How Do Tax Brackets Work? What Is Your Tax Bracket?

How do tax tax brackets work? How do you figure out your tax bracket? These are important questions, especially when you’re trying to make the most of your money.

Figuring out your tax bracket can be very helpful when making personal finance decisions. It can help you decide which type of account to use, for example the TFSA or the RRSP. It can also help you understand how much you’ll keep after receiving a raise. It can help you understand how much tax you’ll pay on any extra spending in retirement. It can also help you understand how large your tax refund will be after making an RRSP contribution.

Understanding how tax brackets work, and what tax bracket you’re in, will help you make smarter financial decisions.

But tax brackets can be confusing, they can feel like a real mess of numbers. And even when you understand how tax brackets work there is something called your Marginal Effective Tax Rate (or METR) that can add to the complexity. This is when we look at both income tax rates plus government benefit clawback rates.

Your METR is more complex and will change over time depending on number of children, partners, age etc. Looking at Marginal Effective Tax Rates can expand the number of tax brackets to 10-20+ and we’ve got a few examples below.

In this post we’re going to show you how tax brackets work with a few visual examples. We’ll break down a few different income levels into their different tax brackets.

We’ll also talk about tax deductions and tax credits and how they affect (or don’t affect) your tax bracket. Lastly, we’ll touch on marginal effective tax rates for a few different situations like one child, two children, and retirement.

How Do Tax Brackets Work?

In Canada we have progressive income tax rates. This means that the more you earn the more taxes you pay in tax. It also means the less you earn the less you pay in tax.

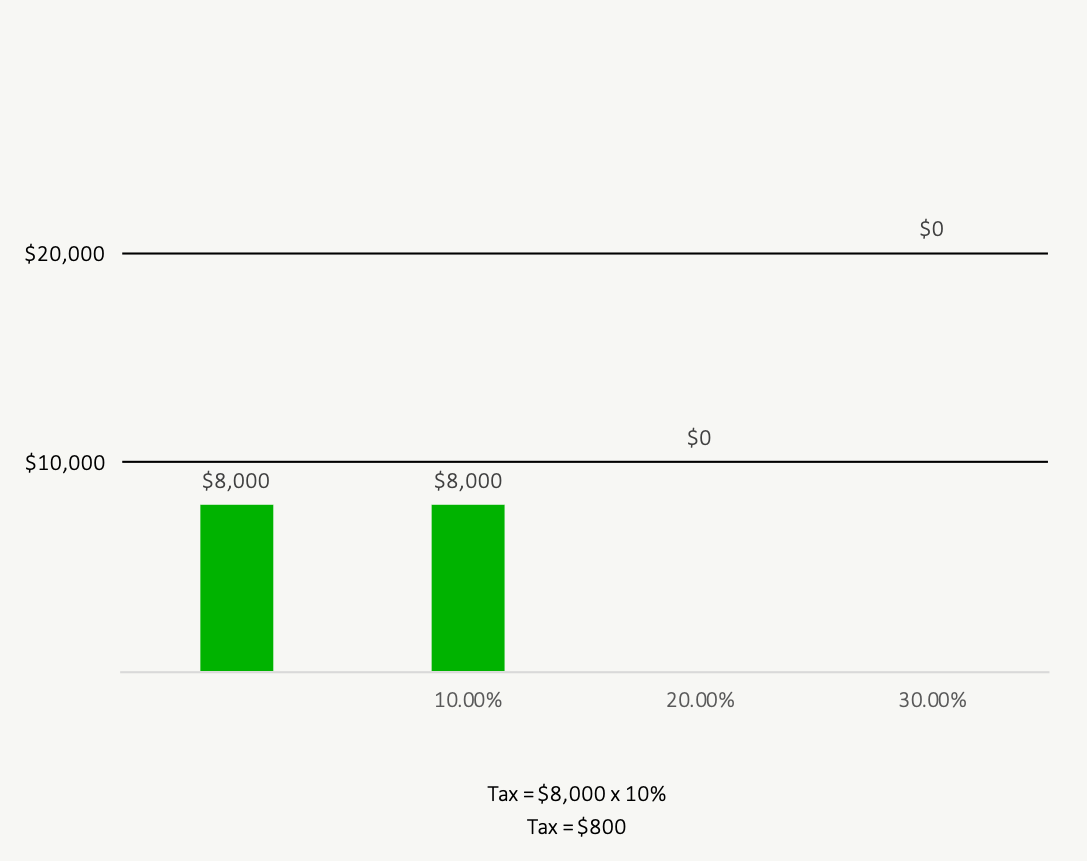

Imagine a simple example where we have three tax brackets, the first tax bracket is 10% tax, the second tax bracket is 20% tax, and the third tax bracket is 30% tax.

The first tax bracket starts at $0 and ends at $10,000. This means any income you earn up to $10,000 gets taxed at 10%. If you earn $5,000 it gets taxed at 10%, if you earn $8,000 it gets taxed at 10%, if you earn $10,000 it gets taxed at 10%.

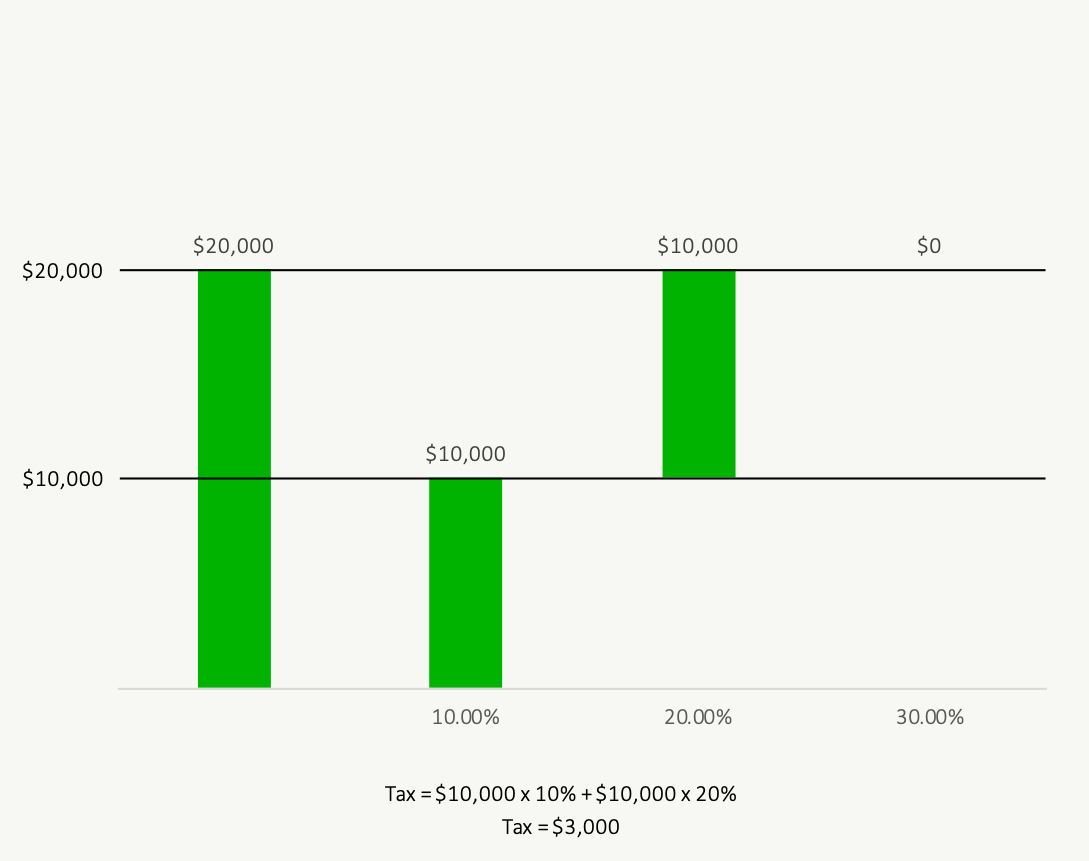

The second tax bracket starts at $10,000 and ends at $20,000. This means any income you earn between $10,000 and $20,000 gets taxed at 20%. But only the income in between $10,000 and $20,000 gets taxed at 20%. The first $10,000 still gets taxed at 10%. If you were to earn $20,000 then the first $10,000 gets taxed at 10% but the second $10,000 gets taxed at 20%. Your total tax would be $1,000 + $2,000 = $3,000.

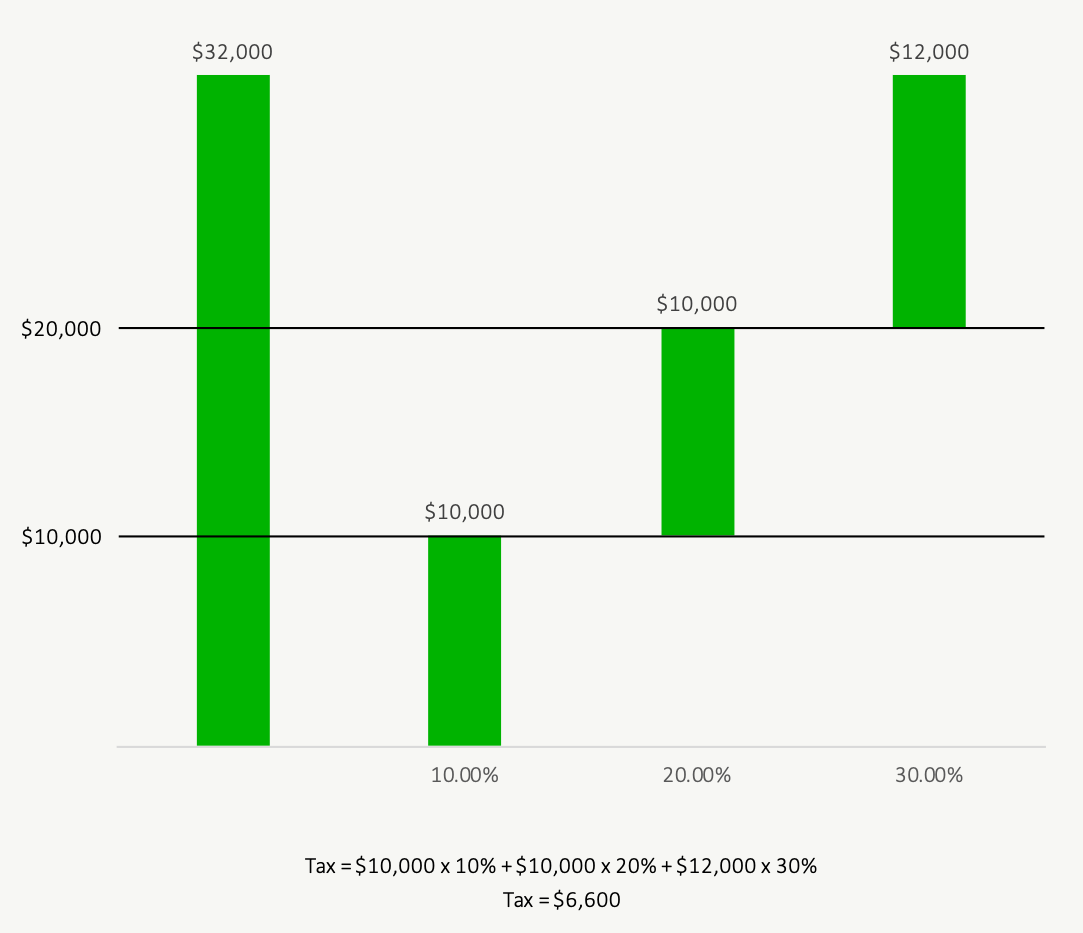

The third tax bracket starts at $20,000 and there is no end. This means any income you earn above $20,000 gets taxed at 30%. But only the income above $20,000 gets taxed at 30%. The first $10,000 still gets taxed at 10% and the second $10,000 gets taxed at 20%.

How do tax brackets work? As you earn more income you cross into a new “tax bracket”. Each progressive tax bracket gets taxed at a tax higher rate. Only the income in that tax bracket gets taxed at that higher rate, all the income below that tax bracket still gets taxed at a lower rate.

An Example Using Current Federal Tax Brackets

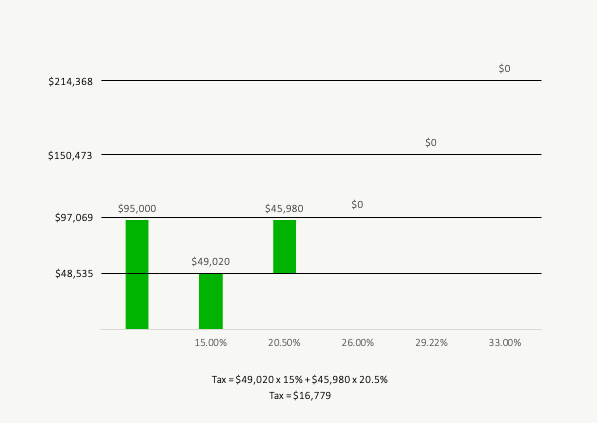

Let’s look at how tax brackets work using an example. We’ll use the current federal tax brackets for 2021 as an example.

We’ll use the Federal tax brackets from 2021 as an example…

- the first $49,020 of taxable income pays 15.00% tax

- the next $49,020 of taxable income pays 20.50% tax (this is the portion of taxable income over $49,020 but below $98,040)

- the next $53,938 of taxable income pays 26.00% tax (on the portion of taxable income over $98,040 up to $151,978)

- the next $64,533 of taxable income pays 29.22% tax (on the portion of taxable income over $151,978 up to $216,511)

- and any taxable income over $216,511 pays 33.00% tax

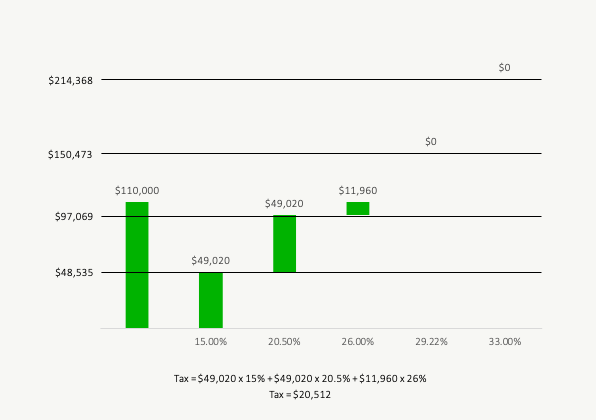

Let’s say someone is earning $95,000 and there are no tax deductions (more on that later). What is their tax bracket and how much tax would they pay?

As you can see, this person is in the 20.50% Federal tax bracket. This is because their last dollar of income is being taxed in the 20.50% tax bracket. Even though they’re in the 20.50% tax bracket they still pay less tax than 20.50% tax overall because their income in the lower tax bracket still gets taxed at a lower rate.

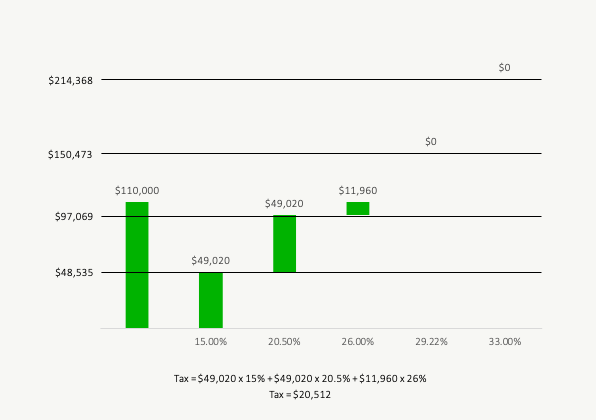

Now what happens if they get a $15,000 promotion? Now their total income is $110,000. What is their tax bracket and how much tax would they pay?

This person is now in the 26.00% Federal tax bracket. This is because their last dollar of income is being taxed in the 26.00% tax bracket. But again, they still pay less than 26.00% tax overall because their income in the lower tax brackets still gets taxed at a lower rate.

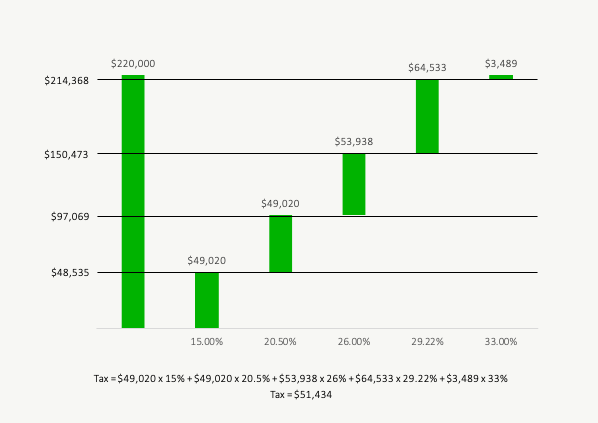

What about someone in the highest tax bracket? Someone earning an income of $220,000 would be in the highest Federal tax bracket. They would have $3,489 taxed at the highest rate of 33.00% but the rest would get taxed at the lower rates. To calculate the Federal income tax they owe we need to break their total income into each tax bracket. Then we multiply the amount in each tax bracket by the income that falls into that bracket.

Although we used Federal tax rates as an example. You can do the same calculation with provincial tax rates included as well. When you combine both Federal and Provincial tax brackets you end up having more tax brackets but the concept is the same.

How Do You Figure Out Your Tax Bracket?

Figuring out your tax bracket can be very helpful when making personal finance decisions. It can help you decide which type of account to use, the TFSA or the RRSP. It can also help you understand how much you’ll keep after receiving a raise.

To figure out your tax bracket you need to look at your last dollar of income and see which tax bracket it falls into. If you earn $110,000 per year like in the example above then you need to see which tax bracket that 110,000th dollar falls into.

Your tax bracket will be affected by where you live because each province has its own tax brackets. Someone earning $60,000 per year in Ontario will have a different tax bracket than someone earning $60,000 per year in Nova Scotia (which has one of the the highest tax brackets at this income level!)

You can use a tax table to help determine your tax bracket. Use this one for Ontario tax brackets or find your provincial tax brackets here.

What Are Tax Deductions?

To make things even more confusing there are things called tax deductions. A tax deduction can help decrease the tax bracket you’re in.

This makes a tax deduction special. A tax deduction decreases your taxable income. A tax deduction essentially makes it look like you’re earning less income in the eye’s of the government.

There are many different types of tax deductions but the most common type of tax deduction is an RRSP contribution. An RRSP contribution lowers your taxable income.

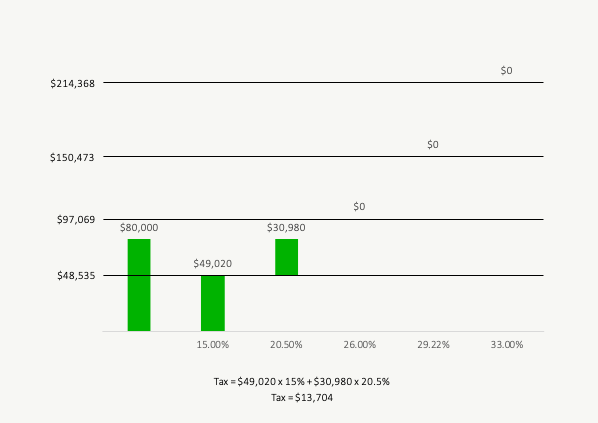

Let’s use our example above where the individual was earning $110,000 per year after their promotion. With no tax deductions they were in the 26.00% Federal tax bracket but what happens if they make an RRSP contribution of $30,000? This decreases their taxable income from $110,000 to $80,000 and this puts them in a lower tax bracket.

Before $30,000 RRSP Contribution

After $30,000 RRSP Contribution

What Are Tax Credits?

Tax credits are different than tax deductions. Tax credits have no effect on your taxable income and don’t affect which tax bracket you’re in.

Tax credits help decrease the amount of tax you have to pay but they don’t help decrease your taxable income. That’s the big difference between a tax credit and a tax deduction. A tax credit only helps decrease the amount of tax you end up paying but it doesn’t affect which tax bracket you’re in.

An example would be the basic Federal tax credit of $13,808. This Federal tax credit decreases your tax payable by $13,808 x 15% = $2,071. It doesn’t matter what tax bracket you’re in, the tax credit reduces your tax payable by the same amount. It works the same for everyone regardless of their income level. This means someone earning $50,000 per year gets the same benefit from a tax credit as someone earning $90,000 per year.

Note: Most tax credits stay the same regardless of income level but a few tax credits are reduced when your income reaches a certain level.

Your Marginal Effective Tax Rate

Now that we’ve covered how tax brackets work it’s important to highlight that this is just one part of your overall marginal effective tax rate.

Many of us receive government benefits at some point in our life. This could be low-income benefits, child benefits, senior benefits etc. Even if you don’t receive these benefits now you may be eligible for them in the future.

The important consideration with government benefits is that they have a ‘clawback’ rate that works much like a tax rate. To truly understand your tax bracket we also need to add these ‘clawback’ rates.

When we add government benefit clawback rates to tax brackets we get marginal effective tax rates. Your marginal effective tax rate is really what we’re concerned with when making financial planning decisions. To figure out what government benefits you may be eligible for now or in the future we recommend reading this post on optimizing government benefits.

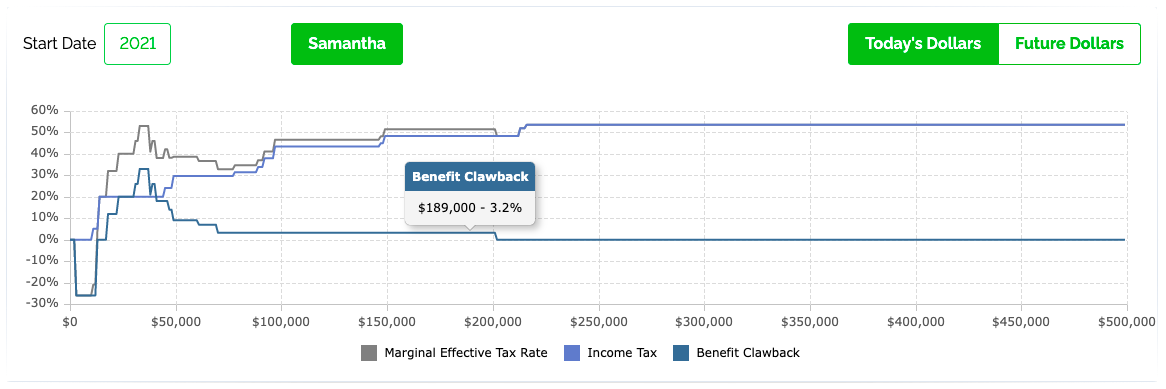

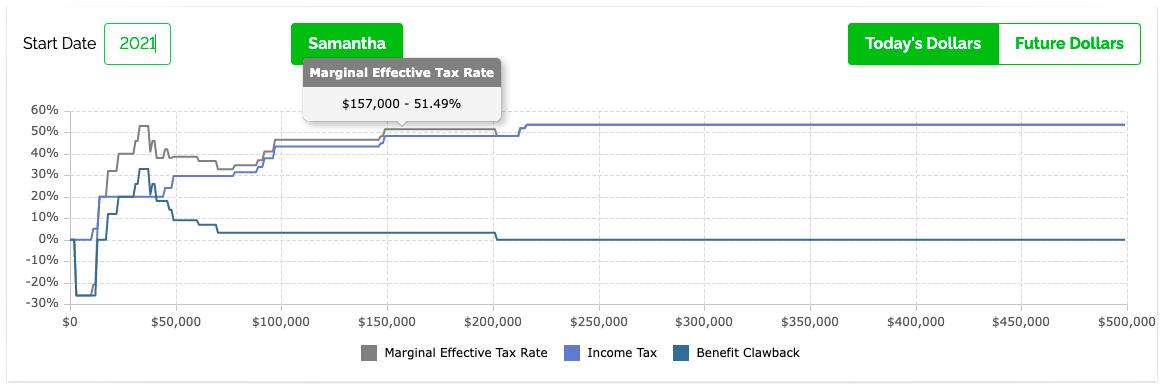

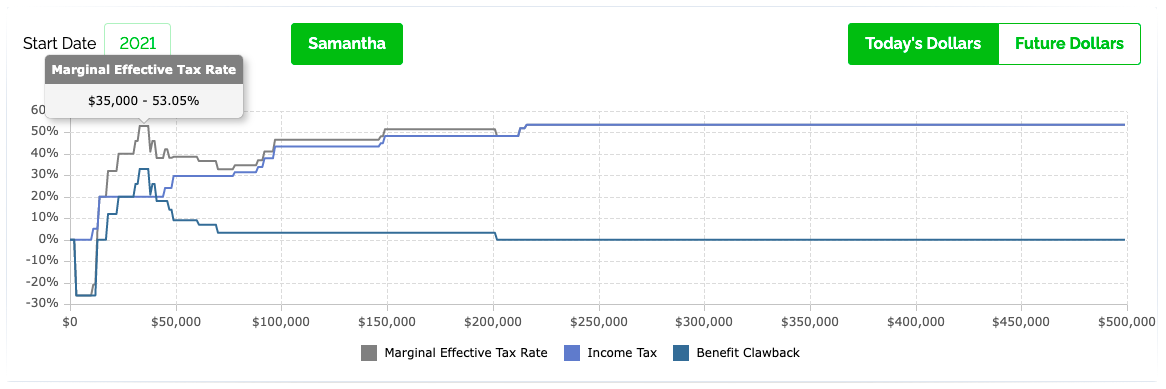

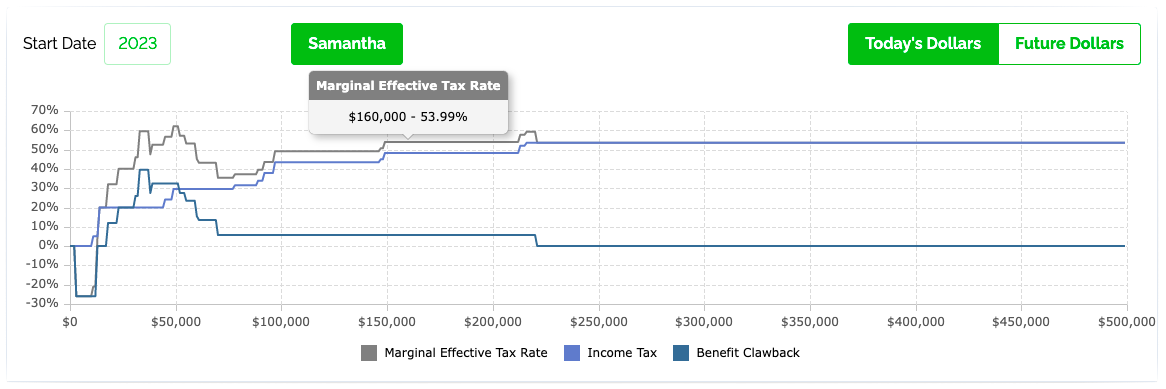

METR Example: Family With One Child

In this example of marginal effective tax rates we have a family with one child and one adult. In this case the ‘clawback’ on the Canada Child Benefit (CCB) is 3.2% at higher income levels but at lower income levels there are many other benefit clawbacks as well.

At higher income levels the 3.2% clawback on the CCB is combined with the marginal tax rate in higher tax brackets. This can lead to higher marginal effective tax rates.

At lower income levels there is a clawback on the CCB but there are other clawbacks as well. There are GST/HST credits, Canada Workers Benefit (CWB) as well as a number of provincial programs. This leads to some very high marginal effective tax rates.

As you can see, this also leads to a lot of “tax brackets”. While income tax brackets are somewhat straightforward, when we start to look at marginal effective tax rate this becomes more complex.

(These METR charts were generated automatically by the PlanEasy platform, start a Financial Plan to create your METR charts)

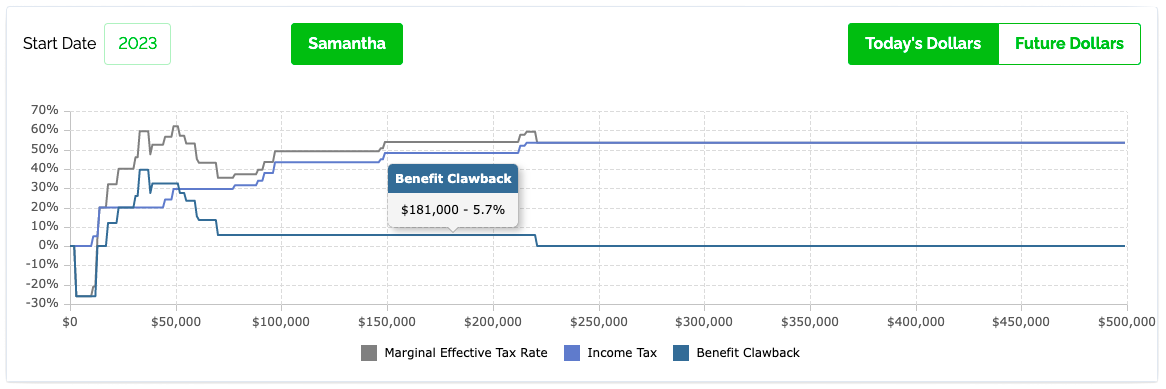

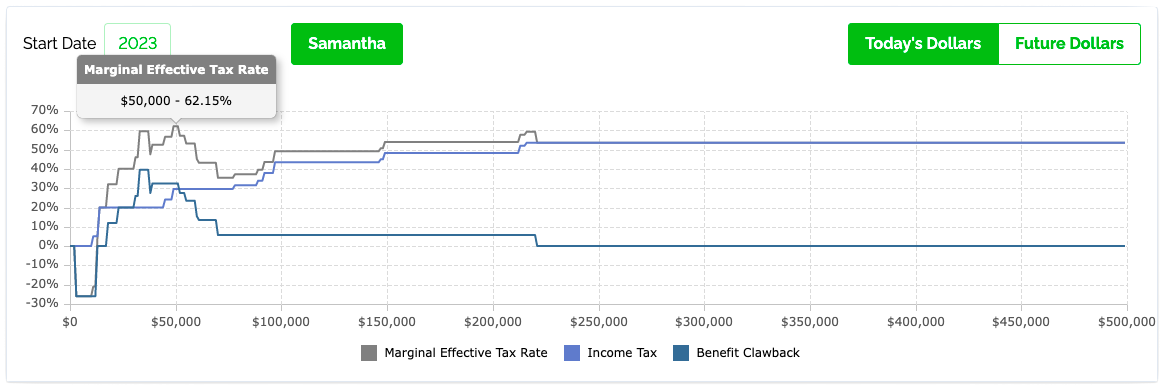

METR Example: Family With Two Children

In this example of marginal effective tax rates we have a family with two children and one adult. In this case the ‘clawback’ on the Canada Child Benefit (CCB) is 5.7% at higher income levels but at lower income levels there are many other benefit clawbacks as well.

At higher income levels the 5.7% clawback on the CCB is combined with the marginal tax rate in higher tax brackets. This can lead to higher marginal effective tax rates.

At lower income levels there is a clawback on the CCB but there are other clawbacks as well. There are GST/HST credits, Canada Workers Benefit (CWB) as well as a number of provincial programs. This leads to some very high marginal effective tax rates, especially given that the CCB has a high clawback rate with two children.

As you can see, this also leads to a lot of “tax brackets” and a peak tax rate at a low income level. While income tax brackets are somewhat straightforward, when we start to look at marginal effective tax rate this becomes more complex.

(These METR charts were generated automatically by the PlanEasy platform, start a Financial Plan to create your METR charts)

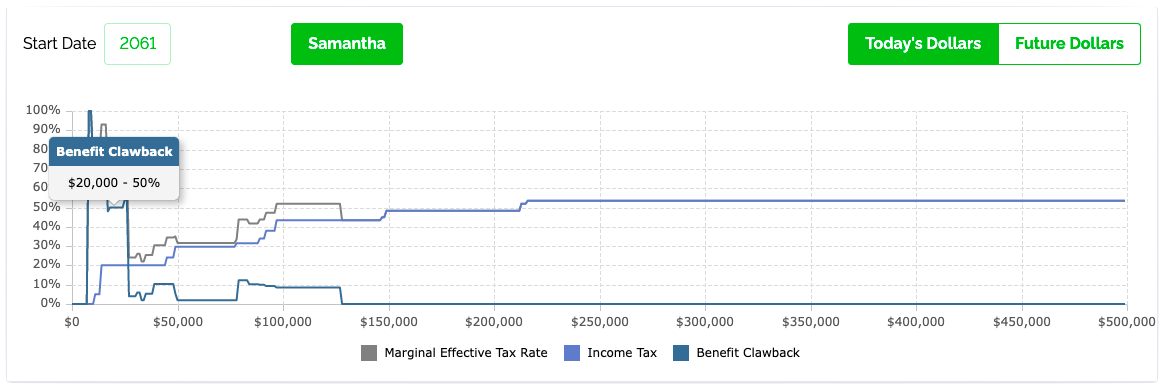

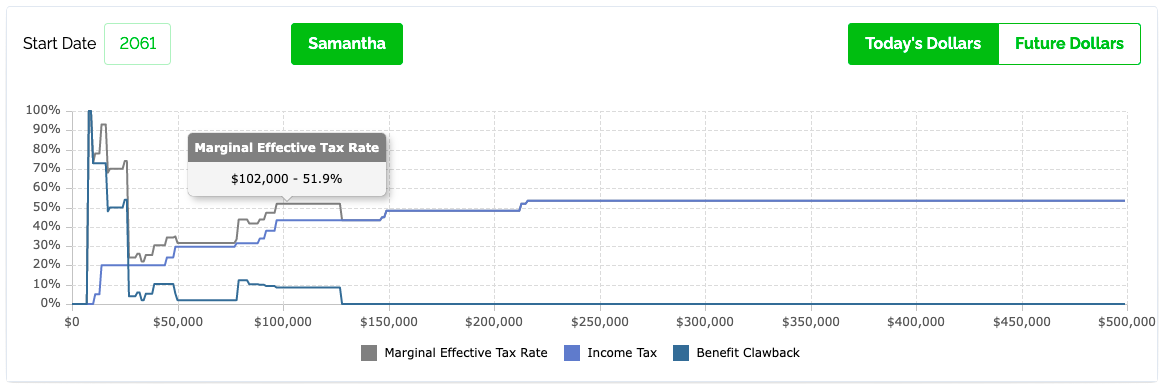

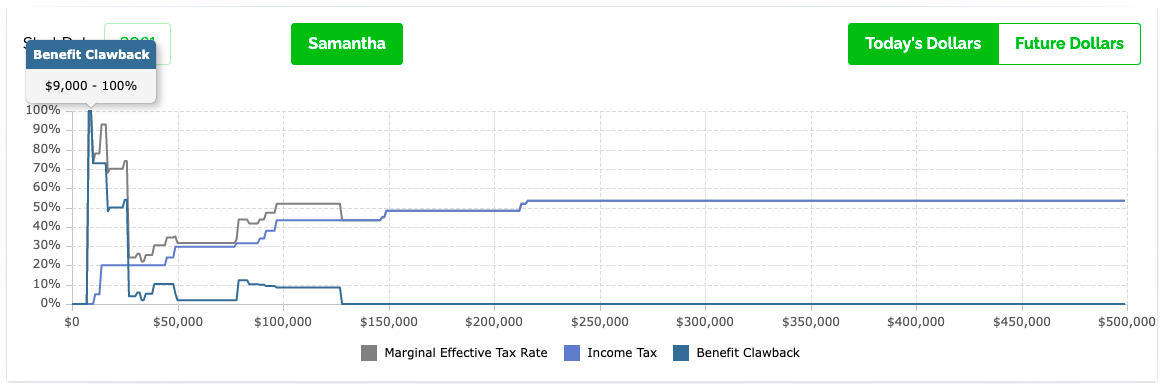

METR Example: Retirement

In this example of marginal effective tax rates we an individual in retirement. In this case there is a large “clawback” on the Guaranteed Income Supplement of 50%.

At higher income levels there is also a “clawback” called the Old Age Security recovery tax. This adds to the marginal tax rate and can quickly push “tax rates” in retirement above 50%.

At lower income levels there is a clawback on the GIS but there are other clawbacks as well. There is also a clawback on GAINS in Ontario which leads to a METR of 100%.

As you can see, these marginal effective tax rates really make this complex in retirement, especially at lower and moderate income levels where government benefit clawbacks can add to tax rates when withdrawing from retirement accounts.

(These METR charts were generated automatically by the PlanEasy platform, start a Financial Plan to create your METR charts)

How Tax Brackets Work

To make the most of your money it’s important to understand how tax brackets work. Your tax bracket can be very helpful when making personal finance decisions. Knowing your tax bracket will make it easier to achieve your financial goals. There are tax planning strategies you can use while you’re in the accumulation stage or the decumulation stage to help make your savings work harder.

Tax brackets can be confusing at first but once you understand how they work it can open up new opportunities to optimize your personal finances and make it easier to achieve your financial goals.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

I believe your comment on progressive tax rates is incorrect.

“In Canada we have progressive income tax rates. This means that the more you earn the more taxes you pay in tax. It also means the less you earn the less you pay in tax.”

You always pay more tax if you make more (even if not progressive). The progressive tax rate means that you pay a higher RATE the more you make. So you pay MORE PER DOLLAR EARNED, not just more tax.

Just want to clarify.

Hi Ken, you are correct! I was a bit lax with my wording in the post. Thanks for adding that!