency fund…

Peace Of Mind: This is purely a psychological benefit but it’s an extremely valuable one. Having a fully funded e-fund provides a significant amount of peace of mind. With an emergency fund your finances feel less precarious and you feel stronger financially. That’s a significant feeling that should not be undervalued. Even if you never need to use it, an emergency fund still provides an incredible amount of peace of mind and this is probably its number one benefit.

Less Stress During An Emergency: Emergencies happen all the time and they can be stressful. The financial impact of an emergency can multiply that stress. Having an emergency fund at least allows you to avoid the financial stress during an emergency. It lets you focus on the important things and forget about the financial impact (at least temporarily).

Avoid Debt: Having a fully funded emergency fund helps avoid the need to draw on credit during an emergency, especially high interest credit like a credit card. High interest debt can be a hard to get out of, interest costs constantly work against you, and often can lead to more financial trouble down the road. Having an emergency fund avoids the need for debt and extra interest costs.

Avoid Investment Withdrawals: E-funds also help avoid the need to draw on investment assets during an emergency (and potentially trigger tax before it was planned). This can be important in retirement as well, where a large withdrawal from an RRSP/RRIF may trigger higher marginal tax rates and potentially OAS clawbacks.

What Should An Emergency Fund Cover (And What It Should Not!)

One common way an emergency fund is misused is when it’s used to cover the cost of expected repairs and maintenance. An emergency fund should NOT be used for home repairs, vehicle repairs, vehicle upgrades etc. These are depreciating assets and it’s important to plan for their eventual maintenance or replacement separately from your emergency fund.

Of course, sometimes these types of repairs and maintenance happen sooner than planned, in these cases an emergency fund can be very helpful to bridge the gap, but in general it’s important to save separately for these types of infrequent expenses that are expected and somewhat predictable.

Planning extra monthly savings for infrequent expenses like home repairs, vehicle repairs, and vehicle upgrades allows an emergency fund to be used for truly unexpected emergencies.

An emergency fund should cover unexpected emergencies, something that isn’t predictable. This is typically something like a job loss, a health emergency, an unexpected repair, an accident, or something else truly unexpected.

How Large Should Your Emergency Fund Be?

There are a few general rules when it comes to the size of your emergency fund. These rules are not set in stone, but they can provide a good guideline for how much you should target in emergency savings.

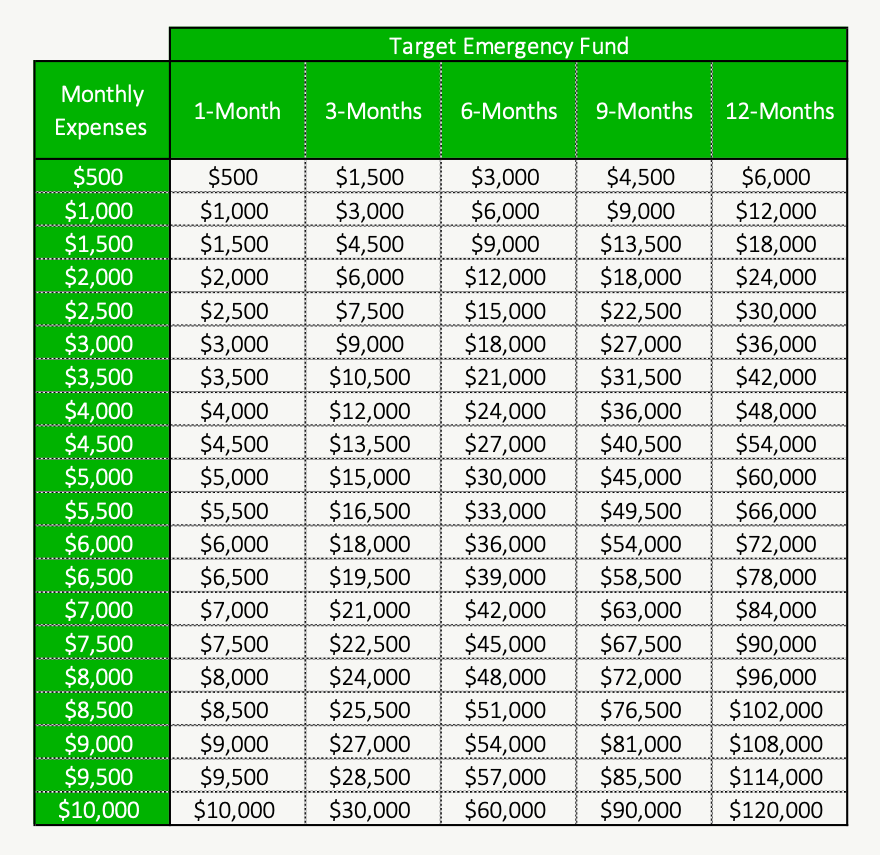

Typically, emergency funds are set based on monthly expenses, 1-month of expenses, 3-months of expenses, 6-months of expenses etc. This helps adjust the size of the emergency fund based on personal spending (including debt payments).

If average monthly expenses are $2,500 per month then a 3-month emergency fund target would be $7,500.

Notice that we do not use income and we do not include savings, this is because we assume that savings would be reduced to zero in the event of an emergency.

General E-Fund Rules:

1. High Interest Debt: Those with high interest debt over 8% should aim for a smaller emergency fund of $1,000 or at most 1-month of expenses. Priority should be given to repaying the debt first.

2. No Dependents and Renting: Renters who have no dependents have more flexibility and therefore need a smaller emergency fund. The general rule is that a renter with no dependents should target 3-months of expenses for an emergency fund.

3. Dependents and/or Home Owners: Those with dependents or those who own a home require additional emergency savings. In these cases, we want to target 6-months of expenses. Dependents would include young children but could also include a spouse/partner/family member who relies on your income. People with dependents or people who own a home have more responsibilities, more expenses, and more risk.

Special Considerations:

1. Variable Income: Highly variable income from sales commissions, contract work, seasonal work etc can be a challenge. It can require an extra 3-months of emergency savings to help bridge any gaps.

2. Rental Properties: Rental properties also add extra risk. With a rental property there is more room for the unexpected. A vacancy, a repair, or an unruly tenant can all require additional savings. Having an extra 3-months of emergency savings can be helpful when owning a rental property.

3. Retirement: If pensions, CPP, OAS, and other ‘safe’ income sources make up a large percentage of retirement income then this can decrease the need for a full 6-month emergency fund. If 50%, 60%, 70%+ of monthly retirement spending is coming from these ‘safe’ income sources then it’s reasonable to keep less cash on hand. Instead of a 6-month emergency fund a retired couple who owns a home may choose to keep just 3-months of emergency savings in cash.

Target Emergency Fund

Where Should You Keep Your Emergency Fund? (Hint: Don’t Invest It! Not Even In Bonds!)

An emergency fund needs to be accessed quickly. It needs to be there when you need it. The best place to keep an emergency fund is in a high interest savings account (HISA). This could be a regular HISA or it could be a TFSA HISA.

The key is that it is NOT invested, not in a GIC, not in bonds, and not in stocks/equities.

An emergency fund can be quite large. It can be tempting to put that cash “to work” by investing it. DO NOT DO THIS. This theoretically could provide a higher return, but it goes against the very purpose of an emergency fund. If invested, an emergency fund could drop by 10%, 20%, 30%+. This could mean that money isn’t there when its needed most.

Even bonds are not “safe”. They are “safer” than stocks but not safe. A bond fund can easily lose value over the short-term.

The best place for an emergency fund is a simple and boring savings account that provides the highest interest possible.

How To Set Up An Emergency Fund

The best way to set up an emergency fund is by using a separate online high interest savings account. Out of sight, out of mind. There are many online savings accounts that provide high interest and are CDIC insured (Canadian Deposit Insurance Corp). This CDIC insurance ensures that your savings are protected up to $100,000.

The best way to build an emergency fund is to set up automatic transfers from your checking account after every payday.

The typical goal, if starting from zero, is to have a fully funded emergency fund within 1-2 years. This assumes a target 20% savings rate. This means saving 20% of your net income each paycheck. This is a pretty standard personal finance benchmark.

With a 20% savings rate, every 4-months of savings should create 1-month of emergency fund. After 1-year we would expect a 3-month emergency fund. After 2-years we would expect a 6-month emergency fund.

A lower savings rate will extend this timing dramatically. A 10% savings rate means every 9-months of saving will only create 1-month of emergency fund. At this rate it will take nearly 5-years to build a 6-month emergency fund, so it’s important to work on increasing your savings rate to reach the 20% benchmark and build an e-fund quickly.

Emergency Funds: So Simple, Yet So Important

Don’t be fooled by their simplicity, emergency funds are probably one of the most important concepts in personal finance. Even if you never need to use it, an emergency fund provides a benefit each and every day. The peace of mind that an emergency fund provides is enormous.

Building up an emergency fund shouldn’t take long and even a small emergency fund can be very beneficial.

The typical emergency fund is between 3-months and 6-months of expenses but could be larger or smaller depending on the circumstances.

The purpose behind an emergency fund is simple. An emergency fund should provide quick access to cash in the event of an emergency.

Everyone needs an emergency fund.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

0 Comments