How Much Does It Take To Retire By Province?

Planning for retirement is all about spending. Spending impacts almost everything about a retirement plan. More spending means more withdrawals and more taxes. Less spending means less withdrawals and less taxes.

More spending could mean there is a higher risk of running out of money. Less spending could mean that we need to be careful around estate planning because there may be a large amount of assets being passed on.

But spending needs to be supported by investment assets, so how much do we need to have invested? How much does it take to retire?

In this post, we’re going to take an interesting look at this question. We’re going to look at how much we need to retire depending on the province we live in. We’re going to look at how much you need to have invested to support the same retirement spending.

Disclaimer: Nothing in this post should be considered financial planning advice. We’re going to use averages and province wide tax rates with only general deductions. Because we’re all unique in some special way, the numbers in this post won’t apply to you, but the relative amount you need to have invested between provinces is interesting!

How Much Does It Take To Retire By Province

The amount of money it takes to retire by province is going to be largely influenced by taxes. Taxes are the largest “expense” in pretty much every retirement plan. Taxes are so important that even a few small changes in draw down strategy can save thousands in taxes and government benefit clawbacks.

To illustrate the impact of taxes, we’re going to calculate the amount we need to retire based on each province’s unique tax rates.

We’ll look at two households. A single retiree spending the median amount of $36,050 per year. Plus, a retiree couple also spending the median amount of $64,800 per year.

To keep things simple, we’ll also assume average CPP of $8,433 per year (this assumption could be very high, or very low, see the factors that affect CPP), full OAS of $7,707 per year, no defined benefit pension, $100,000 per person invested in a TFSA, and the rest of the investment assets in registered accounts (either RRSP or LIRA or both). And we’re going to use the 4% rule to help ensure our retirees don’t run out of money in the future.

Mind you, this doesn’t take different cost of living into account. So, the lifestyle afforded by the same spending may vary by province to province.

Related Posts:

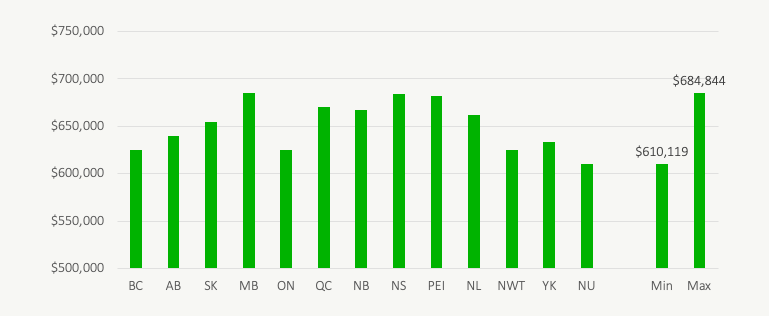

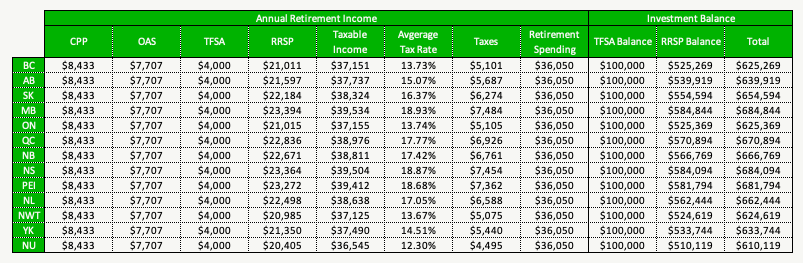

How Much Money Does It Take To Retire… For Individuals

(Example Only! See assumptions above)

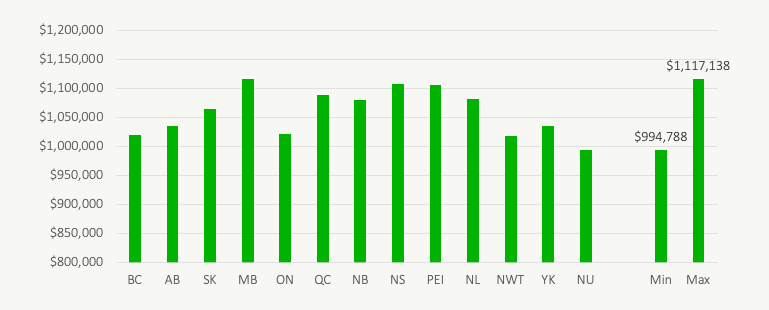

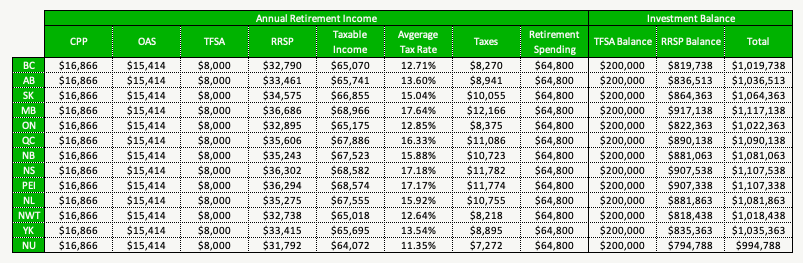

How Much Money Does It Take To Retire… For Couples

(Example Only! See assumptions above)

What Does This Mean?

So what does this mean? Does it mean you should plan to move provinces upon retirement? Probably not. Practically the financial implications of moving would likely outweigh any tax savings. Plus retirement is probably not the best time to be moving away from friends and family.

What this means is that we need to be very aware of the fact that everyone is unique. Use “rules of thumb” for a retirement plan might mean you’re saving way too much (or possibly too little). If you’re in a province with a lower average tax rate you may need to save less for retirement. If you’re in a province with a higher average tax rare you may need to save more for retirement.

Every Financial Plan Is Unique

All this being said, knowing how much it takes to retire by province isn’t super useful… its just an example of how even one factor, where you live and how much tax you pay, can have a HUGE impact on your financial plan. It’s an interesting way to see the need for truly custom financial planning.

If this one factor alone can mean the difference of $100,000+ then imagine the impact other factors could have.

Imagine if you could optimize GIS for a low-income retiree. GIS claw backs are 50% to 75%. For a low-income retiree it’s more important than taxes!

Imagine if you had more than $100,000 in TFSA. Someone in their 30, 40, or 50’s will have a retirement plan that could include $200,000, $300,000, $400,000 or $500,000+ inside a TFSA. In fact, we plan to have $1,000,0000 in our TFSAs by the time we fully retire at age 55. Imagine the different tax implications as your TFSA grows!

Imagine if you wanted to retire early, well before the age when CPP and OAS benefits begin. You would need more financial assets to help bridge the gap, but wouldn’t need the full amount according to the 4% rule because this extra income requirement is only temporary as you wait for CPP & OAS to begin.

Getting a custom financial plan will let you truly understand what it takes to reach your financial goals. Using a “rule of thumb” is a good way to either save too much or save too little. Why work harder than you need to? Why risk running out of money in retirement?

The best way to understand how much it takes to retire is to build a custom financial plan with an advice-only planner.

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

I live in the US but the type of analysis would be similar so it’s interesting to see your thought process. Having visited Vancouver, Whistler and Victoria and loved it, I was excited to see British Columbia clocking in at the low side — I had always fantasized about spending some extended time there, not a move but maybe several months in an AirBNB! I do think moving is a valuable option for people to consider, though agree with your point too that there are costs that may blunt that impact. At least this starts a discussion around what the numbers look like and how one could flex these numbers — by moving, by tax implications, etc.

Vancouver is great. I spent a month there when I just graduated and it was fantastic. I would also like to take an extended vacation in BC in the future!

You’re right about the numbers, its hard to action these numbers because moving just to decrease taxes would have many other implications, both financial and emotional/social. It is very interesting though, especially when we keep seeing retirement numbers of $1M or $2M quoted in the media, the truth is that even just considering where you live could change that number by 5%-10%!

I’m also surprised BC is so low! As you mentioned there are other things to consider like housing- housing in Vancouver is so expensive now even to rent.

Thanks for your comment GYM! There are definitely other things to consider, but if you own your home outright then BC can be a great place to retire… plus in BC retirees can take advantage of the property tax deferral too!

Interesting analysis, is this based on retiring at 65 for 25 years? Do you have a spreadsheet link to this?

Thanks for the comment c3rberus! Yes these assume retirement at 65 and because we’re using the 4% rule we’re assuming at least 30-years of retirement.

I don’t have a spreadsheet but this calculator can help calculate basic tax rates by province… https://www.ey.com/ca/en/services/tax/tax-calculators-2019-personal-tax