Optimizing Your Government Benefits: Both Now and In Retirement

Updated for 2022.

One of the biggest financial planning opportunities for regular people is around government benefits. Unless you’re earning an extremely high income you will probably receive some form of government benefit over the course of your life.

As a student, you may receive GST/HST credits. When you have a family, you may receive the Canada Child Benefit. And when you’re a senior you may receive Old Age Security and the Guaranteed Income Supplement.

Understanding how government benefits work can help you optimize how much you receive both now and in the future. A few simple changes can increase your benefits by $1,000’s per year and help you save more, increase your financial security, and general increase your peace of mind.

Some families may be doing this already, but not realize it.

Other families may not be doing it at all, and losing $1,000’s.

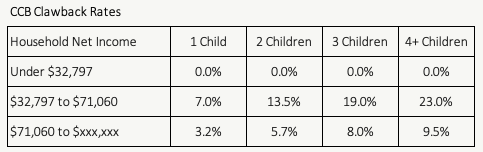

Most benefits are based on your net income and most benefits have clawback rates associated with them. As your income increases, your benefit will go down based on this clawback rate. But not all income is created equal, and some types of saving will increase your benefits.

One of the best ways to optimize your benefits is by carefully planning RRSP contributions. RRSP contributions decrease your family net income and increase your benefits. This increase in benefits can provide a big incentive to save. Depending on the number of children, for some families the increase in benefits from an RRSP contribution is worth more than the tax refund! In total, some families can get back $0.60-$0.70 for each $1 they contribute to RRSPs.

On the other side, when you’re ready to withdrawal from your RRSPs, these withdrawals need to be carefully planned. RRSP withdrawals increase family net income and can potentially trigger clawbacks on GIS and OAS. With clawbacks on GIS reaching up to 75% it’s important to plan RRSP withdrawals carefully to avoid losing 50%-75% of every $1 you withdraw from RRSPs in retirement.

If you’re earning a normal/average income then understanding government benefits can potentially provide a big boost to your long-term financial security. Ignoring government benefits can make things unnecessarily difficult.

Federal Benefit Programs:

Canada Child Benefit:

For working families, the Canada Child Benefit (CCB) is one of the most generous government benefits in Canada. Families with children receive the CCB well into the six-figure income range.

This is a non-taxable benefit. The benefit starts at $6,997/year for each child under 6 and $5,903/year for each child between 6 and 17. The benefit gets clawed back as family net income increases.

The size of this benefit, plus the high clawback rates, makes it an important consideration for anyone with children under the age of 17.

Note on $xxx,xxx: Net income where CCB disappears entirely will depend on age and number of children. For example, for a family with three children, all over 6-years old, the Canada Child Benefit will decrease until family net income crosses $201,548 per year, after which it will disappear entirely.

GST/HST Tax Credit:

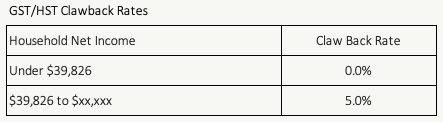

The Federal GST/HST Tax Credit is another non-taxable benefit and it starts at $306/adult, $306/dependent and $161/child. These benefits are then reduced once family net income crosses a certain threshold.

This benefit “helps individuals and families with low and modest incomes offset all or part of the goods and services tax/harmonized sales tax (GST/HST) that they pay.”

One interesting thing to note, for a single person household or a single parent household, there is an additional benefit amount that increases with income. This amount is 2% of net income above $9,919 or $161, whichever is lower. As your income increases you gain 2% of every dollar. Once your net income increases past $17,969 your additional benefit will hit the max of $161.

Note on $xx,xxx: Net income where GST/HST Tax Credit disappears entirely will depend on the household structure. For example, for a family with two adults and three children, the GST/HST Credit will be reduced until family net income crosses $61,726 per year after which it will disappear entirely.

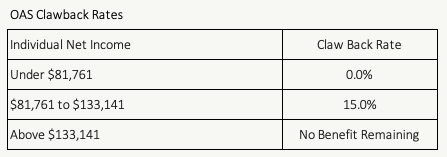

Retirement Benefit: Old Age Security (OAS):

OAS benefits are funded through general government revenue. It’s available after age-65. It’s one of the few government benefits that are taxable. Full OAS benefits begin at $7,707 per person and get reduced once individual income crosses $81,761. OAS gets reduced by 15% for each incremental dollar of net income.

Because OAS is clawed back based on individual income this means a couple could earn up to $266,282 before experiencing OAS clawback if they can split their income evenly in retirement.

Retirement Benefit: Guaranteed Income Supplement (GIS):

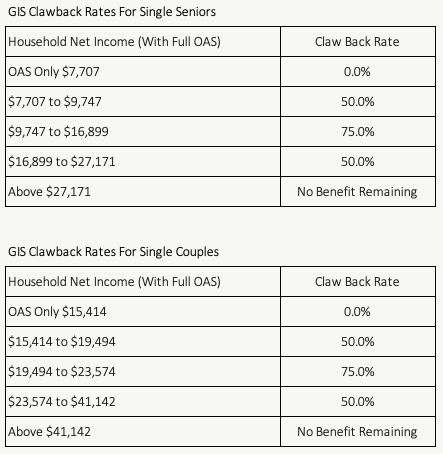

Approximately 1/3rd of seniors receive GIS benefits in Canada. For a single senior GIS benefits start at $11,511 per year. For a family with two adults GIS benefits start at $13,858 per year.

Clawbacks on GIS benefits are extremely high. Seniors who receive GIS will experience clawbacks of 50-75% on net income. For example, the high GIS clawback means that a senior who receives GIS, and makes a withdrawal from their RRSP/RRIF, will see their GIS get clawed back by $0.50 to $0.75 for each $1 withdrawn from the RRSP/RRIF. This is why it is extremely important to plan income/assets before retirement.

GIS clawbacks are based on net income. Because OAS is a taxable benefit it is included in net income. For the purposes of GIS calculation, the clawback ignores OAS income. Every $1 above OAS will reduce GIS by $0.50 to $0.75. If a single senior receives full OAS they can earn up to $27,171 before GIS disappears entirely. A senior couple who receives full OAS can earn up to $41,142 before GIS disappears entirely.

Ontario Benefit Programs:

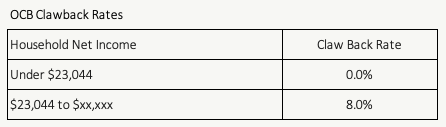

Ontario Child Benefit (OCB):

Not quite as generous as the Canada Child Benefit, the Ontario Child Benefit is targeted more towards lower and moderate income families. The benefit starts at $1,509/year for each child under the age of 17 and gets reduced when family income crosses

Note on $xx,xxx: Net income where the Ontario Child Benefit disappears entirely will depend on the number of children. For example, for a family with three children the Ontario Child Benefit will be reduced until family net income crosses $79,632 per year after which it will disappear entirely.

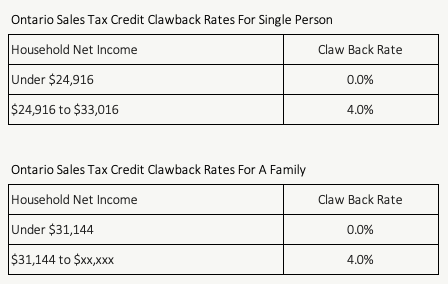

Ontario Sales Tax Credit:

The Ontario Sales Tax Credit starts at $324/adult and $324/child. These benefits are then reduced once family net income crosses a certain threshold.

Note on $xx,xxx: Net income where the Ontario Sales Tax Credit disappears entirely will depend on the household structure. For example, for a family with two adults and three children the Ontario Sales Tax Credit will be reduced until family net income crosses $71,644 per year after which it will disappear entirely.

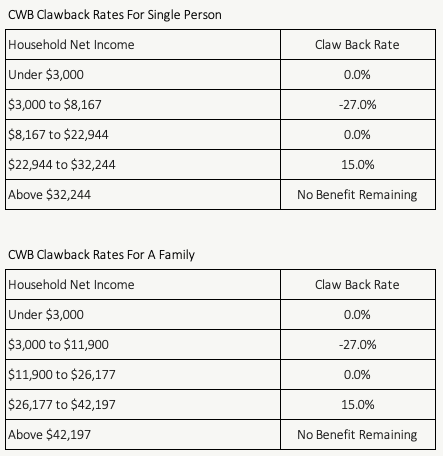

Canada Workers Benefit (CWB):

“The Canada Workers Benefit (CWB) is a refundable tax credit intended to provide tax relief for eligible working low-income individuals and families who are already in the workforce and to encourage other Canadians to enter the workforce.”

For a small window, the Canada Workers Benefit (CWB) increases as you earn more money. This is basically a negative tax rate. For a single person, the CWB maxes out at $1,395 after net income is above $8,167. For a family, the CWB maxes out at $2,403 after net income crosses $11,900.

Starting in the 2021 tax year the CWB got more generous. The benefit amount didn’t increase but the income level where clawbacks begin increased substantially. This provides families an incentive to earn more employment income before clawbacks begin. There is also a new “secondary earner exemption” which allows a lower-income spouse to exclude up to $14,000 in employment income for the purpose of the CWB clawback calculation.

Ontario Property Tax and Energy Credit:

This is a confusing one. The absolute maximum benefit for the Ontario property tax and energy credit is $1,121 for individuals and families and $1,277 for seniors, but your particular maximum will probably be lower, this is because it depends on what you pay for rent and/or property tax.

The Ontario government uses something called occupancy cost (OC) to calculate your benefit. Occupancy cost is either your annual property tax payment or 20% of your annual rent.

For individuals and families, the maximum Energy Credit you can receive is up to $249 or your OC, whichever is lower. The maximum Property Tax Credit you can receive is $62 + 10% of your OC, up to a maximum of $872 or your OC, whichever is lower. An individual or family would need rent of $3,375 per month to qualify for the maximum Property Tax Credit.

For seniors, the maximum Energy Credit you can receive is up to $249 or your OC, whichever is lower. The maximum Property Tax Credit you can receive is $529 + 10% of your OC, up to a maximum of $1,028 or your OC, whichever is lower. A senior would need rent of $2,204 per month to qualify for the maximum Property Tax Credit.

Confusing, isn’t it?

Clawback is 2% of net income above the clawback threshold. The clawback threshold starts at $24,916 for individuals under the age of 64, $31,144 for single seniors, $31,144 for families (including single parents) under the age of 64, and $37,373 for senior couples.

Confused Yet?!? It Might Be Time For Some Help

If it all seems very confusing, don’t worry, you’re not alone. Tax and benefit rules are very complex. Between federal and provincial income taxes, plus federal and provincial benefit programs, there can easily be a dozen or more different rules to be aware of.

For anyone earning a normal/average income this type of tax and benefit planning can potentially provide a big boost to your long-term financial security. Ignoring these rules can make things unnecessarily difficult.

A comprehensive financial plan from your financial planner should include this type of planning. If it doesn’t then you may be missing opportunities and making things more difficult than necessary.

If you want to understand if you have any opportunities, either now or in the future, you can meet with one of our advice-only financial planners for free. We’ll review your situation, discuss your values and goals, and make an assessment to see whether a comprehensive financial plan could benefit you. To see if you have any tax and benefit opportunities just choose one of our advice-only planning options and complete the 2-3-minute questionnaire, after the questionnaire we’ll email you with a link to book a free 30-minute discovery session.

We look forward to talking to you!

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Join over 250,000 people reading PlanEasy.ca each year. New blog posts weekly!

Tax planning, benefit optimization, budgeting, family planning, retirement planning and more...

Related Posts…

5 Comments

Trackbacks/Pingbacks

- February's Great Reads | Spring Financial Planning - […] for good reasons! Whether you’re wondering about Canadian Equity ETFs, the Canada Pension Plan, Optimizing Government Benefits, or why…

- FIRE at 52, how to draw down what we’ve worked so hard for - My Own Advisor - […] income level and sources of income Sam and Margaret can expect a few hundred dollars per year in government…

- February’s Top Three Reads | Personal Finance | Spring Planning - […] for good reasons! Whether you’re wondering about Canadian Equity ETFs, the Canada Pension Plan, Optimizing Government Benefits, or why…

Owen, can a company provided automobile for mostly personal use impact the amount of CCB someone might receive?

Hi Bob, yes it definitely can impact the amount of CCB. If the vehicle is a taxable benefit then the amount will be included on the T4 as employment income and will result in an increase in line 23600, the income amount used to calculate most government benefits. A higher taxable benefit means higher income and less CCB starting the following July.

I couldn’t find this discussed anywhere on the web, thanks Owen.

My daughter is being offered the choice of a $10K pay-rise or the use of a new $40K company vehicle, 100% for personal use. They didn’t mention the potential impact of this benefit. My suggestion is to take the $10K p.a. increase, put the entire amount into an RRSP (so zero impact on the CCB), and drive her current personal vehicle until it needs to be replaced. Then we’ll reassess the best course of action at that time.

This latest post will certainly make a difference in number of part time hours I’ll work in semi retirement. Wish I’d considered all this info years ago so to be set up to maximize govt benefits for seniors. We’ll definitely benefit from having read this post, thank you.

Hi Arlene, great to hear that it helped! To really “fine tune” your income plan in retirement you may want to review this post regarding the Guaranteed Income Supplement. It goes into more detail regarding the GIS benefit and specifically the employment income exemption, earning a bit of employment income in retirement can still be ok and could even be an advantage over the long-term…

https://www.planeasy.ca/what-is-the-guaranteed-income-supplement/

You may also enjoy this post which shows how strategic RRSP contributions can help boost government benefits like GIS…

https://www.planeasy.ca/how-rrsp-contributions-affect-your-government-benefits/